Analysis of the Impact of the Memory Chip Price Surge on the Industry Chain and Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me prepare a comprehensive investment analysis report for you.

The memory chip market is experiencing an unprecedented “super cycle”. Since 2025, DRAM and NAND flash prices have surged sharply, with some specifications seeing increases of up to several times. This price surge has continued from 2025 to 2026, and it is expected to maintain a supply-demand imbalance throughout the year. This report will analyze the impact of the price hike on profitability and investment value from two dimensions: memory chip manufacturers (Micron, SK Hynix, etc.) and downstream PC/server manufacturers.

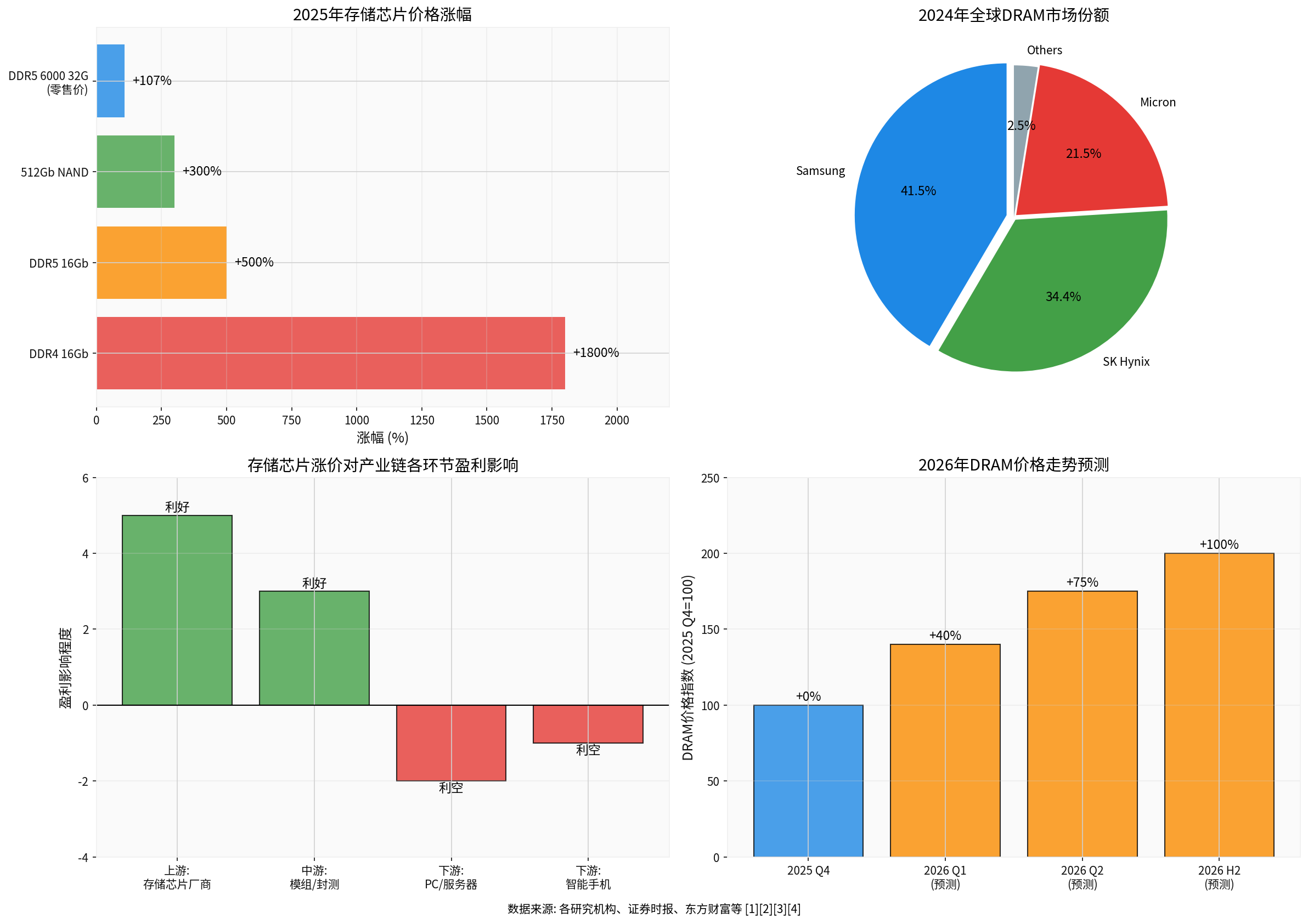

According to the latest market data, memory chip prices rose sharply in 2025:

| Product Type | 2025 Growth Rate | Notes |

|---|---|---|

| DDR4 16Gb | +1800% | Most staggering increase |

| DDR5 16Gb | +500% | Mainstream server memory |

| 512Gb NAND Flash | +300% | Core component of SSDs |

| DDR5 6000 32G (Retail) | +107% | Acer Predator rose from RMB 1,300 to RMB 2,700 |

