AI Bubble Fear vs Dotcom Era: Historical Comparison of Market Consensus

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit users provide nuanced historical perspective on fear dynamics between eras:

-

Market Access Evolution: Then_North_6347 notes that retail access was severely limited before dotcom—no smartphones for on-the-go trading—while today’s $38T debt and inflation push more people into assets, amplifying fear transmission[1].

-

Language & Awareness: ephemeral-me recalls that the term ‘bubble’ was less common pre-2000; media focused on financial fundamentals not supporting valuations, and the lack of forums meant less ubiquitous noise compared to today’s constant discourse[1].

-

Nature of Fear: Wide-Annual-4858 contrasts the fundamental concerns: dotcom fears centered on overvalued firms that wouldn’t make money because people didn’t need their services, whereas AI fears focus on slow delivery and implementation gaps[1].

-

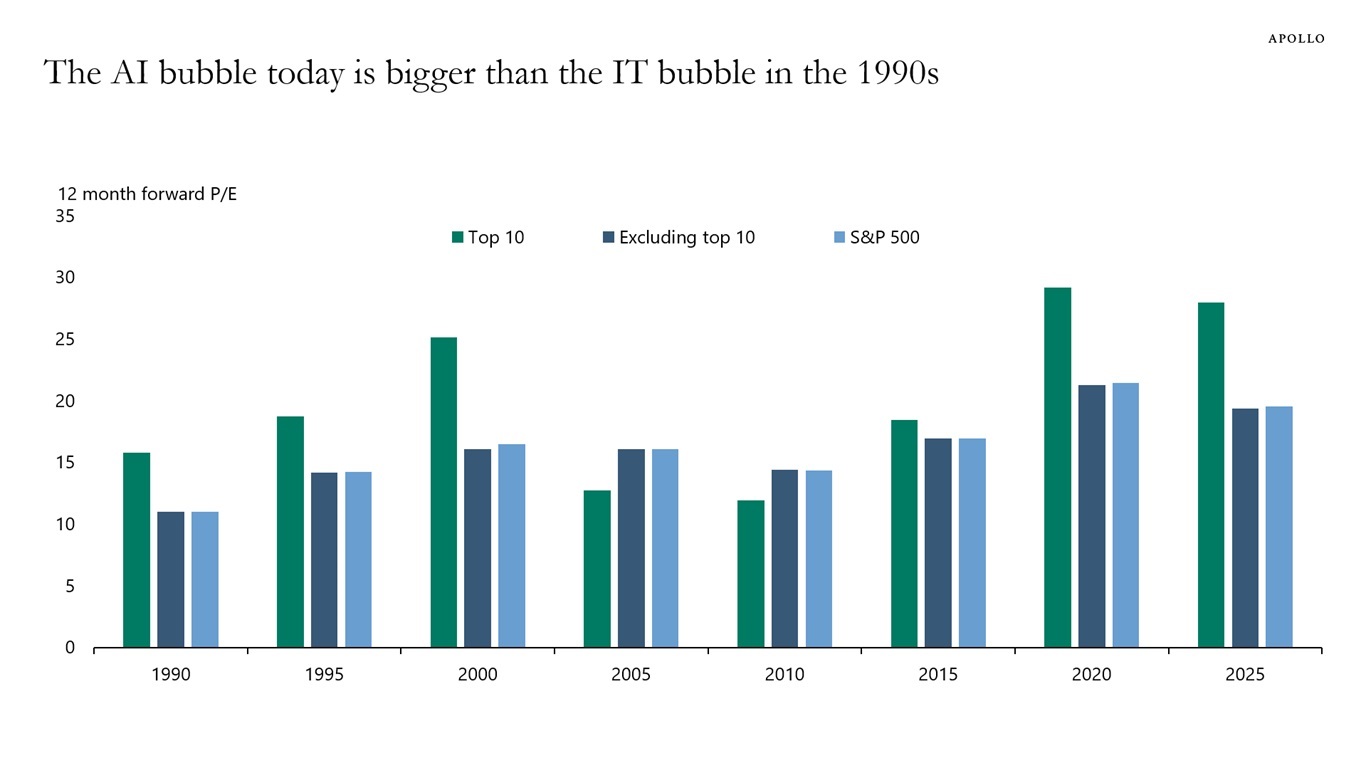

Valuation Context: Working-Active provides forward P/E data showing AI tech (NVDA 30, AVGO 38) still cheaper than some retail (Costco 45, Walmart 35), suggesting valuation gaps remain[1].

-

Consensus Paradox: RiPFrozone references Greenspan’s 1996 ‘irrational exuberance’ remark, noting markets rose for years after; argues that broad consensus of a bubble implies further upside until bears capitulate[1].

-

Expert Recognition vs. Market Exuberance: While prominent figures like Alan Greenspan (famous 1996 “irrational exuberance” warning) and Warren Buffett expressed concerns, many investors remained optimistic despite clear overvaluation signals[2][3].

-

Extreme Overvaluation Metrics: NASDAQ reached P/E ratios exceeding 200 by late 1999—more than double Japanese bubble levels—while tech investment peaked at 15% of US GDP in 2000[2][4].

-

CAPE Ratio Signals: Market reached historic CAPE ratio highs in 1999-2000, indicating severe overvaluation that was recognized by technical analysts but ignored by many investors[2].

-

Cultural Indicators: Super Bowl advertisements by internet companies exploded from 2 in 1999 to 17 in 2000, then collapsed to 3 in 2001—showing bubble dynamics in real-time[2].

-

Coordinated Institutional Warnings: Major financial institutions (J.P. Morgan, Goldman Sachs, Morgan Stanley) are issuing explicit AI bubble warnings in 2025, representing unprecedented consensus[5][6][7].

