In-Depth Analysis of the Sustainability of High-Proportion Cash Dividends for Gree Electric (000651.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and in-depth analysis, I provide you with a professional research report on the sustainability of high-proportion cash dividends for Gree Electric.

The 2025 interim equity distribution plan released by Gree Electric on January 15, 2026 shows: Based on a total of 5.585 billion shares, the company will distribute RMB 10 in cash dividends per 10 shares (tax included), totaling

This interim dividend continues the company’s consistent high-dividend tradition. Calculated based on the current share price of RMB 40.12, the

| Year | Dividend per Share (RMB) | Dividend Payout Ratio (%) | Total Dividend Amount (RMB 100 million) |

|---|---|---|---|

| 2018 | 1.80 | 52.1 | 10.06 |

| 2019 | 1.60 | 48.2 | 8.94 |

| 2020 | 1.20 | 35.6 | 6.70 |

| 2021 | 1.00 | 28.3 | 5.58 |

| 2022 | 1.50 | 38.5 | 8.37 |

| 2023 | 1.80 | 42.1 | 10.04 |

| 2024 | 2.00 | 45.2 | 11.17 |

| 2025(Interim) | 1.00 | - | 55.85 |

- Average Dividend Payout Ratio: 41.4%

- Cumulative Total Dividends: Over RMB 177.6 billion (including this interim dividend)[1]

- Cumulative Dividends Since 2012: Over RMB 172.2 billion[1]

Based on the latest financial data, Gree Electric has the foundational capability to maintain high dividends[0]:

| Financial Indicator | Value | Industry Position |

|---|---|---|

| ROE (Return on Equity) | 22.62% | Excellent |

| Net Profit Margin | 17.62% | Leading |

| Gross Profit Margin | Approximately 30% | Stable |

| Operating Cash Flow | Abundant | Sufficient |

In the first three quarters of 2025, the company achieved a net profit attributable to parent shareholders of

Currently, Gree Electric’s PE is only

- The company has accumulated a large amount of undistributed profits and capital reserves

- Even if the current dividend level is maintained, the consumption of current profits is relatively limited

- The company has sufficient room to maintain or even increase dividends

Chairperson Dong Mingzhu has publicly stated on multiple occasions: “Gree is a responsible enterprise, and our determination to strive for annual dividends will not waver.”[1] The company’s dividend policy complies with relevant regulations such as the “Regulatory Guidelines for Listed Companies No. 3 - Cash Dividends of Listed Companies (2025 Revision).”

In Q3 2025, revenue was RMB 39.855 billion, a year-on-year decrease of 15.09%; in the first three quarters, revenue was RMB 137.180 billion, a year-on-year decrease of 6.50%[1]. The air-conditioning industry faces challenges such as real estate market adjustments and intensified competition. Sluggish revenue growth may affect future dividend capability.

Competitors such as Midea Group and Haier Smart Home continue to invest in diversification and intelligentization, challenging Gree’s air-conditioning-dominant business structure. Continuous investment in technology R&D and channel construction may squeeze the dividend space.

The current dividend payout ratio is approximately 45%, which is at the upper limit of the reasonable range, leaving limited room for further substantial increases.

| Company | PE (x) | Dividend Yield (%) | Dividend Payout Ratio (%) | ROE (%) |

|---|---|---|---|---|

Gree Electric |

6.99 |

4.99 |

45.2 |

22.62 |

| Midea Group | 12.50 | 3.20 | 40.5 | 24.50 |

| Haier Smart Home | 11.20 | 2.80 | 35.2 | 18.20 |

| Hisense Home Appliances | 8.50 | 3.50 | 38.5 | 15.80 |

| Supor | 18.20 | 4.10 | 65.2 | 28.50 |

Industry Average |

11.48 |

3.72 |

44.92 |

21.92 |

Gree Electric ranks among the top in the industry with a

- Leading home appliance enterprises have the ability to generate stable cash flow

- In a low-growth environment, the high-dividend strategy is attractive to institutional investors

- The market has a bias of “low valuation trap” towards the home appliance sector, and high-quality targets are undervalued

The practice of Gree Electric’s continuous high-proportion dividends shows that:

- High-quality state-owned enterprises/blue-chip stockscan realize shareholder returns through high dividends

- Stable dividend policieshelp reduce stock price volatility and enhance valuation stability

- Dividend capabilityis an important indicator for measuring company quality and should be included in the valuation framework

| Comparison Dimension | Gree Electric | Industry Average | Recovery Space |

|---|---|---|---|

| PE | 6.99x | 11.48x | +64% |

| Dividend Yield | 4.99% | 3.72% | - |

| Dividend Payout Ratio | 45.2% | 44.9% | Flat |

If Gree Electric’s valuation returns to the industry average, there is

- Focus on high-dividend high-quality assets: The dividend policies of leading enterprises such as Gree, Midea, and Haier can serve as important references for stock selection

- Matching degree of ROE and dividends: If a high-ROE enterprise can maintain high dividends, it indicates that its profit quality is true and reliable

