Impact Analysis of Risk Resolution Policies for Small and Medium-Sized Financial Institutions and the Real Estate Financing Coordination Mechanism

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above comprehensive information collection and analysis, I will provide you with an in-depth analysis report on the impact of risk resolution policies for small and medium-sized financial institutions on A-share bank stocks and the effectiveness of the real estate financing coordination mechanism.

On January 15, 2026, the annual regulatory work conference held by the State Administration of Financial Regulation clarified five key tasks, among which

From the perspective of policy evolution, the 2024 work conference required “fully promoting the reform and risk resolution of small and medium-sized financial institutions, and grasping the timing, intensity and effectiveness”; the 2025 conference emphasized “accelerating the reform and risk resolution of small and medium-sized financial institutions, adhering to overall coordination from top to bottom, case assignment by division, and pooling efforts”; while the 2026 statement was further upgraded to “promote in a forceful, orderly and effective manner”, reflecting the progressive deepening of the policy and the consistency of implementation intensity [2].

According to regulatory arrangements, the risk resolution of small and medium-sized financial institutions will proceed along the following paths:

| Risk Type | Disposal Strategy | Policy Objective |

|---|---|---|

Stock Risks |

Mergers and Restructuring, Reform and Risk Resolution | Reduce the number of high-risk institutions |

Incremental Risks |

Strict Access, Strengthened Supervision | Contain new risks |

Capital Supplement |

Multi-Channel Financing, Special Treasury Bond Injection | Enhance risk resilience |

Business Transformation |

Focus on Core Business, Differentiated Development | Improve sustainable development capabilities |

It is worth noting that regulators have proposed to “Steadily promote the reduction and quality improvement of small and medium-sized financial institutions, and rationally optimize institutional layout” [1], which means that some small and medium-sized institutions with operational difficulties will be integrated or exited through market-oriented means, and the market has already formed sufficient expectations for this.

In 2025, A-share bank stocks experienced a significant revaluation rally, with a full-year increase of 15.6 trillion yuan [3]. From specific data:

| Bank | Stock Code | Price-to-Earnings Ratio (P/E) | Price-to-Book Ratio (P/B) | Annual Price Change | ROE |

|---|---|---|---|---|---|

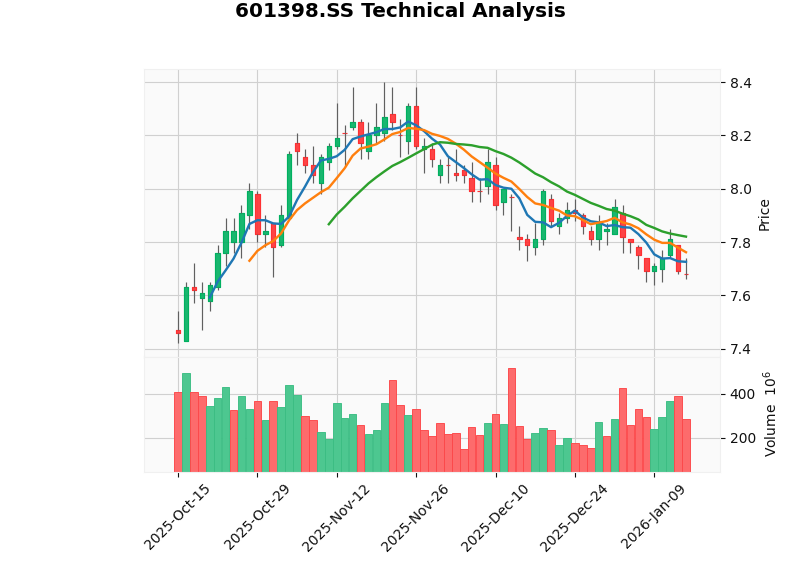

| Industrial and Commercial Bank of China | 601398.SS | 7.46x | 0.69x | +15.84% | 9.13% |

| China Construction Bank | 601939.SS | 6.77x | 0.66x | +8.53% | 10.17% |

| China Merchants Bank | 600036.SS | 6.81x | 0.78x | -1.30% | 12.09% |

| Agricultural Bank of China | 601288.SS | - | - | +51.86% | - |

From the valuation structure, the

-

Debt Resolution Policies Boost Confidence in Asset Quality- Special treasury bond injections into large state-owned banks and policies to resolve local government debt risks have significantly reduced banks’ risk exposure, and policy dividends have enhanced market confidence in bank asset quality [3].

