Deep Investment Value Analysis Report of Zhidemai (300785.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient information to provide you with a systematic and comprehensive investment value analysis report of Zhidemai (300785.SZ).

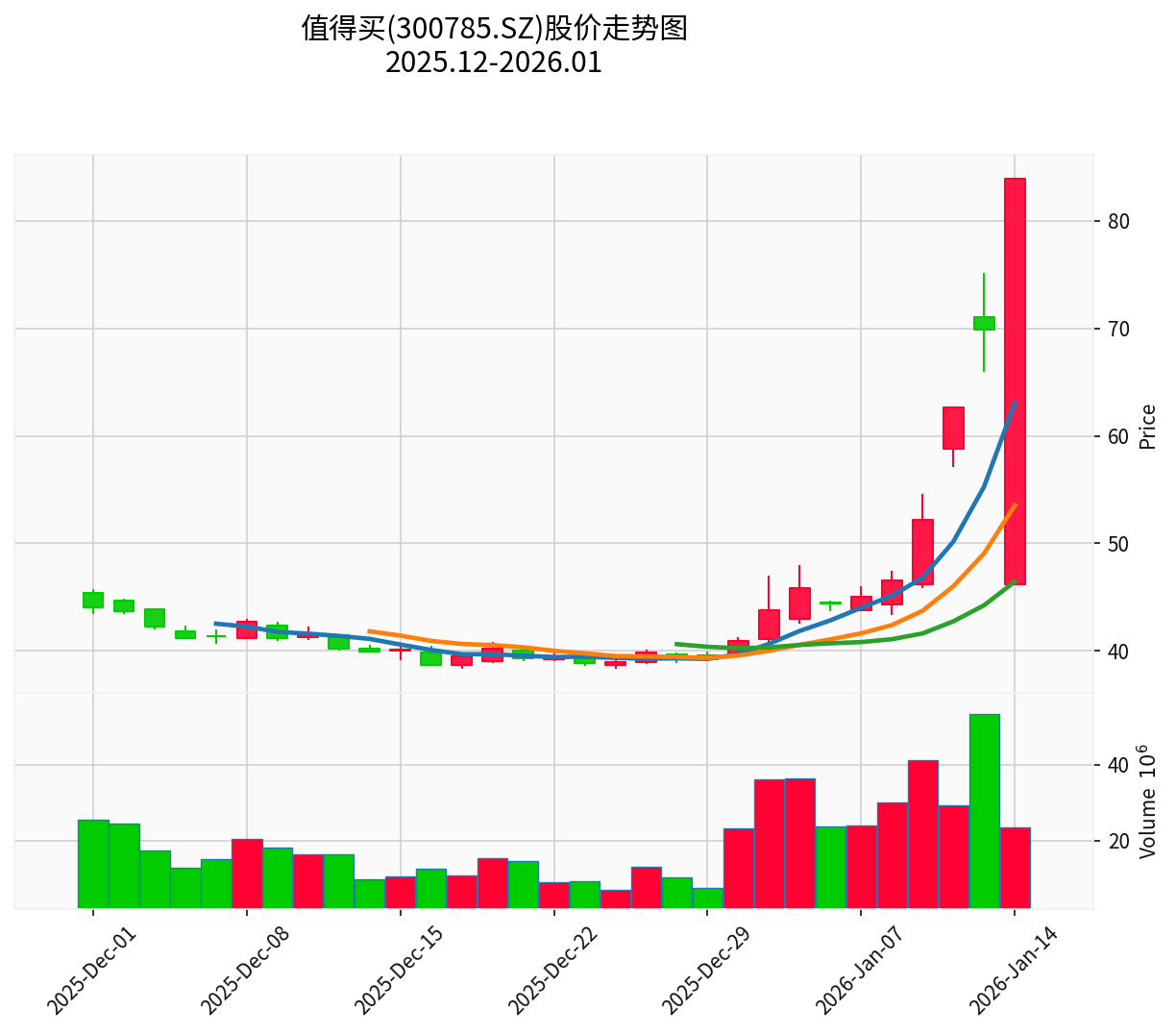

Zhidemai showed extremely strong upward momentum in January 2026, hitting the daily limit for multiple consecutive trading days. As of the midday close on January 14, 2026, the company’s stock price has continued to hit the daily limit, making it one of the most popular high-flying stocks in the A-share market[0]. From a technical analysis perspective[0]:

| Technical Indicator | Value | Signal Interpretation |

|---|---|---|

| Latest Closing Price | RMB 83.89 | Hits all-time high |

| Daily Gain | +20.00% | Limit-up status |

| 5-Day Gain | +89.33% | Strong short-term surge |

| 20-Day Gain | +109.88% | Clear medium-term trend |

| KDJ Indicator | K:89.7, D:81.2, J:106.6 | Enters overbought zone |

| MACD | In bullish zone | Uptrend confirmed |

| Beta Coefficient | 1.06 | High synchronization with the broader market |

- Short-term support level: RMB 53.52

- Current resistance level: RMB 83.89 (already broken)

