Impact Analysis of NHTSA's Regulatory Investigation into Tesla FSD

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data collected, I now present a systematic analysis report for you.

The National Highway Traffic Safety Administration (NHTSA) launched a preliminary evaluation investigation into Tesla’s FSD system in October 2025, focusing on whether vehicles violate traffic regulations when using the Full Self-Driving feature[1]. As of January 16, 2026, the regulatory agency has granted Tesla a five-week extension to submit a complete response by February 23, 2026[1].

- Pending Records for Review:8,313 data records requiring manual review[1]

- Processing Speed:Approximately 300 records per day[1]

- Confirmed Complaints:62 consumer complaints[1]

- Identified Violation Cases:At least 80 traffic violation incidents related to the FSD system[5]

- Types of Violations:Running red lights, crossing into oncoming traffic lanes, etc.[5]

Notably, the number of violation cases has increased from 50 in October 2025 to 80, representing a 60% growth[5].

In addition to the main NHTSA investigation, Tesla is also facing multiple parallel regulatory reviews:

| Regulatory Body | Investigation Content | Status |

|---|---|---|

| NHTSA (Main Investigation) | FSD system traffic violations | Ongoing, extended to February 23 |

| NHTSA (Separate Case) | Delayed crash reporting | Responding |

| NHTSA (Separate Case) | Door handle malfunction issue | Responding |

| California DMV | Exaggerated claims about technical capabilities | Potential sales suspension |

| DOJ | Misleading statements about technology | Investigation phase |

In a document dated January 12, Tesla clearly stated that the burden of responding to multiple NHTSA investigation requests simultaneously may affect the quality of the response[1].

Tesla’s FSD business currently has a relatively limited direct contribution to revenue, but its strategic value is enormous:

- FSD Subscription Rate:Only 12% of Tesla owners have subscribed to the service[2]

- Analyst Expectations:Long-term penetration rate can rise to over 50%[2]

- Software Business Gross Margin:Significantly higher than vehicle sales (can reach 80%+)

- FSD Subscription Business:Expected to contribute over $10 billion in gross profit[2]

- Robotaxi Business:Expected to contribute over $10 billion in gross profit[2]

Based on current market data and analyst forecasts, Tesla’s valuation shows significant hierarchical characteristics:

| Scenario | Valuation Assumptions | Expected Market Capitalization | Relative to Current |

|---|---|---|---|

Base Case Scenario |

Stable vehicle sales + gradual software growth | ~$1.8 trillion | +27% |

Optimistic Scenario |

Breakthrough progress in Robotaxi + FSD | $3 trillion | +113% |

Pessimistic Scenario |

Slowdown in growth + margin compression | $1 trillion | -29% |

Regulatory Risk Scenario |

Major penalties + restricted FSD deployment | $800 billion | -43% |

Tesla’s current market capitalization is $1.41 trillion, with a P/E ratio as high as 268.65x[3]. This valuation is highly dependent on future growth expectations for autonomous driving and robotics businesses.

Regulatory Investigation → Fines/Recalls → FSD Deployment Delays → Decline in Subscription Rates → Downward Revision of Software Revenue Expectations → Valuation Compression

- Direct Fines:Referring to historical cases (such as the 2022 Autopilot recall involving $538 million), fines from this FSD investigation may range from $100 million to $500 million

- Recall Costs:If NHTSA requires a recall of the FSD system, involving software updates for 2-3 million vehicles, the cost could reach hundreds of millions of dollars

- Revenue Delay:A suspension of FSD deployment may reduce 2026 software revenue by 5-15%

- Valuation Discount:Regulatory uncertainty may compress valuation multiples by 10-20%

The commercialization of Tesla’s Robotaxi is the core narrative supporting its long-term high valuation:

- April 2026: Mass production of Cybercab (dedicated Robotaxi model)[2]

- 2026: Deployment in over 30 U.S. cities[2]

