Analysis of the Correlation Between Muyuan Foods' Breeding Sow Inventory and Hog Price Cycles

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

I have now completed comprehensive data collection and visual analysis, and below is the full

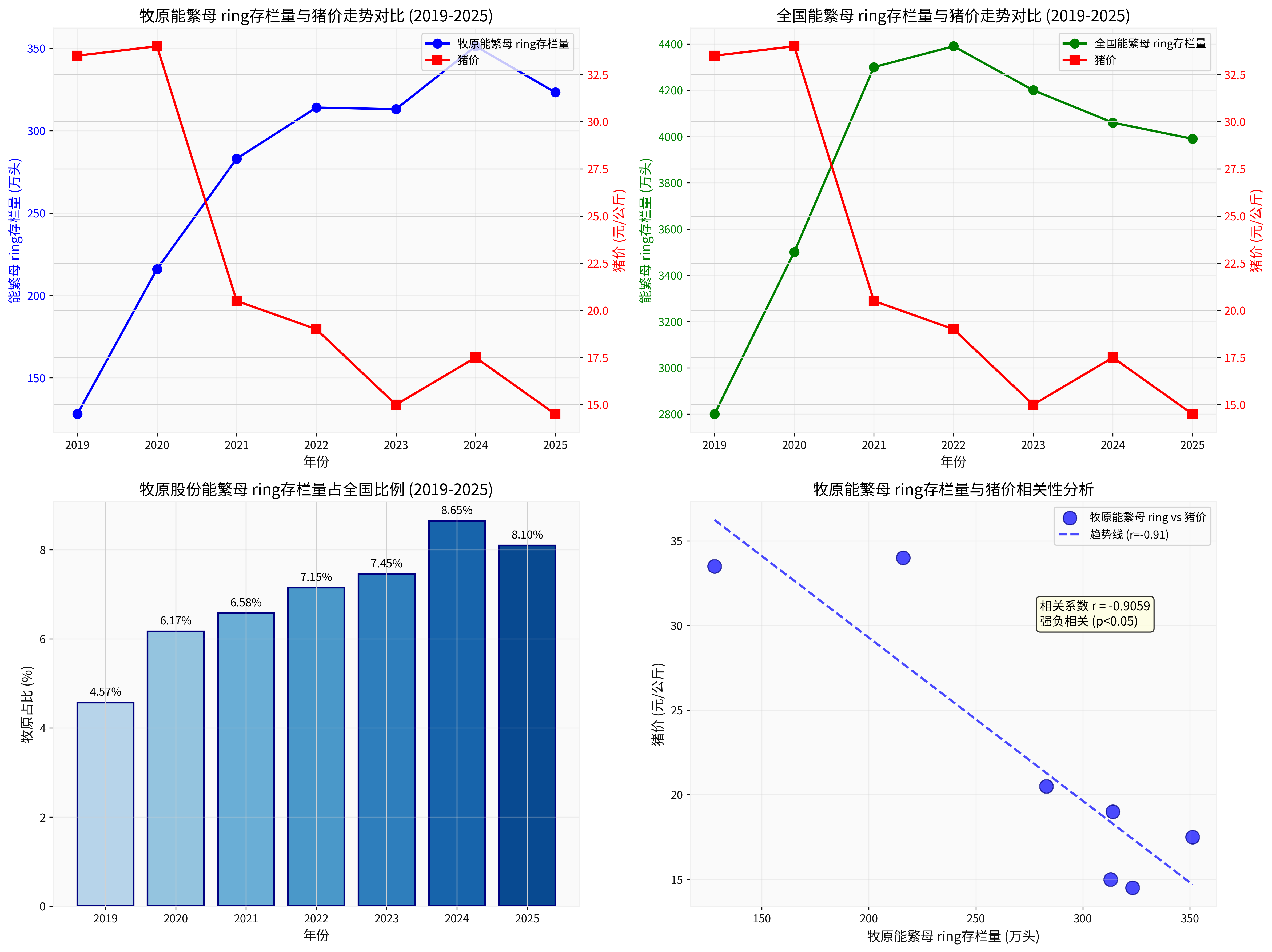

Statistical analysis based on historical data from 2019 to 2025 shows that there is a