- Next target level: RMB 90.39

According to the K-line chart analysis, from December 1, 2025, to January 14, 2026, Zhidemai’s stock price soared from RMB 42.08 to RMB 83.89, with a cumulative increase of

Zhidemai is currently in a critical period of strategic adjustment and governance structure optimization. According to public information[1][2], the company revised 35 core management systems in one go, covering key areas such as director and supervisor rules, and connected transaction management:

- System Standardization: Fully revised 35 core systems to establish a more sound internal control system

- Risk Control Enhancement: Purchased RMB 50 million liability insurance for directors and senior executives

- Decision-Making Mechanism Optimization: Established an investment decision-making committee to improve decision-making scientificity

- Supervision System Reform: Abolished the board of supervisors, and the audit committee will exercise supervision powers instead

- Independent Director Expansion: Increased the proportion of independent directors to enhance board independence and decision-making transparency

This series of governance upgrading measures sends a positive signal of standardized operation to the market, significantly boosting the confidence of institutional investors[1][2].

Zhidemai is positioned as a technology-driven enterprise with

- 153% year-on-year growth in AI product revenue: Indicates that the AI strategic layout has entered the harvest period

- Douyin DP business achieves full profitability: Made breakthrough progress in the short-video e-commerce sector

- GE2N product builds three AI engines: Formed a complete AI ecosystem

Based on the GE2N product, the company has built three AI engines to promote AI ecological co-construction, showing great potential in understanding consumer intentions and generating AI-adapted high-quality product information[3]. This technological advantage enables Zhidemai to form a differentiated competitive barrier in the content shopping guide sector.

Although the company is under certain pressure on the revenue side, its profitability has improved significantly[1]:

| Financial Indicator | First Three Quarters of 2025 | Year-on-Year Change |

|---|---|---|

| Operating Revenue | RMB 806 million | -20.37% |

| Net Profit Attributable to Shareholders | RMB 13.4486 million | +253.49% |

| Non-recurring Net Profit | RMB 9.0219 million | +46.27% |

| Gross Profit Margin | 49.52% | At a high level in the industry |

| Asset-Liability Ratio | 20.54% | Far below the industry average |

| Current Ratio | 5.10 | Extremely sound financial position |

- The pattern of declining revenue but rising profitsreflects the company’s remarkable achievements in cost control and operational efficiency improvement

- The 49.52% gross profit marginis at a high level in the e-commerce shopping guide industry, demonstrating the company’s core competitiveness

- The asset-liability ratio of only 20.54%is far below the industry average, indicating a very sound financial structure

- A current ratio of 5.10indicates that the company has extremely strong short-term debt-paying ability, providing sufficient financial support for subsequent business expansion

Against the backdrop of consumption boost and accelerated integration of culture and tourism, the “Ticket Stub Economy” is becoming an important part of the urban consumption ecosystem[1]. The “Ticket Stub Economy” refers to a closed-loop chain consumption model that starts with movie tickets, concert tickets, sports event tickets, etc., activates multi-dimensional consumption scenarios such as catering, accommodation, and retail through benefit extension, and realizes “one ticket purchase, full-domain linkage”.

As a leading domestic consumer content platform and decision-making entry point, Zhidemai, relying on its strong user mindshare, data insight, and scenario connection capabilities, has become one of the most benefited targets in the “Ticket Stub Economy” wave[1]:

- User Group Alignment: The platform has gathered a large number of young middle-class users who are sensitive to “cost performance” and “experience”, and their consumption habits are highly aligned with the social fission demand of the “Ticket Stub Economy”

- Improved Content Matrix: Has built a full-domain content matrix covering graphic reviews, short-video guides, and live-stream e-commerce, enabling seamless connection from interest stimulation to consumption conversion

- Regional Operation Capability: As the “Ticket Stub Economy” sinks from first-tier cities to second- and third-tier cities, the company’s regional operation capability and merchant resource network will form a strong moat

The investment logic of the consumption sector in 2026 is undergoing profound reshaping[4][5]. According to the latest views of institutional investors:

- Going Global: The second growth curve brought by the global layout of Chinese brands

- New Consumption Models: New formats such as discount retail and service consumption

- AI Agents: Promote the arrival of an era where “super consumers” and “super entrepreneurs” coexist

Huatai Securities pointed out that against the backdrop that the accelerated corporate profit growth in the consumption sector throughout the year is expected to gradually drive the increase in residents’ income and consumption willingness,

As an AI-driven content shopping guide platform, Zhidemai exactly fits the two mainlines of “new consumption models” and “AI intelligence”.

