Nebius (NBIS) Q3 2025 Earnings Analysis: Strong Growth Amid Market Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Reddit discussion [1] published on November 12, 2025, which highlighted the paradox of Nebius (NBIS) reporting strong earnings yet experiencing significant stock pullback.

Nebius Group N.V. (NBIS) delivered remarkable Q3 2025 results with 355% year-over-year revenue growth to $146 million and a landmark $3 billion partnership with Meta [0]. However, the stock declined 7.69% to $94.36 in after-hours trading on November 12, 2025 [0], creating a complex investment narrative that requires careful analysis of both opportunities and risks.

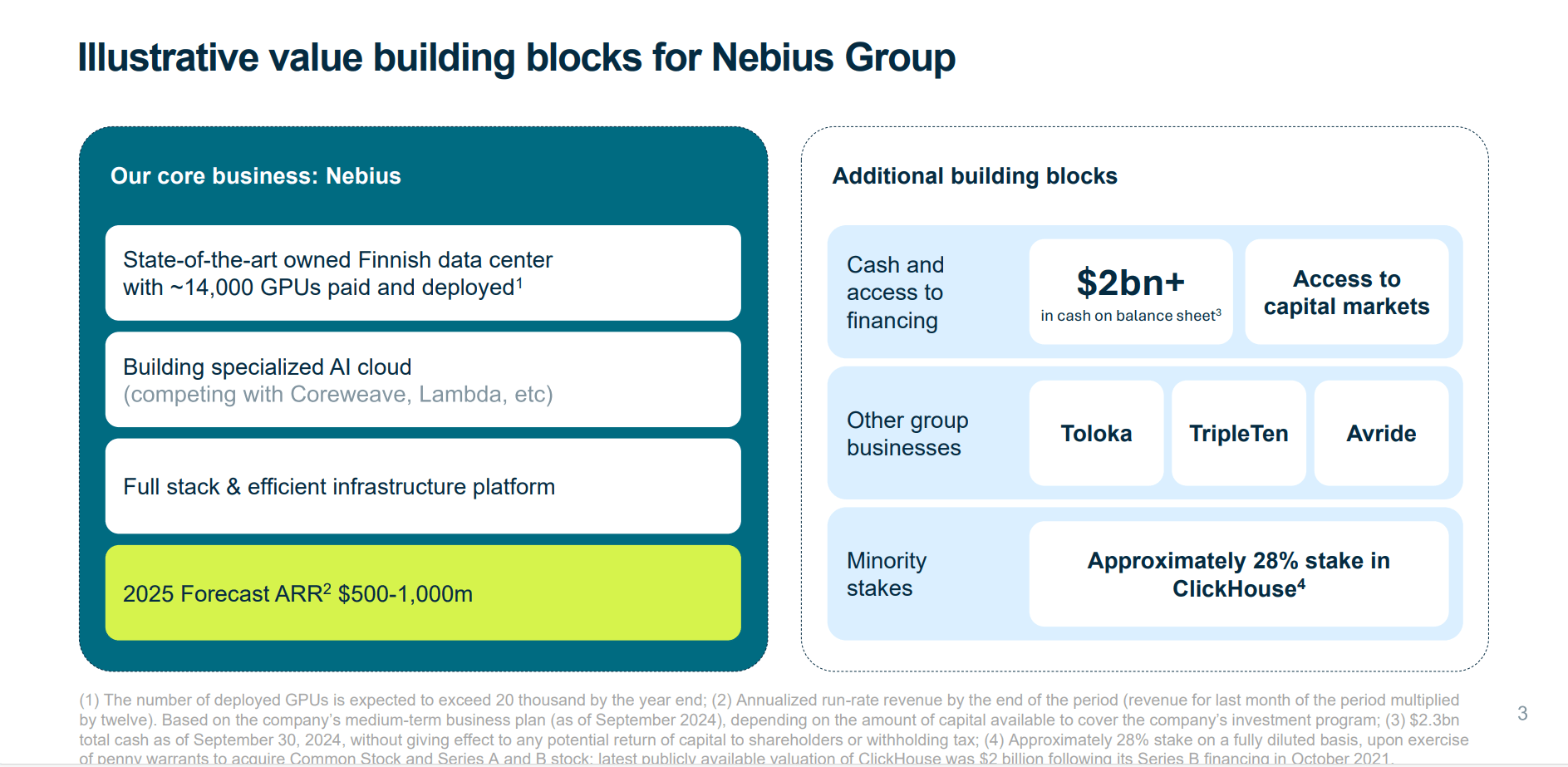

The disconnect between fundamental performance and market reaction stems from several key factors. While revenue growth was impressive at 355% YoY, it slightly missed analyst expectations of $155.4 million [0][1]. The company’s core infrastructure business grew even faster at 400% YoY, representing 90% of total revenue with expanding adjusted EBITDA margins approaching 19% [0]. Despite these strong metrics, management tightened 2025 revenue guidance to $500-550 million (from $450-630 million), suggesting timing challenges in execution [0].

