Analysis of Market Expectations Behind Northbound Capital's 146% Increase in Holdings of Wanma Co., Ltd.

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I will systematically analyze the market expectations behind Northbound Capital’s substantial increase in holdings of Wanma Co., Ltd.

According to the 2025 year-end Northbound Capital holding data disclosed by the Shanghai and Shenzhen Stock Exchanges, the end-of-period shareholding ratio of Wanma Co., Ltd. (002276.SZ)

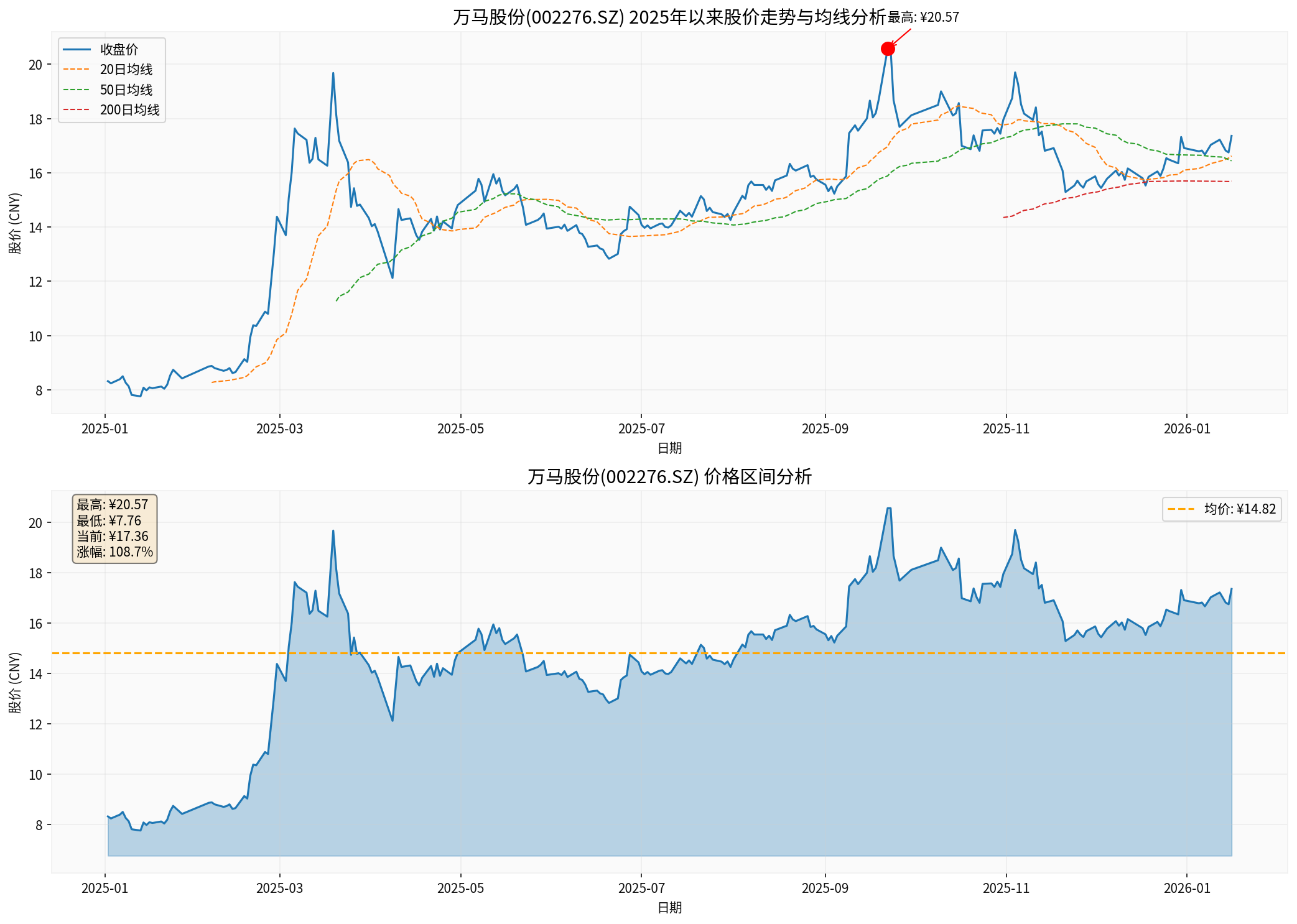

From the perspective of secondary market performance, the stock price of Wanma Co., Ltd. has risen by

The main business of Wanma Co., Ltd. covers the R&D, production and sales of wires and cables, and polymer materials, while actively expanding products and services related to new energy charging piles[3]. The company has established a stable competitive advantage in the mid-to-high-end cable product market, and has been ranked among the “Top 10 Most Competitive Enterprises in China’s Cable Industry” for 7 consecutive years. The company’s customers include large central enterprises such as State Grid, China Energy Investment Corporation, China State Railway Group, PetroChina, and Sinopec, with stable and high-quality order sources.

| Indicator | First Three Quarters of 2025 Data | Year-on-Year Change |

|---|---|---|

| Operating Revenue | RMB 14.109 billion | +8.36% |

| Net Profit Attributable to Parent Company | RMB 412 million | +61.57% |

| Non-recurring Net Profit | RMB 371 million | +75.44% |

| Q3 Single-Quarter Net Profit | RMB 161 million | +227.7% |

| Q3 Single-Quarter Non-recurring Net Profit | RMB 150 million | +315.91% |

The company’s gross profit margin remains at a healthy level of 12.59%, financial expenses are well controlled, and the asset-liability ratio is 63.02%, with an overall stable financial structure[3][4].