The seamless integration of content and shelves is becoming the core engine of e-commerce growth[6]. Whether it is the live-stream penetration of Taobao Tmall or the full-domain operation of Douyin, it shows that simple product exposure is no longer sufficient. Consumers expect to feel the “New Year vibe” and gain inspiration in short videos and live streams, and then complete convenient purchases through search and malls.

| Competitor Type | Representative Enterprises | Competitive Advantages | Zhidemai’s Differentiated Positioning |

|---|---|---|---|

| Traditional E-Commerce Platforms | Taobao, JD, Pinduoduo | Traffic advantages, supply chain capabilities | Professional consumption decision-making entry point |

| Short-Video Platforms | Douyin, Kuaishou | Content creation capabilities, user stickiness | In-depth professional review content |

| Traditional Shopping Guide Platforms | Fanli.com, SMZDM | User accumulation, commission system | AI Technology-Driven , content quality |

Zhidemai’s core competitiveness lies in its

Zhidemai recently reached strategic cooperation with Huawei and Weimeng, opening up new growth space[1][2]:

- Cooperation with Weimeng: Weimeng is an important service provider in the WeChat ecosystem. After the cooperation, Zhidemai users can directly complete the order closed-loop on the platform, greatly improving conversion efficiency

- Cooperation with Huawei: Leverage Huawei’s technological advantages and ecological resources to further strengthen the company’s AI technology capabilities

- Indirect Connection with Taobao: After Weimeng reached strategic cooperation with Taobao, Zhidemai indirectly obtained a connection channel with the Taobao ecosystem, providing users with richer product choices

This strategic layout enables Zhidemai to transform from a simple “shopping guide traffic diversion” platform to a “transaction closed-loop” platform, and its business model has been significantly upgraded.

| Valuation Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 196.53x | Significantly higher than the industry average |

| Price-to-Book Ratio (P/B) | 8.83x | At a high level |

| Price-to-Sales Ratio (P/S) | 12.72x | Obvious premium |

| ROE | 4.48% | Relatively low |

- The current P/E ratio of 196x is indeed at a high level, reflecting the market’s expectation of the company’s future high growth

- The valuation premium mainly comes from: high growth expectations of the AI business, new business imagination space of the “Ticket Stub Economy”, and industry beta against the backdrop of consumption recovery

- The average institutional target price is RMB 42.46, but the current stock price has exceeded the institutional target price, which not only reflects that the improvement of fundamentals is recognized by the market, but also hints at the risk of short-term valuation pullback

According to market data[1][2], the consecutive limit-up moves of Zhidemai recently are actively driven by main capital:

| Capital Type | Flow Characteristics | Scale |

|---|---|---|

| Main Capital | Continuous net inflow | Active buying |

| Hot Money | Net outflow at market close | Phased profit-taking |

| Retail Capital | Net outflow at market close | Follow-up selling |

- Main capital adopts the trading strategy of “shock accumulation by opening low in the early session, breakout and pull-up with heavy volume in the afternoon, and shock washing at the market close”

- In the market close stage, main capital did not sell, but instead took over the selling orders from hot money and retail investors, further consolidating their position

- On January 12, this stock was included in the Dragon and Tiger List, with a turnover of RMB 1.76 billion, indicating extremely high market attention

- A total of 3 institutions gave ratings to Zhidemai in the past 90 days

- Among them, 2 gave “Buy” ratings, and 1 gave “Overweight” rating

- The average institutional target price is RMB 42.46

It should be noted that as of January 9, the closing price of Zhidemai has reached RMB 52.2, exceeding the average institutional target price, which not only reflects that the market’s recognition of the company’s fundamental improvement is increasing, but also hints that the current stock price may have fully priced in short-term positive factors.

Although Zhidemai has significant investment highlights, investors still need to pay attention to the following risks[1]:

| Risk Type | Specific Description | Risk Level |

|---|---|---|

Intensified Industry Competition |

Giants such as ByteDance and Alibaba have laid out in the content shopping guide field, which may impact Zhidemai’s market share | Medium-High |

AI Strategy Progress Falling Short of Expectations |

Large investment in AI technology, if the subsequent application effect falls short of expectations, may affect performance growth and valuation | Medium |

Market Sentiment Fluctuation Risk |

The A-share market sentiment is volatile. If the overall market environment weakens, it may drive the stock price to pull back | Medium |

Valuation Pullback Risk |

The current P/E ratio of 196x has fully reflected optimistic expectations, and there is a risk of valuation regression | Medium-High |

Policy Risk |

Changes in relevant policies such as cultural and tourism integration and consumption boost may affect the development of the “Ticket Stub Economy” | Low |

| Time Dimension | Core Logic | Risk-Return Characteristics |

|---|---|---|

Short-term (1-3 months) |

Capital-driven, sentiment-driven, theme speculation | High volatility, high return, high risk |