- Q1 2026: Contract prices are expected to continue rising by 30%-40%

- DDR5 RDIMM Memory: Expected to rise by over 40%

- Server DRAM: Samsung and SK Hynix plan to raise prices by 60%-70% (compared to Q4 2025)

- Full-Year Outlook: Guotai Junan Securities expects DRAM demand growth (20%-25%) to outpace supply growth (15%-20%), and the supply-demand imbalance will persist throughout the year [1][2]

- Explosive AI computing demand: North America’s four major cloud vendors (Google, Meta, Microsoft, Amazon) are expected to invest USD 600 billion in AI infrastructure in 2026

- Data center expansion: Demand for AI servers and general-purpose servers is rising simultaneously; DRAM consumption in the server segment is expected to grow by 40%-50% year-over-year in 2026

- Smartphone upgrades: Storage capacity of terminals such as iPhone continues to increase [3]

- HBM capacity expansion leads to tight supply of general-purpose DRAM

- Samsung and SK Hynix shifted part of their DDR5 production capacity to HBM

- Packaging and testing capacity has become a new bottleneck in the industry chain

- Global memory chip capacity expansion takes time, and supply recovery will be slow in the short term [4]

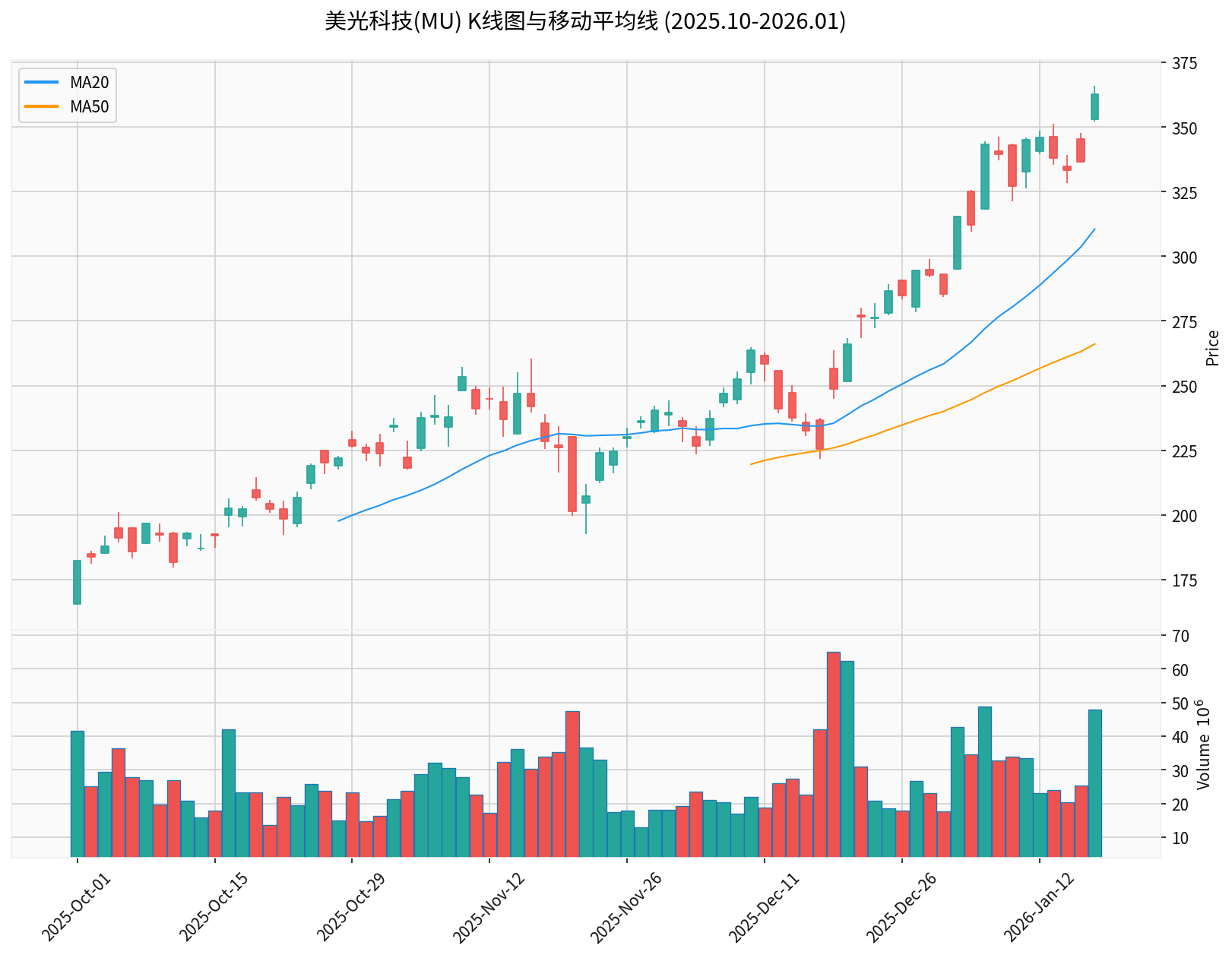

Micron Technology’s stock has performed exceptionally well during the memory chip super cycle:

| Indicator | Value |

|---|---|

Current Stock Price |

$362.75 |

52-Week Growth Rate |

+243.03% |

6-Month Growth Rate |

+220.28% |

1-Month Growth Rate |

+60.85% |

52-Week High |

$365.81 (recently broken through) |

52-Week Low |

$61.54 |

Market Capitalization |

$408.28B |

P/E (TTM) |

34.27x |

P/B |

6.94x |

ROE |

22.43% |

Net Profit Margin |

28.15% |

Technical analysis shows that MU is in a clear uptrend, with a buy signal issued on January 9, 2026. It is currently testing the resistance level of $365.81, with the next target level at $382.28 [0].

According to Micron Technology’s SEC filing dated November 27, 2025 (Q4 FY2025) [5]:

| Indicator | Q4 FY2025 | Q4 FY2024 | Year-over-Year Change |

|---|---|---|---|

