US-Taiwan Strategic AI Partnership and Semiconductor Supply Chain Restructuring: In-Depth Analysis of Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me prepare a systematic and professional analysis report for you based on the comprehensive collected data:

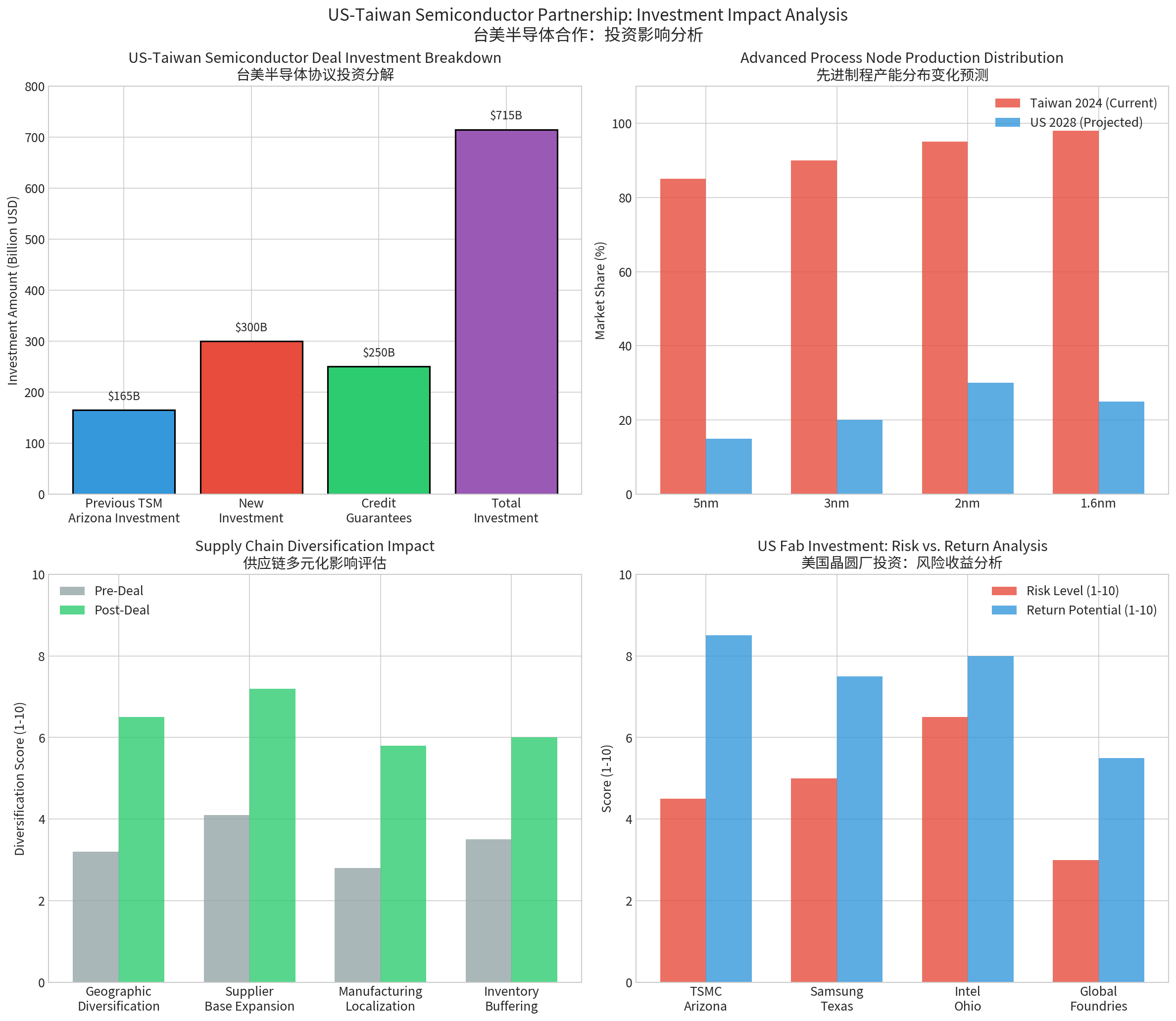

On January 15, 2026, the U.S. Department of Commerce announced the signing of a landmark trade and investment agreement with Taiwan, marking the most profound structural transformation of the global semiconductor supply chain landscape since the 1980s [1][2]. Built on the successful implementation of the U.S. CHIPS and Science Act (CHIPS Act), this agreement further strengthens U.S. strategic autonomy in advanced semiconductor manufacturing.

