Fulaite Glass (601865) Soda Ash Price Sensitivity Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me present the complete Fulaite Glass Soda Ash Price Fluctuation Sensitivity Analysis Report for you.

Fulaite Glass Group Co., Ltd. is one of the duopoly leading enterprises in China’s photovoltaic glass industry, and is ranked among the top two suppliers in the industry alongside Xinyi Solar [1]. The company is mainly engaged in the production and sales of photovoltaic glass, float glass, household glass and engineering glass. As of the first half of 2023, the company’s nominal photovoltaic glass production capacity reached 20,600 tons/day [1].

Based on industry research data, the production cost structure of photovoltaic glass is as follows [1][2]:

| Cost Item | Proportion |

|---|---|

| Direct Materials | 40% |

| Including: Soda Ash | 19% |

| Including: Quartz Sand | 10% |

| Including: Other Materials | 11% |

| Fuel and Power | 40% |

| Manufacturing Overhead | 15% |

| Direct Labor | 5% |

Soda ash is one of the most important raw materials in photovoltaic glass production, accounting for as high as 47% of raw material costs [2]. This means that fluctuations in soda ash prices will directly affect the company’s profitability and cost competitiveness.

According to Fulaite’s 2024 Annual Report [3]:

- Operating Revenue: RMB 18.783 billion

- Operating Cost: RMB 15.788 billion (down 6.2% year-on-year, mainly benefiting from the decline in soda ash prices)

- Gross Profit Margin: 15.50% (down 6.30 percentage points year-on-year)

- Gross Profit: RMB 2.890 billion (down 38.31% year-on-year)

The main reason for the decline in gross profit margin is the sharp drop in the average selling price of photovoltaic glass due to industry supply-demand imbalance, although the decline in raw material costs (mainly soda ash) partially offset the impact of the price drop.

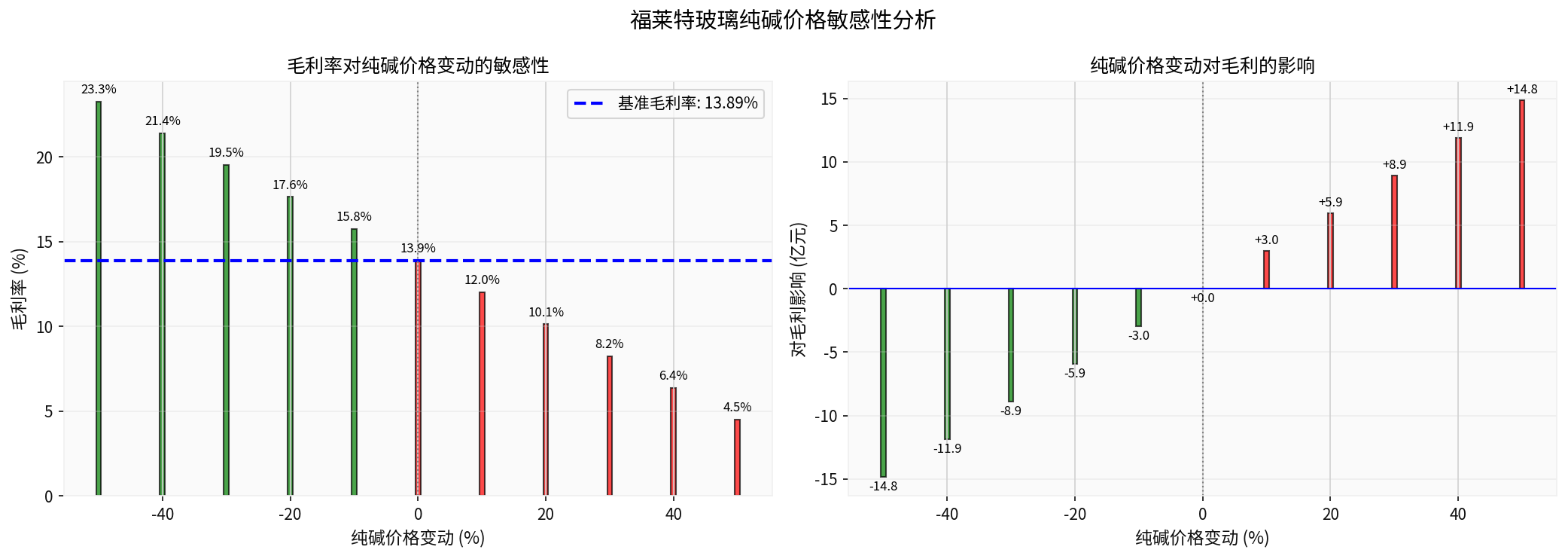

Sensitivity analysis based on Fulaite’s 2024 financial data shows:

