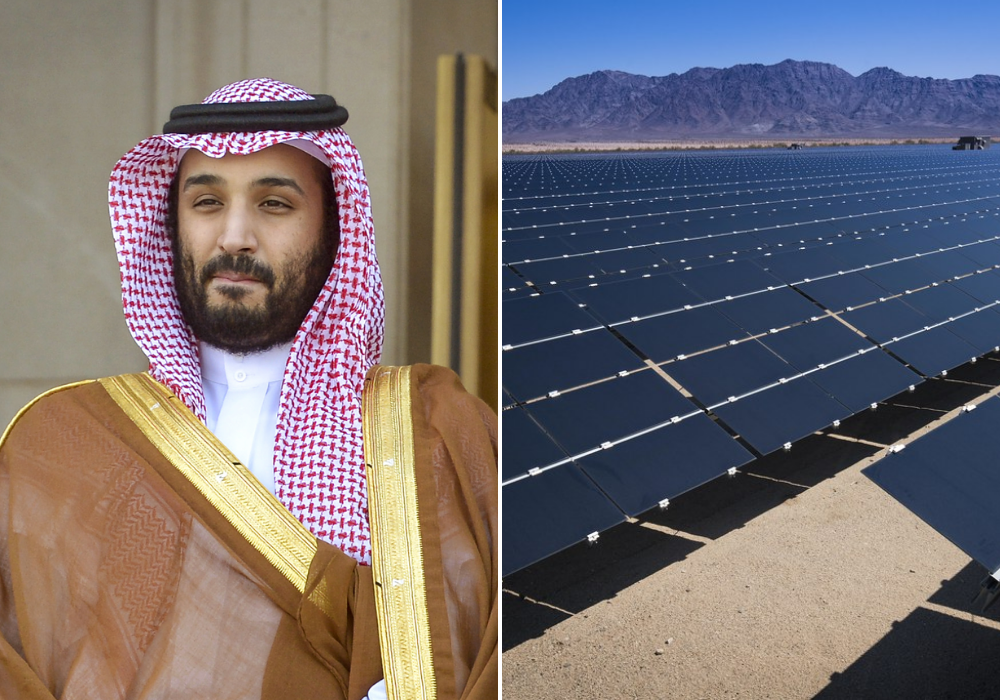

Analysis of Saudi Aramco's Investment in Bicheng Energy and the Trend of Capital Integration in the Energy Industry Chain

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data, I will conduct a systematic and comprehensive analysis for you.

Saudi Aramco has built a systematic new energy investment matrix through its corporate venture capital arm

| Fund Name | Size | Investment Focus |

|---|---|---|

| Digital/Industrial Fund | US$500 million | Digitalization, industrial solutions |

| Prosperity7 Fund | US$500 million | Diversified venture capital |

| Energy Transition Fund | US$1.5 billion | Clean energy technologies |

To date, Saudi Aramco’s global investment portfolio has reached

Saudi Aramco has established

The lead investor lineup for Bicheng Energy’s Series B financing is highly meaningful:

- Aramco Ventures: Represents energy transition capital from an oil giant

- Eurazeo: A well-known European investment group

- LONGi Green Energy: Global leader in photovoltaic industry

- Yiyan Capital: Professional industrial capital

This combined investment model of “Oil Capital + European Capital + Industry Leader” clearly demonstrates the strategic intent of

Judging from Saudi Aramco’s investment portfolio, its new energy strategy presents

- Green Power: Solar and wind energy projects (targeting 12GW of renewable energy capacity by 2030)[3]

- Hydrogen Energy: Blue hydrogen and ammonia production (targeting annual output of 11 million tons of blue ammonia by 2030)[4]

- CCUS: Carbon Capture, Utilization and Storage technologies

- Cutting-edge Technologies: Direct air capture, energy storage, AI optimization

Notably, against the backdrop of “slowing low-carbon investment” in the global oil and gas industry, Saudi Aramco’s investment strategy presents

| Company | Strategic Characteristics | 2025 Developments |

|---|---|---|

Saudi Aramco |

Diversified layout, steady advancement | Continued investment in clean energy, launch of RMB 55 billion China-focused fund[2] |

BP |

Pullback after aggressive transformation | Cut renewable energy spending from US$5 billion to US$1.5-2 billion[5] |

Shell |

Retreat from offshore wind power | Exit new offshore wind power investments[5] |

TotalEnergies |

Focus on power business | Target to increase power business share from 12.5% to 20% by 2030[6] |

Saudi Aramco has chosen a path of

On January 8, 2026, the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) approved the

