Tongwei Co., Ltd. In-Depth Analysis Report: Survival and Breakthrough in the Industry Winter

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data analysis, I will provide you with an

China’s photovoltaic industry is experiencing the most severe overcapacity cycle in its history. According to a S&P Global Ratings research report, the total capacity of the polysilicon industry exceeded 3 million tonnes in 2024, while actual output was only about 1.8 million tonnes, with a capacity utilization rate of less than 60%[4]. Severe oversupply has emerged in all links of the industrial chain:

| Segment | Capacity Utilization Rate (2024) | Price Performance |

|---|---|---|

| Polysilicon | ~60% | Fell from RMB 59,000/tonne at the start of the year to RMB 39,000/tonne, a drop of over 35% |

| Silicon Wafer | ~55% | Under sustained pressure, below cash cost |

| Solar Cell | ~65% (relatively better) | Fierce price war |

| Module | ~50% | Low-price competition has become the norm |

Polysilicon prices have experienced a volatile rollercoaster trend:

- 2022 Peak Period: Prices exceeded RMB 300,000/tonne, with the industry enjoying excessive profits

- Second Half of 2023: Capacity was released in a concentrated manner, and prices began to decline

- June 2024: Prices fell to RMB 39,000/tonne, breaking the industry-wide cash cost

- Second Half of 2024: Industry self-discipline production cuts pushed prices back up to RMB 50,000-60,000/tonne

- December 2025: Prices were approximately RMB 53,200/tonne, an increase of over 50% from the mid-year low[2]

However, the antitrust interview conducted by the State Administration for Market Regulation in early January 2026 broke this fragile price balance. The interview explicitly prohibited enterprises from agreeing on production capacity, production and sales volume, and sales prices, directly negating the previous core operating model of “production control to support prices”[5]. This means that the profit model of relying on coordinated production cuts to maintain high prices is no longer sustainable.

Tongwei Co., Ltd. expects a full-year net loss of

| Influencing Factor | Specific Performance |

|---|---|

| Product price decline | Polysilicon prices broke through the cost line |

| Decline in operating rate | Insufficient capacity utilization, making it difficult to amortize fixed costs |

| Inventory impairment | Inventory scale reached RMB 15.373 billion, a year-on-year increase of 25.2% |

| Inventory write-down losses | Large provisions in 2024 severely eroded profits |

- 2022: Performance peak, net profit of RMB 25.7 billion (benefiting from high polysilicon prices)

- 2023: Performance declined sharply, and losses began

- 2024: Sustained losses, stock price hit a new low in recent years

- 2025: Expected loss of RMB 9-10 billion

| Indicator | Value | Industry Evaluation |

|---|---|---|

| P/E | -10.57x | Loss-making status |

| ROE | -18.28% | Under severe pressure |

| Net Profit Margin | -9.44% | Negative profit |

| Current Ratio | 1.24 | Average short-term solvency |

| Asset-Liability Ratio | ~57% | Moderately high |

- Free Cash Flow: -RMB 27.24 billion (2024)

- Operating Cash Flow: The polysilicon business turned positive in the third quarter

- Inventory Turnover Efficiency: Continued to deteriorate, inventory impairment risk increased[5]

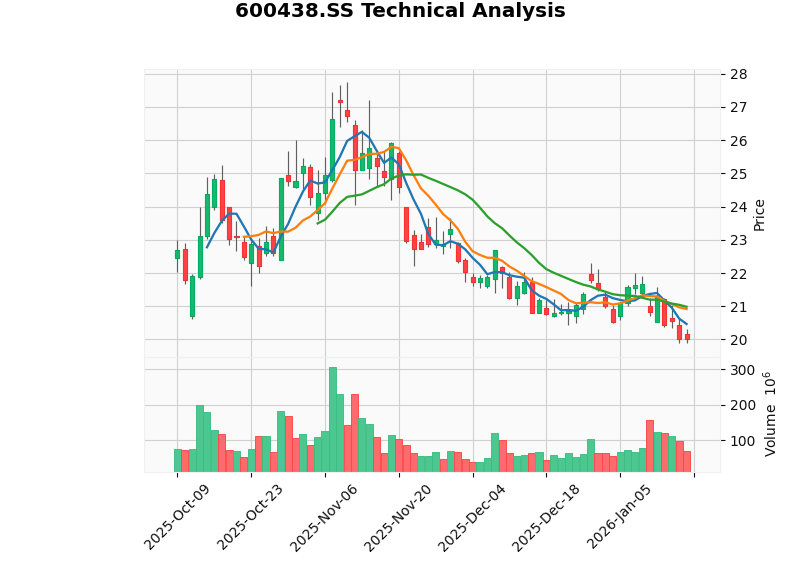

- Current Price: RMB 20.02 (January 16, 2026)