According to the official statement released by the U.S. Department of Commerce, the core investment commitments of the agreement cover three pillars: First, Taiwanese semiconductor and technology companies will make direct investments in the U.S. totaling

The agreement also establishes a predictable tariff framework. Under the terms, the

As a direct outcome of the agreement, Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest wafer foundry, plans to significantly increase its total investment in Arizona from the previously announced

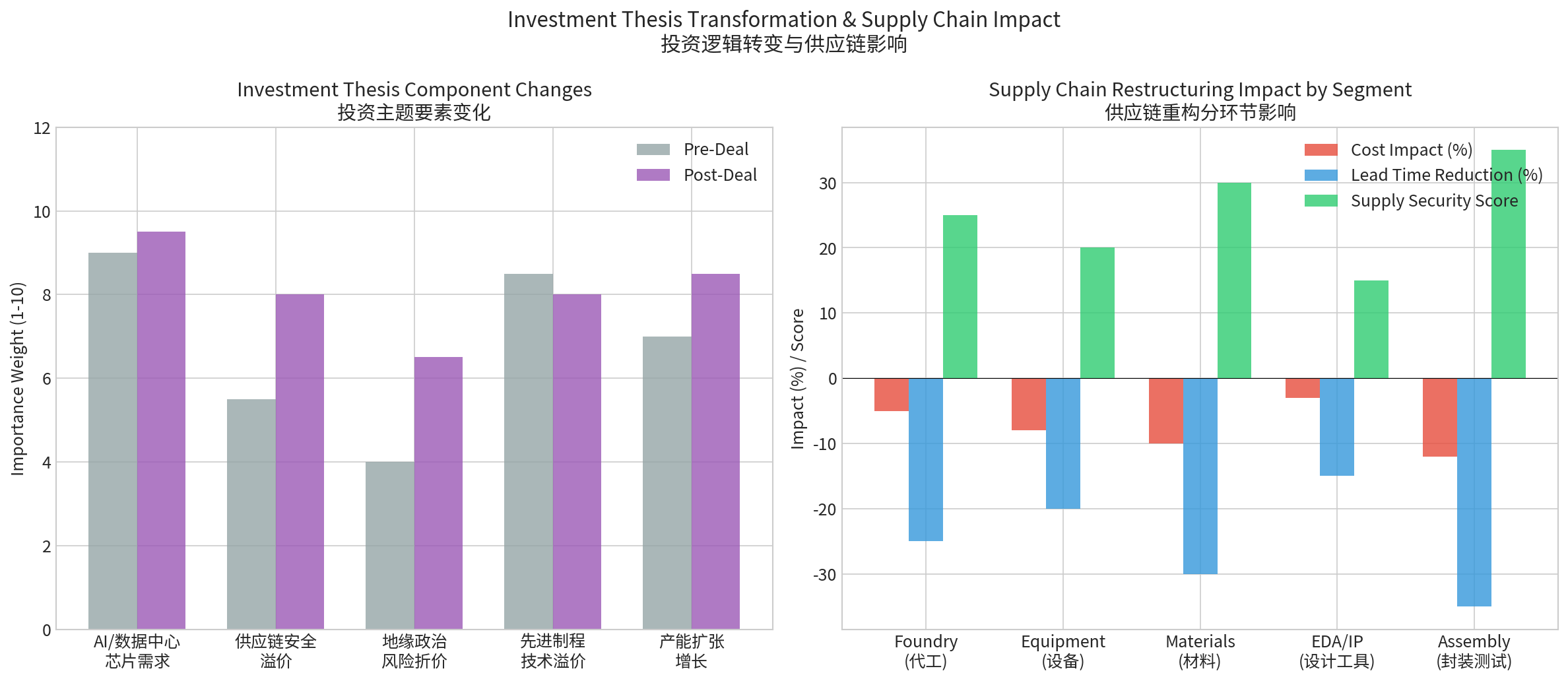

The signing of the US-Taiwan agreement marks a paradigm shift in the semiconductor industry’s investment logic. According to a Q4 2025 KPMG survey of 151 semiconductor industry executives,

From an investment theme perspective, four key dimensions are undergoing significant changes:

