Analysis on the Sustainability of Performance Growth of YUEGUI Co., Ltd. Driven by the Sulfur Chemical Concept

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me prepare a systematic and comprehensive analysis report for you:

YUEGUI Co., Ltd. (Stock Code: 000833.SZ) is a comprehensive listed company focusing on the development and utilization of non-metallic mineral resources and sugar manufacturing. The company is actively promoting the industrial development strategy of “Chemical Industry + New Energy Materials”, committed to building an industrial system of mineral resources and non-metallic materials, and becoming an advanced enterprise of green chemical new materials in Guangdong Province[1].

The company currently has

- Sugar Manufacturing Business: Traditional core business, benefiting from the Guangxi Sugar Industry Development Plan

- Non-metallic Minerals and Chemicals: Sulfur chemical industry chain with pyrite development at its core

- New Energy Materials: Under-construction projects such as refined phosphoric acid and quartz materials

The core carrier of the company’s sulfur chemical business is its wholly-owned subsidiary

| Indicator | Data |

|---|---|

| Cumulative Proven Pyrite Resource Reserves | 208 million tons |

| Average Grade | 31.04% |

| Proportion of National Rich Ore Reserves | Approximately 85% |

| Annual Production Capacity | Approximately 3 million tons |

| Proportion of National Pyrite Output | 16.63% |

This resource reserve scale enables YUEGUI Co., Ltd. to occupy a

- Project Positioning: Produce electronic-grade phosphoric acid, directly meeting the demand for cathode materials of lithium iron phosphate batteries

- Investment Scale: One of the main investment directions of raised funds

- Latest Progress:

- Construction of the purification section is underway

- The original production plan remains unchanged, expected to be put into production in mid-2026[3]

- EIA Progress: Submitted to the Yunfu Municipal Environmental Protection Bureau, expected to obtain approval in February 2026

- Project Content: Acquire the Fanbeichong Quartz Mine, produce key materials for photovoltaic/semiconductor industries such as silver powder and quartz materials

- Latest Status: Announcement completed, pre-construction planning, demonstration and approval are in progress

- Capacity Planning: Specific capacity data has not been disclosed yet

- Production Time: To be determined after demonstration[3]

According to the interactive Q&A information, the company’s sulfur concentrate quotation continued to increase from November to December 2025:

- December Quotation: Sulfur concentrate ex-factory price isRMB 1,120/ton(dry basis, tax-included, spot exchange)

- Increase from Previous Period: RMB 150/ton

- Price Correlation: The rise in sulfur price will indirectly affect the sulfur concentrate price (substitution effect between sulfur-based sulfuric acid and pyrite-based sulfuric acid)

| Financial Indicator | 2022 | 2023 | 2024 | Jan-Sep 2025 |

|---|---|---|---|---|

| Operating Revenue (RMB 100 million) | 18.5 | 20.8 | 27.96 | 21.44 |

| Net Profit Attributable to Parent Shareholders (RMB 100 million) | 0.65 | 0.66 | 2.79 |

4.44 |

| Net Profit Margin (%) | 3.5 | 3.2 | 10.0 | 20.7 |

| YoY Growth of Operating Revenue (%) | - | 12.4 | 34.4 |

- |

The main driving factors for the

- Enhanced Control over Upstream Raw Materials: Increased self-sufficiency rate of pyrite resources reduces raw material procurement costs

- Optimized Internal Production and Sales Synergy: The synergy effect of the sulfur chemical industry chain has emerged

- Product Structure Adjustment: The proportion of high-value-added chemical products has increased

- Upward Cycle of Sulfur Chemical Industry: The continuous rise in sulfuric acid and sulfur prices has driven the upward trend of sulfur concentrate prices

| Financial Indicator | Data | Industry Evaluation |

|---|---|---|

| ROE (Return on Equity) | 13.43% |

Good |

| Net Profit Margin | 17.05% |

Excellent |

| Operating Profit Margin | 20.48% |

Excellent |

| Current Ratio | 1.60 |

Stable |

| Quick Ratio | 1.12 |

Good |

| Debt Risk | Low Risk |

Financially Healthy |

Financial analysis shows that the company’s accounting policies remain neutral, its financial attitude is prudent, its debt risk is low, and its overall financial health is good[0].

