Shengyi Technology (600183) Analysis of Strategies to Address Rising Copper Prices

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected information, I provide you with an in-depth analysis report on Shengyi Technology’s strategies to address rising copper prices:

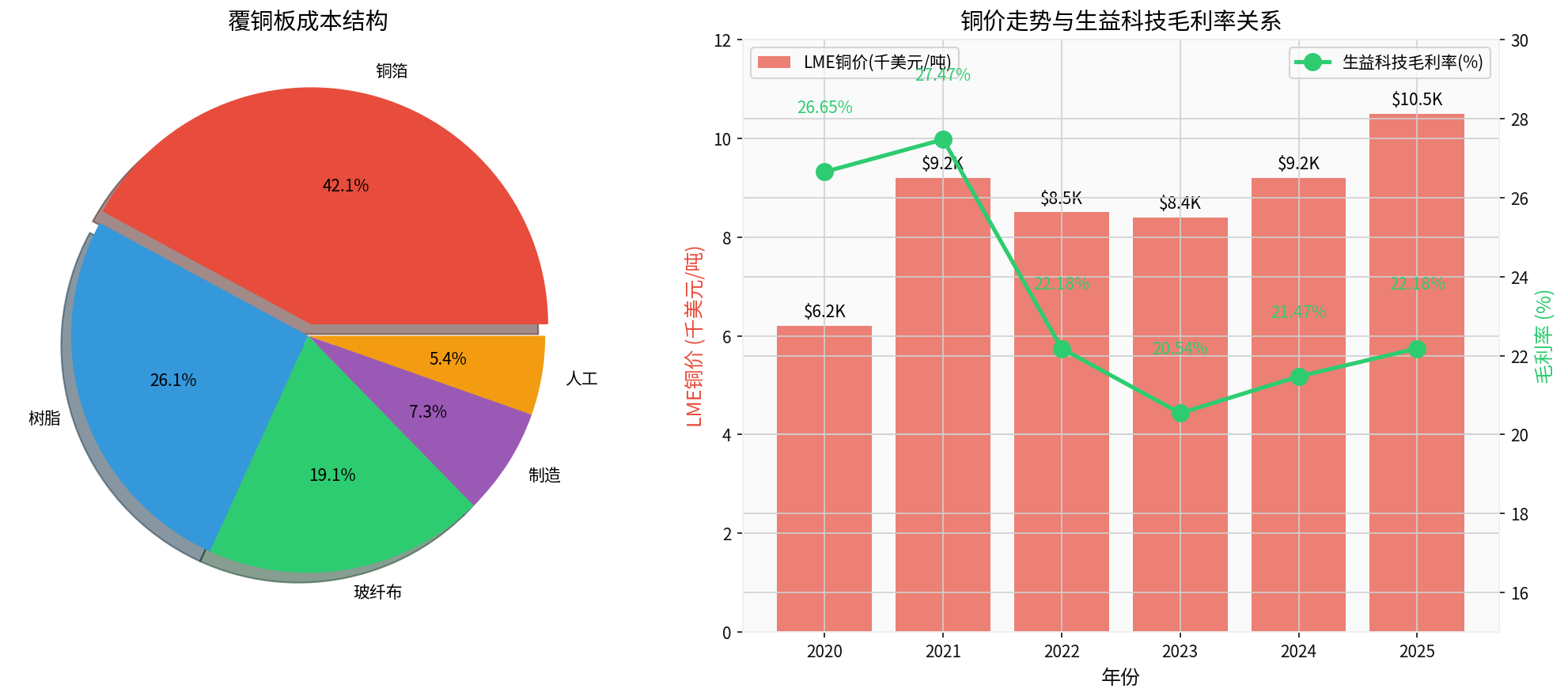

Based on financial data and industry research, the cost structure of Shengyi Technology’s CCL products is as follows[0][4][5]:

| Cost Item | Proportion | Description |

|---|---|---|

Copper Foil |

42.1% | Core raw material, price directly linked to LME copper prices |

Resin |

26.1% | Chemical raw materials such as epoxy resin |

Glass Fiber Cloth |

19.1% | Glass fiber reinforced material |

Manufacturing Overhead |

7.3% | Production and operation costs |

Labor Costs |

5.4% | Labor expenses |

-

Inventory Management Objective:Maintaining a certain level of raw material inventory allows the company to lock in procurement costs during periods of rising copper prices, avoiding the risk of high prices from spot purchases.

-

Industry Practice:The CCL industry generally adopts a “low inventory, high turnover” model. According to industry data, Shengyi Technology’s inventory turnover days were approximately 90-120 days from 2020 to 2023, which is within a reasonable range in the industry[6].

