In-Depth Investment Value Analysis of Apichope (300723.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Apichope released its performance forecast in January 2025, expecting a full-year net loss of RMB 313 million to RMB 442 million, a significant narrowing compared to the net loss of RMB 540 million in the same period of 2024. The loss size decreased by approximately 18%-42%[0][1]. However, the company is still in a phase of strategic loss, and performance pressure mainly stems from the superposition of three factors:

| Influencing Factors | Specific Performances | Expected Duration of Impact |

|---|---|---|

| Decline in product sales and gross profit margin | Deepening of volume-based procurement policy, compressed profit margins of traditional products | Policy digestion period |

| Increase in capacity depreciation | Guangdong Ruishi Innovative API Base put into operation and transferred to fixed assets | Capacity ramp-up period (2-3 years) |

| Continuous R&D investment | R&D expense ratio exceeded 22% in 2024, with focus on innovative pipeline layout | Long-term strategic investment |

According to the latest financial data, the company achieved operating revenue of RMB 814 million in the first three quarters of 2025, a year-over-year decrease of 34.35%; the net profit attributable to shareholders of listed company was -RMB 136 million, with the loss size narrowing by 44.80%[0]. This indicates that the trend of narrowing losses has been verified, but the pressure of revenue decline remains significant.

Apichope’s core innovative drug

- Global Phase III REDUCE 2 Trial: More than 50% of subject enrollment has been completed, with full enrollment expected to be finished in H1 2025

- Significant Clinical Efficacy: Data from the completed multi-center Phase IIb trial shows that AR882 outperforms existing therapies in uric acid-lowering efficacy and safety

- Academic Recognition: Selected for multiple presentations at the 2025 European Alliance of Associations for Rheumatology (EULAR) Annual Congress, including oral presentations and poster displays

- Regulatory Breakthrough: Granted Fast Track Designation (FTD) by the U.S. FDA for tophi research

On December 13, 2025, Swedish biopharmaceutical company Sobi announced the acquisition of Arthrosi Therapeutics, a portfolio company of Apichope, for

| Item | Details |

|---|---|

| Total Acquisition Price | Up to USD 1.5 billion |

| Apichope’s Shareholding Ratio | 13.45% (held through wholly-owned subsidiary Ruiteng Biotech (Hong Kong)) |

| Expected Amount to Be Received | Approximately USD 202 million (approximately RMB 1.45 billion) |

| China Region Rights | Apichope retains 100% rights |

| Priority Supply Right | Obtained global priority supply right for AR882 active pharmaceutical ingredients (APIs) |

- Closing is expected to be completed after U.S. antitrust filing in Q1 2026

- The USD 950 million upfront payment (equivalent to approximately RMB 6.713 billion) is expected to be received in Q1 2026

- AR882’s clinical trials are expected to conclude around mid-2026, followed by the submission of a New Drug Application (NDA)