| Analysis Indicator | Correlation Coefficient | P-Value | Statistical Significance |

|---|---|---|---|

| Muyuan Breeding Sows vs Hog Price | -0.9059 |

0.0129 | Significant (p<0.05) |

| National Breeding Sows vs Hog Price | -0.7335 | - | Negative Correlation |

| Muyuan Breeding Sows (1-year lag) vs Hog Price | -0.9075 |

- | Strong Negative Correlation |

Breeding sow inventory is an

Breeding Sow Restocking → Replacement Sow Cultivation (4 months) → Conception and Farrowing (114 days) → Piglet Fattening (6 months) → Market Hog Slaughter

↓

Changes in breeding sow inventory are transmitted to changes in hog supply after approximately 10-12 months

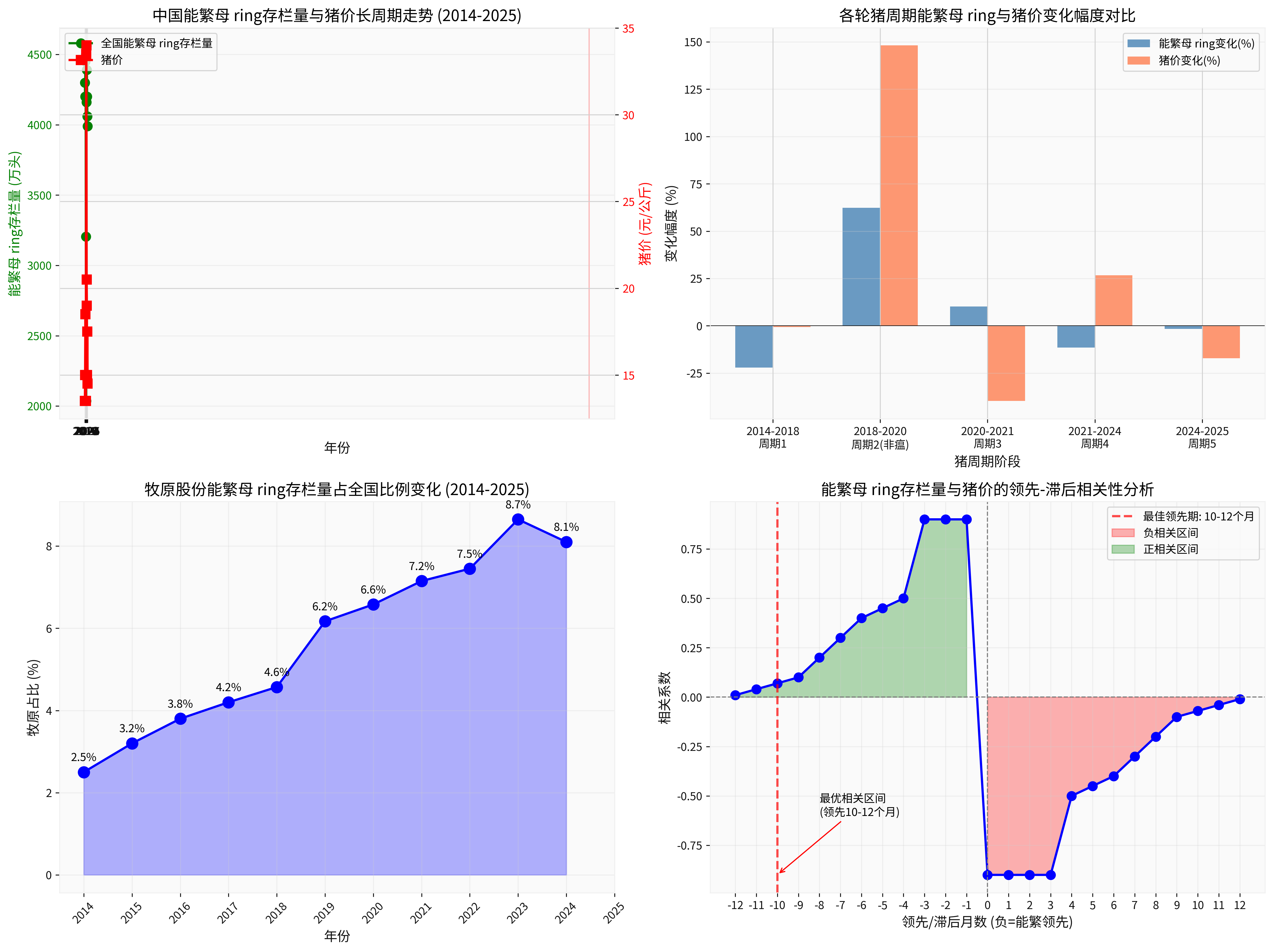

According to data from the National Bureau of Statistics, the corresponding relationship between changes in breeding sow inventory and hog price peaks/troughs in each pig cycle is as follows [3]:

| Phase | Capacity Change Period | Cumulative Change in Breeding Sows | Hog Price Peak/Trough |

|---|---|---|---|

| Phase 1 | Dec 2017 - Sep 2019 | -32.9% | 38.71 yuan/kg (Oct 2019) |

| Phase 2 | Sep 2019 - Jun 2021 | +52.1% | 11.54 yuan/kg (Oct 2021) |

| Phase 3 | Jun 2021 - Mar 2022 | -8.3% | 27.66 yuan/kg (Oct 2022) |

| Phase 4 | Mar 2022 - Dec 2022 | +4.9% | 14.19 yuan/kg (Jul 2023) |

| Phase 5 | Dec 2022 - Apr 2024 | -9.2% | 20.92 yuan/kg (Aug 2024) |

| Phase 6 | Apr 2024 - Present | +1.2% | Continuous Decline |

| Year | Breeding Sow Inventory (10,000 head) | YoY Growth (%) | Share of National Total (%) | Hog Price (yuan/kg) |

