Analysis of the Impact of Escalating Geopolitical Risks on Trade-Sensitive Industries and Transatlantic Investment Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Recently, US President Trump’s threat to impose tariffs on Greenland has triggered a new round of transatlantic trade tensions. According to the latest news, Trump announced that countries including Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland will be subject to a 10% tariff starting from February 1, 2026, due to Greenland-related matters, and the tariff on Greenland will be increased to 25% starting from June 1 [1][2]. French Finance Minister Roland Lescure has issued a stern warning, stating that if the US attempts to seize Greenland, economic ties between the US and Europe may suffer a severe blow [3]. European Commission President Ursula von der Leyen has clearly stated that Greenland can rely on EU support in all aspects including politics, economy, funding, and security [3].

The escalation of this geopolitical tension marks the further expansion of the Trump administration’s strategy of ‘using tariffs as a geopolitical tool’. Dan Alamariu, Chief Geopolitical Strategist at Alpine Macro, pointed out that if the US imposes ‘large-scale’ economic pressure on Denmark in the form of tariffs or sanctions, it will likely provoke a strong counterattack from the EU, which could in turn trigger some form of trade war between the US and Europe [3].

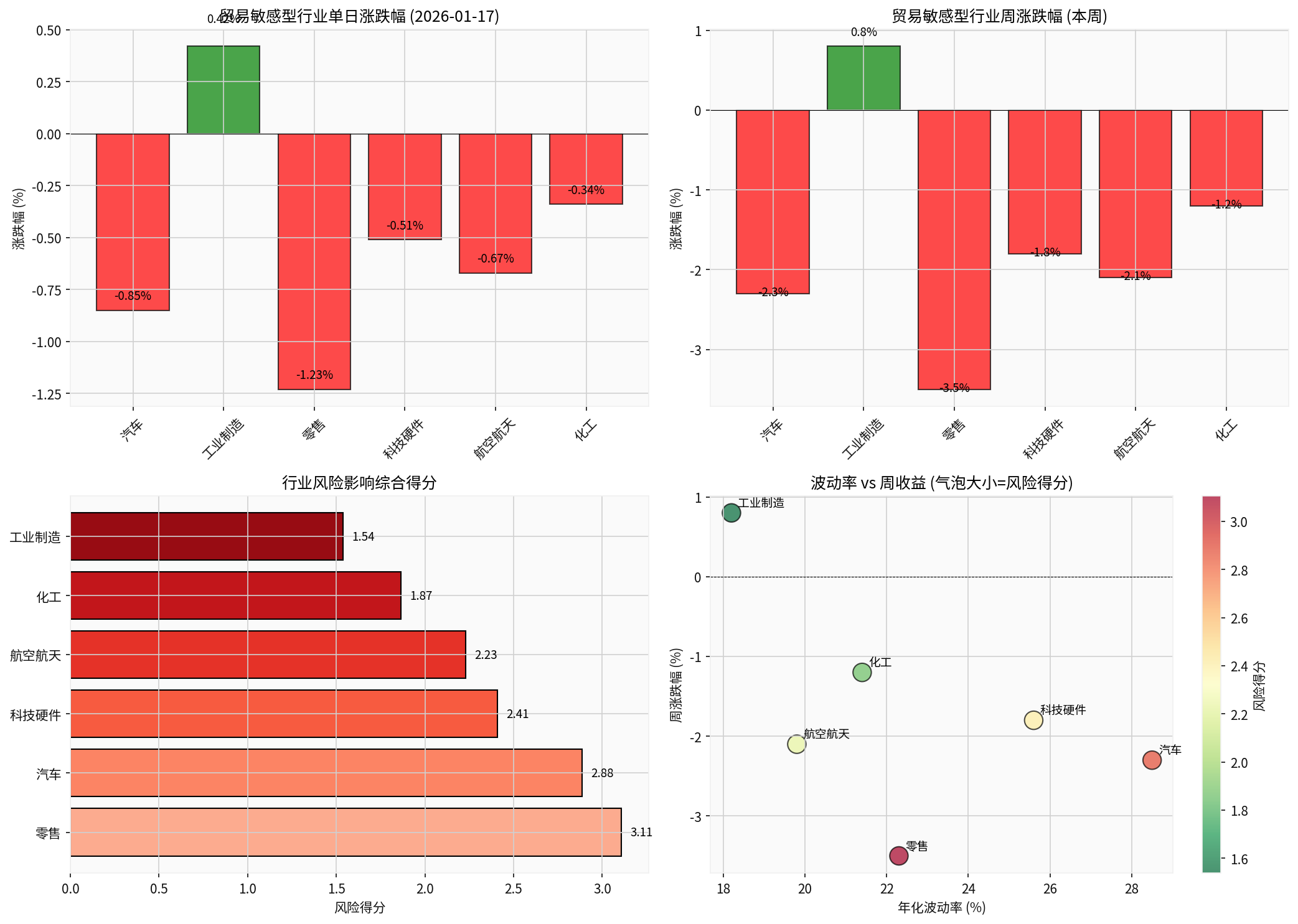

According to market data analysis, trade-sensitive industries have shown significant downward pressure amid this round of escalating geopolitical risks. The table below summarizes the market performance of the main affected industries:

| Industry | Single-Day Change | Weekly Change | Annualized Volatility | Risk Impact Score |

|---|---|---|---|---|

| Retail | -1.23% | -3.5% | 22.3% | 3.107 |

| Automotive | -0.85% | -2.3% | 28.5% | 2.885 |

| Tech Hardware | -0.51% | -1.8% | 25.6% | 2.409 |

| Aerospace | -0.67% | -2.1% | 19.8% | 2.229 |

| Chemicals | -0.34% | -1.2% | 21.4% | 1.866 |

| Industrial Manufacturing | +0.42% | +0.8% | 18.2% | 1.538 |

-

Increase Allocations to Defensive Assets: Given the rising geopolitical uncertainty, it is recommended that investors increase their allocation to defensive sectors such as utilities, consumer staples, and healthcare. Data shows that the utilities sector fell 2.93% this week, but this may also mean that valuation appeal is emerging [0].

-

Manage Currency Risk Exposure: The US Dollar Index currently stands at 99.150, and EUR/USD is at 1.15978 [0]. Investors should closely monitor exchange rate fluctuations and manage euro and dollar exposure through foreign exchange hedging tools when necessary.

-

Volatility Strategy: Consider allocating to safe-haven assets such as gold. Silver futures rose 12.70% this week, and gold also saw significant fluctuations [2]. Precious metals usually demonstrate good resilience during periods of rising geopolitical risk.

-

Invest in Supply Chain Diversification: Focus on enterprises that have already achieved regionalized supply chain layouts. For example, in the automotive industry, enterprises need to shift production bases from high-tariff regions to regions such as Mexico and Southeast Asia to avoid trade barriers.

-

Beneficiaries of ‘De-Risking’: Supply chain ‘de-risking’ will continue to deepen in 2026, creating opportunities for enterprises that can provide alternative supply chain solutions. Chinese enterprises are actively expanding into markets along the ‘Belt and Road’ to reduce their dependence on European and US markets [4][5].

-

Themed Investment in Technological Self-Reliance: Against the backdrop of ongoing Sino-US technological competition, self-reliance in sectors such as semiconductors, quantum computing, and high-performance computing will be a long-term investment theme. The introduction of the U.S. 2025 Comprehensive Outbound Investment National Security Act (COINS Act) means that cross-border investment reviews will become more stringent [5].

- Tariff threats gradually ease, and both sides reach a compromise through negotiations

- Valuations of trade-sensitive industries recover

- Risk assets rebound moderately

- US-EU mutual tariff imposition escalates comprehensively

- Transatlantic trade relations spiral downward

- The survival of NATO is questioned

- Trade-sensitive industries fall by 15-25%

- The US takes military action against Greenland

- The EU imposes comprehensive economic sanctions

- Global supply chains are severely disrupted

- Risk assets fall sharply

The current escalation of geopolitical risks has exerted significant pressure on trade-sensitive industries, especially the retail, automotive, and tech hardware industries. From an investment strategy perspective, it is recommended that investors:

- Short Term: Remain cautious and increase allocations to defensive assets and safe-haven assets

- Medium Term: Focus on investment opportunities brought by supply chain diversification

- Long Term: Focus on themed investment in technological self-reliance and in-depth regional market cultivation

Maria Martiute, Policy Analyst at the Centre for European Policy Studies, pointed out that many European countries have strengthened military deployments within the NATO framework, which is both a signal to the US and an indication that neither side wants the situation to completely spiral out of control [3]. Therefore, although short-term market volatility is inevitable, the probability of a full-scale trade war is relatively limited. Investors should closely monitor the Supreme Court’s ruling on the legality of IEEPA tariffs, which will determine the predictability of future tariff policies [1].

[1] Sina Finance - EU Prepares to Suspend US-EU Trade Agreement After Trump’s Latest Tariff Threat (https://finance.sina.com.cn/world/2026-01-18/doc-inhhsmvf9125523.shtml)

[2] Forex CN - Trump Proposes New Tariffs While Promoting Greenland Acquisition (http://forex.cnfol.com/glsc/20260117/31950402.shtml)

[3] Sina Finance - US Threat to Seize Greenland Sparks Fears of Trade War (https://finance.sina.com.cn/stock/usstock/c/2026-01-17/doc-inhhpryi2286390.shtml)

[4] Economic Herald - Risk Prevention and Control for Chinese Overseas Enterprises Enters a New Normal Stage (https://www.jingjidaokan.com/icms/null/null/ns:LHQ6LGY6LGM6MmM5ZTg1NTc5YjA3ZmZmMjAxOWI0ZTZmOTBmMzAwMWEscDosYTosbTo=/show.vsml)

[5] Huxiu - 2026 Geopolitical Changes: Strategic Responses and Risk Navigation by Corporate General Counsel (https://www.huxiu.com/article/4825086.html)

[0] Jinling AI Market Data API

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.