In-Depth Analysis of Divergent Trends of Chinese Concept Stocks and Investment Value Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

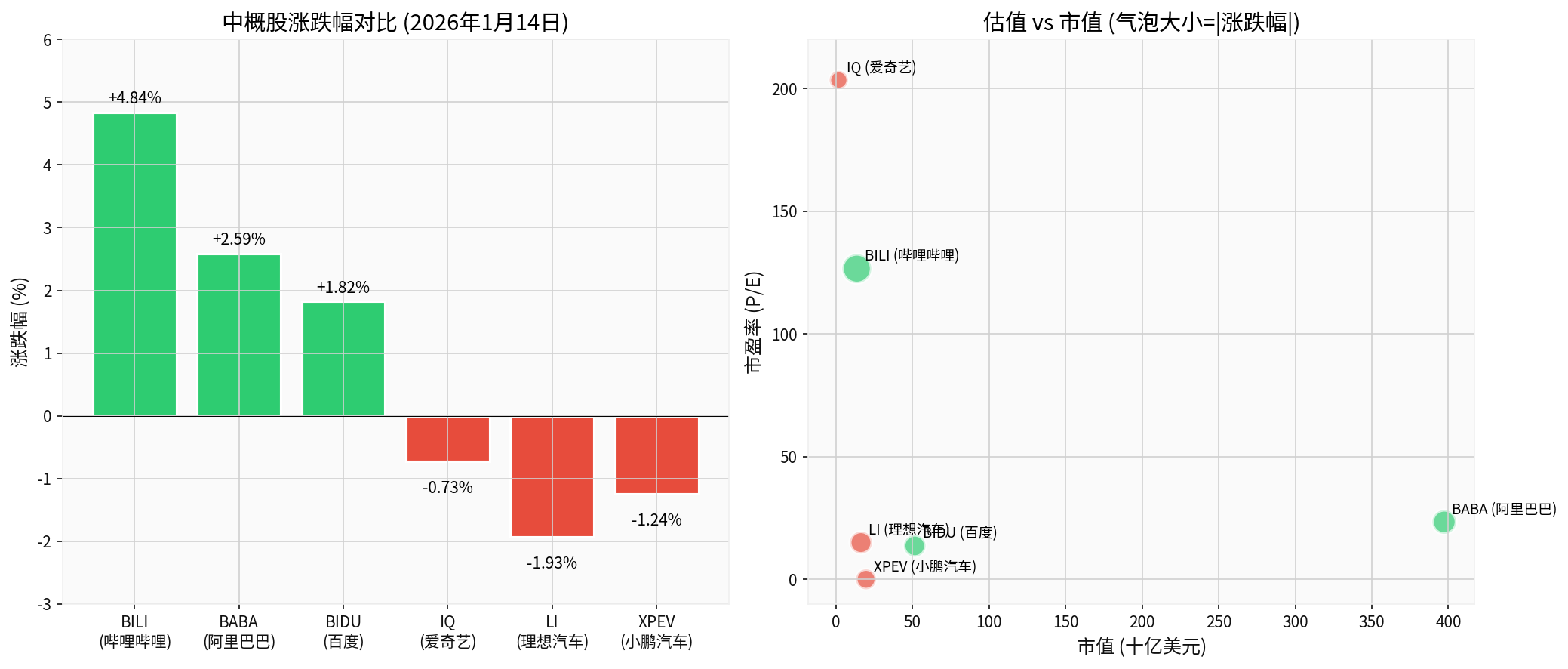

During the US stock trading session on January 14, 2026, Chinese concept stocks showed a significant divergent pattern[0]. Based on actual trading data:

| Stock Ticker | Company Name | Closing Price | Price Change | Market Cap (USD 100 million) | Price-to-Earnings (P/E) |

|---|---|---|---|---|---|

| BILI | Bilibili | $32.92 | +4.84% |

137.7 | 126.62 |

| BABA | Alibaba | $171.34 | +2.59% |

3,973.3 | 23.38 |

| BIDU | Baidu | $152.07 | +1.82% |

515.7 | 13.63 |

| IQ | iQiyi | $2.04 | -0.73% | 19.6 | 203.50 |

| LI | Li Auto | $16.32 | -1.93% |

164.7 | 14.97 |

| XPEV | XPeng Motors | $20.79 | -1.24% |

197.5 | Loss |

From the above data, it can be clearly observed that internet platform economy targets represented by Bilibili, Alibaba, and Baidu moved higher against the trend, while the new energy vehicle sector including Li Auto and XPeng Motors came under pressure and declined[0].