| Soda Ash Price Change | Impact on Gross Profit (RMB 100 million) | Gross Profit Margin | Change in Gross Profit Margin (Percentage Points) |

|---|---|---|---|

| -50% | +14.84 | 23.29% | +7.90 |

| -40% | +11.87 | 21.41% | +6.32 |

| -30% | +8.90 | 19.53% | +4.74 |

| -20% | +5.94 | 17.65% | +3.16 |

| -10% | +2.97 | 15.77% | +1.58 |

Baseline (0%) |

0 |

13.89% |

0 |

| +10% | -2.97 | 12.01% | -1.58 |

| +20% | -5.94 | 10.13% | -3.16 |

| +30% | -8.90 | 8.25% | -4.74 |

| +40% | -11.87 | 6.37% | -6.32 |

| +50% | -14.84 | 4.49% | -7.90 |

-

Price Transmission Coefficient:

- For every 10% change in soda ash price → Gross profit margin changes in the opposite direction by approximately 1.58 percentage points

-

Profit Sensitivity:

- For every 10% drop in soda ash price → Gross profit increases by approximately RMB 297 million

- For every 10% increase in soda ash price → Gross profit decreases by approximately RMB 297 million

-

Break-Even Analysis:

- Current soda ash price is approximately RMB 1,300/ton

- Soda ash price needs to rise by approximately 107% (to about RMB 2,700/ton) to bring gross profit to zero

- This indicates that the company has a large buffer against soda ash price declines

| Period | Soda Ash Price (RMB/ton) |

|---|---|

| 2021 | Approximately 1,800 |

| 2022 | Approximately 2,600 |

| March 2023 (Peak) | Approximately 2,975 |

| End of 2023 | Approximately 2,400 |

| 2024 | Approximately 1,800 (nearly 30% drop for the full year) |

| July 2025 | Approximately 1,300 |

- Soda ash price is expected to fluctuate at a low level in the range of RMB 1,200-1,700/ton

- Overcapacity remains the main theme, and new production capacity will still be put into operation in 2025

- The oversupply situation in the soda ash market is difficult to be fundamentally changed in the short term

- The decline in soda ash prices has significantly reduced the company’s direct material costs

- The company has actively deployed upstream quartz sand mines (reserves exceeding 140 million tons), effectively hedging against raw material price risks [2]

- The release of cost-side pressure is expected to drive profit recovery in the industry

- Photovoltaic glass prices are under pressure due to industry overcapacity

- A rebound in soda ash prices will compress profit margins

- Fluctuations in downstream photovoltaic module demand may affect the company’s sales volume

Soda ash price sensitivity analysis indicates that:

- The current low soda ash price environment constitutes a cost benefit for Fulaite, and the company has significant room for gross profit margin improvement

- Sensitivity coefficient is approximately 1.58: that is, for every 10% drop in soda ash price, gross profit margin increases by approximately 1.58 percentage points

- Obvious cost advantage: Through the layout of upstream quartz sand mines and the current low soda ash price environment, the company has strong competitiveness on the cost side

- Risk Warning: Attention should be paid to the progress of capacity clearance in the photovoltaic glass industry and the risk of periodic rebound in soda ash prices

The figure above shows the sensitivity of gross profit margin to changes in soda ash prices, as well as the direct impact of soda ash price changes on the company’s gross profit.

[1] Huafu Securities - In-Depth Research Report on Fulaite (601865.SH) (https://pdf.dfcfw.com/pdf/H3_AP202310171601756986_1.pdf)

[2] LeadLeo - Comparative Analysis of Chinese Photovoltaic Glass Enterprises (https://pdf.dfcfw.com/pdf/H3_AP202307061592075782_1.pdf)

[3] Fulaite Glass Group Co., Ltd. 2024 Annual Report (https://www.hkexnews.hk/listedco/listconews/sehk/2025/0327/2025032701214_c.pdf)

[4] Guosen Futures - Glass and Soda Ash Research Report (https://www.guosenqh.com.cn/attach/20250630/20250630081331554_678145.pdf)

[5] Securities Times - Soda Ash Market Analysis (https://stcn.com/article/detail/1510460.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.