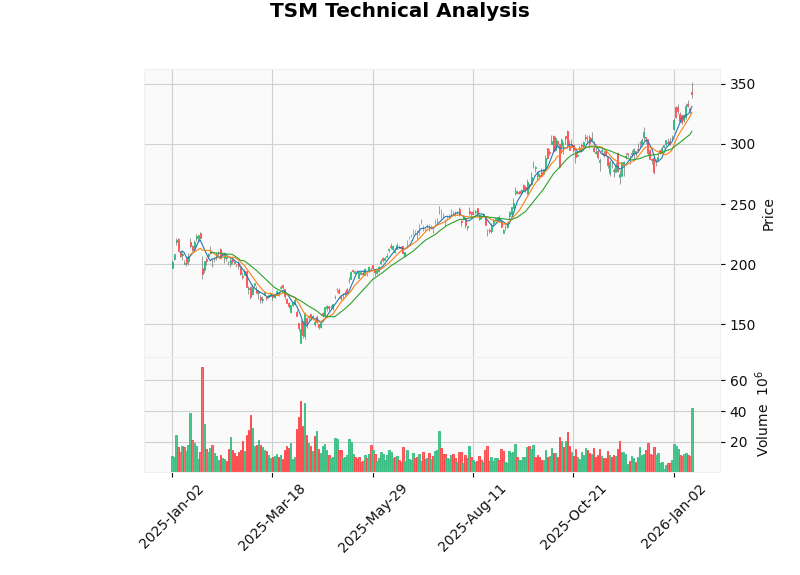

As the absolute leader in advanced process technology (holding approximately 63% of the wafer foundry market share), TSMC is in the most advantageous position under the agreement framework [7]. From a financial perspective, TSMC’s 2024 free cash flow reached $8701.7 billion, with a net profit margin of 43.7% and ROE of 34.52% [8]. DCF valuation analysis shows that intrinsic value under conservative assumptions is $1806.68, representing 428.8% upside from the current share price of $341.64; even under neutral assumptions, valuation reaches $2022.49, with 492.0% upside [9].

TSMC’s investment logic is shifting from a “pure growth” model to a dual-driven model of “growth + strategic value”. Its Arizona capacity expansion not only enables access to U.S. government subsidies (CHIPS Act funds) but also brings it closer to major North American customers (NVIDIA, AMD, Apple, etc.), shortening product delivery cycles and reducing logistics costs [4].

As the absolute leader in AI chip design, the core of NVIDIA’s investment logic is ensuring stable supply of advanced process capacity. TSMC’s U.S.-based capacity expansion provides NVIDIA with a more reliable supply chain option, reducing vulnerability from sole dependence on Taiwanese production [6]. Industry analysis suggests NVIDIA may further strengthen vertical supply chain integration through acquisitions of photonics platform companies such as POET to maintain long-term leadership in AI infrastructure [6].

Intel is in a critical transformation period, and its IDM 2.0 strategy positions it as both a potential competitor and customer of TSMC. According to the latest analysis, Intel’s 18A process node introduces two breakthrough technologies: the RibbonFET Gate-All-Around transistor architecture and PowerVia backside power delivery technology, giving it its first technological lead in power delivery in a decade [10]. However, Intel’s foundry business still faces fierce competition from TSMC and Samsung, with negative free cash flow (-$15.66 billion) and a moderate debt risk rating [11].

For Intel, the US-Taiwan agreement brings both opportunities and challenges. On one hand, growing U.S.-based foundry demand may bring more orders; on the other, TSMC’s accelerated U.S. expansion will further squeeze its market space.

The US-Taiwan agreement will further accelerate regional restructuring of the global semiconductor supply chain. According to industry analysis, this restructuring will unfold along three main paths [7]:

Supply chain diversification requires balancing security and cost efficiency. The KPMG survey shows that while 93% of semiconductor executives expect 2026 revenue growth, supply chain risks have replaced talent shortages as the industry’s top concern [5].

Industry research shows significant variation in impact across supply chain segments:

The US-Taiwan agreement has significantly altered the semiconductor industry’s geopolitical risk exposure. Industry analysis shows a potential Taiwan Strait conflict could cause over

However, investors must still monitor the following risks:

Based on the above risk assessment, the following strategies are recommended for investors:

The US-Taiwan agreement will further reshape the global wafer foundry landscape:

The AI chip market’s competitive landscape is also undergoing profound changes:

Based on the above analysis, investment ratings for semiconductor sub-segments are as follows:

| Segment | Investment Rating | Rationale |

|---|---|---|

| Wafer Foundry (TSMC) | Strong Buy |

AI demand growth + U.S. capacity expansion + enhanced pricing power |

| AI Chip Design (NVDA) | Buy |

Beneficiary of AI infrastructure expansion, strengthened supply chain security |

| Semiconductor Equipment (ASML, LAM, etc.) | Buy |

Direct beneficiary of global capacity expansion |

| Assembly, Testing & Packaging | Buy |

Growing advanced packaging demand + U.S. localization trend |

| Memory Chips | Buy |

HBM super cycle + structural AI demand growth |

| Intel (INTC) | Hold |

Transformation efficacy unproven, intense foundry competition pressure |

TSMC is the most direct and critical beneficiary of the US-Taiwan agreement. Its investment value is analyzed across multiple dimensions:

Expanding U.S.-based advanced packaging capacity creates significant investment opportunities. TSMC’s Arizona advanced packaging plant will reduce reliance on Taiwanese packaging capacity while creating local jobs.