Revenue |

$13.64B | $8.71B | +56.7% |

Net Profit |

$5.24B | $1.87B | +180% |

Diluted EPS |

$4.60 | $1.67 | +175% |

Gross Margin |

56.0% | 38.4% | +17.6pct |

Operating Margin |

45.0% | 25.0% | +20pct |

- DRAM: $10.81B (79% of revenue), +69% year-over-year

- NAND: $2.74B (20% of revenue), +22% year-over-year

- Other: $0.09B

- Operating Cash Flow: $8.41B (+159% year-over-year)

- Free Cash Flow: $3.02B

- Cash and Cash Equivalents: $97.3B

- Current Ratio: 2.46 (healthy)

- Long-term Debt: $11.19B (decreased from the previous quarter)

- Financial Stance: Conservative (high depreciation/capital expenditure ratio)

- Simultaneous Growth in Volume and Price: Revenue grew 56.7% year-over-year, with price contributing the main increment

- Significant Gross Margin Improvement: Increased from 38.4% to 56%, demonstrating strong pricing power

- Release of Operating Leverage: Scale effect led to a 20-percentage-point increase in operating margin

- Strong AI Demand: HBM and high-end DRAM products are in short supply

| Rating | Percentage |

|---|---|

Buy |

80.9% |

Hold |

16.2% |

Sell |

2.9% |

- Consensus Target Price: $330.00 (9% discount to current price)

- Target Range: $190.00 - $450.00

- Wells Fargo: Maintain Overweight (2026-01-15)

- Citigroup: Maintain Buy (2026-01-15)

- B of A Securities: Maintain Buy (2026-01-13)

- Keybanc: Maintain Overweight (2026-01-13) [0]

✓ 21.5% DRAM market share, the world’s third-largest DRAM manufacturer

✓ Directly benefits from the explosive demand for AI servers

✓ Healthy financial condition with abundant cash flow

✓ Strong stock performance with bullish technical outlook

✓ Over 80% of analysts give a Buy rating

✗ Current P/E of 34x is at a historical high

✗ KDJ indicator shows short-term overbought (K:81.7, D:82.3)

✗ Need to focus on the earnings report on March 19, 2026 (expected EPS $8.40)

✗ Intensified competition with Samsung and SK Hynix in the HBM segment

As the world’s second-largest DRAM manufacturer (34.44% market share), SK Hynix has also performed strongly during this super cycle:

- Q3 FY2025 confirmed that HBM supply shortage will persist until 2027

- All HBM products are sold out, and prices remain at profitable levels

- Although HBM accounts for only 20% of DRAM shipment volume, it contributes over 50% of operating profit

- Expected to achieve the 2026 operating profit target of KRW 50 trillion [2]

- Leading mass production of 12-layer HBM3E products

- Secured large orders from AI chip manufacturers such as NVIDIA

- Samsung’s 12-layer HBM3E products are priced about 30% lower (current quote approx. $200 vs. SK Hynix’s $300)

- The key component “substrate” for HBM4 is outsourced to TSMC, with costs 6 times higher than in-house production

- Faces competitive pressure from Samsung’s “volume offensive” strategy [2]

- Quarterly revenue: KRW 93 trillion (approx. USD 445 billion), a record high

- Memory chip revenue: KRW 37.4 trillion (approx. USD 178 billion), a record high

- Quarterly operating profit: Exceeded KRW 20 trillion (approx. USD 96.2 billion)

- Adopted a “volume offensive” strategy, expanding supply despite short-term losses

- Reduced the price of 12-layer HBM3E products by 30%, creating price pressure on SK Hynix

- Stock price surged nearly 7.5% on January 5, 2026, hitting a new all-time high [1]

| Indicator | SK Hynix | Samsung Electronics |

|---|---|---|

| DRAM Market Share | 34.44% | 41.54% |

| HBM Competitiveness | Technology leader | Cost advantage |

| 2026 Operating Profit Target | KRW 50 trillion | Confidential |

| Stock Performance | Strong uptrend | Hit all-time high |

| Risks | Price competition | Profit margin pressure |

According to industry estimates:

- Storage cost ratio for mobile phones/PCs: 15%-20% of BOM

- If storage prices rise by 30%-40%: Impact on overall BOM is approx. 5%-8%

- Impact varies among different manufacturers[4]

| Manufacturer | Price Adjustment Range | Specific Measures |

|---|---|---|

Lenovo |

10%-30% | Executives visited Samsung, SK Hynix, and Micron repeatedly to secure supply; inventory stockpile is 50% higher than usual |

Dell |

10%-30%, 20% for commercial models | Executives stated “Never seen memory chip costs rise so fast” |

HP |

Preparing for price adjustment | CEO stated that price hikes will be implemented if necessary |

Acer, ASUS |

Warned of 15%-20% price hike | Industry expects widespread retail price increases for terminals |

- Leading manufacturers(Lenovo, HP): Cost pressure is relatively controllable due to scale advantages and long-term procurement agreements

- Small and medium-sized manufacturers: Facing the dilemma of “unable to secure supplies even with money”, with orders delayed or forced to accept higher prices

- IDC expects global PC shipments to decline by 4.9% in 2026; if storage supply further deteriorates, the decline may expand [4]

- AI server manufacturers can pass on cost pressure through product price hikes

- Cloud vendors (AWS, Azure, Google Cloud) can pass on costs through service pricing

- Computing demand is rigid, with strong cost transmission capability

| Manufacturer | Impact Level | Response Measures |

|---|---|---|

Apple |

Relatively controllable | Signed long-term agreements with Samsung to lock in capacity, keeping cost increase within 10%; diversifies risks through service revenue |

Huawei |

Relatively controllable | Develops self-designed storage controllers, lays out domestic substitution, and has strong supply chain resilience |

Xiaomi and others |

Under significant pressure | Starting price of Xiaomi 17 Ultra is RMB 500 higher than the previous generation |

- Higher product selling prices → improved gross margin

- Supply-demand imbalance → enhanced pricing power

- Rigid AI demand → simultaneous growth in volume and price

- Micron’s Q4 FY2025 net profit increased by 180% year-over-year

- Samsung’s memory business revenue hit a record high

- SK Hynix’s HBM contributes over 50% of operating profit

- Advanced packaging (related to HBM, 3D NAND)

- High-value-added module products

- Packaging and testing services closely tied to AI storage

- The benefits of higher packaging and testing quotes are expected to be reflected in financial reports starting from Q1 2026

- Price transmission for standardized traditional packaging and testing services is limited

- Presents a “structural price hike” rather than a “comprehensive universal hike” [4]

