Precious Metals Investment Value Assessment Report: Gold and Silver

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data, technical analysis, and professional institutional forecasts, I will provide you with a comprehensive precious metals investment value assessment report.

US December 2025 CPI data shows that the annual inflation rate remained at 2.7%, in line with market expectations, down from the 3% peak in September 2024, but still significantly above the Federal Reserve’s 2% target [1][2]. This inflation pattern provides structural support for precious metals: while inflation is declining, the “higher for longer” interest rate environment is shifting, and the market widely expects the Federal Reserve to cut interest rates by an additional 75-100 basis points in 2026 [3].

Current geopolitical risks continue to escalate:

- The Russia-Ukraine conflict is deadlocked, with slow progress in peace negotiations

- The situation in Venezuela is turbulent, and the US has imposed sanctions on the country’s oil

- Tensions in the Middle East persist

- Uncertainty over the Trump administration’s tariff policy (Supreme Court ruling imminent) [4][5]

These risk factors continue to strengthen the safe-haven demand for gold.

| Indicator | Gold (GCUSD) | Silver (SIUSD) |

|---|---|---|

Current Price |

$2,682.30/oz | $30.35/oz |

20-Day Moving Average |

$2,800.46 | $31.73 |

50-Day Moving Average |

$2,890.33 | $32.56 |

200-Day Moving Average |

$3,313.48 | $36.61 |

RSI(14) |

20.94 (Oversold Territory) | 34.16 (Near Oversold) |

Price vs 50-Day MA |

-7.20% | -6.79% |

Price vs 200-Day MA |

-19.05% | -17.10% |

52-Week Low |

$2,682.30 | $29.23 |

52-Week High |

$4,505.70 | $71.14 |

YTD Performance |

-42.15% | -66.65% |

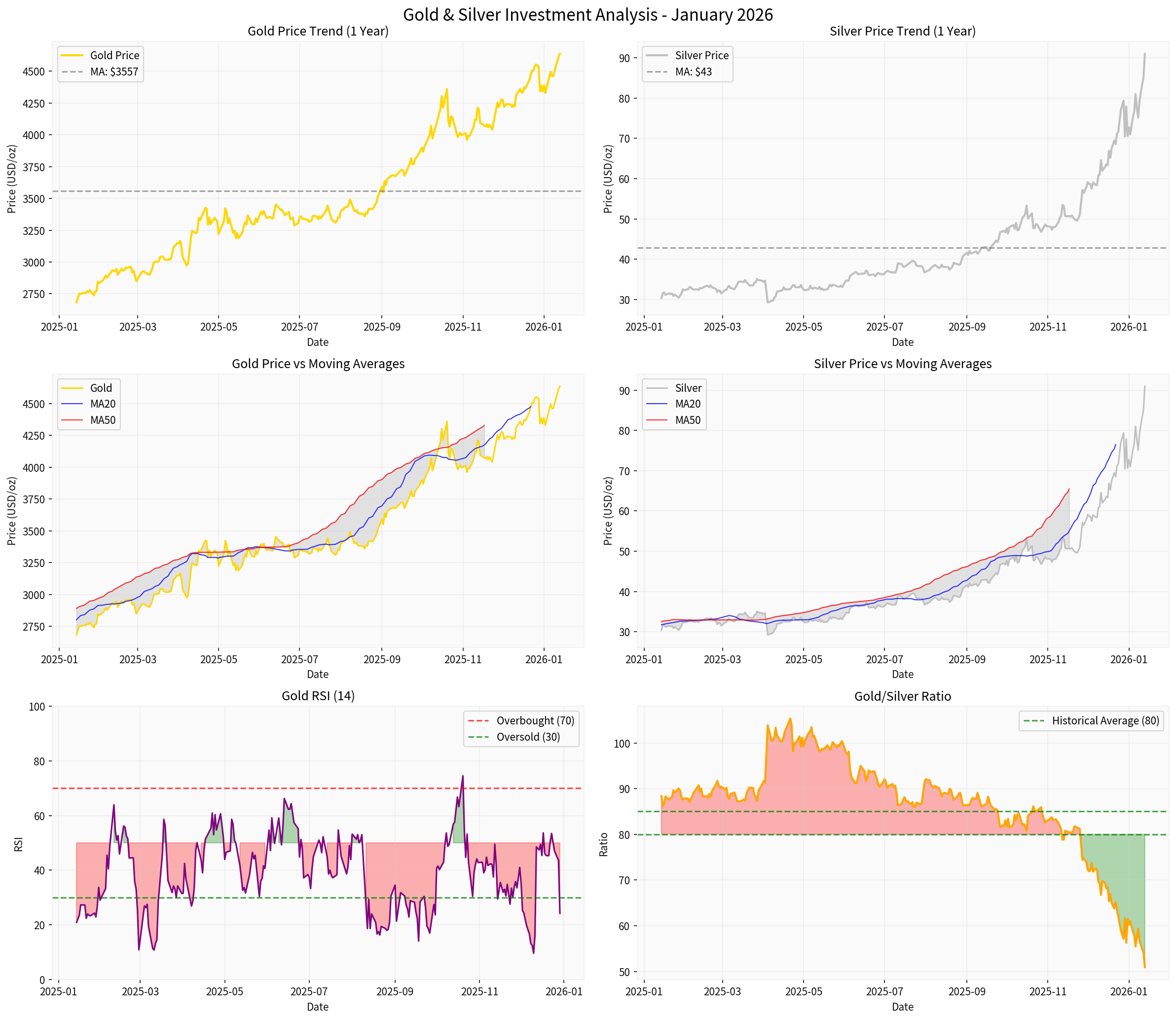

- Both gold and silver are currently in technical oversold territories; an RSI below 30 indicates possible excessive selling in the market

