Analysis of Jaguar Health Inc (JAGX) 8-K Material Event Disclosure

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the detailed information obtained, below is a professional analysis of the material event disclosure in Jaguar Health Inc (NASDAQ: JAGX)'s 8-K filing:

On January 12, 2026, Jaguar Health Inc filed an 8-K form with the SEC, disclosing a significant licensing agreement with Future Pak, LLC, which is a key milestone in the company’s strategic transformation [1].

| Category | Details |

|---|---|

Upfront Payment |

$18 million ($16 million paid at closing, $2 million paid upon satisfaction of post-closing conditions) |

Milestone Payments |

Up to $20 million |

Licensed Products |

Mytesi® (human use) and Canalevia®-CA1 (veterinary use) |

Licensing Scope |

Future Pak becomes the exclusive marketer of the above products in the U.S. market |

Retained Rights |

Jaguar continues as the product manufacturer and retains a repurchase right within 12 months |

This agreement has multiple strategic values for Jaguar Health:

-

Non-Dilutive Financing: The $18 million upfront payment provides the company with valuable non-dilutive capital, avoiding dilution of existing shareholders’ equity from further equity financings [1]

-

Reduced Operational Complexity: By outsourcing commercial marketing functions to a specialized partner, Jaguar can focus its resources on its core rare disease R&D pipeline

-

Strategic Focus: The company has clearly stated that it will concentrate on developing crofelemer for rare disease indications, specifically Microvillus Inclusion Disease (MVID) and Short Bowel Syndrome with Intestinal Failure (SBS-IF)

Based on the latest financial data, Jaguar Health’s cash flow position is relatively tight:

- Current ratio is only 0.81, quick ratio is 0.52

- $34.1 million loss over the trailing 12 months

- Market capitalization is only $1.66 million [2]

The $18 million upfront payment will significantly improve the company’s liquidity position in the short term.

Jaguar is transforming from a diversified pharmaceutical company to a biotech firm focused on rare diseases:

- Mytesi revenue accounted for 98.5% of total revenue in Q3 2025

- The company’s core R&D resources will be concentrated on the development of crofelemer for MVID and SBS-IF

- Preliminary study results from December 2025 showed that crofelemer reduced parenteral nutrition requirements by 37% in pediatric MVID patients [3]

The company expects to receive preliminary results from the Phase 2 study for MVID in March 2026, and may seek FDA Breakthrough Therapy Designation based on these results [1].

Granting marketing rights for Mytesi and Canalevia-CA1 to Future Pak means Jaguar is dependent on the partner’s commercial capabilities. If Future Pak’s marketing efforts underperform, it will directly impact the company’s revenue.

While Jaguar retains a repurchase right within 12 months, this right can only be exercised when “additional crofelemer indications agreed by both parties receive U.S. regulatory approval” [1], meaning the realization of the repurchase right depends on the progress of regulatory approval.

The additional $20 million in milestone payments depends on future business developments and carries high uncertainty.

- Cash inflow of $16-$18 million eases the imminent liquidity crisis

- Eliminates market concerns about dilution from continuous financings

- Clear strategic direction helps investors understand the company’s value

- The stock price has dropped 96.46% over the past year, severely damaging market confidence [2]

- Q3 2025 performance significantly missed expectations (revenue of $3.08 million vs. expected $4.21 million, a 26.77% gap) [2]