-

Continuous Inflow of Medium- and Long-Term Capital- Long-term capital such as insurance funds and social security funds have substantially increased their holdings of bank stocks and locked them in due to accounting standards and allocation needs, while public funds have also accelerated their replenishment of this long-term underweight sector under the new regulation reforms [3].

-

Regulatory Guidance for Valuation Recovery- Policies clearly indicate that more diversified means will be used for market value management, pointing out the direction for valuation adjustment of the banking sector [5].

-

Continuous Narrowing of Net Interest Margin- Although the net interest margin of commercial banks has gradually stabilized at 1.42% since the second quarter of 2025, it is still at a historical low [6]. In October 2025, the weighted average interest rate of new corporate loans fell to around 3.1%, making it increasingly difficult for banks to balance supporting the real economy and maintaining their own profitability [6].

-

Risk Exposure of Small and Medium-Sized Banks- Some small and medium-sized banks have low capital adequacy ratios, and under the background of downward economic pressure and real estate market adjustments, the difficulty of risk disposal has increased [5]. Regional differentiation has intensified, and risk disposal is more difficult for small and medium-sized banks in central and western regions [6].

From a technical analysis perspective [4]:

- Current Price: $7.68

- Trading Range: $7.62 - $7.82 (Support/Resistance Levels)

- MACD Indicator: No crossover signal, bearish bias

- KDJ Indicator: K value 23.6, D value 28.2, in a weak range

- Trend Judgment: Sideways consolidation, no clear direction

- Current Price: $40.11

- Trading Range: $39.80 - $41.68

- KDJ Indicator: K value 9.8, D value 21.3, J value -13.2, entering oversold territory

- RSI Indicator: Entering oversold territory

- Trend Judgment: Sideways consolidation, rebound opportunity exists

According to the latest data [4][6]:

| Indicator | Value | Assessment |

|---|---|---|

| Non-Performing Loan Ratio of Commercial Banks | 1.52% | Slightly increased but generally controllable |

| Provision Coverage Ratio | 207.15% | Robust risk mitigation capability |

| Net Interest Margin | 1.42% | Historical low, initial signs of stabilization |

From a financial analysis perspective, Industrial and Commercial Bank of China has a debt risk rating of “moderate risk” and maintains a neutral financial stance [4]. Free cash flow remains stable, with the latest data showing FCF reaching 543.6 billion yuan [4].

Real estate industry risks remain the main factor affecting bank asset quality:

| Bank | Non-Performing Ratio of Real Estate Loans | Change from the Beginning of the Year |

|---|---|---|

| Industrial and Commercial Bank of China | 5.37% | +0.38 percentage points |

| Bank of China | 5.38% | - |

| Agricultural Bank of China | 5.35% | - |

| China Merchants Bank | 4.74% | - |

| Shanghai Pudong Development Bank | 1.29% (overall) | -0.07 percentage points |

| Bank of Zhengzhou | 9.75% | - |

| Bank of Chongqing | 7.19% | - |

The non-performing loan ratio of the real estate sector of a listed bank soared to 21.32% in the first half of 2025, and the non-performing loan ratio of real estate loans of some large state-owned banks exceeded 5%, reflecting industry-wide pressure [6]. Retail credit risks are also quietly accumulating, and the non-performing loan ratios of personal housing loans of the six large state-owned banks have all risen [6].