- Beware of the “revenue growth without profit growth” trap: Be cautious of companies with revenue growth but declining profit margins and dividend capability

- Sector valuation hub: Gree Electric’s low valuation (PE 6.99x) may restrict the upper valuation limit of the entire home appliance sector

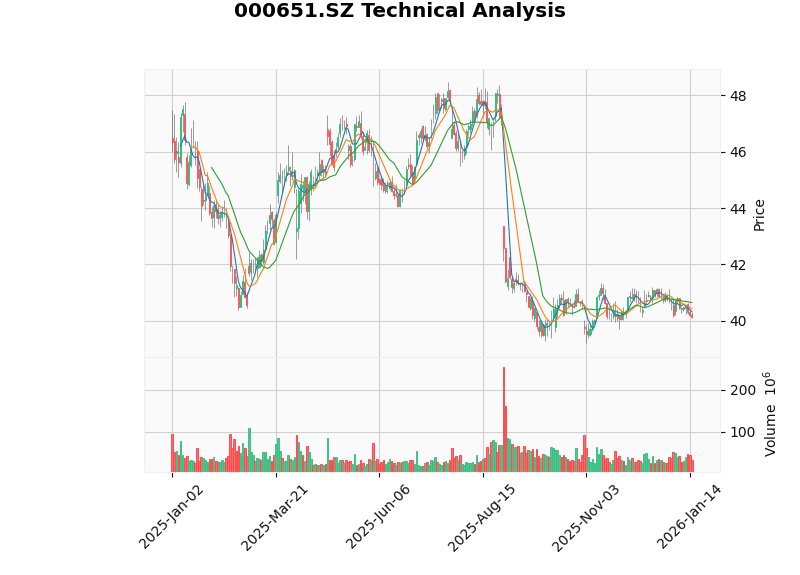

Based on technical analysis[0]:

| Indicator | Status | Signal Significance |

|---|---|---|

Trend |

Downtrend (to be confirmed) | Short-term pressure |

MACD |

Bearish crossover | Short-term bearish |

KDJ |

K=17.1, D=27.1 | Oversold zone, potential rebound |

RSI |

Oversold | Potential rebound opportunity |

Beta |

0.47 | Relatively defensive |

- Support Level: RMB 40.10

- Resistance Level: RMB 41.20

- Downside Target: RMB 39.74

Short-term technical indicators show that the stock price is in an oversold zone, with strong support at the integer level of RMB 40. Combined with the high-dividend yield feature, the current price has a good margin of safety.

| Dimension | Rating | Description |

|---|---|---|

Dividend Sustainability |

★★★★☆ | Strong financial strength, but under pressure from revenue growth |

Valuation Attractiveness |

★★★★★ | PE only 6.99x, dividend yield nearly 5% |

Profit Quality |

★★★★☆ | ROE 22.62%, abundant cash flow |

Technical Aspects |

★★★☆☆ | In a downtrend, oversold rebound expected |

-

Suitable Investor Types:

- Value investorspursuing stable cash returns

- Long-term investors who prefer high-dividend strategies

- Conservative capital focusing on asset preservation and appreciation

-

Investment Strategy:

- Gradually build positions in the range below RMB 40

- Hold medium-term to enjoy dividend income

- Pay attention to changes in annual report dividend policies

-

Risk Warnings:

- Risk of sustained pressure on revenue growth

- Risk of intensified industry competition

- Risk of real estate market spillover

- Risk of dividend policy adjustments

Gree Electric’s continuous high-proportion cash dividends have strong sustainability. With stable profitability, abundant cash flow, and a low valuation level, the company is expected to maintain a relatively generous dividend policy in the future. The 2025 interim dividend plan of RMB 5.585 billion continues the company’s tradition of rewarding shareholders, and the annualized 4.99% dividend yield is significantly attractive in the current low-interest rate environment.

For the A-share home appliance sector, Gree Electric’s valuation and dividend practice have important reference significance:

- Established a benchmark for high-dividend value investment

- Revealed the valuation recovery spaceof high-quality home appliance leaders

- Provided investors with dividend capabilityas an important reference dimension for stock selection

In the current market environment, as an investment target with the characteristics of

[0] Jinling API Market Data (Real-time Quotes, Financial Analysis, Technical Analysis)

[1] IT Home - “Gree Electric Distributes RMB 5.585 Billion in Cash Dividends for 2025 Interim Period” (https://m.ithome.com/html/913582.htm)

[2] OFweek Smart Home Network - “Earned RMB 21.4 Billion in First Three Quarters! Gree Electric Plans to Distribute RMB 5.585 Billion in Dividends” (https://smarthome.ofweek.com/2025-11/ART-91005-12008-30672931.html)

[3] Gree Electric Official Website - “Gree Electric Releases 2025 Q3 Report: Stabilize Foundations, Enhance Resilience, Interim Dividends Exceed RMB 5.585 Billion” (https://www.gree.com/Article/view/f4990624e60144a7a19102a71ed92947)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.