-

Risk Hedging:The 40.14% proportion of raw materials in inventory indicates that the company needs to both ensure production continuity and control its risk exposure to copper price fluctuations.

Rising copper prices → Increased copper foil costs → Increased CCL production costs → Product price hikes passed on to downstream

- Flexible Pricing Strategy:The company adopts a differentiated price hike strategy that “combines raw material price fluctuations with market conditions”, implementing flexible price adjustments for different customers[1][4]

- Collaboration with Leading Manufacturers:As an important member of the industry’s CR5 (with a combined market share of over 55%), Shengyi Technology has formed pricing tacit understanding with leading manufacturers such as Kingboard Laminates, enabling effective pass-through of cost pressures to downstream PCB manufacturers[5]

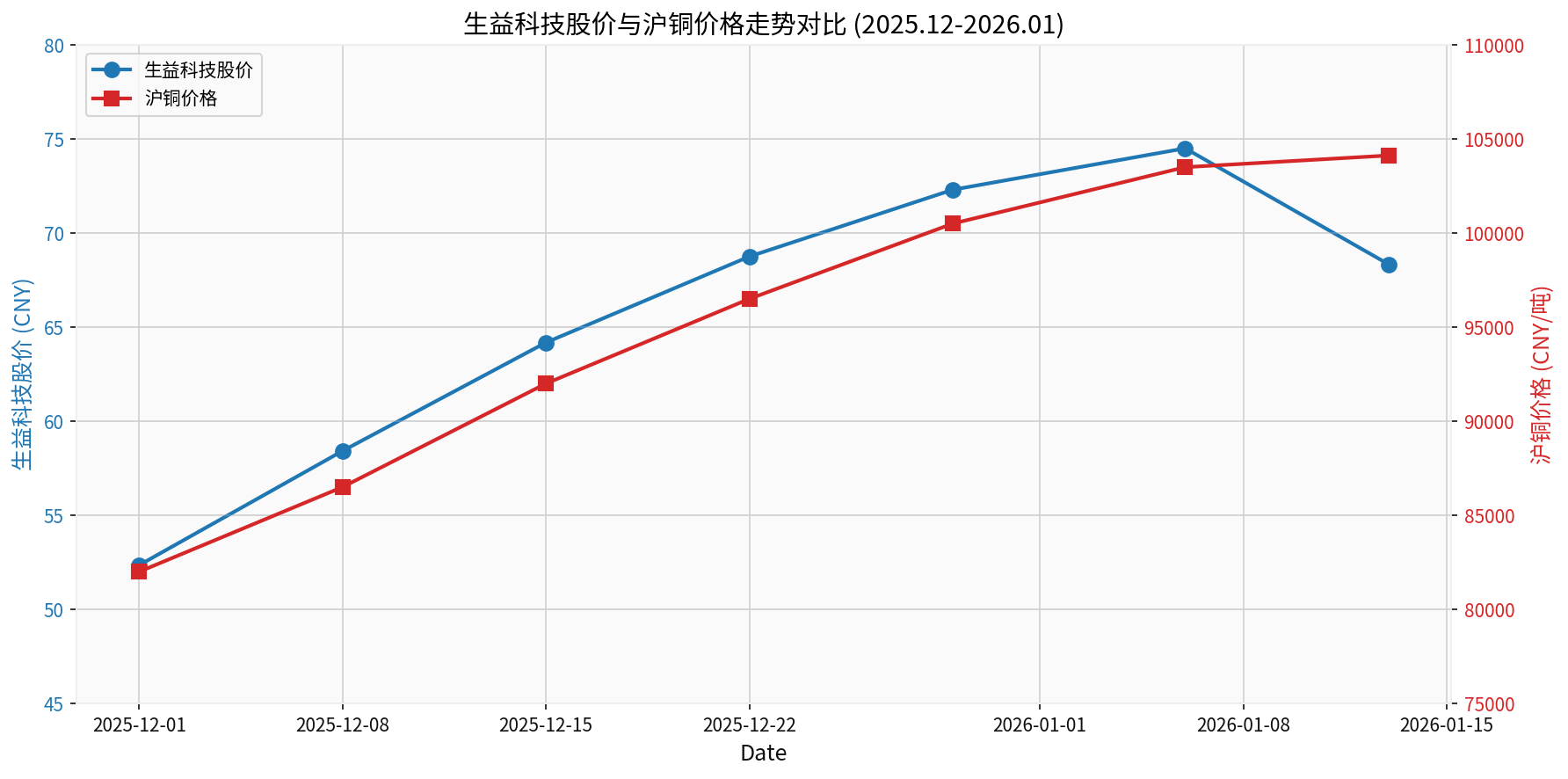

- Price Hikes in 2024-2025:Since August 2025, the company has adjusted product prices multiple times, successfully transferring the pressure from rising raw material costs to downstream[1]