Bank asset quality shows obvious characteristics of

- First Echelon(Agricultural Bank of China): Non-performing ratio 1.27%, provision coverage ratio 295%, leading asset quality

- Second Echelon(ICBC, CCB, BOC): High real estate exposure (26%-27%), persistent market concerns

- Third Echelon(Bank of Communications, Postal Savings Bank of China): Growth stagnation, declining net interest margin and provision coverage ratio

- High-quality targets: China Merchants Bank, Shanghai Pudong Development Bank, China CITIC Bank

- Lagging targets: Huaxia Bank, China Minsheng Bank, trapped in a vicious circle of “deteriorating asset quality - declining profitability - depressed valuation”

The real estate financing coordination mechanism is the most important countercyclical adjustment tool in this round of adjustments, with its core objectives being to resolve the liquidity risks of real estate enterprises and ensure “delivery of completed housing” [9]. It has made significant progress since its accelerated implementation starting in January 2024.

Regulatory authorities issued the latest policy guidance in early 2026, stating that eligible projects already on the “white list” can extend their loans for up to 5 years (previously the maximum extension was 2.5 years). This adjustment marks:

- Term Breakthrough: Breaks the original extension limit in the Measures for the Administration of Working Capital Loans

- Policy Transformation: Shifts from short-term relief to long-term guarantee

- Institutionalization: Gradually becomes an important financing system under the new model of real estate development

| Time Node | Approved Amount | Remarks |

|---|---|---|

| End of March 2024 | 520 billion yuan | - |

| October 2024 | 2.23 trillion yuan | Accelerated implementation |

| End of 2024 | 5.03 trillion yuan | Exceeded annual target |

| September 2025 | 7 trillion yuan | Continuous expansion |

This scale is equivalent to Shanghai’s full-year GDP in 2023 (approximately 4.72 trillion yuan), indicating the regulators’ strong determination to stabilize the market and massive resource investment [9]. At the local level, the cumulative disbursement amount of “white list” projects in Jiangsu Province reached 412.7 billion yuan, ranking among the top in the country [9].

-

High-Quality Real Estate Enterprises Benefit Significantly: Central enterprises, state-owned enterprises, and high-quality private enterprises obtain direct liquidity support through their credit advantages, and leading real estate enterprises with over 60% dependence on bank loans (such as China Vanke, Country Garden, Poly Developments, etc.) benefit significantly [8]

-

Risk Mitigation at the Project Level:

- Secure a recovery period for compliant high-quality projects trapped in a sluggish market

- Prevent high-quality projects from becoming unfinished buildings due to capital chain breaks

- Strike a balance between “ensuring delivery” and “preventing risks”

-

Improvement of Bank Asset Quality: Avoid immediate bad debt recognition through loan extensions, curbing the upward trend of non-performing loan ratios [8]

-

Strict Collateral Requirements: According to a survey by China Index Academy, about 60% of institutions report that “providing full-value collateral” is the most difficult condition to meet for projects to enter the “white list” [8]

-

Disbursement Efficiency Needs Improvement: Some real estate enterprises have “white list” credit lines of about 10 billion yuan, but only 25%-30% of the line has been actually disbursed [8]

-

Limited Policy Coverage: Policy benefits for distressed real estate enterprises are limited; the “white list” mainly targets the project level and has not yet completely resolved the balance sheet crisis of real estate enterprise entities [9]

In addition to the “white list” mechanism, other financing channels for real estate enterprises have also maintained strong momentum [8]:

| Financing Channel | Scale in November 2025 | YoY Change | Proportion |

|---|---|---|---|

| Credit Bonds | 26.22 billion yuan | - | 42.3% |

| ABS | 29.4 billion yuan | +36% | 47.4% |

| Overseas Bonds | 6.42 billion yuan | - | 10.3% |

Total |

62.04 billion yuan |

+28.5% |

100% |

Industry bond financing has shown signs of stabilization since the end of 2025, with ABS financing growth being particularly prominent [8].