- 52-Week Performance: New low in the past six months

- 3-Year Decline: 51.05%

- Technical Aspects: In a sideways oscillation pattern, the KDJ indicator shows oversold conditions[0]

Tongwei Co., Ltd. has a significant scale advantage in the polysilicon sector:

| Indicator | Tongwei Co., Ltd. | Industry Status |

|---|---|---|

| Polysilicon Capacity | 900,000 tonnes (end of 2024) |

Global No.1 |

| Planned Total Capacity | Over 1.3 million tonnes | Continuous expansion |

| Solar Cell Capacity | 95GW | Global No.1 (for 7 consecutive years) |

| Module Capacity | 80GW | Top 5 globally |

| Global Market Share | ~30% | No.1 in the polysilicon sector |

| Cost Component | Proportion | Tongwei’s Advantage |

|---|---|---|

| Raw Materials | ~45% | Strong bargaining power from large-scale procurement |

| Energy | ~25% | Hydropower advantage in the southwest region |

| Labor | ~12% | High degree of automation |

| Manufacturing Expenses (including depreciation) | ~18% | Amortized through scale effects |

- Tongwei Co., Ltd.'s costs are in the industry’s first echelon

- Obvious advantage compared to some small and medium-sized enterprises (costs of approximately RMB 60,000-80,000/tonne)

- When the industry is generally loss-making, Tongwei is expected to be the last loss-making survivor

Tongwei Co., Ltd. continues to invest in technological upgrading[4]:

| Technological Direction | Progress | Expected Effect |

|---|---|---|

| TNC Cells | Capacity exceeds 100GW | Cost reduction by another 20% |

| HJT Cells | First cell rolled off the production line | Efficiency improvement |

| TOPCon | Pilot line in operation | Coverage of mainstream technologies |

| XBC/Perovskite | R&D layout | Future technological reserve |

| 0BB/Copper Interconnection | Key R&D focus | Cost reduction and efficiency improvement |

Tongwei has developed from a single polysilicon business to an integrated layout of “Polysilicon + Cells + Modules”:

Polysilicon (900,000 tonnes) → Solar Cells (95GW) → Modules (80GW)

↓ ↓

High self-supply ratio Overseas market expansion

- Self-supplied polysilicon for cells reduces procurement costs

- The module business is growing rapidly, with shipment volume entering the top 5 globally

- Overseas Markets: Added key markets such as South Africa and the UAE, and secured large overseas orders[4]

On January 6, 2026, the State Administration for Market Regulation interviewed six polysilicon enterprises including Tongwei Co., Ltd., explicitly prohibiting the “production control to support prices” behavior[5]:

- The main polysilicon futures contract fell sharply after the interview

- Tongwei Co., Ltd.'s stock price was under short-term pressure

- The industry’s coordinated production cut and price support model has ended

- If production cuts are terminated, prices may return to a downward trend

- The risk of enterprises competing to cut prices for shipments increases

- The price decline trend in the first half of last year may recur

| Risk Point | Specific Performance |

|---|---|

| Debt Scale | Continued to rise in recent years |

| Short-Term Debt Repayment | Current ratio of 1.24, quick ratio of 0.99 |

| Inventory Pressure | RMB 15.373 billion in inventory, high price decline risk |

| Financing Environment | Industry valuation is under pressure, financing difficulty increases |

- Export Tax Rebate Rate Cut: Starting from December 1, 2024, the export tax rebate rate for silicon wafers, cells, and modules was reduced from 13% to 9%

- VAT Rebate Cancellation: The export tax rebate for photovoltaic and other products will be fully canceled starting from April 1, 2026[5]

- Overseas Market Uncertainties: Whether demand in incremental markets such as the Middle East and Australia can be sustained

| Strategy | Specific Measures | Expected Effect |

|---|---|---|

| Capacity Optimization | Proactive production cuts and control | Reduce inventory backlog |

| Cost Control | Continuous cost reduction and efficiency improvement | Improve profitability |

| Inventory Management | Optimize inventory structure | Reduce impairment risk |

| Cash Management | Strengthen collection | Ensure liquidity |

-

Technological Upgrading-Driven:

