Analysis of Capital Structure Improvement After Juhe Materials' Hong Kong Stock Listing

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

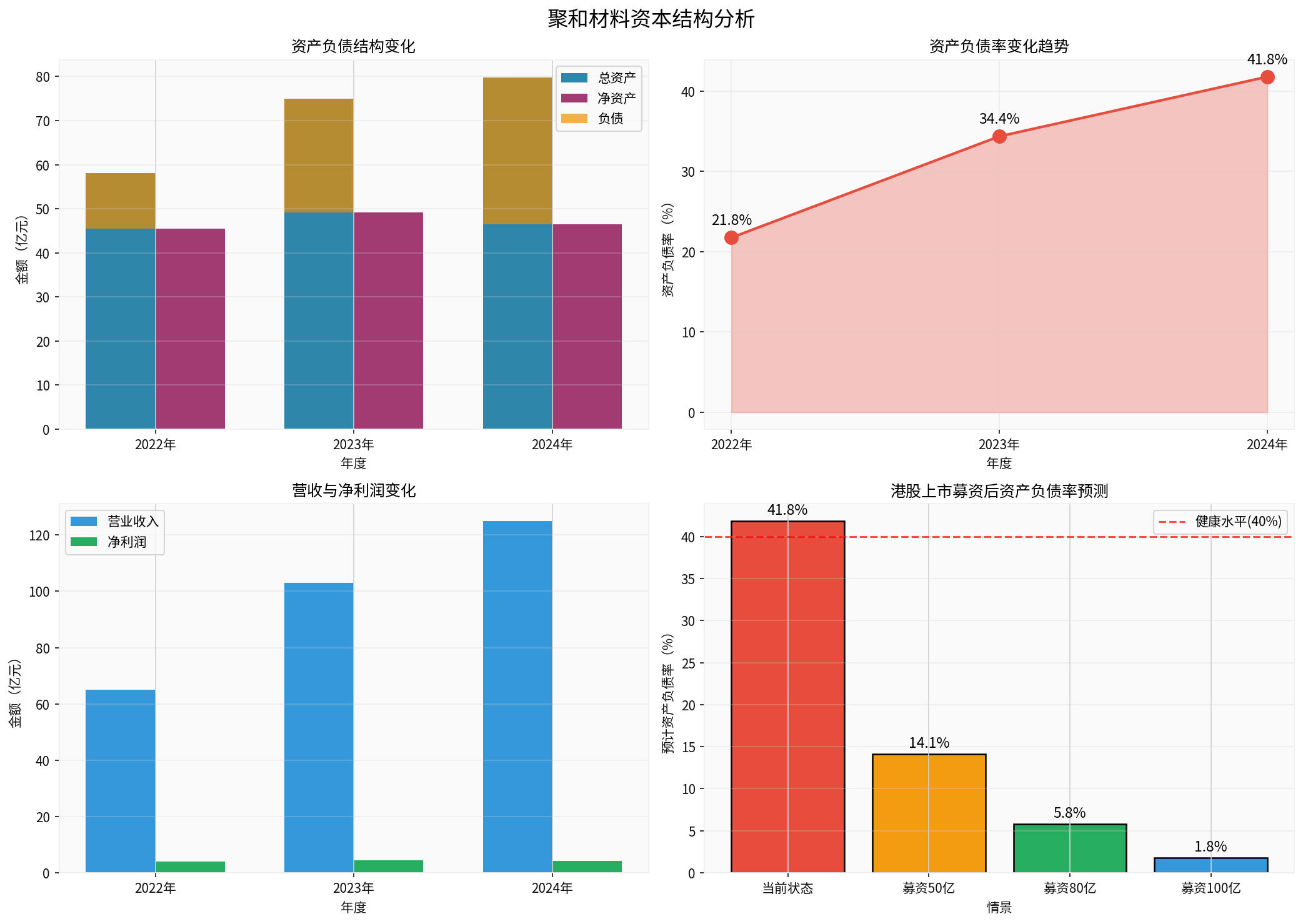

| Financial Indicators | 2022 | 2023 | 2024 | YoY Change |

|---|---|---|---|---|

| Operating Revenue (RMB 100 million) | 65.04 | 102.90 | 124.88 | +21.35% |

| Net Profit Attributable to Shareholders (RMB 100 million) | 3.91 | 4.42 | 4.18 | -5.45% |

| Total Assets (RMB 100 million) | 58.11 | 74.96 | 79.76 | +6.41% |

| Net Assets Attributable to Shareholders of Listed Company (RMB 100 million) | 45.47 | 49.20 | 46.44 | -5.60% |

| Asset-Liability Ratio | 21.75% | 34.37% | 41.80% | +7.43pct |

As of the end of 2024, Juhe Materials’ capital structure has the following characteristics:

- Asset-Liability Ratio: 41.80%: Increased by 7.43 percentage points compared to 34.37% in 2023, with liability growth outpacing asset growth [3]

- Liability Structure: Short-term borrowings of RMB 2.597 billion, accounting for 32.56% of total liabilities, mainly used for discounted and outstanding bank bills [3]

- Monetary Capital: RMB 622 million, a decrease of 16.92% from the previous period

- Trading Financial Assets: RMB 1.139 billion

- Operating Cash Flow: The net cash flow from operating activities in 2024 was -RMB 895 million, which improved compared to the previous year but remained negative [3]

2025 is a “boom year” for the Hong Kong IPO market. According to Deloitte China’s forecast, the total IPO fundraising in Hong Kong for the whole year is expected to reach approximately HK$286.3 billion, an increase of over 200% compared to 2024, surpassing Nasdaq to return to the top globally [4]. The launch of the Hong Kong Stock Exchange’s “Tech Enterprise Fast Track” and the optimization of the IPO pricing mechanism have significantly enhanced its attractiveness to tech enterprises, and the “A+H” listing model remains popular.

