In-Depth Analysis of the Impact of Memory Chip Price Hikes on the Smartphone Industry and Huawei's Competitive Position

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data and analysis I have collected, I will provide you with a

The current global memory chip market is experiencing the

| Product Type | Early 2024 Price | Late 2025 Price | Increase | Comparison with 15-Year Historical High |

|---|---|---|---|---|

| 4GB DRAM | ~US$15 | ~US$48 | +220% |

15-year high (previous high was ~US$20) [2] |

| 16GB DRAM | ~US$25 | ~US$65 | +160% |

Far exceeds historical levels |

| 64GB NAND | ~US$8 | ~US$15 | +87.5% |

Continuing to rise |

| 256GB NAND | ~US$22 | ~US$48 | +118% |

Tight supply and demand |

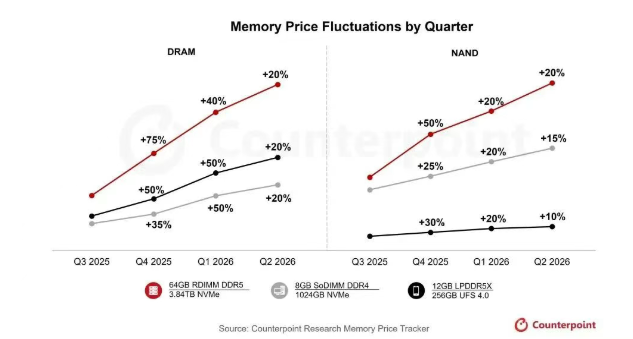

According to Counterpoint Research forecasts,

-

AI Server Demand Surge: OpenAI’s “Stargate” project is expected to require 900,000 DRAM wafers per month [1]. Cloud providers have locked in production capacity in advance, and HBM (High Bandwidth Memory) has a gross profit margin of over 70%, prompting memory chip manufacturers to shift consumer electronics production capacity to AI servers.

-

Smartphone Configuration Upgrades: After completing storage capacity upgrades in 2025, the iPhone is expected to undergo another upgrade in 2026, continuing to drive demand.

-

Supply-Side Bottlenecks: The expansion cycle for memory chip production is 18-24 months. Even if new production capacity construction starts in H2 2025, effective supply will not be formed until 2027 [2].

Source: DRAMeXchange, Global Semiconductor Observer [1]

A UBS research report points out that

| Time Node | Memory Share in Flagship Models | Memory Share in Mid-Range & Entry-Level Models | Unit Cost of Flagship Models | Incremental Unit Cost of Mid-Range & Entry-Level Models |

|---|---|---|---|---|

| Q4 2024 | 8% | 22% | $52 | $16 |

| Q4 2025 | 11% | 27% | $52→$58 | $16→$22 |

| Q4 2026 (Estimated) | 14% |

34% |

$52→ $73 |

$16→ $32 |

- The increase in memory costs for flagship models (+41%) accounts for only about 2%of the selling price, which is relatively manageable [1]

- The increase in memory costs for mid-range and entry-level models (+37%) accounts for about 6%of the selling price, with a disproportionately large impact [1]

Affected by memory chip price hikes,

| Manufacturer | Downgrade Magnitude | Affected Models | Reason |

|---|---|---|---|

| Xiaomi | Over 20% |

Mid-range, entry-level, and overseas models | Cost pressure cannot be passed on |

| OPPO | Over 20% |

Mid-range and entry-level product lines | Limited memory supply |

| vivo | Nearly 15% |

Core product lines | Compressed profit margins |

| Transsion | Below 70 million units |

Entry-level models | Costs cannot be covered by 1,000-yuan (~US$139) models |

TrendForce has further downgraded its forecast for 2026 smartphone production volume from a

“We haven’t seen a market like this in over a decade… Amid the memory chip shortage, we predict the smartphone market will enter a phase of ‘survival of the fittest’.” [2]

—— Sales Director of a memory chip manufacturer

- The cost of smartphones priced around 1,000 yuan has reached US$90-100, making it difficult to cover costs [2]

- Memory chip manufacturers prioritize Tier 1 customers(Apple, Samsung, Huawei), leaving non-headline manufacturers facing supply shortages

- The industry is shifting from scale expansion to value competition, with small and medium-sized manufacturers being eliminated at an accelerated pace

According to IDC data,

| Indicator | 2023 | 2024 | 2025 | Trend |

|---|---|---|---|---|

| China Market Share | 12% | 13.5% | 16.4% |

Continued growth |

| Premium Market Share (US$600+) | 21.4% | 30.7% | 34.4% |

Approaching Apple |

| Global Shipment Volume | — | — | 46 million units |

+28.6% (fastest growth rate) |

| Global Ranking | — | 9th | 8th | Up 1 spot |

- Apple’s market share in the US$600+ segment fell from 61.8% in 2023 to 51.1% in 2024, and further dropped to48% in 2025[5]

- Huawei climbed from 21.4% to 34.4%, breaking Apple’s monopoly [5]

Huawei’s counter-cycle advantage stems from

| Components | 2020 | 2023 | 2025 | Supplier Changes |

|---|---|---|---|---|

Localization Rate |

19% | 32% | 60% |

Increased by 41 percentage points |

| Memory Chips | 0% | 5% | Yangtze Memory Technologies (YMTC)/ChangXin Memory Technologies (CXMT) |

Fully replaced imports |

| Displays | 20% | 40% | BOE |

Primary supplier |

| Main Chips | 0% | Kirin 9000S | Kirin 9020 |

7nm equivalent breakthrough |

| Components from Japan, US, and South Korea | 70% | 55% | <40% |

Decreased by over 30 percentage points |

- Huawei has completed the replacement development of over 13,000 componentsand the board replacement development of4,000 circuit boards[5]