- Mid-2026: Fleet size reaches 2,500 vehicles[2]

| Time Node | Original Plan | Potential Impact |

|---|---|---|

| FSD Deployment Approval | Q1-Q2 2026 | May be delayed by 3-6 months |

| Cybercab Production | April 2026 | On schedule (not directly affected by FSD investigation) |

| City Expansion | Throughout 2026 | Slower pace |

| Large-Scale Operation | H2 2026 | Delayed to 2027 |

Regulatory pressure may alter the autonomous driving competitive landscape:

- Waymo is already operating in Austin, Phoenix, Los Angeles, San Francisco, and other cities[6]

- Plans to expand to 26 markets in 2026[6]

- Regulatory endorsement may enhance its market credibility

- Shift to a pure subscription model(effective February 14, 2026)[4]

- Emphasize that FSD is trained on billions of miles of real-world driving data(including extreme scenarios such as power outages)[2]

- Rely on technological differentiation with an end-to-end AI architecture

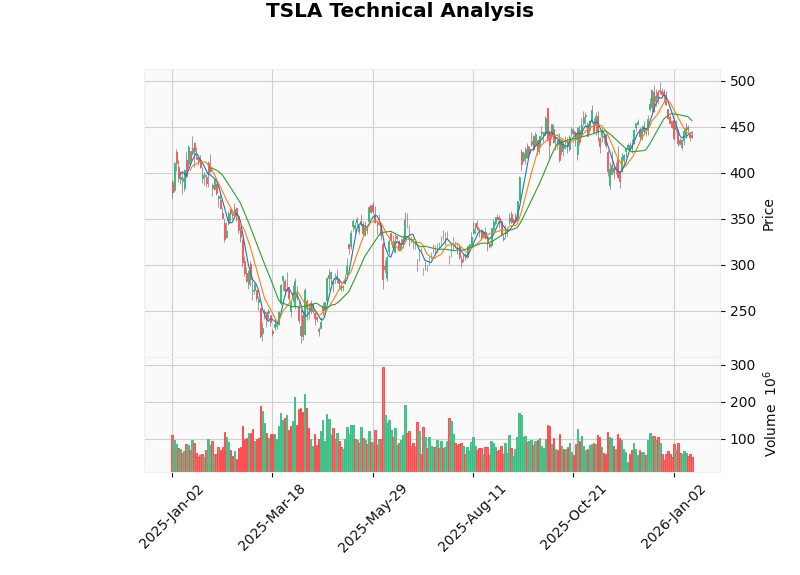

- 1-month: -10.47% (underperforms the broader market)[3]

- 6-month: +36.34% (benefits from AI/autonomous driving narrative)[3]

- Beta Coefficient: 1.83 (high volatility)[3]

- Trading Range: $431.02 - $456.97[3]

- Consensus Rating: Hold (31 Buy / 32 Hold / 17 Sell)[3]

- Median Target Price: $491.50 (implying 12.1% upside potential)[3]

- Rating divergence reflects the impact of regulatory uncertainty on valuation

- Michael Burry (December 2025): Publicly stated that Tesla is overvalued[6]

- Porter Collins (January 2026): Released bearish comments[6]

- Cathie Wood (Ark Invest): Extremely bullish on Robotaxi prospects (2029 revenue forecast of $756 billion)[2]

- Accelerated Technological Iteration:Regulatory pressure may prompt Tesla to accelerate technological improvements

- Compliance Advantage:Can obtain more solid regulatory endorsement after passing the investigation

- Software Revenue Transformation:Subscription model helps establish a predictable recurring revenue stream

- Brand Reputation:Frequent regulatory investigations may impact consumer trust in FSD

- California Market Risk:If the California DMV imposes a sales suspension, it may impact a key market[1]

- Capital Allocation:Addressing regulations may divert management attention and resources

- Talent Atrophy:Sustained negative publicity may impact the morale of the autonomous driving team