In the first quarter of 2025, the cable sector of Wanma Co., Ltd. won a series of large orders in industries such as power grid, energy, rail transit, new energy vehicles, and computing power centers, with a total winning bid amount of approximately RMB 4.5 billion, laying a solid foundation for the successful achievement of the annual target[4]. This indicates that the company’s market expansion capabilities in various segmented fields are continuously strengthening.

From the perspective of sector allocation, the power equipment sector was the largest sector in terms of market value held by Northbound Capital at the end of 2025, exceeding RMB 449.5 billion; the market value held in the electronics sector exceeded RMB 387 billion, and the market value held in the non-ferrous metals sector exceeded RMB 185.5 billion[1][2]. Compared with the end of 2024, the market value held in the electronics, power equipment and non-ferrous metals sectors all achieved growth of hundreds of billions of yuan, with the non-ferrous metals sector recording an increase of over 170%.

Northbound Capital’s substantial increase in holdings of Wanma Co., Ltd. reflects the following core market expectations:

-

Continuous Efforts in New Energy Infrastructure: As core products for power grid construction and supporting facilities for new energy power stations, wires and cables benefit from the advancement of the national “Dual Carbon” strategy and the construction of a new power system.

-

Charging Piles and New Energy Vehicle Industry Chain: The company’s active layout of new energy charging pile business aligns with the industry trend of continuous improvement in the penetration rate of new energy vehicles.

-

AI Computing Power Infrastructure Construction: The increasing demand for cable products from data centers and computing power centers has brought new growth points for the company.

-

Increased Concentration of Central Enterprise Orders: The trend of large central enterprises concentrating orders on leading suppliers is obvious, and Wanma Co., Ltd. is expected to continue to benefit from its technological and brand advantages.

From a technical analysis perspective, the current stock price of Wanma Co., Ltd.

| Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 35.05x | Above Medium |

| Price-to-Book Ratio (P/B) | 2.86x | Reasonable Range |

| Return on Equity (ROE) | 8.50% | Medium Level |

The company’s current valuation is at a relatively high level in history, but considering the high growth of its performance and industry prosperity, institutions generally maintain optimistic expectations. A total of 4 institutions have given ratings in the last 90 days, including 3 buy ratings and 1 overweight rating, with an average institutional target price of RMB 20[3].

Although Northbound Capital’s substantial increase in holdings reflects foreign investors’ confidence in the company, investors still need to pay attention to the following risk factors:

-

Valuation Correction Risk: The company’s stock price has risen significantly this year, with a P/E ratio of 35x. If market sentiment shifts or performance growth falls short of expectations, the stock price may face adjustment pressure.

-

Raw Material Price Fluctuation Risk: The wire and cable business is sensitive to the prices of bulk commodities such as copper and aluminum, and there is a time lag in cost pass-through.

-

Intensified Industry Competition: The cable industry has a fragmented competitive landscape, so changes in market share and fluctuations in profitability need to be monitored.

-

Accounts Receivable Management Risk: Although central enterprise customers have good credit, their payment cycles may affect the company’s cash flow.

Northbound Capital’s 146% increase in holdings of Wanma Co., Ltd. reflects the market’s recognition of the company’s improved fundamentals, increased industry prosperity, and long-term development space in the new energy industry chain. With its technological accumulation, customer resources, and order acquisition capabilities, the company is expected to continue to benefit in segmented fields such as power grid construction, new energy vehicle charging, and computing power infrastructure.

From an investment perspective, Wanma Co., Ltd. is a typical “Northbound Capital-driven” target, and foreign investors’ substantial increase in holdings provides strong capital-side support for the company. However, given the current valuation level and the year-to-date increase, investors should combine their own risk preferences, pay attention to the company’s order execution, performance fulfillment progress, and changes in overall market sentiment, and look for layout opportunities during corrections.

[1] Sina Finance - “Northbound Capital’s Holding Path Exposed! Global Lithium Battery Giant Has Received Increased Holdings for 7 Consecutive Quarters” (https://finance.sina.com.cn/roll/2026-01-12/doc-inhfyxfe0170654.shtml)

[2] NetEase Finance - “Smart Money Holdings Approach Historical High: Overweight Technology Stocks, Prefer These Guangdong Enterprises” (https://www.163.com/dy/article/KJ83F9J805199NPP.html)

[3] Securities Times - “Stock Market Express: Wanma Co., Ltd. (002276) Saw Net Selling of RMB 73.05 Million by Main Capital on January 14” (https://www.sohu.com/a/976094803_121319643)

[4] Securities Times - “Wanma Co., Ltd. Won Approximately RMB 4.5 Billion in Orders in the First Quarter of This Year” (https://www.stcn.com/article/detail/1647269.html)

[0] Gilin AI Financial Database - Market Data of Wanma Co., Ltd. (002276.SZ)

三博脑科脑科学基金投向分析:7亿元布局三大领域

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.