BOJ Policy Acceleration: Impact Analysis on Japanese Equities, Yen, and Global Carry Trades

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive market data and recent developments, here is a detailed analysis of how earlier-than-expected Bank of Japan (BOJ) rate hikes could affect Japanese equities, the yen currency, and global carry trade strategies.

The BOJ raised its policy rate to

| Asset | Period Performance | Current Level |

|---|---|---|

| Nikkei 225 | +7.03% |

53,855 |

| EWJ (MSCI Japan ETF) | +3.55% |

$85.42 |

| USD/JPY | +2.91% (Yen weakening) |

~156-157 |

Japanese equities have demonstrated remarkable resilience despite rising yields. The Nikkei 225’s

- Corporate Profit Strength: Corporate profits remain at high levels with rising wages and tight labor markets [2]

- Fiscal Support: The Takaichi Cabinet has adopted more accommodative fiscal policy, delaying consolidation [3]

- Structural Reforms: Wage increases and inflation normalization support long-term growth narratives

However, sustained rate hikes could create headwinds:

| Risk Factor | Impact |

|---|---|

| Higher borrowing costs | Reduced corporate profitability for leveraged companies |

| Yen appreciation | Pressures export-oriented manufacturers |

| Valuation compression | Higher discount rates reduce P/E multiples |

| Capital repatriation | Japanese investors may return capital as domestic yields rise |

Despite BOJ tightening, the yen has remained relatively weak, trading around

- Still-wide interest rate differentials with the US (Fed at ~3.75-4.00% vs BOJ at 0.75%)

- Persistent Japanese outbound investment flows (households purchased ~¥9.4 trillion in foreign stocks in 2025)

- Negative real rates in Japan compared to positive real yields in the US [4]

| Scenario | USD/JPY Forecast | Timeline |

|---|---|---|

| Gradual BOJ tightening | 160+ | Through 2026 |

| Moderate convergence | 148 | 12-month horizon |

| Aggressive BOJ | 140-145 | Year-end 2026 |

Analysts at JPMorgan and BNP Paribas project the yen could reach

Morgan Stanley estimates approximately

Borrow Yen (0.75%) → Convert to USD → Invest in US assets (~4-5%)

↓

Net Carry: ~3.25%

| BOJ Policy Rate | Fed Rate (Assumed) | Carry Yield | Yen Risk |

|---|---|---|---|

| 0.75% | 3.50% | 2.75% | Moderate |

| 1.00% | 3.25% | 2.25% | Elevated |

| 1.25% | 3.00% | 1.75% | High |

| 1.50% | 3.00% | 1.50% | Very High |

The market correction during August 2024 demonstrated how rapid yen surges can cascade into liquidations across US equities and cryptocurrencies [1]. Options markets are already pricing elevated volatility for Q1 2026 [2].

CFTC data shows net short yen positions declining

| Scenario | Probability | Equity Impact | Yen Impact | Carry Trade Effect |

|---|---|---|---|---|

Gradual (+25bp every 6-9 months) |

High | Moderate bullish | Gradual appreciation | Slow unwind |

Moderate (+50bp in H1 2026) |

Medium | Volatile, range-bound | 5-8% appreciation | Accelerated unwind |

Aggressive (+75bp+) |

Low | Significant drawdown | 10%+ appreciation | Disorderly unwind |

- Favor: Domestic-focused sectors (utilities, REITs with JGB linkages), companies with strong pricing power

- Hedge: Currency-hedged exposure (DXJ) to protect against yen appreciation

- Avoid: Highly leveraged exporters, interest-rate-sensitive sectors

- Reduce exposureto multi-year carry positions funded by yen

- Hedge FX riskusing options or forward contracts

- Diversify funding currenciesto reduce single-currency dependence

- Monitor BOJ communication closely for policy signal shifts

- Consider reduced beta to yen-sensitive assets (EM bonds, high-yield credit)

- Evaluate liquidity buffer requirements for potential volatility spikes

- Japanese equities remain resilientbut face medium-term headwinds from rising yields and potential yen appreciation

- The yen’s weakness is structural, supported by capital outflows and wide rate differentials, but these are gradually eroding

- Carry trade unwind is already underway, with institutional investors proactively reducing exposure

- Disorderly unwinding risk remains elevated, though smart money positioning suggests better preparedness than in 2024

- Currency-hedged strategiesoffer protection for Japan-focused investors concerned about yen volatility