-

Valuation Recovery Remains the Main Theme: The valuation performance-to-price ratio of bank stocks remains prominent amid their long-term trading below book value, with P/B generally in the 0.6-0.8x range [3]

-

High Dividend Strategy Dominates: In a low-interest rate environment, the dividend yield of over 4% for bank stocks has obvious appeal

-

Select Leading Targets: Targets with excellent asset quality and sufficient provisions, such as Agricultural Bank of China and China Merchants Bank, have higher allocation value

- Erosion of profits from continuous narrowing of net interest margin

- Risk exposure related to real estate exposure

- Risk transmission from small and medium-sized financial institutions

- Macroeconomic recovery falling short of expectations

- Deepening of Extension Policies: The 5-year loan extension is expected to smooth debt repayment pressure to after 2028

- Lead Bank System: Clarify rights and responsibilities, build a cooperation model of shared interests and risks

- Reassessment of Collateral Value: Adapt to market changes, flexibly adjust collateral assessment standards

- Actual disbursement conversion rate of “white list” project loans

- Stabilization of real estate sales data

- Smooth passage of the debt repayment peak for leading real estate enterprises

- Changes in bank asset quality indicators

-

Risk resolution policies for small and medium-sized financial institutionsprovidesupportfor the valuation of A-share bank stocks. Through debt resolution policies, capital supplementation, and regulatory guidance, they have enhanced market confidence in bank asset quality, promoting the evolution of bank stocks from valuation recovery to revaluation. However, the policies also bring adifferentiation effect- leading high-quality banks benefit significantly, while small and medium-sized banks and banks with high real estate exposure still face valuation pressure.

-

The real estate financing coordination mechanismhas achieved phased results, with over 7 trillion yuan in approved loans for “white list” projects, effectively easing the liquidity pressure of some high-quality real estate enterprises. The optimization of the extension policy to 5 years has won valuable adjustment time for the industry, but the mechanism mainly targets project-level risks, with limited effect on the credit repair of real estate enterprise entities, and the final effect depends on whether the sales side can stabilize and rebound.

-

Bank asset qualityis generally controllable but faces structural pressure, with real estate-related loans remaining the main risk source. Retail credit risks (personal housing loans, credit cards) are also accumulating and require continuous attention.

-

In terms of investment strategies, it is recommended to focus on leading bank targets with excellent asset quality, sufficient provisions, and high dividends, and be alert to risk exposure of small and medium-sized banks with excessive real estate exposure and high downward pressure on regional economies.

[1] Sina Finance - State Administration of Financial Regulation: Promote Risk Resolution for Small and Medium-Sized Financial Institutions in a Forceful, Orderly, and Effective Manner (https://finance.sina.cn/2026-01-15/detail-inhhmamt4654284.d.html)

[2] Securities Times Network - State Administration of Financial Regulation’s 2026 Regulatory Work Conference Arranges 5 Key Tasks (https://www.stcn.com/article/detail/3595619.html)

[3] Tencent News - Insight 2025 | Behind the “Elephants Dancing”: The Road to Revaluation of 15.6 Trillion Yuan in Bank Stocks (https://news.qq.com/rain/a/20251230A02V0400)

[4] Gilin API Data - Overview and Technical Analysis of Bank Stock Companies

[5] Xinhua News Agency - Commercial Banks Accelerate Capital Raising Through Intensive Rights Offerings at Year-End (http://jjckb.xinhuanet.com/20251216/b76eeba2b8694ff6aee81cda518f49f7/c.html)

[6] Sina Finance - The Invisible “Liquidation Line”: Behind the Exit of 600 Banks (https://finance.sina.com.cn/money/bank/bank_hydt/2026-01-05/doc-inhffwpp2168915.shtml)

[7] Futu NiuNiu - Bank Stocks in 2025: Who Led the Gains and Who Lagged? (https://news.futunn.com/en/post/66830298)

[8] Eastmoney - Real Estate Enterprises’ “White List Projects” to Loosen Loan Extension Restrictions Imminently; Collateral Value Reassessment is the Key (https://wap.eastmoney.com/a/202601133617709732.html)

[9] FT Chinese - Outlook 2026: As Real Estate Continues to Decline, How Will All Parties Respond? (https://big5.ftchinese.com/story/001108557)

[10] Securities Times Network - “White List” Policy Shifts to Long-Term Guarantee; Real Estate Enterprise Financing Warms Up (https://www.stcn.com/article/detail/3591494.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.