- Increased Proportion of High-Value-Added Products:In the first three quarters of 2025, the proportion of the company’s high-end high-speed products increased significantly, with high-end products achieving breakthroughs in emerging sectors such as AI servers and AI smartphones[0][1]

- Technological Leading Advantage:As early as 2005, Shengyi Technology laid out high-frequency high-speed packaging substrate technology. Currently, it has obtained certifications from global leading terminal customers in the AI GPU field, achieving a breakthrough in domestic substitution in the high-end CCL sector[0]

- 2025 Performance Verification:In the first half of 2025, the company’s operating revenue reached 12.68 billion yuan, a year-on-year increase of 31.68%. The revenue growth rate exceeded the sales volume growth rate, reflecting the effectiveness of product structure optimization[1]

- Futures Hedging:According to industry experience, downstream leading PCB enterprises such as Dongshan Precision and Foxconn Interconnect Technology have adopted commodity hedging to control raw material cost risks. As an upstream supplier, Shengyi Technology can also use the futures market to hedge against copper price fluctuations[2]

- Long-Term Supplier Cooperation:Establish strategic cooperative relationships with upstream copper foil manufacturers to ensure stable raw material supply and advantages in price negotiation[4]

- Global Layout:In December 2024, the company’s Thailand project broke ground, providing high-end substrates for automotive electronics and AI servers to overseas customers; the second phase of the Jiangxi Shengyi project was capped, adding an annual CCL production capacity of 18 million square meters[5]

- Proximity to Customers:By building factories in major customer regions, the company reduces logistics costs and improves supply chain efficiency

- Material Substitution R&D:The company follows the progress of “copper-to-aluminum substitution” technology, exploring more cost-effective material solutions on the premise of ensuring product performance[3]

- Process Optimization:Continuously optimize production processes, improve material utilization rates, and reduce raw material consumption per unit of product

- Institutions such as Goldman Sachs predict that LME copper prices may remain at a high level of $12,000-$13,000/ton, but may pull back to around $11,000/ton in the second half of the year as US tariff policies become clearer[2][3]

- The CCL industry is expected to continue passing on cost pressures through price hikes

- The explosive growth in demand for AI computing power will continue to drive demand for high-end CCLs, and the company, as a domestic leader in high-end CCLs, will fully benefit from this

- The output value of PCBs used in servers and data centers is expected to achieve a compound annual growth rate of 11.6% from 2024 to 2029, driving both volume and price growth of high-speed CCLs[5]

- Pricing power endowed by the high concentration of the industry’s CR5

- Technological leadership in high-end products and first-mover advantage in domestic substitution

- High-end customer binding brought by AI server certifications

- Flexible cost pass-through mechanism

- Sustained and substantial increases in copper prices may compress gross profit margin in the short term

- Risk of time lag in downstream PCB manufacturers accepting price hikes

- Risk of intensified competition in high-end products

- Downward macroeconomic pressure affecting terminal demand

[0] Guohai Securities - Shengyi Technology (600183.SH) Research Report: Global CCL Leader, Upward Cycle & AI Demand-Driven Growth (https://pdf.dfcfw.com/pdf/H3_AP202507211713123561_1.pdf)

[1] Securities Market Weekly - Booming Demand for High-End CCLs, Shengyi Technology and Nan Ya New Materials See Simultaneous Growth in Performance and Stock Prices (https://static.weeklyonstock.com/25/1203/zbf092028.html)

[2] Securities Times - Copper Prices Break $13,000 to Hit New High, US Copper Tariff Signals May Become a “Bull-to-Bear” Turning Point (https://www.stcn.com/article/detail/3594213.html)

[3] Wall Street CN - Copper Price Surpasses Expectations! Goldman Sachs Raises First-Half Target Price (https://wallstreetcn.com/articles/3762912)

[4] 21st Century Business Herald - Shanghai Copper Approaches the 100,000 Yuan Mark, CCL Giants Raise Prices Again (https://www.21jingji.com/article/20251226/herald/f37c102ee236a9744b3cb3e9ccd25d88.html)

[5] Pacific Securities - Leading CCL Manufacturers, Volume Growth of High-End High-Speed Products Expected (https://pdf.dfcfw.com/pdf/H3_AP202505231677628490_1.pdf)

[6] Tianfeng Securities - Initial Coverage Report on Shengyi Technology (600183) (https://pdf.dfcfw.com/pdf/H3_AP202104191486310166_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.