In-depth Analysis Report on the Doubling of Contract Liabilities of Zhongwu Hi-tech (000657.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data and analysis, I now provide you with a comprehensive and professional analysis report on the doubling of contract liabilities of Zhongwu Hi-tech.

Zhongwu Hi-tech Materials Co., Ltd. is the operation and management platform for the tungsten business under China Minmetals, with a

From the perspective of industry development, tungsten, as a rare metal and strategic resource, its market demand is closely related to the development of the manufacturing industry. In recent years, with the recovery of high-end manufacturing and the rapid development of the new energy industry, the demand for products such as hard alloy cutting tools and cutting tools has continued to grow, creating a favorable market environment for the business development of Zhongwu Hi-tech[3].

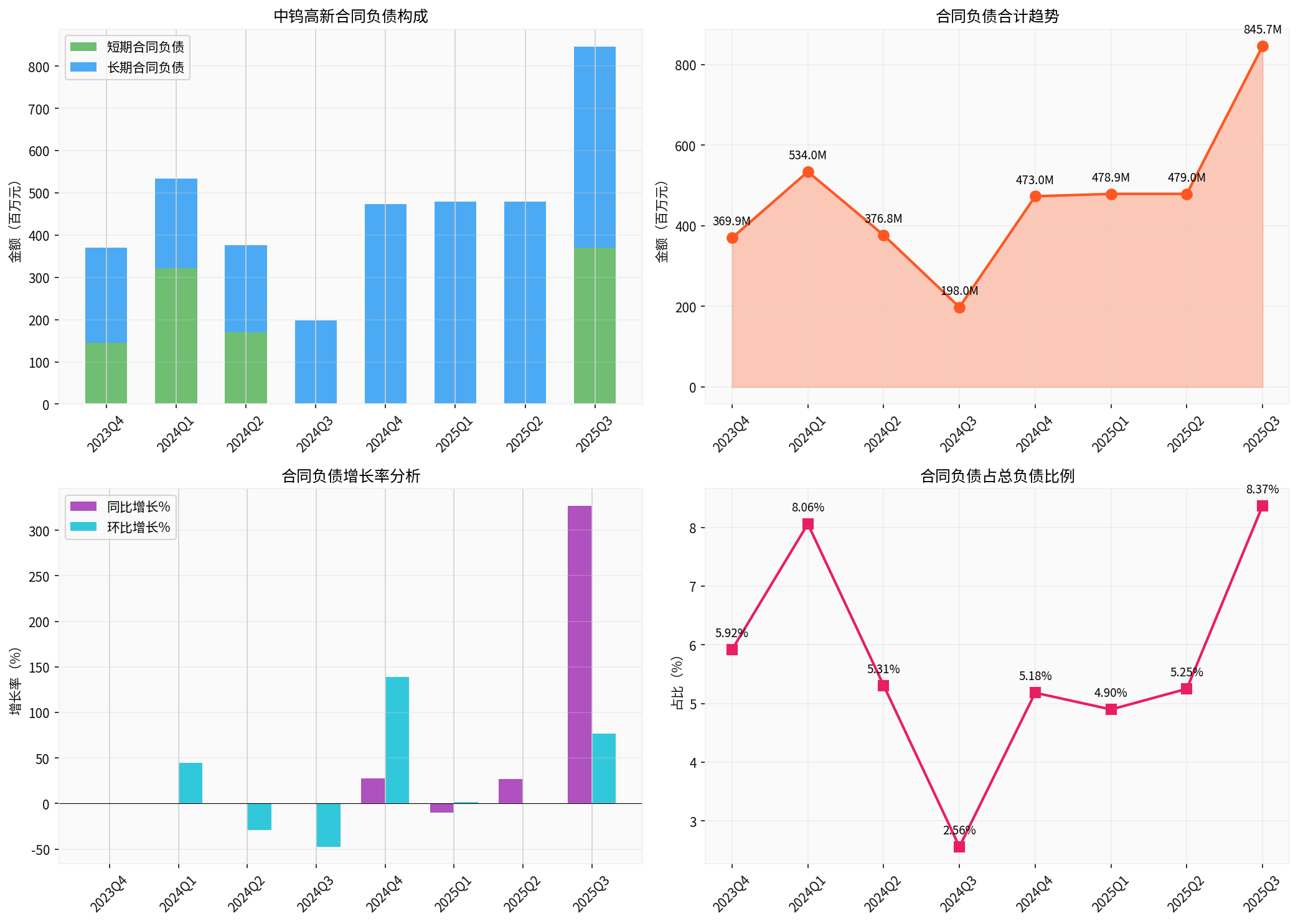

Based on the financial report data of Zhongwu Hi-tech for the past eight quarters, contract liabilities have shown a significant growth trend. The specific data changes are shown in the following table:

| Time Period | Short-term Contract Liabilities | Long-term Contract Liabilities | Total Contract Liabilities | Quarter-on-Quarter Growth | Year-on-Year Growth |

|---|---|---|---|---|---|

| Q4 2023 | RMB 146 million | RMB 224 million | RMB 370 million |

— | — |

| Q1 2024 | RMB 322 million | RMB 212 million | RMB 534 million | 44.38% | — |

| Q2 2024 | RMB 170 million | RMB 207 million | RMB 377 million | -29.45% | — |

| Q3 2024 | RMB 0 | RMB 198 million | RMB 198 million | -47.44% | — |

| Q4 2024 | RMB 0 | RMB 473 million | RMB 473 million |

138.85% | 27.88% |

| Q1 2025 | RMB 0 | RMB 479 million | RMB 479 million | 1.25% | -10.32% |

| Q2 2025 | RMB 0 | RMB 479 million | RMB 479 million | 0.001% | 27.12% |

| Q3 2025 | RMB 371 million | RMB 475 million | RMB 846 million |

76.57% | 327.03% |

- Q4 2023 to Q3 2025: Total contract liabilities grew from RMB 370 million to RMB 846 million, representing acumulative growth of 128.6%