As a basic chemical raw material, sulfuric acid is widely used in industries such as phosphate fertilizer, titanium dioxide, hydrofluoric acid, and viscose staple fiber. In recent years, with the rapid development of the new energy industry, the demand for sulfuric acid from

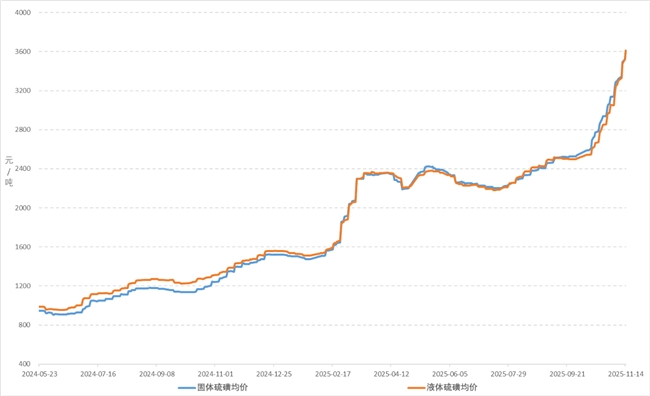

According to industry data, the sulfuric acid market from 2024 to 2025 shows the following characteristics:

- Increased Capacity Utilization: The overall utilization rate of the sulfuric acid industry has increased from about 70% in 2023 to over 80% in 2025

- Upward Shift in Price Center: The price of sulfuric acid has risen from RMB 200-300/ton in mid-2024 to RMB 400-600/ton at the end of 2025

- Optimized Demand Structure: The proportion of demand from new energy materials (lithium iron phosphate) has increased to about 15%

The rapid development of lithium iron phosphate power batteries and energy storage batteries is the core driving force for the growth of sulfur chemical demand:

- Increased Penetration of New Energy Vehicles: The penetration rate of new energy vehicles in China is expected to exceed 40% in 2025

- Booming Energy Storage Market: The demand for grid-side and user-side energy storage is growing at an annual rate of over 50%

- Lithium Iron Phosphate Technical Route Dominates: Sodium-ion batteries complement lithium iron phosphate, and lithium iron phosphate still dominates

The sulfur price has risen from about RMB 2,500/ton in the second half of 2024 to

- Substitution Effect: Competitive relationship between sulfur-based sulfuric acid and pyrite-based sulfuric acid

- Cost Conduction: The rise in sulfur price drives the increase in demand for pyrite-based sulfuric acid

- Price Support: The overall upward trend of sulfuric acid prices provides support for sulfur concentrate prices

According to the announcement in January 2026, YUEGUI Co., Ltd.'s 2025 A-share issuance to specific targets has been accepted by the Shenzhen Stock Exchange[1]:

| Item | Details |

|---|---|

| Issuance Volume | No more than 156,400,000 shares (no more than 19.50% of total share capital) |

| Raised Funds | No more than RMB 900 million |

| Listing Venue | Shenzhen Stock Exchange |

| Sponsor | China Merchants Securities Co., Ltd. |

| Serial No. | Project Name | Investment Direction |

|---|---|---|

| 1 | 100,000 t/a Refined Wet-process Phosphoric Acid Project | New Energy Materials |

| 2 | Investment Project of Glass Quartz Sandstone Mine in Baimianshi Mining Area, Xiatai Town, Yingde City, Guangdong Province | Resource Reserve |

| 3 | Large-scale and Automated Transformation Project of Grinding System of Yunliu Mining | Capacity Upgrade |

The company disclosed the following risk factors in the private placement prospectus[2]:

- Risk of Fluctuation in Capacity Utilization: If the market cultivation cycle of products is prolonged or the demand from intended customers falls short of expectations, the new capacity may not be effectively absorbed in the short term

- Risk of Project Falling Short of Expected Returns: Changes in macro policies, market, technology, environmental protection and other factors may affect the expected returns of the project

- Risk of Approval Progress: The approval progress of permits such as EIA and forest land use may affect the scheduled construction and production of the project

- Risk of Leased Land: Some projects involve allocated land from Yunliu Group, which may have uncertainties

| Time Period | Change Range | Market Performance |

|---|---|---|

| 5 Days | +6.39% |

Strong |

| 1 Month | +15.23% |

Robust |

| 3 Months | +49.76% |

Strong |

| 6 Months | +77.31% |

Outstanding |

| 1 Year | +82.74% |

Excellent |

| 3 Years | +273.74% |

Exceptional |

| 5 Years | +471.54% |

Exceptional |

| Indicator | Data | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 34.64x |

Medium-to-High |

| Price-to-Book Ratio (P/B) | 4.42x |

Medium |

| Price-to-Sales Ratio (P/S) | 5.90x |

Medium |

| Market Capitalization | RMB 17.237 billion | Medium-sized |

According to the technical analysis results[0]:

| Indicator | Value/Status | Signal Interpretation |

|---|---|---|

| 20-day Moving Average | RMB 19.64 | Short-term Support |

| 50-day Moving Average | RMB 19.98 | Medium-term Support |

| 200-day Moving Average | RMB 14.58 | Long-term Upward Trend |

| KDJ | K:64.4, D:62.3, J:68.5 | Bullish Bias |

| RSI | Overbought Zone | Risk Warning |

| MACD | Bullish Crossover | Upward Trend |

| Beta | 0.13 | Low Volatility |

- 208 million tons of pyrite reserves can support mining for more than 50 years in the future