The underlying reason for the divergent trends of Chinese concept stocks is closely related to the global macro environment. According to the latest market analysis[1][2], on January 14, 2026, the global financial market presented a pattern of “US stock correction, USD stabilization, and commodity strength”. The probability of the Federal Reserve cutting interest rates by 25 basis points in January is only 5.0%, while the probability of maintaining interest rates unchanged is as high as 95.0%[1]. The expectation of marginal tightening has formed systematic pressure on high-valued growth stocks.

-

Adjustment of Capital Risk Preference: Data on January 13 shows that capital shifted from high-risk-preference technology growth sectors to low-risk-preference defensive safe-haven assets[1]. Main funds in growth sectors such as computers and electronics saw a net outflow of over RMB 22 billion, while the precious metals sector saw a net inflow of RMB 475 million[1]. This “weeding out the fake and retaining the real” capital flow directly affected the sector performance of Chinese concept stocks.

-

AI Application Sector Moves Higher Against the Trend: Despite the overall market pressure, the AI application sector showed an independent trend. Leading large model enterprises such as Zhipu (2513.HK) and MiniMax (0100.HK) successfully listed on the Hong Kong Stock Exchange, with intraday gains of over 60% and 30% respectively on January 12[1]. This trend directly benefits internet platform enterprises with AI deployment.

The counter-trend rise of internet platform enterprises such as Alibaba and Baidu is not accidental, but the result of the resonance of multiple positive factors:

- Marginal Improvement in Regulatory Environment: The regulatory framework in areas such as platform economy and data security has gradually become clear, and the market expects that the worst period of policy uncertainty has passed[2].

- Prominent Valuation Advantage: After experiencing in-depth adjustments over the past two years, Alibaba’s current P/E ratio is only 23.38 times[0], which is in the historical low valuation range.

- Improved Cash Flow: Alibaba’s latest annual report shows that the company’s free cash flow reached USD 77.5 billion, with a low-risk financial status[3].

The pressure on the new energy vehicle sector stems from changes in industry fundamentals:

- Continuous Price War: Since 2025, price competition in the new energy vehicle market has intensified, and corporate profitability has continued to be under pressure[2][4].

- Pressure from Declining Deliveries: Li Auto’s deliveries have seen a “six consecutive decline”, and the industry’s growth momentum has weakened[4].

- Valuation Digestion: XPeng Motors is currently in a loss-making state (P/E ratio of -32.48)[0], and the market holds a cautious attitude towards its profit prospects.

The pressure of the Chinese concept stock earnings season has different impacts on different sectors[2]:

- E-commerce Industry: Q4 performance of some enterprises may fall short of expectations, triggering valuation correction due to poor performance

- New Energy Vehicles: Profit pressure is more obvious, and capital expenditure pressure continues

- Internet Platforms: The market has more rational performance expectations for mature enterprises, and negative factors have been fully digested

According to calculations from a professional valuation model[3], Alibaba’s current price is significantly undervalued:

| Valuation Scenario | Intrinsic Value | Relative Upside from Current Price |

|---|---|---|

| Conservative Scenario | $2,534.15 | +1,378.5% |

| Base Scenario | $4,227.78 | +2,366.7% |

| Optimistic Scenario | $11,746.13 | +6,753.3% |

| Probability-Weighted | $6,169.35 | +3,499.5% |

- Conservative Scenario: Zero revenue growth, EBITDA margin of 18.8%

- Base Scenario: 8.6% revenue growth (matching 5-year historical average), EBITDA margin of 19.8%

- Optimistic Scenario: 11.6% revenue growth, EBITDA margin of 20.7%

From a five-dimensional financial analysis[3]:

- Financial Stance: Neutral, with balanced accounting policies

- Debt Risk: Low risk, with well-controlled financial leverage

- Cash Flow: Abundant free cash flow, with latest annual FCF reaching USD 77.5 billion

- Profitability: Net profit margin remains around 11.6%, relatively stable

Alibaba has medium- to long-term allocation value, with the core logic as follows:

- Sufficient Valuation Margin of Safety: Current P/E ratio is only 23.38 times, significantly lower than the historical average

- Strong Cash Flow: Abundant annualized free cash flow, supporting shareholder return capability

- Optimistic Analyst Consensus: 2029 EPS expectation range is USD 72.11 to USD 88.48[3]

Compared with Alibaba, Bilibili’s valuation restoration potential is relatively limited[3]:

| Valuation Scenario | Intrinsic Value | Relative Upside from Current Price |

|---|---|---|

| Conservative Scenario | $31.02 | -5.8% |

| Base Scenario | $30.87 | -6.2% |

| Optimistic Scenario | $39.90 | +21.2% |

| Probability-Weighted | $33.93 | +3.1% |

Bilibili’s financial status shows typical growth stock characteristics[3]:

- Revenue Growth: 5-year CAGR reaches 22.3%, with relatively fast growth rate

- Profitability: EBITDA is still negative (-9.7%), and scale profitability has not yet been achieved

- Financial Stance: Conservative accounting policies, high depreciation/capital expenditure ratio

- Debt Risk: Low risk

Medium- to long-term investment in Bilibili requires careful consideration:

- Short-Term Momentum: Today’s +4.84% gain mostly reflects a technical rebound and capital rotation

- Relatively High Valuation: P/E ratio reaches 126.62 times[0], reflecting the market’s expectation of high growth

- Profit Verification: Need to continuously pay attention to user growth monetization capability and the progress of gross profit margin improvement in the advertising business

Baidu’s current P/E ratio is only 13.63 times[0], the lowest in the Chinese concept internet sector, showing significant valuation depression characteristics.

- In-Depth AI Deployment: Baidu has leading deployment in AI large models and autonomous driving fields

- Valuation Re-Rating Potential: With the acceleration of AI application commercialization, Baidu is expected to see a valuation re-rating

- Stable Cash Flow: The search business provides stable cash flow support

- Declining Deliveries: Deliveries saw a “six consecutive decline” in the second half of 2025[4], and growth momentum has weakened

- Valuation Pressure: P/E ratio is 14.97 times[0]. Although it seems not high, the sustainability of profit growth needs to be considered

- Personnel Changes: Zhang Xiao, president of the second product line, resigned[4], triggering market concerns about the product line strategy

- Continuous Price War: Competition in the new energy vehicle market intensifies, putting pressure on profit margins

- Pure Electric Transformation: Faces uncertainties in the process of transforming from extended-range to pure electric vehicles

- Continuous Losses: Current P/E ratio is -32.48 times[0], and the profit timeline is still unclear

- Cash Flow Pressure: New car-making forces generally face capital expenditure pressure

- Intensified Competition: Market share is facing dual pressure from traditional car companies and new forces

| Target | Short-Term Rating | Medium- to Long-Term Rating | Core Logic |

|---|---|---|---|

| Alibaba | Overweight |

Overweight |

Large valuation restoration potential, abundant cash flow |

| Baidu | Overweight |

Overweight |

AI valuation re-rating potential, valuation depression |

| Bilibili | Hold |

Cautious |

Short-term rebound expected, profit to be verified |

| Li Auto | Underweight |

Neutral |

Transformation pain, delivery pressure |

| XPeng Motors | Underweight |

Avoid |

Continuous losses, intensified competition |

- Federal Reserve Policy Risk: If the January interest rate meeting clarifies “interest rate cut delay + balance sheet reduction continuation”, US bond yields may rise further[2]

- Earnings Season Pressure: Q4 performance falling short of expectations may trigger further adjustments

- Geopolitical Risk: Uncertainties in China-US relations may affect the risk premium of Chinese concept stocks

- Industry Policy Risk: Changes in regulatory policies in domestic fields such as platform economy and data security[2]

- Alibaba: Can accumulate on dips, hold for medium to long term, and the target price can refer to the lower limit of the DCF valuation range

- Baidu: AI-themed investment target, pay attention to the commercialization progress of Ernie Bot

- New Energy Vehicles: Avoid in the short term, and arrange positions after the industry pattern becomes clear

The divergent trends of Chinese concept stocks on January 14, 2026, essentially reflect the market’s re-pricing of fundamentals and valuations of different industries. Internet platform economy targets (Alibaba, Baidu) moved higher against the trend supported by valuation advantages, improved cash flow, and AI theme drive; while the new energy vehicle sector (Li Auto, XPeng Motors) faces multiple challenges such as intensified industry competition, declining deliveries, and profit pressure.

From a medium- to long-term perspective, Alibaba has relatively clear investment value with significant valuation restoration potential; Bilibili needs further verification of the sustainability of its profit model; it is recommended to temporarily avoid the new energy vehicle sector and re-evaluate it after the industry pattern stabilizes.

[0] Jinling API Real-Time Market Data (January 14, 2026)

[1] January 14, 2026 A-Share Pre-Market In-Depth Decision Report: Quantitative Analysis Under a Four-Dimensional Framework (https://unifuncs.com/s/fFAfmMvO)

[2] Three Negative News Broke Late at Night, Pinduoduo Plunged 5%, 36 Chinese Concept Leaders Plunged (https://caifuhao.eastmoney.com/news/20260113233111708781710)

[3] Jinling API Financial Analysis and DCF Valuation Data

[4] Popular Chinese Concept Stocks Generally Declined, Pony.ai and Pinduoduo Led the Decline (http://www.news18a.com/news/storys_224115.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.