- Trend Judgment:Sideways consolidation (no clear direction)[3]

- MACD Signal:Bearish crossover, biased bearish[3]

- KDJ Indicator:K=44.9, D=39.7, J=55.5, short-term bullish[3]

- Moving Averages:20-day MA $456.97, 50-day MA $443.20, 200-day MA $368.28[3]

- Key Support Level:$431.02

- Key Resistance Level:$456.97

| Index | 60-Day Performance | Volatility |

|---|---|---|

| S&P 500 | +1.94% | 0.50% |

| Nasdaq | +1.54% | 0.70% |

| Dow Jones | +3.91% | 0.60% |

| Russell 2000 | +7.75% | 0.87% |

Tesla |

+2.29% | 4.12% |

Tesla’s volatility is significantly higher than the broader market (4.12% vs ~0.6%), reflecting high stock price sensitivity to regulatory news.

| Scenario | Probability | 12-Month Target Price | Core Driver |

|---|---|---|---|

| Base Case Scenario | 55% | $480-520 | FSD investigation resolved smoothly, stable deliveries |

| Optimistic Scenario | 25% | $550-650 | Robotaxi scaling exceeds expectations, FSD penetration exceeds 50% |

| Pessimistic Scenario | 20% | $300-380 | Regulatory penalties escalate, vehicle deliveries decline consecutively |

- NHTSA investigation results (regulatory feedback after Tesla’s response on February 23)

- Implementation of California DMV sales suspension (if any)

- Q4 FY2025 Earnings Report (January 28, 2026)[3]

- Release and safety records of FSD V13/V14

- Cybercab mass production progress

- Number of cities with Robotaxi deployments

- Evolution of global regulatory frameworks

- Technological progress of competitors (Waymo, Cruise, XPeng)

- Commercialization progress of Tesla’s Optimus robot

- Regulatory Risk:NHTSA may issue a recall order or FSD deployment restrictions

- Execution Risk:Musk has a history of overpromising[2]

- Competitive Risk:Waymo and local competitors are accelerating their catch-up

- Macroeconomic Risk:Slowdown in electric vehicle demand, interest rate environment

- Technological Risk:Potential safety incidents involving the FSD system

NHTSA’s regulatory investigation into Tesla’s FSD poses a

- Short-Term Impact:Uncertainty caused by the investigation has already been reflected in the nearly 10% pullback in the stock price; if the investigation is resolved smoothly, it may release suppressed valuation

- Mid-Term Impact:FSD deployment may be delayed by 3-6 months, but this will not affect the overall strategic framework of Robotaxi

- Long-Term Impact:After passing regulatory review, Tesla is expected to obtain a more solid compliance status, which will instead strengthen its competitive moat

[1] Yahoo Finance - “Tesla gets 5-week extension in US probe of Full Self-Driving traffic violations” (https://ca.finance.yahoo.com/news/tesla-gets-5-week-extension-132916930.html)

[2] Gasgoo Auto News - “Tesla’s 2026 mission, Navigating Through Competition with Chinese Automakers” (https://autonews.gasgoo.com/articles/news/teslas-2026-mission-navigating-through-competition-with-chinese-automakers-2010712617306140673)

[3] Gilin API Data - Tesla Company Profile, Stock Price Data, Financial Analysis

[4] USA TODAY - “Tesla shifting Full Self-Drive to subscriptions” (https://www.usatoday.com/story/cars/shopping/evs/2026/01/14/tesla-full-self-drive-subscription/88176519007/)

[5] The Tech Buzz - “NHTSA Finds 80 Tesla FSD Violations, Expands Safety Investigation” (https://www.techbuzz.ai/articles/nhtsa-finds-80-tesla-fsd-violations-expands-safety-investigation)

[6] AOL Finance - “Global robotaxi industry projected to hit $105B by 2035” (https://www.aol.com/finance/global-robotaxi-industry-projected-hit-123000156.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.