- In 2025, R&D expenditure reached RMB 180 billion, with R&D investment ratio increasing from 14%-15% to22%-23%[5]

Against the backdrop of a widespread 10%-20% price increase in the industry driven by memory chip hikes,

| Product | Pricing Strategy | Pricing Changes | Competitive Advantage |

|---|---|---|---|

| Mate 80 Series | Direct price cut of RMB 800 | Starting at RMB 4,699 | The only Kirin + HarmonyOS offering in the same price range |

| Pura Series | Price reduction under discussion | To be determined | Controllable costs |

| nova Series | Maintain competitiveness | RMB 2,000-4,000 | Full range coverage |

- Manufacturers such as Xiaomi and OPPO are forced to reduce entry-level models and raise prices

- Huawei, however, can maintain relatively stable production capacity and costs, forming differentiated competitiveness

| Indicator | 2025 | 2026 Forecast | Change |

|---|---|---|---|

| Global Shipment Volume | 1.26 billion units | ~1.15 billion units |

-3% to -4% |

| China Market Share (US$600+) | — | 35.9% |

+5.4 percentage points |

| China Market Share (Under US$200) | — | 20.0% |

-4.3 percentage points |

| Tier | Representative Manufacturers | 2026 Outlook | Strategic Choices |

|---|---|---|---|

Tier 1 |

Apple, Samsung, Huawei | Relatively stable | Protect profits, seize market share |

Tier 2 |

Xiaomi, OPPO, vivo | Under pressure | Downsize entry-level segment, focus on premium segment |

Tier 3 |

Transsion, Honor | Differentiated | Deepen regional presence or seek breakthroughs |

Others |

Small and medium-sized brands | Accelerated elimination | Facing survival crisis |

- Sustained Cost Advantage: Localization rate has reached 60%, enhancing immunity to international memory chip price hikes

- HarmonyOS Ecological Expansion: HarmonyOS devices exceeded 32 million in 2025, with over 10 million developers and 350,000 applications [5]

- Accelerated Technological Breakthroughs: Kirin 9020 performance improved by 35%, with in-depth optimization of HarmonyOS [8]

- Rising Brand Momentum: The Mate 60 Series sold nearly 10 million units, establishing a domestic premium brand image

- Chip Process Bottleneck: The 7nm equivalent process still lags behind international advanced levels

- Uncertainties in International Supply Chain: US chip export restrictions on China may escalate

- AI Smartphone Competition: Manufacturers such as Apple and vivo are accelerating the deployment of on-device AI

- Production Capacity Ramp-Up: Domestic memory chip production capacity still requires time to expand

-

Far-Reaching Impact of Memory Chip Price Hikes: 2026 will be the “year of smartphone price increases”, with the mid-range and entry-level market under severe pressure, and the industry entering a phase of “survival of the fittest”

-

Huawei’s Localization Advantage Stands Out: The 60% localization rate has given it a dual moat ofcost advantage + strategic independenceamid the supply chain crisis

-

Accelerated Differentiation of Competitive Landscape:

- Premium Market: The “duel between Huawei and Apple” will continue to intensify

- Mid-Range & Entry-Level Market: Price wars are fading, with cost-performance competition giving way to brand and ecosystem competition

-

Huawei’s Market Share Expansion is Expected: Driven by three factors—cost advantages, brand momentum, and technological breakthroughs—Huawei’s China market share is expected to exceed 20% in 2026

| Investment Theme | Related Targets | Rationale |

|---|---|---|

Memory Chip Price Hikes |

Samsung, SK Hynix, Micron | Tight supply and demand continue, with both volume and price rising |

Accelerated Domestic Substitution |

Yangtze Memory Technologies (YMTC), ChangXin Memory Technologies (CXMT), GigaDevice | Market window opens, with market share increasing |

Huawei Supply Chain |

BOE, Goodix, Will Semiconductor | Domestic substitution dividends are being released |

Reshaping of Smartphone Landscape |

Focus on investment opportunities in the Huawei industry chain | The pattern of “the strong get stronger” is established |

[1] Sina Finance - “Epic Surge in Memory Chip Prices Makes 2026 the Year of Smartphone Price Hikes” (https://finance.sina.com.cn/roll/2025-12-29/doc-inhemysr0273695.shtml)

[2] 21st Century Business Herald - “Memory Chip Prices Continue to Soar, Smartphone Industry Enters Phase of Survival of the Fittest” (https://www.21jingji.com/article/20260114/b23ec4dac61e6afa13551abca9d21340.html)

[3] IT Home - “Xiaomi, OPPO, vivo, Transsion Said to Have Downgraded 2026 Full-Year Smartphone Shipment Forecasts” (https://www.ithome.com/0/913/900.htm)

[4] Jiemian News - Reports on Adjustments to Smartphone Manufacturers’ Shipment Targets Amid Memory Chip Price Hikes

[5] NetEhao - Chief Brand Review - “Huawei Phones Return to the Top Spot” (https://www.163.com/dy/article/KJBOJIS3051980LO.html)

[6] IDC - “Global Quarterly Smartphone Tracker” (January 14, 2026)

[7] Ennews - “Huawei Phone Localization Rate Exceeds 60%” (https://m.ennews.com/news-119964.html)

[8] OFweek Electronics Engineering Network - “Price Revolution Amid Memory Chip Surge: Huawei’s Counter-Cycle Price Cuts Reshape the Smartphone Industry Landscape” (https://tele.ofweek.com/2025-12/ART-8320511-8120-30677389.html)

[9] AJ Securities Research Report - “Memory Chip Price Hikes Will Continue Into 2026” (December 22, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.