Nebius maintains compelling strategic advantages in the AI infrastructure market. The company reports being “sold out” of available capacity, indicating strong demand [0]. Their blue-chip customer base includes Microsoft ($17.4-19.4 billion deal) and now Meta ($3 billion deal), creating substantial revenue visibility [0]. The company targets 2.5 gigawatts of contracted capacity by 2026, up from 1 GW, with new facilities in Israel, UK, and New Jersey featuring pre-sold capacity [0]. With $4.8 billion in cash and a current ratio of 6.57, Nebius has substantial financial runway [0][3].

The stock’s decline reflects several legitimate investor concerns:

- Capital Intensity: CapEx guidance increased dramatically from $2 billion to approximately $5 billion for 2025 [0]

- Dilution Risk: An at-the-market equity program for up to 25 million shares could significantly impact existing shareholders [0]

- Profitability Timeline: The company expects to remain unprofitable through 2025, with only slight positive EBITDA by year-end [0]

- Customer Concentration: Microsoft and Meta deals represent over 80% of projected future revenue, creating concentration risk [0]

Nebius represents a classic high-growth investment case where fundamental strength clashes with execution uncertainty. The company operates in a rapidly expanding AI infrastructure market with strong secular tailwinds, yet faces massive capital requirements and operational complexity [0]. The $3 billion Meta deal adds $600 million in annualized revenue potential, supporting management’s aggressive 2026 ARR target of $7-9 billion [0][3].

With a P/E ratio of 122.55, the stock reflects extremely high growth expectations [0]. The 100% Buy rating from analysts with an average price target of $101.00 suggests professional optimism, yet the market’s immediate reaction indicates skepticism about execution [0]. This divergence creates a potential opportunity for investors who can tolerate volatility and believe in management’s ability to execute.

Critical gaps remain for decision-makers, including the specific path to sustainable profitability, competitive positioning against rivals like CoreWeave, and the timeline for meeting aggressive capacity expansion targets [0]. The company’s guidance that more large contracts are in the pipeline suggests additional positive catalysts, but execution remains the key variable [0].

- Capital Execution Risk: The $5 billion CapEx increase represents a massive undertaking that could face delays or cost overruns [0]

- Dilution Risk: The 25 million share ATM program could significantly impact existing shareholders’ ownership percentage [0]

- Customer Concentration: Heavy reliance on two major customers creates vulnerability to contract changes or renegotiations [0]

- Market Timing Risk: AI infrastructure investments face potential oversupply concerns as more competitors enter the market [0]

- Strategic Position: Nebius has secured premier partnerships with Microsoft and Meta, providing revenue visibility and credibility [0]

- Demand-Supply Imbalance: The company reports being sold out of capacity, indicating strong market demand [0]

- Expansion Catalysts: New facility deployments and additional mega-deal announcements could serve as positive catalysts [0]

- Long-Term AI Trend: Exposure to the secular growth in AI infrastructure demand provides long-term tailwinds [3]

Nebius presents a complex investment case characterized by exceptional growth (355% YoY revenue increase) alongside significant execution challenges. The company’s strong strategic positioning with blue-chip customers and sold-out capacity contrasts with concerns about capital intensity, dilution risk, and delayed profitability [0]. The stock’s post-earnings decline appears to reflect these concerns rather than fundamental weakness.

Key monitoring factors include Q4 capacity deployment success, additional large contract announcements, profitability progress through EBITDA margin expansion, and competitive dynamics in the GPU cloud infrastructure market [0]. With $4.8 billion in cash providing substantial runway and institutional support at 20% ownership with net buying activity, Nebius has resources to execute but faces significant operational and financial challenges [3].

The decision to “buy the dip” versus “hold for the long term” depends on individual risk tolerance and belief in management’s ability to execute on their ambitious expansion plans while navigating the capital-intensive nature of AI infrastructure development.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.