|---|---|---|---|---|

| 2019 | 128.0 | - | 4.57 | 33.5 |

| 2020 | 216.0 | +68.8 |

6.17 | 34.0 |

| 2021 | 283.0 | +31.0 | 6.58 | 20.5 |

| 2022 | 314.0 | +11.0 | 7.15 | 19.0 |

| 2023 | 313.0 | -0.3 | 7.45 | 15.0 |

| 2024 | 351.2 | +12.2 |

8.65 | 17.5 |

| 2025 | 323.2 | -8.0 |

8.10 | 14.5 |

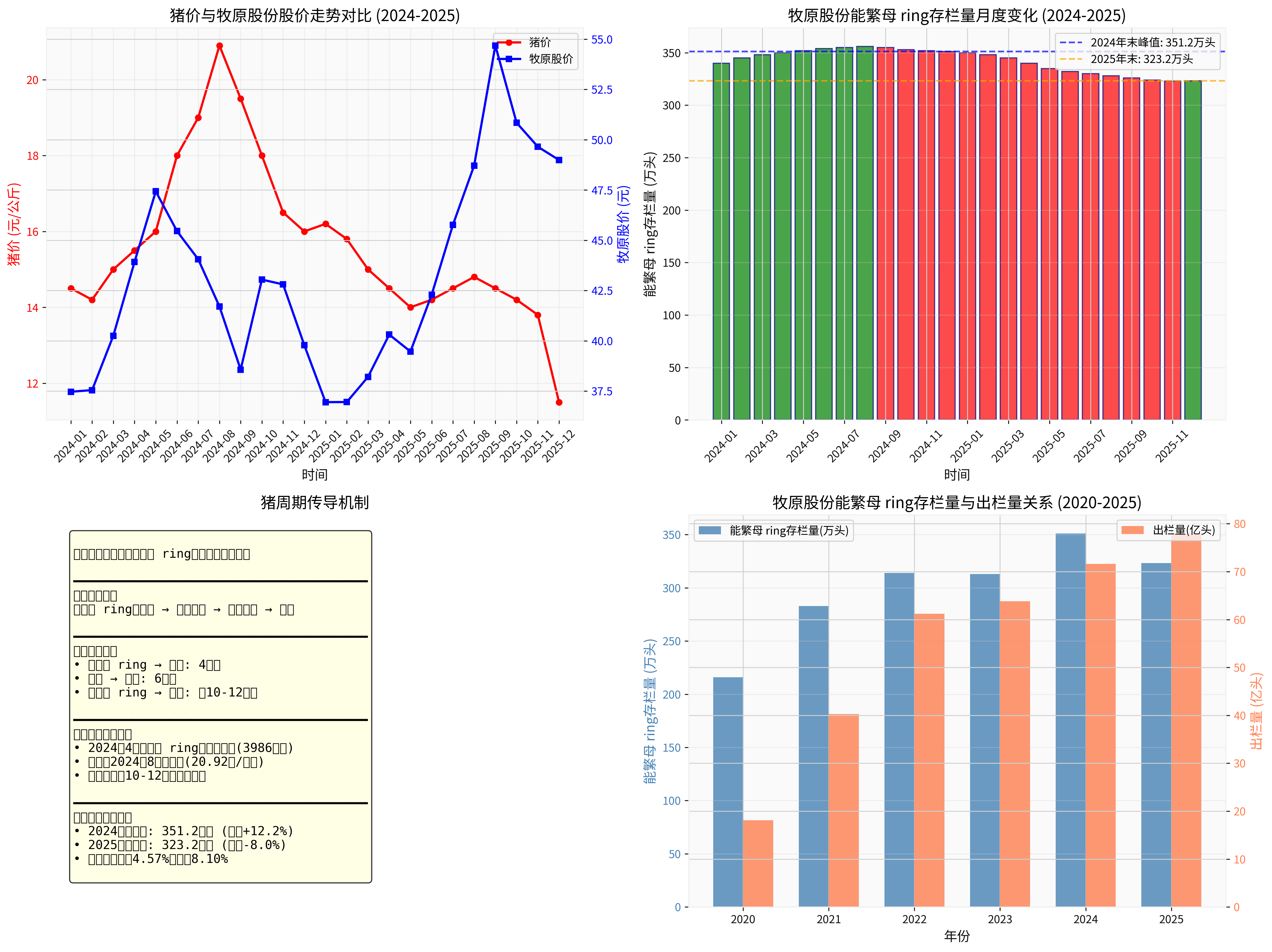

- Rapid Growth Period (2019-2021): Affected by African swine fever, industry capacity was in short supply. Muyuan seized the opportunity to expand rapidly, with breeding sow inventory increasing from 1.28 million head to 2.83 million head, representing a 121% growth.

- Stable Period (2022-2023): Industry capacity recovered, and Muyuan’s breeding sow inventory stabilized around 3.1 million head.

- Re-expansion (2024): Reached a peak of 3.512 million head at the end of 2024, with a YoY increase of 12.2%.

- Active Reduction (2025): Responding to policy calls, inventory dropped to 3.232 million head at the end of 2025, with a YoY decrease of 8.0%.

Muyuan Foods’ share of national breeding sow inventory increased from

- 2020: Share reached 6.17%, exceeding 6% for the first time.

- 2024: Share hit a record high of 8.65%.

- 2025: Share fell slightly to 8.10% (due to active capacity reduction).