- Full Industrial Chain Closed Loop: “Crude oil import - refining and chemical production - aviation fuel transportation - airport refueling”

- Scale Effect: Benchmarked against international integrated energy giants such as Shell and BP[8]

- Enhanced Competitiveness: Upgrading from single-channel competition to comprehensive competition based on full-industry-chain efficiency and cost

As a global leader in the photovoltaic industry, LONGi Green Energy’s participation in the investment in Bicheng Energy reflects its

- In November 2025, LONGi Green Energy announced the acquisition of Jingkong Energyto enter the energy storage track[9]

- Participated in the polysilicon storage consortium to promote capacity integration[10]

- Actively responded to the “anti-involution” policy in the photovoltaic industry to promote the orderly exit of backward production capacity

CATL plans to participate in the investment of

Analysis of Driving Factors for Industrial Chain Integration

├── Policy Guidance Level

│ ├── Ministry of Industry and Information Technology promotes the "anti-involution" policy in the photovoltaic industry

│ ├── SASAC promotes specialized integration of central state-owned enterprises

│ └── Market-oriented reform of grid-connected electricity prices for new energy

├── Market-driven Level

│ ├── Overcapacity leads to in-depth industry reshuffle

│ ├── Escalating international trade frictions (US high tariffs on Southeast Asian photovoltaic products)

│ └── Consumption of refined oil products faces a historical inflection point

└── Industrial Development Level

├── Accelerated technological iteration (BC batteries, perovskite tandem cells)

├── Electricity market reform requires higher absorption capacity

└── High-proportion new energy grid connection spurs demand for "photovoltaic-storage integration"

| Integration Model | Representative Case | Core Logic |

|---|---|---|

Horizontal Integration |

Restructuring of Sinopec and China National Aviation Fuel | Merger of similar businesses to increase market concentration |

Vertical Integration |

LONGi Green Energy’s acquisition of Jingkong Energy | Synergy of upstream and downstream industrial chains, covering “photovoltaic + energy storage” |

Cross Investment |

Bicheng Energy’s Series B Financing | Joint investment by oil capital, industrial capital and financial capital |

Platform-based Integration |

Polysilicon Storage Consortium | Leading enterprises establish a platform to stabilize prices and production capacity |

| Traditional Competition Dimensions | New Competition Dimensions |

|---|---|

| Single-point cost advantage | Full-industry-chain efficiency and cost |

| Single product performance | System solution capability |

| Market share competition | Niche control and discourse power |

| Domestic market layout | Global supply chain integration |

As analyzed by experts, after the restructuring of Sinopec and China National Aviation Fuel, the competition will upgrade from “single-channel competition to comprehensive competition based on full-industry-chain efficiency and cost”[8].

Industrial chain integration is driving

-

Photovoltaic Industry:

- In 2025, the coexistence of “cross-border layout” and “batch exit” emerged[12]

- The top five module leaders collectively entered the energy storage track

- The “retreat drama” of enterprises that entered the photovoltaic industry cross-border continues to unfold

-

Aviation Fuel Market:

- Market concentration increased significantly after the restructuring

- All parties in the industrial chain re-examine their positioning

- Small and medium-sized refining and chemical enterprises face short-term adaptation pressure[8]

-

Central State-owned Enterprises:

- Specialized integration has been accurately implemented, focusing on strengthening and supplementing the industrial chain[13]

- Over 300 listed companies established industrial M&A fundsin 2025[11]

Pre-integration Structure Post-integration Structure

┌─────────────┐ ┌─────────────┐

│ Upstream │ │ Super │

│ Suppliers │ │ Integrated │

│ ←--------→ │ │ Holding │

│ Middle │ ===> │ Group │

│ Channels │ │ ↑ ↓ │

│ ←--------→ │ │ Specialized │

│ Downstream │ │ Service │

│ Users │ │ Providers │

└─────────────┘ └─────────────┘

Taking the aviation fuel market as an example: the “stable relationship”[8] formed between upstream “Big Three Oil Companies”, private refining and chemical enterprises, China National Aviation Fuel (super channel), and airlines is being broken and restructured.