- The 85% share of national rich ore reserves forms a natural moat

- The cost advantage brought by increased resource self-sufficiency will continue to emerge

- The 100,000 t/a refined wet-process phosphoric acid project will significantly boost performance after its production in 2026

- The quartz material project meets the domestic substitution demand of photovoltaic and semiconductor industries

- The new energy materials business is expected to become the second growth curve

- The continuous growth of lithium iron phosphate demand ensures the demand for sulfuric acid

- The sulfur price fluctuates at a high level, providing support for the sulfur concentrate price

- The sugar manufacturing business benefits from the Guangxi Sugar Industry Development Plan

- The “14th Five-Year Plan for the Development of Raw Material Industry” encourages resource integration and new material development

- The “Action Plan for Optimizing and Upgrading the Raw Material Industry Led by Standard Improvement (2025-2027)” supports green upgrading

- The “14th Five-Year Plan for the Development of Guangxi Sugar Industry” supports the integration of sugar manufacturing capacity

- The prices of sulfuric acid and sulfur concentrate fluctuate due to supply and demand relations

- Intensified price competition of new energy materials may compress profit margins

- Cyclical fluctuations may affect short-term performance

- The production time of the refined phosphoric acid project may be delayed due to approval and other factors

- The market cultivation cycle of new energy materials is uncertain

- The production time of the quartz mine project has not yet been determined

- The stock price has risen significantly in the past year (82.74%), facing short-term adjustment pressure

- There may be a time lag between concept speculation and actual performance realization

- The market has high expectations for the company, and underperformance may lead to a pullback

- The entry barrier of the sulfur chemical industry is relatively low

- The capacity expansion of lithium iron phosphate materials may lead to oversupply

- Resource enterprises face technical challenges when extending to new materials

| Evaluation Dimension | Rating | Explanation |

|---|---|---|

| Resource Guarantee Capability | ★★★★★ | Leading national resource reserves |

| Industrial Chain Extension Capability | ★★★★☆ | New energy material projects are progressing in an orderly manner |

| Sustainability of Market Demand | ★★★★☆ | There is still room for growth in lithium iron phosphate demand |

| Financial Health | ★★★★★ | Low debt, high profit quality |

| Valuation Rationality | ★★★☆☆ | 34x P/E is at a medium-to-high level |

Comprehensive Sustainability |

★★★★☆ |

Generally optimistic, but need to pay attention to valuation risks |

- Obvious Resource Endowment Advantage: The company controls the largest pyrite rich ore resources in the country, with a solid resource barrier, providing a strong raw material guarantee for the sulfur chemical business

- Clear New Energy Transformation Path: The 100,000 t/a refined wet-process phosphoric acid project will significantly improve the company’s performance after production, and the new energy materials business is expected to become a new profit growth point

- Sustainable Industry Prosperity: The demand for lithium iron phosphate batteries continues to grow, the supply and demand pattern of sulfuric acid is tight, and the sulfur concentrate price has support

- Healthy Financial Situation: Low debt, high profit quality, good operating cash flow, with the ability to continue investment and expansion

Investors need to pay attention to the following risks:

- Short-term Valuation Risk: The current 34x P/E is at a medium-to-high level in history, and the stock price may face adjustment pressure in the short term

- Risk of Project Progress: The production time of the refined phosphoric acid project may be delayed due to approval and other factors

- Risk of Product Price Fluctuation: The prices of sulfuric acid and sulfur concentrate fluctuate due to market supply and demand

- Risk of Concept Speculation: The stock price has risen significantly, need to guard against pullback caused by unmet expectations

- Short-term (1-3 months):Hold/Moderate Reduction— The stock price has risen significantly in the short term, facing technical adjustment pressure

- Medium-term (3-6 months):Hold— Focus on the production progress of the refined phosphoric acid project and performance realization

- Long-term (6-12 months):Accumulate on Dips— The release of new energy materials capacity is expected to drive sustained performance growth

[1] Sina Finance - “YUEGUI Co., Ltd.'s Private Placement Accepted to Be Listed on Shenzhen Stock Exchange” (https://finance.sina.com.cn/stock/relnews/cn/2026-01-09/doc-inhfssrr3004453.shtml)

[2] China Listed Companies Network - “Securities Issuance Sponsor’s Report of YUEGUI Co., Ltd.” (https://www.kakayi.com/tglj/1134.html)

[3] Interactive E - “Investor Q&A of YUEGUI Co., Ltd.” (https://www.lixinger.com/equity/company/detail/sz/000833/833/shareholders-interactions)

[4] Longzhong Information - “Sulfur Market Price” (https://chem.oilchem.net/chemical/sulfur.shtml)

[0] Jinling AI Financial Database - Company Overview, Financial Analysis, Technical Analysis, Market Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.