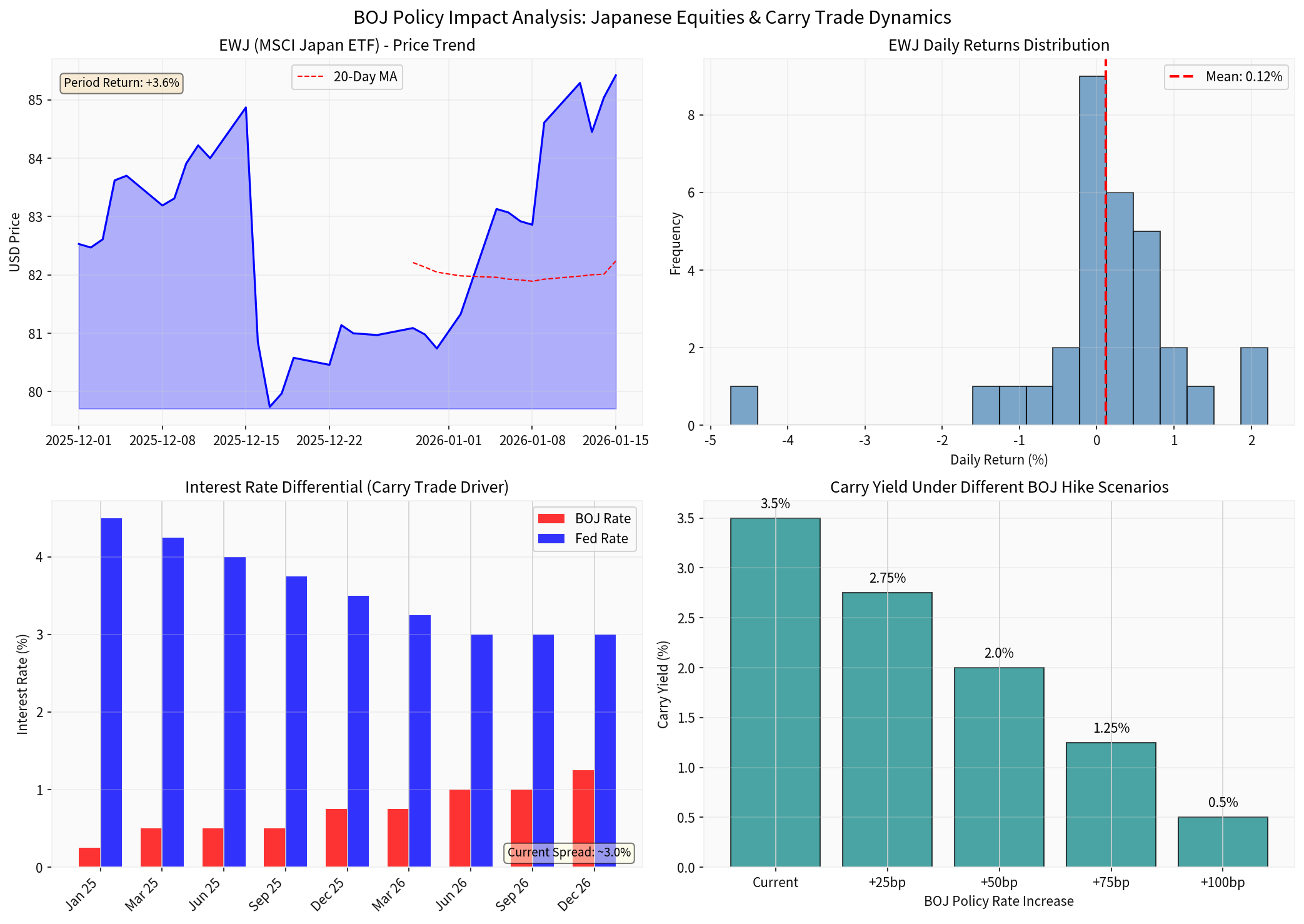

The chart illustrates:

- EWJ price trendwith 20-day moving average support

- Daily returns distributionshowing volatility characteristics

- Interest rate differentialbetween BOJ and Fed (the carry trade driver)

- Carry yield scenariosunder different BOJ policy paths

[1] Investing.com - “The BoJ Just Pulled the Trigger: Markets Brace for Carry Trade Chaos” (https://www.investing.com/analysis/the-boj-just-pulled-the-trigger-markets-brace-for-carry-trade-chaos-200672097)

[2] KPMG - “Central Bank Scanner: Rate Cuts Will Abate in 2026” (https://kpmg.com/us/en/articles/2026/january-2026-central-bank-scanner.html)

[3] Morgan Stanley - “Macro Outlook: Finding Investment Opportunities Across Shifting Global Macro Climates” (https://www.morganstanley.com/im/en-gb/institutional-investor/insights/articles/opportunities-across-shifting-global-macro-climates.html)

[4] Yahoo Finance - “Yen Bearish Voices Build for 2026 on Cautious BOJ Policy” (https://finance.yahoo.com/news/yen-bearish-voices-build-2026-220024517.html)

[5] Kavout - “Japan ETF Outlook 2026: How the Bank of Japan Rate Hike Affects EWJ, DXJ and BBJP” (https://www.kavout.com/market-lens/japan-etf-outlook-2026-how-the-bank-of-japan-rate-hike-affects-ewj-dxj-and-bbjp)

[6] BNP Paribas Wealth Management - “Japan can overcome hurdles” (https://wealthmanagement.bnpparibas/lu/en/insights/video-podcast-hubs/podcasts-hub/japan-can-overcome-hurdles.html)

[7] AInvest - “Japan’s Yield Curve Steepening: A Structural Shift in Borrowing Costs” (https://www.ainvest.com/news/japan-yield-curve-steepening-structural-shift-borrowing-costs-2601/)

[0] Market data retrieved from financial data providers for EWJ, Nikkei 225, and USD/JPY (December 2025 - January 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.