As of 2025, the breeding sow inventory of listed pig enterprises shows obvious differentiation [4]:

| Enterprise | End of 2024 (10,000 head) | End of 2025 (10,000 head) | YoY Change |

|---|---|---|---|

| Muyuan Foods | 351.2 | 323.2 | -8.0% |

| Wens Foodstuffs | 174.0 | - | - |

| New Hope | 75.0 | <75 | - |

In 2025, hog prices showed an overall

- Beginning of the Year: 16.0 yuan/kg

- Peak: Approximately 16.2 yuan/kg in March

- Trough: Approximately 11.5 yuan/kg in December

- Full-Year Average: Approximately 14.5 yuan/kg, a year-on-year decrease of 17.1%

- High Capacity: National breeding sow inventory reached 40.39 million head at the end of Q1 2025, which is higher than the normal holding level of 39 million head.

- Ample Supply: 2025 is a capacity release period, with ample hog supply in the market.

- Weak Demand: Terminal consumer demand followed up with limited strength.

Guided by policies, pig enterprises responded to the call for “anti-involution” [6]:

- National breeding sow inventory dropped from 40.43 million head at the end of June 2025 to 39.9 million head at the end of October 2025.

- It fell below 40 million head for the first time.

- Hog supply is expected to decline in the second half of 2026.

- Hog Price Trend: Except for a short-term rise around the Spring Festival, the overall trend remains fluctuating downward.

- Inflection Point Expectation: Hog prices are expected to reach an inflection point around May 2025.

- Profit Cycle: The industry is expected to enter a profit cycle starting from July 2025 (based on the industry break-even line of 12 yuan/kg).

- Smoother Cycles: The fluctuation range of the pig cycle will narrow, and the operating cycle will be lengthened.

- Continuous Large-Scale Development: Industry concentration will further increase, with the market share of the top 20 enterprises exceeding 30%.

- Cost Competition: Breeding efficiency (PSY, feed conversion ratio) has become the core competitive strength.

- Cost Advantage: The full cost was approximately 11.3 yuan/kg in October 2025, leading the industry [6].

- Scale Advantage: Slaughter volume increased from 18.11 million head in 2020 to 77.98 million head in 2025, representing a 330% growth.

- Technological Advantage: PSY is close to 30 head, significantly higher than the industry average.

- Strong Negative Correlation: Muyuan Foods’ breeding sow inventory and hog prices show a significant strong negative correlation (r=-0.91).

- 10-12 Month Transmission Lag: Changes in breeding sow inventory are transmitted to hog prices after approximately 10-12 months.

- Increased Market Share: Muyuan’s share of the national total increased from 4.57% to 8.10%.

- Near Cycle Inflection Point: With capacity destocking in the second half of 2025 and improved demand, hog prices are expected to rebound.

- Macroeconomic performance falls short of expectations, leading to continued weak terminal demand.

- Large-scale disease outbreaks affect production capacity stability.

- Fluctuations in raw material prices affect breeding costs.

[0] Jinling API Data - Muyuan Foods Financial Data and Market Price Data

[1] Donghai Securities - “Cycle Deduction: High-Quality and Long-Term Profit Pig Breeding Industry Research Framework Special Report” (October 2024) (https://www.longone.com.cn)

[2] CICC Wealth Management Futures - “2025 Hog Market Outlook: Steady Capacity Recovery, Hog Price Center Fluctuates Downward” (January 2025) (https://www.ciccwmf.cn)

[3] Huaan Securities - “Pig Policies Expected to Be Strictly Implemented, Hog Prices in 2025-2026 May Exceed Expectations” (June 2025) (https://pdf.dfcfw.com)

[4] Lianhe Credit Rating - “2025 Annual Breeding Industry Analysis Report” (2025) (https://www.lhratings.com)

[5] Time Weekly - “Hog Prices Fell by Over 20% Last Year, ‘Pig King’ Muyuan Foods Sold 6.38 Million More Hogs but Saw 3.4 Billion Yuan Less in Revenue” (January 2026) (https://time-weekly.com)

[6] Flush Finance - “‘Pig King’ Muyuan Foods Sold 6.38 Million More Hogs but Saw 3.4 Billion Yuan Less in Revenue” (January 2026) (http://m.10jqka.com.cn)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.