Medium-term (3-6 months) |

AI business growth realization, performance improvement verification | Needs to wait for fundamental verification |

Long-term (more than 6 months) |

Valuation re-rating, successful platform transformation, “Ticket Stub Economy” implementation | Large growth space, but continuous tracking is required |

| Evaluation Dimension | Score | Explanation |

|---|---|---|

| Fundamental Improvement | ★★★★☆ | Profitability improved, financial structure sound |

| Growth | ★★★★★ | AI business grows rapidly, “Ticket Stub Economy” opens up new space |

| Valuation Rationality | ★★☆☆☆ | Current valuation has fully reflected optimistic expectations |

| Technical Aspect | ★★★☆☆ | Enters overbought zone, faces pullback pressure |

| Capital Aspect | ★★★★★ | Main capital actively lays out |

-

Short-Term Investors:

- Can pay attention to the opportunity to buy on dips when the price pulls back below RMB 50

- Set the stop-loss level at RMB 45 (previous support level)

- Target level at RMB 54.88 (near the 52-week high)

- Currently has entered the overbought zone, need to be cautious of chasing highs

-

Medium-Term Investors:

- Wait for the stock price to pull back to near the 60-day moving average to confirm support before positioning

- Focus on the revenue growth rate of the AI business and changes in gross profit margin

- Pay attention to the implementation progress of the “Ticket Stub Economy” business

-

Long-Term Investors:

- The company is in a critical period of transformation from a “good product recommendation platform” to an “urban consumption operating system”

- The core investment value lies in the first-mover advantage in the “AI + consumption” field and the “Ticket Stub Economy”

- Can adopt a phased position-building strategy and hold for the long term

| Tracking Indicator | Focus Time Point | Expected Change |

|---|---|---|

| AI Business Revenue Growth Rate | Quarterly financial reports | Maintain 100%+ growth |

| Gross Profit Margin Change | Quarterly financial reports | Maintain the range of 48%-50% |

| GMV of “Ticket Stub Economy” Business | Major cooperation announcements | Gradually increase its proportion |

| Institutional Target Price Upgrade | Each rating update | Valuation repair space |

| Continuous Inflow of Main Capital | Daily capital flow | Confirmation of market continuity |

Behind the consecutive limit-up moves of Zhidemai (300785) is the superposition and resonance of four positive factors:

From the perspective of investment value evaluation:

- Short-term: The stock price has entered the overbought zone, and the risk of technical pullback has increased. It is recommended that investors be cautious of chasing highs

- Medium-term: Need to pay attention to the realization of AI business growth and verification of performance improvement

- Long-term: If the “Ticket Stub Economy” business is successfully implemented, the company is expected to realize a leap from a “good product recommendation platform” to an “urban consumption operating system”, and its growth space is worth looking forward to

Investors should formulate corresponding investment strategies according to their own risk preferences and investment horizons, and focus on tracking the progress of the company’s AI business and the development of the “Ticket Stub Economy” business.

[0] Jinling AI Financial Data System - Company Overview, Technical Analysis and Market Data of Zhidemai (300785.SZ)

[1] NetEase Finance - “Surged 12.14% in a Single Day! Deciphering the Main Trading Code of Zhidemai (300785)” (https://www.163.com/dy/article/KJ1A3EUE055666U7.html)

[2] Sina Finance - “Limit-Up Analysis of Zhidemai on January 12, 2026: Corporate Governance Upgrading + AI Business Growth + Financial Structure Optimization” (https://finance.sina.com.cn/stock/aiassist/ydfx/2026-01-12/doc-inhfzcnv8511746.shtml)

[3] Eastmoney.com Wealth Account - “Such Companies Usually Have Announced a Full Embrace of AI Strategy” (https://caifuhao.eastmoney.com/news/20260112132100232232250)

[4] 21st Century Business Herald - “Where Will the Wind of Consumption Blow in 2026? Institutions Discuss Valuation Repair and Three Long-Term Tracks” (https://www.21jingji.com/article/20251231/herald/0b8d35ee186f8482dddea289f0cdd9e2.html)

[5] Securities Times - “Save it! Ten Brokerage Chiefs Decode 2026 Investment Strategies!” (https://www.stcn.com/article/detail/3569442.html)

[6] NetEase - “Huofu Observation | The Longest New Year Shopping Festival in History is Coming! Understand the Game Logic of E-Commerce Platforms in Advance” (https://www.163.com/dy/article/KITUM2530518NEE5.html)

[7] Snowball - Stock Price, Market and Discussion of Zhidemai (SZ300785) (https://xueqiu.com/S/SZ300785)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.