According to the company announcement, Juhe Materials plans to issue H shares and list on the Hong Kong Stock Exchange, with joint sponsors being HTI Financial Holdings (Hong Kong) Limited and Jefferies Financial Group Hong Kong Limited [1]. Mr. Liu Haidong and the equity structure controlled by him hold a total of approximately 20.46% of the company’s voting rights (excluding treasury shares) [1].

| Fundraising Scenario | Expected Fundraising | Asset-Liability Ratio After Improvement | Improvement Margin |

|---|---|---|---|

| Current Status | - | 41.80% | - |

| Conservative Scenario | RMB 5 billion | Approx. 35% | -6.8pct |

| Base Case Scenario | RMB 8 billion | Approx. 31% | -10.8pct |

| Optimistic Scenario | RMB 10 billion | Approx. 28% | -13.8pct |

The funds raised from the Hong Kong listing will directly increase the company’s equity capital and significantly reduce the asset-liability ratio. If RMB 8 billion is raised under the base case scenario, the asset-liability ratio is expected to drop from the current 41.80% to approximately 31%, entering a healthier capital structure range.

- Optimize Liability Structure: Raised funds can be used to repay high-cost short-term borrowings and reduce financial expenses

- Enhance Risk Resistance: Sufficient cash reserves improve the company’s ability to cope with industry cyclical fluctuations

- Improve Credit Rating: A healthier capital structure helps obtain more favorable bank credit terms

- Support R&D Investment: The company’s R&D investment in 2024 reached RMB 842 million, accounting for 6.74% of operating revenue [5]. The Hong Kong listing can provide more sufficient funding support for continuous R&D

Juhe Materials is a global leader in the photovoltaic conductive paste market. According to data from CIC Consulting, in the nine months ended September 30, 2025, the company’s photovoltaic conductive paste sales revenue ranked first among all global photovoltaic conductive paste manufacturers [1]. The proportion of N-type products reached 78% in 2024, and exceeded 95% in the first quarter of 2025 [5].

| Company | Asset-Liability Ratio | Features |

|---|---|---|

| Juhe Materials | 41.80% | Upward trend in liability ratio, urgent fundraising demand |

| Industry Leader A | 35-40% | Relatively healthy capital structure |

| Industry Average | 45-55% | Generally facing liability ratio pressure |

The Hong Kong listing will involve issuing new shares, which will dilute the shareholding ratio of existing shareholders. Mr. Liu Haidong and his concerted parties currently control approximately 32.20% of the shares in total, and their shareholding ratio may drop to around 25-28% after the Hong Kong listing [1][2].

The valuation of photovoltaic industry chain companies in the Hong Kong stock market is generally lower than that in the A-share market. Although the 2025 Hong Kong IPO market is booming, factors such as secondary market liquidity and dividend policies may affect the company’s long-term valuation performance.

The photovoltaic industry is facing overcapacity pressure, and the 5.45% YoY decline in net profit in 2024 has already reflected industry pressure [3]. If the industry boom continues to slump, the actual utilization effect of the funds raised from the Hong Kong listing may be affected.

- Reduce Liability Ratio: Expected to reduce the asset-liability ratio from the current 41.80% to around 30%

- Optimize Financial Structure: Enhance capital strength and reduce dependence on debt financing

- Enhance Market Competitiveness: Sufficient funds support R&D and overseas market expansion

- Improve Corporate Governance: Introduce supervision from international investors and improve the quality of information disclosure

- Focus on the final scale and utilization plan of funds raised from the Hong Kong listing

- Focus on how the company balances expansion and capital structure optimization

- Focus on the impact of photovoltaic industry cycle changes on the company’s performance

- Focus on the stock price performance and valuation recovery room after the Hong Kong listing

[1] Sina Finance - Juhe Materials Submits Application to HKEX, Ranks First Globally in Photovoltaic Conductive Paste Sales Revenue (https://finance.sina.com.cn/stock/hkstock/hkstocknews/2026-01-15/doc-inhhiurv4387084.shtml)

[2] Stockstar - Equity Structure of Juhe Materials’ Hong Kong Stock Listing (https://hk.stockstar.com/RB2026011500004834.shtml)

[3] CNINFO - Juhe Materials 2024 Annual Report (http://static.cninfo.com.cn/finalpage/2025-04-28/1223347795.PDF)

[4] Southern Plus - A-Share Financing Warms Up, Hong Kong Listing Fever! 2025 Investment Bank Ranking Competition Intensifies (https://www.nfnews.com/content/K3BDJkjkoY.html)

[5] East Money - Juhe Materials Investor Relations Activity Record (https://pdf.dfcfw.com/pdf/H22_AN202505061668351839_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.