The U.S. and Europe are increasing investments in semiconductor equipment localization. Suppliers such as Applied Materials (AMAT) and Lam Research (LAM) will benefit from global fab expansion, especially the upcoming DRAM super cycle [13].

Semiconductor material suppliers are expanding global capacity to support diversified supply chains. Firms such as Shin-Etsu Chemical and GlobalWafers will benefit from this trend.

- Macroeconomic Risk: Rising interest rates and economic recession may suppress AI infrastructure investment and chip demand.

- Geopolitical Risk: Escalating Taiwan Strait tensions could severely disrupt supply chains.

- Execution Risk: TSMC’s U.S. capacity expansion may face cost overruns, delays, and technical challenges.

- Competitive Risk: Catching up by Samsung and Intel may squeeze TSMC’s market share and pricing power.

- Phased Position Building: Avoid single-batch overweighting; use phased position building to reduce timing risk.

- Hedging Protection: Consider option strategies to hedge tail risks.

- Dynamic Adjustment: Adjust allocation ratios dynamically based on industry trends and valuation changes.

The $500 billion semiconductor agreement under the US-Taiwan strategic AI partnership is the most significant structural change in the global semiconductor supply chain since the 1980s. This agreement will not only reshape the geographic map of global semiconductor manufacturing but also profoundly alter the industry’s investment logic and valuation framework.

-

TSMC is the Largest Beneficiary: As the absolute leader in advanced processes, TSMC will capture strategic value premiums through U.S. capacity expansion. Its current $341.64 share price trades at a significant discount to intrinsic value, offering long-term investment potential.

-

Supply Chain Security Becomes a Core Investment Theme: 54% of semiconductor executives are focusing on geographic diversification, marking the industry’s strategic shift from efficiency priority to security priority.

-

Geopolitical Risk Discount Will Gradually Narrow: U.S.-based advanced process capacity reduces supply chain vulnerability, providing a basis for investors to re-evaluate risk premiums.

-

Equipment, Packaging, and Materials Segments Will Synchronously Benefit: The global fab expansion wave will benefit the entire semiconductor supply chain, offering diversified allocation options for investors.

Looking ahead, as the agreement is implemented and capacity is gradually released, the semiconductor industry will enter a new era of “regionalization + diversification”. Investors need to re-examine traditional investment frameworks, incorporating geopolitical risks, supply chain security premiums, and regional capacity layout into core considerations. For investors who can accurately grasp this structural transformation, the current market adjustment may provide rare long-term allocation opportunities.

[1] U.S. Department of Commerce. “Fact Sheet: Restoring American Semiconductor Manufacturing Leadership.” January 15, 2026. https://www.commerce.gov/news/fact-sheets/2026/01/fact-sheet-restoring-american-semiconductor-manufacturing-leadership

[2] CommonWealth Magazine. “U.S.–Taiwan Seal $500B Semiconductor Pact to Reshore Chips and Secure Supply Chains.” January 16, 2026. https://english.cw.com.tw/article/article.action?id=4563

[3] Proactive Investors. “Taiwanese chipmakers to invest $250B in US under new trade agreement.” January 15, 2026. https://www.proactiveinvestors.com/companies/news/1085726/taiwanese-chipmakers-to-invest-250b-in-us-under-new-trade-agreement-1085726.html

[4] EE News Europe. “TSMC Arizona investment set to jump to $465bn under proposed US-Taiwan trade deal.” January 2026. https://www.eenewseurope.com/en/tsmc-arizona-investment-465bn/

[5] Manufacturing Dive. “Semiconductor industry most concerned by tariffs, trade policy: KPMG survey.” January 2026. https://www.manufacturingdive.com/news/kpmg-survey-semiconductor-manufacturing-industry-tariffs-trade-policy/807999/

[6] Eurasia Group via LinkedIn. “Tech Sector Alert: 2026 Top Risks and Geopolitical Implications.” January 2026. https://www.linkedin.com/posts/efish1_eurasia-group-the-top-risks-of-2026-activity-7414036069630849024-CVYH

[7] FinancialContent. “Taiwan Rejects US Semiconductor Split, Solidifying ‘Silicon Shield’ Amidst Global Supply Chain Reshuffle.” October 2025. https://markets.financialcontent.com/stocks

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.