The impact of industrial chain integration has transcended the domestic market and affected

- Technology Export + Localized Production: Facing trade barriers in Europe and the US, leading enterprises are shifting from “manufacturing going global to system services”[12]

- Supply Chain Security Becomes a Core Concern: Geopolitical fluctuations drive enterprises to build more resilient supply chains

- Enhanced Pricing Discourse Power: Integrated giants will gain stronger global resource allocation capabilities

| Entity | Strategic Recommendations |

|---|---|

Energy Enterprises |

Actively participate in industrial chain integration to build full-chain competitiveness |

Photovoltaic/New Energy Enterprises |

Seize the policy window of “anti-involution” to promote capacity optimization and integration |

Investment Institutions |

Focus on industrial fund models and participate in high-quality asset allocation |

Manufacturing Enterprises |

Accelerate technological iteration to avoid marginalization |

- Policy Implementation Risk: The effect of industrial chain integration depends on the intensity of policy implementation

- Market Monopoly Risk: The increase in concentration requires prevention of abuse of market dominant position[8]

- Integration Synergy Risk: Restructuring of central state-owned enterprises involves challenges such as management integration and cultural integration

- Technical Route Risk: The commercialization process of new technologies such as BC and perovskite is uncertain

Saudi Aramco’s investment in Bicheng Energy is a concrete manifestation of its

- Capital Structure Innovation: Combined model of oil capital, industry leader and European capital

- Industrial Chain Synergy: LONGi Green Energy’s participation highlights the trend of upstream and downstream integration

- Global Vision: Saudi Aramco’s strategic intent to deeply cultivate the Chinese market is obvious

Industrial chain capital integration is fundamentally reshaping the competitive landscape of the energy industry:

- Transformation of Competition Logic: From single-point competition to full-industry-chain competition

- Changes in Market Structure: Increased concentration and strengthened head effect

- Redistribution of Discourse Power: Integrated giants dominate the industrial chain

Looking forward, the energy industry will present a competitive landscape of

[1] OGN News - “Aramco’s venture capital boost local entrepreneurial ecosystem, units” (https://ognnews.com/Article/47685/Aramco’s_venture_capital_boost_local_entrepreneurial_ecosystem,_units)

[2] Aramco China - “Aramco vows to expand investment in China, eyeing three strategic sectors” (https://china.aramco.com/en/news-media/china-news/2025/aramco-vows-to-expand-investment-in-china-eyeing-three-strategic-sectors)

[3] OGN News - “ARAMCO POWERS AHEAD WITH UPSTREAM, DOWNSTREAM & ENERGY TRANSITION PLANS” (https://ognnews.com/Article/47681/ARAMCO_POWERS_AHEAD_WITH_UPSTREAM,_DOWNSTREAM__ENERGY_TRANSITION_PLANS)

[4] Arab News - “Beyond the barrel: How Aramco is reinventing energy production for a new era” (https://www.arabnews.com/node/2600971/business-economy)

[5] Eastmoney - “IEA Delays Peak Oil and Gas Demand by 20 Years, Oil and Gas Giants Collective ‘Backtrack’” (https://caifuhao.eastmoney.com/news/20260112090131367426450)

[6] Securities Times - “International Oil Companies Hit the Brakes on Low-carbon Investment: What Insights?” (https://www.stcn.com/article/detail/3548169.html)

[7] Securities Times - “Two Major Central Energy Enterprises Restructure, All Parties in the Aviation Fuel Chain Seek New Positions” (https://www.stcn.com/article/detail/3580375.html)

[8] Sina Finance - “Two Central Enterprises Restructure to Create an Aviation Fuel ‘Giant’ and Reshape the Industrial Pattern” (https://finance.sina.com.cn/roll/2026-01-14/doc-inhhfvyr6668165.shtml)

[9] Pacific Securities - “Event Review of LONGi Green Energy in 2025: BC Volume Growth Helps Reduce Losses YoY and QoQ in Q3, Acquisition of Jingkong Energy to Enter Energy Storage”

[10] Shanghai Securities News - “New Progress in Polysilicon Storage” (2025-11-06)

[11] Xinhua Finance - “Over 300 Listed Companies Established Industrial M&A Funds in 2025” (http://jjckb.xinhuanet.com/20260115/574f2cd7400d42559fc42a7d06bed6fb/c.html)

[12] CNFOl - “2025 Year-end Review of China’s Photovoltaic Industry” (http://mp.cnfol.com/56191/article/1767771544-142201925.html)

[13] Eastmoney - “Restructuring of Central and State-owned Enterprises Accelerates, Upstream and Downstream Industrial Synergy Strengthened” (https://wap.eastmoney.com/a/202601103614651428.html)

[14] IEA - “World Energy Investment 2025” (https://www.iea.org/reports/world-energy-investment-2025/middle-east)

[15] Rystad Energy - “Middle East oil and gas: Six strategic themes from 2025” (https://www.rystadenergy.com/insights/middle-east-oil-and-gas-six-strategic-themes-from-2025-and-what-to-watch-in-2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.