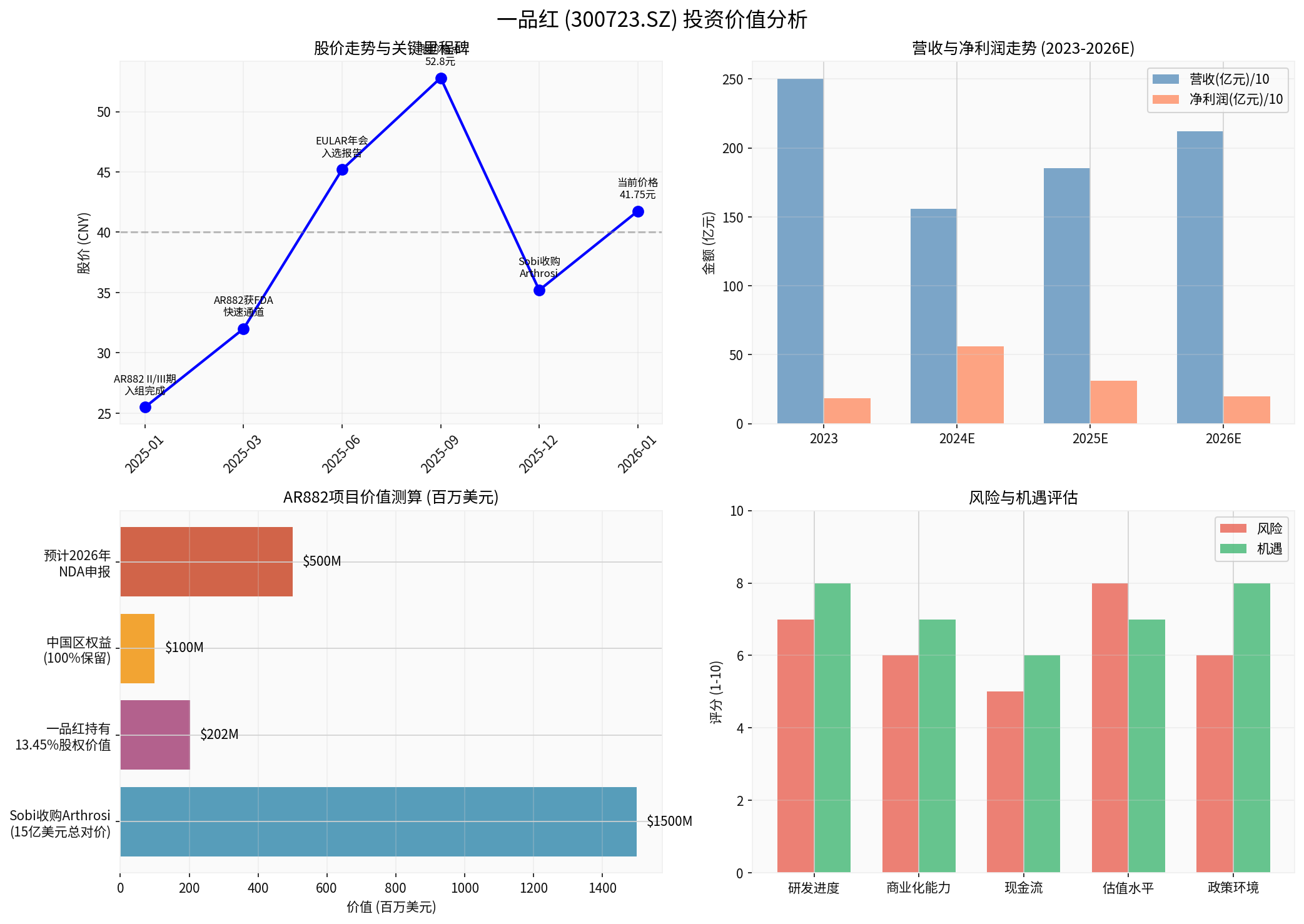

As of January 14, 2026, Apichope’s closing price was RMB 41.75, representing a 2.11% decrease, with a market capitalization of USD 18.86 billion[0]:

| Valuation Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | -43.95x | In loss status |

| Price-to-Book Ratio (P/B) | 10.65x | Relatively high |

| 1-Year Price Increase | +144.44% | Significantly outperforms the industry |

| 3-Year Price Increase | +60.76% | Neutral to weak |

-

Apichope retains 100% rights to AR882 in China

- There are over 10 million gout patients in China, representing huge market potential

- Apichope has a mature commercialization team with the capability for rapid market expansion

- Based on comparable company valuations, the value of AR882’s China market rights is approximately RMB 5 billion to RMB 10 billion

-

Expected Cash Flow Improvement

- The USD 950 million upfront payment will significantly improve the company’s cash flow

- The company plans to invest the funds in new product R&D to continuously build its innovative pipeline

- The equity incentive plan (RMB 17.28 per share) demonstrates the management’s confidence in future development

-

Policy Support for Innovative Drug R&D

- For clinically urgently needed innovative drugs, the “R&D-evaluation linkage” mechanism is implemented, shortening the review period to 30 working days

- Qualified innovative drugs will be included in the medical insurance reimbursement scope

- Apichope’s innovative layout is highly aligned with the direction of policy support

-

Clear Short-Term Performance Pressure

- The expected net loss in 2024 was RMB 472 million to RMB 679 million, and the traditional business still needs time to bottom out

- Depreciation pressure during the capacity ramp-up period of the Guangdong Ruishi Base continues

- The volume-based procurement policy expansion in the pharmaceutical industry continues to deepen

-

R&D Uncertainties

- AR882’s Phase III clinical data has not been unblinded yet, with the risk of failing to meet expectations

- The NDA review cycle is approximately 12-15 months, and commercialization is still pending

- The success rate of Phase III clinical trials for new gout drugs is less than 30%

-

Market Sentiment Volatility

- Investors discount “uncommercialized pipelines” based on success probability

- A limit-down occurred after the acquisition announcement was released in December, reflecting sensitive market sentiment

- The valuation logic of the pharmaceutical sector has changed, shifting from “concept-driven” to “value realization”

| Scenario | Key Assumptions | Valuation Expectations |

|---|---|---|

Optimistic Scenario |

AR882’s Phase III data exceeds expectations, NDA approval proceeds smoothly, traditional business stabilizes | P/E ratio of 40-50x, share price of RMB 60-80 |

Neutral Scenario |

AR882 progresses as planned, traditional business gradually recovers | P/E ratio of 30-40x, share price of RMB 45-60 |

Pessimistic Scenario |

Clinical data fails to meet expectations, traditional business continues to decline | P/E ratio of 20-30x, share price of RMB 30-45 |

Apichope’s innovative drug transformation strategy has certain valuation support logic, but it is currently in a

- Short-Term (2026): The USD 950 million upfront payment will bring significant cash flow improvement, and AR882’s NDA submission is the core catalyst

