Wilmington Trust Flags Labor Market Weakness as Red Flag for Markets Amid Slowing Economic Growth

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on Meghan Shue’s appearance on CNBC’s “Closing Bell” [1] on

The December 2025 employment report revealed structural challenges that support Shue’s warning [4]:

| Metric | December 2025 | Context |

|---|---|---|

| Jobs Added | 50,000 | Below 60,000 consensus |

| 2025 Annual Total | 584,000 | vs. 2 million in 2024 |

| Unemployment Rate | 4.4% | Down due to shrinking labor force |

| Median Unemployment Duration | 11.4 weeks | 4-year high |

The 2025 monthly average of ~49,000 jobs represents a sharp decline from ~168,000/month in 2024, marking the weakest annual job growth since 2003 outside recession years [4].

Major indices showed mixed-to-negative performance on January 13, 2026 [0]:

| Index | Daily Change |

|---|---|

| Dow Jones | -0.86% |

| Russell 2000 | -0.43% |

| S&P 500 | -0.20% |

| NASDAQ | -0.11% |

Sector rotation reflected defensive positioning [0]:

- Outperformers: Real Estate (+1.73%), Consumer Defensive (+0.84%), Energy (+0.70%)

- Underperformers: Consumer Cyclical (-1.08%), Communication Services (-0.72%), Healthcare (-0.72%)

The firm’s Capital Markets Forecast identifies three interconnected risks [2][3]:

- Tariff Impact: “Unprecedented post-WWII tariff levels” creating business uncertainty

- Labor Supply Constraints: Demographics, immigration restrictions, and AI adoption constraining workforce

- Fiscal Pressures: Rising sovereign debt affecting rates, housing, and currency

The firm expects U.S. economic growth to slow below 1% in 2026 [2].

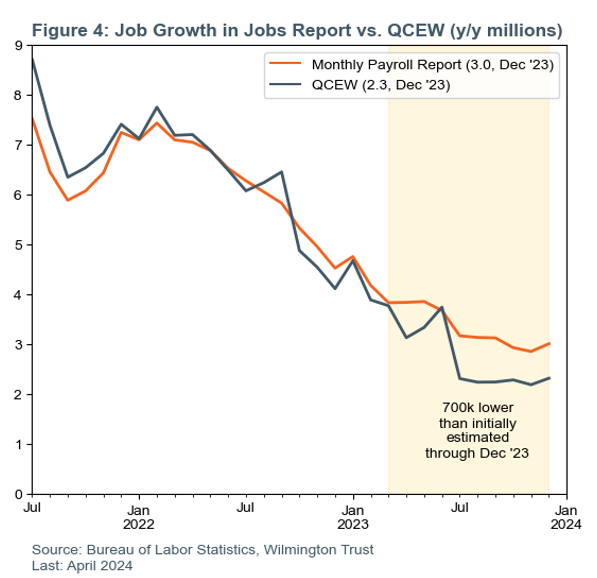

The labor market data suggests this is not merely cyclical weakness. Manufacturing lost 68,000 jobs in 2025, while federal government employment declined by 274,000 jobs [4]. The “low-fire, low-hire” dynamic—with initial jobless claims near 4-month lows at 211,750—indicates employers are holding steady rather than expanding [5][6].

The Consumer Cyclical sector’s underperformance (-1.08%) reflects market concerns about spending sustainability [0]. Wage growth remains solid at 3.8% YoY [4], but weakening employment momentum could pressure consumer confidence.

Wilmington Trust notes markets are characterized by “elevated valuations, historically high equity concentration and tight credit spreads” [3], increasing vulnerability to disappointing economic data.

| Risk | Severity | Timeframe |

|---|---|---|

| Consumer spending decline | High | Near-term |

| Manufacturing contraction | Moderate-High | Ongoing |

| Fed policy lag | Moderate | Q1-Q2 2026 |

| Earnings disappointments | Elevated | Q4 2025 results |

- AI-driven productivity gains may offset labor constraints longer-term [3]

- Initial jobless claims remain historically low [5]

- Wage growth supports income fundamentals [4]

Based on Wilmington Trust’s framework [2][3]:

- Defensive sectors (Real Estate, Consumer Staples) showing relative strength

- Investment-grade credit favored over high-yield

- Precious metals and diversified currency exposure as hedges

| Indicator | Next Release | Significance |

|---|---|---|

| Initial Jobless Claims | January 15, 2026 | Weekly labor pulse |

| Fed Meeting | January 27-28, 2026 | Policy trajectory |

| January Employment Report | Early February | 2026 trend confirmation |

| Q4 Earnings | Ongoing | Corporate labor demand signals |

- December jobs growth (50,000) significantly below 2024 monthly average (168,000)

- Annual 2025 job creation (584,000) at multi-decade lows outside recessions

- Defensive sector rotation evident in market positioning

- Wilmington Trust projects sub-1% GDP growth for 2026

- Specific sector/company risk assessments from Shue not disclosed

- Fed response to labor weakening remains uncertain

- Timing of AI productivity benefits unclear

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.