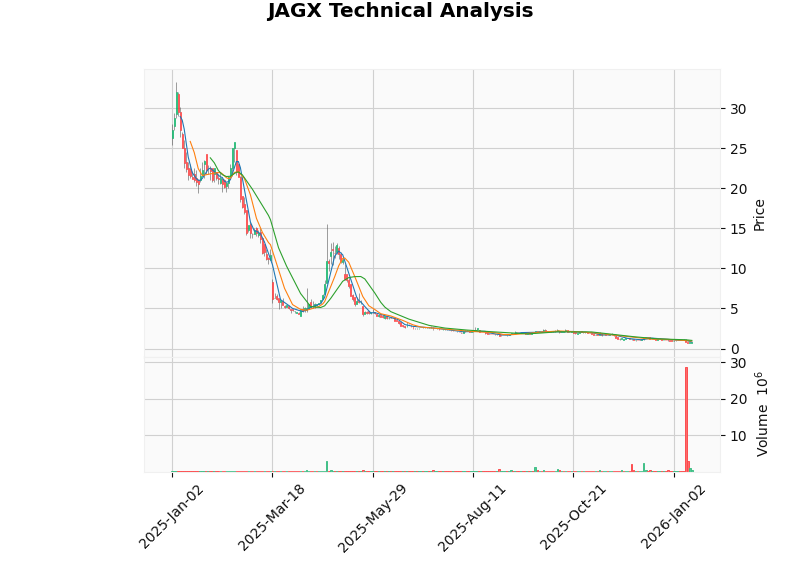

- Technical indicators show the stock is in an oversold zone but lacks clear trend signals

If crofelemer achieves positive progress in rare disease indications (especially MVID), the company’s valuation may receive a significant re-rating:

- The current analyst consensus target price is $12.98, representing approximately 1,600% upside potential from the current price [2]

- MVID is a rare, life-threatening disease with no approved treatments currently available, representing significant unmet medical need [3]

Recent 8-K disclosures show that the company has issued unsecured promissory notes and warrants to accredited investors on multiple occasions [4]. This may lead to:

- Potential equity dilution

- Stock price pressure upon future exercise (warrant exercise price is $1.00)

| Risk Dimension | Rating | Explanation |

|---|---|---|

| Financial Risk | High | Sustained losses, tight liquidity |

| Regulatory Risk | Medium-High | Awaiting Phase 2 clinical data, potential for Breakthrough Therapy Designation |

| Commercial Risk | Medium | Dependent on partner Future Pak |

| Technical Risk | High | Severe stock price volatility, 99% drop from peak |

| Valuation Risk | High | Market capitalization of only $1.66 million, extreme volatility |

- Latest Closing Price: $0.76 (January 15, 2026)

- Trend Judgment: Sideways consolidation, no clear trend

- Trading Range: $0.70 - $1.02

- MACD Indicator: No crossover, bearish bias

- KDJ Indicator: K=26.9, D=32.4, bearish bias

- RSI(14): In oversold zone, potential opportunity

- Beta Coefficient: -0.4 (negatively correlated with the broader market)

The licensing agreement disclosed in Jaguar Health’s 8-K is a positive strategic move for the company:

-

Resolved Short-Term Liquidity Crisis— The $18 million upfront payment provides the company with necessary financial buffer ahead of the release of key clinical data

-

Clarified Strategic Direction— The company is transforming from a commercial pharmaceutical company to a R&D-focused biotech firm specializing in rare diseases

-

Retained Future Upside Potential— The repurchase option and milestone payment mechanism allow the company to regain commercial control if progress is made in the crofelemer rare disease pipeline

However, investors should be aware of the following major risks:

- Clinical Trial Risk: The results of Phase 2 studies for MVID and SBS-IF are not yet confirmed; if the data is unsatisfactory, the company’s value could be reduced to zero

- Sustained Losses: The company has not yet achieved profitability, and losses are substantial (Q3 2025 EPS was -$6.28)

- Stock Price Volatility: The 96% stock price drop over the past year indicates extremely low market confidence in the company; any negative news could trigger further declines

- Dilution Risk: Continuous financing needs may lead to further equity dilution

- Professional investors with high risk tolerance

- Investors with in-depth understanding of the crofelemer rare disease pipeline

- Investors who can tolerate total loss of principal

- Risk-averse investors

- Investors requiring stable cash flow

- Investors lacking understanding of biotech clinical trial risks

[1] Jaguar Health Enters into U.S. License Agreement with Future Pak for Crofelemer - SEC EDGAR (https://www.sec.gov/Archives/edgar/data/1585608/000119312526014231/jagx-20260112.htm)

[2] Company Overview and Financial Metrics - Jinling API Data

[3] Jaguar Health Reports Approval of All Proposals at December 2025 Special Meeting - SEC EDGAR (https://www.sec.gov/Archives/edgar/data/1585608/000119312525311294/jagx-20251208.htm)

[4] Jaguar Health Inc Reports Material Event - StockTitan.net (https://www.stocktitan.net/sec-filings/JAGX/8-k-jaguar-health-inc-reports-material-event-63b3a94863f1.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.