- Mid-Term (2027-2028): If AR882 is approved for marketing, it is expected to become a blockbuster product in the tophi treatment field, driving valuation reshaping

- Long-Term (2029-2030): The company plans to submit 1-2 innovative drug applications per year, with a multi-pipeline layout to reduce single-product risks

- R&D Progress Fails to Meet Expectations: Innovative drug clinical trials carry a high risk of failure

- Intensified Market Competition: Competition in the gout drug field is becoming increasingly fierce

- Unexpected Policy Impacts: Changes in pharmaceutical industry policies may have an impact on the company’s operations

- Cash Flow Pressure: R&D investment continues to increase, requiring attention to the rate of capital consumption

It is recommended that investors focus on the following catalysts:

- Unblinding time of AR882’s global Phase III clinical data

- Progress of NDA submission and approval results

- Completion of Sobi’s acquisition closing and status of payment receipt

- Performance fulfillment of the 2025 annual report

- Progress of subsequent innovative pipeline advancement

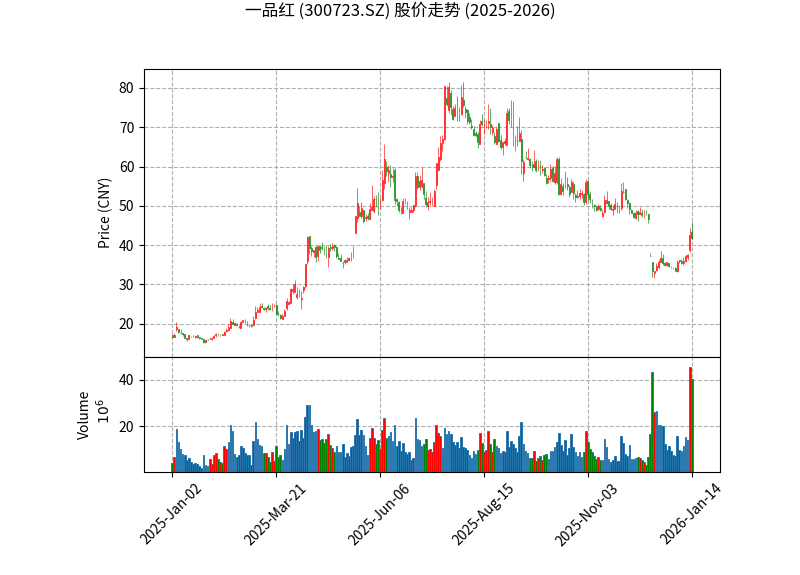

The chart above shows Apichope’s share price trend since 2025. It rose from a low at the beginning of the year to a high of RMB 52.8 in September (an increase of over 100%), then corrected due to different market interpretations of the acquisition. The current price of RMB 41.75 is still in a relatively reasonable range.

The comprehensive analysis chart shows: ① The company’s share price is highly correlated with key milestones; ② Performance is in the transformation pain period but the trend of narrowing losses is clear; ③ The value of the AR882 project has been recognized by international pharmaceutical companies; ④ Risks and opportunities coexist, with innovation transformation as the main driving force.

[0] Jinling API Data - Real-time quotes, company profile, financial analysis, and 2025 Q3 report of Apichope (300723.SZ)

[1] Investing.com - “Breaking! 14 Daily Limit Ups in 19 Days: Packaging and Printing Stock Releases Performance Forecast” (https://cn.investing.com/news/stock-market-news/article-3165579)

[2] Apichope Official Website - “Gout Innovative Drug Daobotinuolei (AR882) Selected for Multiple Presentations at EULAR 2025 Annual Congress” (https://www.apichope.com/article/2445.html)

[3] Vivabio Innovator - “USD 1.5 Billion: Vivabio Innovator’s Portfolio Company Arthrosi Reaches Acquisition Agreement with Sobi” (https://www.vivabioinnovator.com/news-cn/15yi-mei-yuan-wei-ya-sheng-wu-tou-zi-fu-hua-gong-si-arthrosiyu-sobida-cheng-shou-gou)

[4] Apichope Investor Relations - “Investor Relations Activity Record Form” (https://pdf.dfcfw.com/pdf/H2_AN202512161801737194_1.pdf)

[5] 21st Century Business Herald - “Growing Pains in Performance Amid Innovative Drug Bets: Apichope’s USD 950 Million Acquisition Good News Triggers Selling” (https://www.21jingji.com/article/20251216/herald/9d818c53810c2674235d9b0caa8d4ecd.html)

[6] Sobi Official Website - “Sobi to acquire Arthrosi Therapeutics” (https://www.sobi.com/en/press-releases/sobi-acquire-arthrosi-therapeutics-strengthening-pipeline-potential-treatment-gout-2413046)

[7] Securities Times - “Apichope: AR882’s Domestic Phase II/III Clinical Trial Completes Phase II Subject Enrollment Ahead of Schedule” (https://www.stcn.com/article/detail/1235846.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.