- Rising memory chip costs → increased overall BOM costs

- Price hikes may lead to sales decline

- Profit margins of small and medium-sized manufacturers are compressed

- Economies of scale and supply chain management capabilities

- Coverage of long-term procurement agreements

- Brand premium and product differentiation

- Cost pass-through capability

| Company | Ticker | Investment Rating | Rationale |

|---|---|---|---|

Micron Technology |

MU | Buy (Watch for Pullback) |

Directly benefits from memory price hikes, strong AI demand, and healthy financials; however, note the short-term high valuation |

SK Hynix |

000660.KS | Buy on Dips |

Technology leader in HBM, significantly benefits from the AI wave; monitor price competition with Samsung |

Samsung Electronics |

005930.KS | Hold |

Comprehensive electronics giant with strong memory business; but faces pressure from HBM price war |

- Small and medium-sized PC/smartphone manufacturers (profit margins under pressure)

- White-label equipment suppliers (weak bargaining power)

- Lenovo Group (scale advantages, strong supply chain management capabilities)

- Apple (brand premium, service revenue diversifies risks)

- AI server manufacturers (strong cost pass-through capability)

- Yangtze Memory Technologies (YMTC), CXMT: Opportunities to increase market share

- Foresee, BIWIN: Product upgrades for module manufacturers

- Packaging and testing enterprises: Growing demand for advanced packaging

- Industry Cyclical Risk: The memory chip industry is highly cyclical; need to monitor the risk of cycle reversal

- Price War Risk: Samsung’s “volume offensive” may trigger price competition

- Valuation Risk: Micron’s current P/E of 34x has fully reflected price hike expectations

- Capacity Release Risk: New capacity release in 2026-2027 may change the supply-demand pattern

- Technology Iteration Risk: Yield ramp-up of new technologies such as HBM may fall short of expectations

- Downstream Demand Risk: If AI investment growth slows down, it will affect demand intensity

-

Memory Chip Super Cycle Continues: Supply-demand imbalance is expected to persist throughout 2026, with prices continuing to rise by 30%-40%; the boom will last at least until H1 2026

-

Upstream Manufacturers Benefit Significantly: Memory chip manufacturers such as Micron, SK Hynix, and Samsung are entering a historic profit improvement cycle; the DRAM market size will grow 5 times compared to 2023

-

Downstream Manufacturers Show Clear Divergence: Leading PC/server manufacturers can partially absorb cost pressure through scale advantages and long-term agreements; small and medium-sized manufacturers are under significant pressure and may face industry consolidation

-

Investment Value Assessment:

- Micron (MU): Short-term valuation is high; it is recommended to wait for a pullback before positioning, and it still has allocation value in the medium term

- SK Hynix: Technology leader in HBM, fully benefits from the AI wave; recommended to buy on dips

- Samsung Electronics: Comprehensive giant with strong memory business, but need to monitor profit margin pressure

- Downstream Manufacturers: Be cautious with small and medium-sized brands; focus on leading enterprises with scale advantages and cost pass-through capability

-

Industry Trend: This price hike is driven by AI demand, different from historical cycles; industry structure upgrading resonates with cyclical factors, and the boom may last longer than expected

- Memory chip manufacturers: Reduce positions moderately to lock in profits, wait for a pullback

- Focus on Micron’s earnings report to be released on March 19, 2026

- Accumulate positions in Micron and SK Hynix on dips

- Focus on opportunities in the domestic memory industry chain

- Monitor capacity release rhythm and changes in supply-demand pattern

- Track progress of AI infrastructure investment

[1] Securities Times - “Price Hikes of Up to 70%! Major Breaking News from Two Chip Giants!” (https://www.stcn.com/article/detail/3572106.html)

[2] ICdeal - “Samsung and SK Hynix Sharply Raised Q4 DRAM and NAND Prices by 30%” (https://www.icdeal.com/news/3/2335.html)

[3] AJ Securities - “Memory Chip Price Hikes Will Continue Until 2026” Industry In-Depth Report (https://pdf.dfcfw.com/pdf/H3_AP202512221805753876_1.pdf)

[4] Eastmoney/China Business Journal - “Memory Chip Price Surge Will Persist Throughout 2026” (https://finance.eastmoney.com/a/202601173622284748.html)

[5] Micron Technology SEC 10-Q Filing (2025-12-18) - https://www.sec.gov/Archives/edgar/data/723125/000072312525000046/mu-20251127.htm

[6] Yicai Global - “Responding to Memory Chip Price Hikes, a PC Executive Visited Samsung, SK Hynix Repeatedly to Secure Supply” (https://m.yicai.com/news/102968844.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.