Analysis of Leverage Ratio Level of CITIC Securities (600030)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest financial data, I will provide a detailed analysis of the leverage ratio level of CITIC Securities for you.

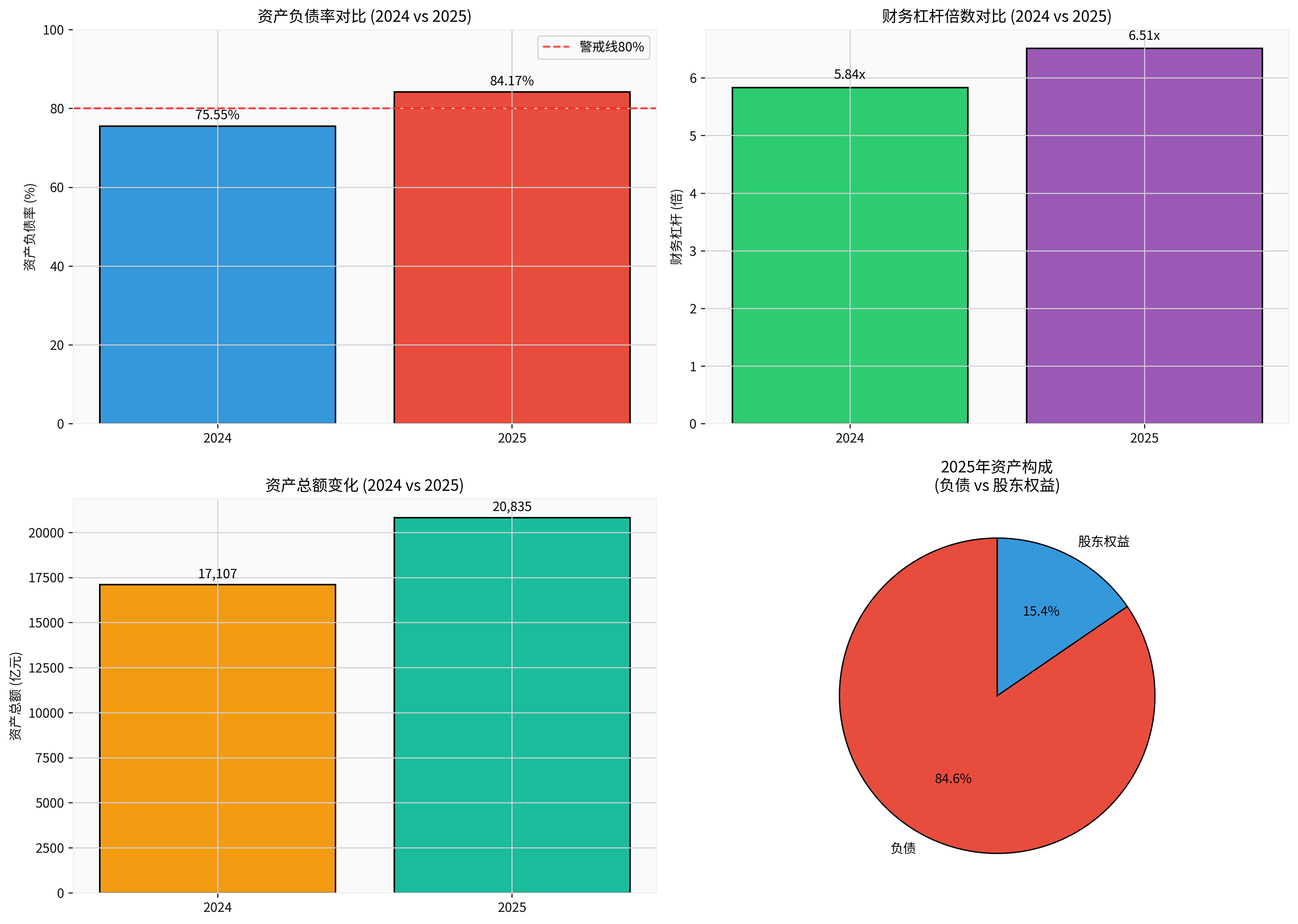

| Indicator | 2025 | 2024 | Change |

|---|---|---|---|

Asset-Liability Ratio |

84.17% | 75.55% | +8.62 percentage points |

Financial Leverage Multiple |

6.51x | 5.84x | +0.68x |

Total Assets |

20,835.34 hundred million yuan | 17,107.11 hundred million yuan | +21.79% |

Shareholders’ Equity |

3,199.05 hundred million yuan | 2,931.09 hundred million yuan | +9.14% |

Total Liabilities |

17,537.11 hundred million yuan | 12,924.42 hundred million yuan | +35.69% |

- In 2025, CITIC Securities’ asset-liability ratio reached 84.17%, a significant increase of 8.62 percentage points from 75.55% in 2024

- This level is close to the warning line for the securities industry (usually 80%)[1][2]

- This reflects the asset-heavy nature of the securities industry, where securities firms generally rely on debt operations

- The financial leverage multiple increased from 5.84x in 2024 to 6.51x in 2025

- The equity multiplier rose simultaneously, indicating that the leveraging effect of shareholders’ equity on assets has increased

- Against the backdrop of rapid asset scale expansion (21.79%), the growth rate of shareholders’ equity (9.14%) is relatively slow

- By the end of 2025, total assets reached 20,835.34 hundred million yuan, making it the first domestic securities firm to enter the “2 Trillion Club”

- The asset scale increased by 21.79% year-on-year, representing a significant growth rate

- The growth rate of liabilities (35.69%) is much higher than that of assets, indicating that the company actively increased leverage to expand its business scale

| Assessment Dimension | Conclusion |

|---|---|

Industry Comparison |

It is at a relatively high level in the securities industry, and within the normal range among leading securities firms |

Risk Assessment |

The leverage level has increased but the overall risk is controllable, complying with regulatory requirements |

Business Driver |

Asset expansion is mainly driven by increased demand for businesses such as brokerage and proprietary trading |

Capital Adequacy |

Shareholders’ equity attributable to the parent company is 3,199 hundred million yuan, providing support for risk buffering |

The chart above shows:

- Annual comparison of asset-liability ratio and the warning line

- Upward trend of financial leverage multiple

- Significant growth of asset scale

- In 2025, liabilities accounted for 84.2% and shareholders’ equity accounted for 15.8% of the asset composition

As an industry leader, CITIC Securities’ leverage ratio level reflects the following characteristics:

- High but Reasonable Leverage Ratio: The characteristics of the securities industry determine a relatively high asset-liability ratio level

- Strong Expansion Momentum: The asset scale exceeding RMB 2 trillion shows strong development momentum

- Controllable Risk: As a leading securities firm, it has strong capital adequacy and risk control capabilities

- Need to Monitor Subsequent Changes: With the tightening of regulatory policies, there is limited room for further increase in the leverage ratio

[1] Eastmoney - CITIC Securities (600030) Financial Data Page (http://quote.eastmoney.com/sh600030.html)

[2] Shanghai Securities News - 2025 Annual Performance Express Announcement of CITIC Securities Co., Ltd. (https://paper.cnstock.com/html/2026-01/15/content_2170244.htm)

[3] CLS - First Securities Firm Performance Express Released! CITIC Securities’ Net Profit Exceeds RMB 30 Billion (https://www.cls.cn/detail/2257731)

[4] Investing.com - CITIC Securities’ 2025 Net Profit Attributable to Parent Company is 30,051 million yuan (https://cn.investing.com/news/stock-market-news/article-3165306)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.