- Promote mass production of high-efficiency cells such as TNC and HJT

- Lay out next-generation technologies such as perovskite

- Maintain cost leadership through technological innovation

-

Global Layout:

- Expand overseas manufacturing bases

- Diversify market risks

- Seize emerging market opportunities

-

Deepened Integration:

- Improve industrial chain collaboration

- Increase the proportion of the module business

- Enhance terminal bargaining power

-

Industry Integration Opportunities:

- Focus on opportunities for small and medium-sized capacity clearing

- Conduct mergers and acquisitions at the right time

- Consolidate leading position

According to forecasts from institutions such as S&P Global Ratings[4]:

| Time Node | Expected Changes |

|---|---|

| 2025 | The industry’s capacity clearing enters the later stage, and effective capacity utilization is expected to improve |

| 2026 | Supply and demand pattern is reshaped, prices and profits recover with fluctuations |

| 2027 | Backward capacity is basically cleared, and the industry returns to healthy competition |

| Indicator | Value | Evaluation |

|---|---|---|

| P/E | -10.57x | Loss-making status, no practical significance |

| P/B | 2.02x | In the historical low range |

| P/S | 1.00x | Market capitalization supported by revenue scale |

- ✓ Global No.1 in capacity scale, strong risk resistance during industry troughs

- ✓ Leading cost control, expected to be the last loss-making enterprise in the industry

- ✓ Cash flow turned positive in Q3 2024, showing signs of operational improvement

- ✓ Integrated layout smooths fluctuations in single segments

- ✓ Sufficient technological reserves, long-term competitiveness guaranteed

- ✗ Inventory scale remains high, price decline risk persists

- ✗ Antitrust interview broke the “production control to support prices” profit model

- ✗ The timing of the industry cycle reversal is unclear

- ✗ Debt pressure tests financing capabilities

As the

- Scale Advantage: 900,000 tonnes of polysilicon capacity, global No.1, obvious unit cost advantage

- Cost Leadership: Production cost of approximately RMB 40,000 per tonne, in the industry’s first echelon

- Market Share: ~30% market share in polysilicon, global No.1 in solar cells for 7 consecutive years

- Technological Reserves: Perfect layout of new-generation technologies such as TNC and HJT

- Integrated Collaboration: Full industrial chain layout of polysilicon - cells - modules

The photovoltaic industry is in the stage of switching valuation systems from growth to cyclical. As an industry leader, Tongwei Co., Ltd. is undergoing severe tests. The company’s expected net loss of RMB 9-10 billion in 2025 reflects the structural dilemma faced by the entire industry[0][2].

- Cost control capability is at the leading level in the industry

- Scale advantage brings a significant moat

- Integrated strategy enhances risk resistance

- Progress of Industry Capacity Clearing: The supply and demand pattern is expected to gradually improve in 2026

- Sustainability of Cost Advantage: Whether technological innovation can maintain leadership

- Cash Flow Management Capability: Maintaining liquidity during the loss-making period

- Changes in Policy Environment: Compliant operation after the antitrust interview

For investors, the current period is at the bottom of the industry cycle, with

[0] Jinling API Data - Tongwei Co., Ltd. Company Profile, Financial Analysis, Stock Price Data

[1] NetEase News - “Photovoltaic Industry’s Pre-Loss Alarm Sounds Loudly, These Leaders Are Set to Post Losses for Two Consecutive Years”

[2] China Energy Network - Analysis of 2025 Performance Pre-Loss of Photovoltaic Leading Enterprises

[3] Debon Research Institute - In-Depth Research Report on Tongwei Co., Ltd.

[4] S&P Global Ratings - “In-Depth Adjustment Under Photovoltaic ‘Anti-Involution’, Who Can Survive the Winter?”

[5] The Paper - “Antitrust Interview Halts Polysilicon ‘Production Control to Support Prices’, Tongwei Co., Ltd. Which Has Posted Losses for Eight Consecutive Quarters Faces Even Greater Difficulties”

[6] Huaan Securities - In-Depth Research Report on Tongwei Co., Ltd.

[7] China Development Bank Securities - In-Depth Report on Tongwei Co., Ltd.'s “Cost Is King, Proactive Layout of Photovoltaic Integration”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.