-

Massive Investment Requirements: J.P. Morgan estimates AI sector needs $650 billion annual revenue by 2030 for just 10% returns on current investments—highlighting sustainability concerns[5].

-

Direct Historical Parallels: Goldman Sachs identifies 5 dot-com bubble warning signals appearing in current AI market conditions, creating explicit historical framework[6].

-

Continued Capital Flow Despite Warnings: Mega-cap tech firms (Amazon, Meta, Microsoft, Alphabet, Apple) projected to spend $349 billion on AI capex in 2025, while venture capital continues flowing to AI startups[8][9][10].

-

Implementation Reality Gap: McKinsey reports 95% of genAI pilots in businesses are failing, creating significant disconnect between investment and actual adoption[11].

-

High-Profile Skeptics: Michael Burry has shorted $1.2 billion of Nvidia and Palantir stock, betting against AI bubble[12].

- Consensus-Driven Extension: Widespread bubble recognition may paradoxically extend the bull run as bears capitulate, similar to post-Greenspan 1996 rally[1][2]

- Implementation Gap: 95% failure rate for genAI pilots suggests significant revenue realization challenges ahead[11]

- Capital Allocation Inefficiency: $349B in projected AI capex by mega-caps may face diminishing returns if adoption stalls[8]

- Selective Exposure: Forward P/E analysis shows some AI names (NVDA 30x, AVGO 38x) trade at reasonable multiples relative to traditional growth[1]

- Implementation Solutions: Companies addressing the 95% pilot failure rate could capture significant value[11]

- Historical Pattern Recognition: Understanding dotcom bubble dynamics provides framework for timing exposure adjustments[6]

The current AI bubble features greater fear consensus and coordinated institutional warnings than the dotcom era, yet this consensus may actually extend rather than precipitate the bull run. The key distinction lies in business model viability—dotcom firms often lacked paths to profitability, while AI firms face implementation challenges. Investors should focus on companies addressing the implementation gap while maintaining selective exposure to reasonably valued AI names.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.