Impact Assessment Report on Boying Special Welding's Vietnam Production Base

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected public information and market data, I will conduct a comprehensive analysis of the impact of Boying Special Welding’s Vietnam Production Base after it reaches full-capacity operation.

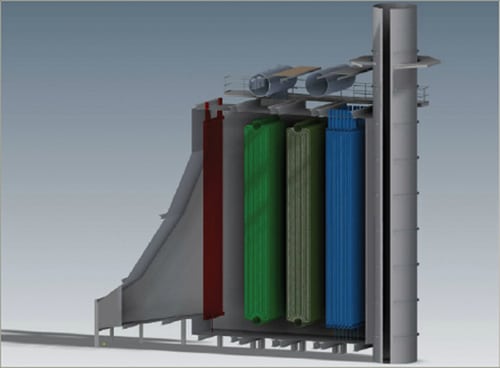

Boying Special Welding (301468.SZ)'s Vietnam Production Base is located in the Nam Dinh Vu Industrial Zone, Haiphong, Vietnam. The first phase, with 4 HRSG (Heat Recovery Steam Generator) production lines, reached full-capacity operation in September 2025[1][2]. The company plans to deploy 12 production lines in Vietnam (4 are currently in operation, and 8 lines in the second phase are expected to be put into production in phases starting from Q2 2026). Meanwhile, 2 production lines at the Da’ao Base in China are expected to be put into production in 2026, at which point the company will have a total production capacity of 14 lines[1][3].

According to public research report forecasts, Boying Special Welding’s operating revenue will grow from RMB 460 million in 2024 to RMB 925 million in 2026 and RMB 1.387 billion in 2027, with a year-on-year growth rate of as high as

| Revenue Growth Drivers | Estimated Increment in 2026 (RMB 100 million) | Main Contribution Sources |

|---|---|---|

| Overseas Capacity Release | 3.50 | Full-capacity operation of 4 lines in Vietnam Phase I + commissioning of Phase II |

| AI Data Center Demand | 2.00 | Supporting demand for gas turbines brought by North American computing centers |

| Breakthrough in North American Customers | 1.50 | Passed certification of some customer systems and obtained US orders |

| Gas Turbine Replacement Cycle | 1.50 | Overseas gas turbines have entered an upward cycle driven by replacement demand |

| Middle East Oil and Gas Composite Pipes | 0.80 | Deep-sea oil and gas exploration drives demand for composite pipes |

The company’s proportion of overseas revenue has increased from 11% in 2021 to 55% in 2024, and is expected to reach 65% in 2025, 75% in 2026, and further rise to

The company has passed the production system certification of some North American customers and obtained US orders. The factory audit process for potential customers has been completed, and it is about to enter the order negotiation stage[2]. The North American HRSG market has high access thresholds, requiring certification from the American Society of Mechanical Engineers (ASME) and production system certification from main engine manufacturers. The company has taken the lead in breaking through this barrier, forming a significant

The comprehensive gross profit margin is expected to increase from 27.42% in 2024 to 34.57% in 2026 and

| Improvement Drivers | Gross Profit Margin Contribution (Percentage Points) | Mechanism |

|---|---|---|

| Low-cost Advantage in Vietnam | 1.5 | Labor costs, tax incentives |

| Improvement in Capacity Utilization | 2.0 | Capacity release dilutes fixed costs |

| Scale Effect | 1.0 | Scale effect in procurement and production |

| Product Structure Optimization | 1.2 | Increased proportion of high-margin HRSG products |

| High-margin Orders in North America | 2.5 | Stronger pricing power in the North American market |

The current overseas HRSG capacity gap reaches 50% and continues to expand. According to industry research, the average value of a single overseas HRSG production line is approximately USD 10-12 million, and the industry’s average net profit margin is 20-30%. As the supply-demand gap widens, the industry’s net profit margin is expected to exceed

2023.08 → Vietnam Project Launched

2024.01 → Registration of Vietnam Subsidiary Completed

2025.09 → 4 Lines in Vietnam Phase I Put into Production (Now at Full Capacity)

2026.Q2 → First 4 Lines of Vietnam Phase II Put into Production

2026.H2 → Remaining 4 Lines of Vietnam Phase II Put into Production

2026 → 2 Lines at China's Da'ao Base Put into Production

━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Total: 14 Production Lines (12 in Vietnam + 2 in China)

- Explosive Demand for AI Data Centers: The rapid development of the North American AI industry has led to explosive demand for data centers. Gas turbine power generation has become a major solution to power shortages, and demand for HRSG as supporting equipment is strong[1][3].

- Gas Turbine Replacement Cycle: Overseas gas turbines have entered an upward cycle driven by replacement demand. GEV expects its backlog of orders to reach 80GW by the end of 2025, with order scheduling extending to 2029[1].

- Expansion of the Middle East Market: The company plans to establish an overseas manufacturing base for oil and gas composite pipes, focusing on developing the Middle East market. Deep-sea and ultra-deep well oil and gas exploration drives strong demand for composite pipes[1].

| Indicators | 2024A | 2025E | 2026E | 2027E |

|---|---|---|---|---|

| Operating Revenue (RMB 100 million) | 4.60 | 4.76 | 9.25 | 13.87 |

| Year-on-Year Growth Rate (%) | -23.8 | 3.5 | 94.2 |

49.9 |

| Proportion of Overseas Revenue (%) | 55 | 65 | 75 | 80 |

| Comprehensive Gross Profit Margin (%) | 27.42 | 27.42 | 34.57 | 39.65 |

| Net Profit Attributable to Shareholders (RMB 100 million) | 0.69 | 0.53 | 1.79 | 3.46 |

| Year-on-Year Growth Rate (%) | -47.0 | -23.5 | 236.1 |

93.7 |

- Revenue Side: The release of Vietnam’s production capacity will drive the company’s revenue to achieve leapfrog growth. Revenue is expected to nearly double in 2026, mainly benefiting from breakthroughs in the North American market and demand driven by AI data centers.

- Profit Side: With the increase in the proportion of high-margin overseas businesses and the improvement of capacity utilization, there is significant upside potential for both gross profit margin and net profit margin. The net profit attributable to shareholders is expected to grow by 236% year-on-year in 2026.

- Valuation: As a leading enterprise in China’s surfacing welding field, the company has taken the lead in breaking through the North American HRSG market, with obvious scarcity. Guosen Securities has given the company a 12-month reasonable valuation range of RMB 67.50-74.25 (corresponding to 2026 PE of 50-55x), and initiated coverage with an “Outperform” rating[1].

[1] Guosen Securities - Boying Special Welding (301468.SZ) In-Depth Research Report: HRSG and Oil & Gas Composite Pipes are Expected to Open the Second and Third Growth Curves (January 2026)

https://pdf.dfcfw.com/pdf/H3_AP202601051815472716_1.pdf

[2] Guangdong Boying Special Welding Technology Co., Ltd. - Announcement on the Commissioning of Vietnam Production Base (September 25, 2025)

http://file.finance.sina.com.cn/211.154.219.97:9494/MRGG/CNSESZ_STOCK/2025/2025-9/2025-09-25/11480289.PDF

[3] Wall Street CN - Power Equipment Going Global: Gas Turbines and HRSG (December 3, 2025)

https://wallstreetcn.com/articles/3760615

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.