- Prices are significantly below the 200-day moving average, showing a large recent pullback

- Both have pulled back sharply from their 2025 all-time highs, but the long-term uptrend remains intact

- Price has broken below the 50-day and 200-day moving averages, but RSI is in an extreme oversold territory at 20.94

- Annualized volatility is approximately 14%, which is within a reasonable range

- It has pulled back about 40% from the 2025 high of $4,505, potentially forming a key support zone

- Higher volatility (approximately 26% annualized), reflecting its more speculative nature

- RSI of 34.16 is near the oversold threshold

- The gold-silver ratio is currently 88.38, above the historical average of 80-85, indicating that silver is undervalued relative to gold [0]

| Institution | Target Price | Time Frame |

|---|---|---|

| Goldman Sachs | $4,900 | End of 2026 |

| J.P. Morgan | $5,055 (Average) | Q4 2026 |

| Bank of America | $5,000 | 2026 |

| Morgan Stanley | $4,800 | Q4 2026 |

| UBS | $4,500 | Mid-2026 |

| Deutsche Bank | $4,450 | 2026 Average |

- Goldman Sachs forecast: $85-$100/oz (2026 average) [6]

- Metals Focus: $100/oz

- Gold (based on Goldman Sachs target): +83%

- Gold (based on J.P. Morgan target): +88%

- Silver (based on Goldman Sachs target): +180%

- Sustained Central Bank Gold Purchases: In the first three quarters of 2025, global central banks net purchased 634 tons of gold, and institutional portfolio allocations increased from 1.5% to 2.8% [7]

- Fed Rate Cut Expectations: Falling real yields will reduce the opportunity cost of holding gold

- Safe-Haven Demand: Geopolitical risks have driven capital inflows into gold ETFs, with a single-day inflow of $950 million

- Expected Weakening of the US Dollar: Institutions predict that the US dollar will face downward pressure in 2026

- The current price has pulled back sharply from the high, which may require time to consolidate

- Goldman Sachs warning: Overcrowded trades may lead to increased volatility

- Technical oversold recovery requires a catalyst

- Strong Industrial Demand: The green energy transition (photovoltaics, electric vehicles) provides structural demand support

- Elevated Gold-Silver Ratio: The ratio of 88.38 indicates that silver is significantly undervalued relative to gold

- Higher Volatility: Offers greater upside potential, suitable for trend trading

- Its industrial nature makes it more sensitive to the economic cycle

- Volatility is nearly twice that of gold

- High inventories may limit upside

- Gold’s current price of $2,682 has fallen about 40% from the 2025 high of $4,505, but institutional target prices remain in the $4,500-$5,300 range

- Silver has fallen 57% from the $71 high, but industrial demand and the green transition provide long-term support

- RSI shows that both are in oversold territories, with potential for a technical rebound

| Precious Metal | Comprehensive Score | Investment Recommendation |

|---|---|---|

Gold |

★★★★☆ (8.5/10) | Accumulate on dips as a portfolio hedging tool |

Silver |

★★★★☆ (8.0/10) | Priority choice for aggressive investors |

- Conservative Investors: Build positions in gold in batches in the $2,500-$2,600 range, with a stop-loss set below $2,400

- Aggressive Investors: Silver has a higher margin of safety in the $28-$30 range; consider a dollar-cost averaging strategy

- Allocation Ratio: It is recommended that precious metals account for 5%-15% of the investment portfolio, with a gold-silver ratio of 70:30

- Federal Reserve January interest rate meeting resolution

- US Supreme Court ruling on tariff policy

- Progress of geopolitical events

- Central bank gold purchase data

[1] Yahoo Finance - “The US ended 2025 with steady but elevated inflation in December” (https://finance.yahoo.com/news/us-ended-2025-steady-elevated-213208487.html)

[2] USA TODAY - “Annual inflation remains 2.7% in December, final 2025 report reveals” (https://www.usatoday.com/story/money/2026/01/13/annual-inflation-cpi-december-report/88133586007/)

[3] Morningstar - “The Fed will be forced into deep rate cuts in 2026” (https://www.morningstar.com/news/marketwatch/20260110180/the-fed-will-be-forced-into-deep-rate-cuts-in-2026-boosting-gold-and-breaking-the-dollar)

[4] Times of India - “Gold & silver outlook: Bullion seen holding firm next week” (https://timesofindia.indiatimes.com/business/india-business/gold-silver-outlook-bullion-seen-holding-firm-next-week-us-tariff-verdict-geopolitics-in-focus/articleshow/126466174.cms)

[5] LinkedIn - “Gold Price to Hit 15000/oz by 2026 Amid Global Tensions” (https://www.linkedin.com/posts/dhruvgarg333_gold-may-touch-15000-ounce-by-end-of-2026-activity-7414631677647552512-ULMF)

[6] Kavout - “Gold and Silver Price Forecast 2026” (https://www.kavout.com/market-lens/gold-and-silver-price-forecast-2026-why-precious-metals-hit-record-highs-and-what-comes-next)

[7] TheStreet - “Major bank issues bold gold price target for 2026” (https://www.thestreet.com/investing/major-bank-issues-bold-gold-price-target-for-2026)

[8] Morningstar - “Investors flocking to gold for safety may be making a big mistake, Goldman says” (https://www.morningstar.com/news/marketwatch/20260113109/investors-flocking-to-gold-for-safety-may-be-making-a-big-mistake-goldman-says)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.