- Outstanding Performance in Q3 2025: Quarterly contract liabilities reached RMB 846 million, hitting a historical high, with a quarter-on-quarter growth of 76.57% and a year-on-year growth of as high as 327.03%

- Structural Change: Short-term contract liabilities surged from 0 to RMB 371 million in Q3 2025, indicating a large number of new short-term advance payments received recently

Contract Liability is an account recognized in accordance with Accounting Standards for Business Enterprises No. 14 - Revenue, referring to the obligation of an enterprise to transfer goods to customers in exchange for consideration received or receivable from customers. Contract liabilities are recognized when an enterprise pre-sells goods or services and receives payment from customers before transfer[4]. Changes in this account directly reflect the level of business transaction activity between the enterprise and its customers, as well as future revenue expectations.

The most direct implication of the doubling of contract liabilities is that the advance payments received by Zhongwu Hi-tech from customers have increased significantly. According to the company’s 2025 semi-annual report, in the first half of 2025, the company achieved operating revenue of RMB 7.849 billion, a year-on-year increase of 3.09%; net profit attributable to parent shareholders was RMB 510 million, a year-on-year increase of 8.70%[5]. Against the backdrop of steady growth in revenue and profit, the explosive growth of contract liabilities indicates that:

- Customers have strong willingness to purchase the company’s products and are willing to lock in supply through advance payments

- The supply-demand relationship in the tungsten products market is tight, and products are selling well

- Demand in downstream manufacturing industries, especially in automotive, aerospace, electronic information and other fields, is strong

In December 2024, Zhongwu Hi-tech completed the acquisition of 100% equity of Hunan Shizhuyuan Nonferrous Metals Co., Ltd., and in March 2025, the company issued shares privately to specific investors to raise supporting funds of approximately RMB 1.8 billion[6]. This major asset restructuring expanded the company from the hard alloy segment to the entire tungsten industry chain covering mines, smelting, and alloys, significantly enhancing its upstream resource control capabilities. The synergistic effects brought by industrial chain integration include:

- The company’s voice in the tungsten industry chain has been enhanced, and its pricing power over downstream customers has improved

- Supply chain stability has been improved, and customers have more confidence in the company’s supply capacity

- The advantages of large-scale production are gradually emerging, attracting more long-term cooperative customers

The change in the structure of contract liabilities (the surge in short-term contract liabilities in Q3 2025) may reflect adjustments to the company’s sales policies and customer structure. An increase in short-term contract liabilities usually means:

- Large new short-term orders have been added, with customers making advance payments

- The company has adopted advance payment discount policies for some high-quality customers to accelerate capital recovery

- Long-term customer relationships have been deepened, and customers are willing to obtain priority supply rights through advance payments

From a financial analysis perspective, contract liabilities are a “reservoir” for future revenue. When the company fulfills its contract obligations and transfers goods or services, contract liabilities will be gradually converted into operating revenue. Therefore, the current substantial growth in contract liabilities provides a

Contract liabilities are essentially advance payments, which increase the company’s operating cash inflows. According to the 2025 semi-annual report data, the company’s monetary funds reached RMB 2.01 billion, a 32.43% increase from the beginning of the year, significantly enhancing its capital strength[7]. Ample cash reserves help to:

- Reduce financial expenses and financing costs

- Support capacity expansion and R&D investment

- Enhance the ability to resist cyclical fluctuations in the industry

The increase in contract liabilities is accompanied by improved accounts receivable turnover. From the perspective of asset composition, the company’s accounts receivable in the first half of 2025 were RMB 3.556 billion, accounting for 18.29% of total assets, which is an increase from 12.44% at the beginning of the year but still within a reasonable range. The advance payment model helps to reduce the risk of bad debts on accounts receivable and improve asset quality.

The growth of contract liabilities reflects the improvement of Zhongwu Hi-tech’s competitive position in the industry. As the core platform for the tungsten business under China Minmetals, the company has significant advantages in tungsten resource reserves and hard alloy processing capabilities. The increase in industry concentration has benefited leading enterprises more significantly.

A significant increase in contract liabilities means that the company needs to deliver goods or services of corresponding value as agreed in the future. If the company’s capacity expansion cannot keep up with the growth rate of orders, or if there is a shortage of raw material supply, it may face the risk of failing to perform on time, which may lead to contract disputes or customer loss.

The conversion of contract liabilities to operating revenue requires meeting revenue recognition conditions. If customer demand changes or orders are canceled, the recognized contract liabilities may need to be refunded, affecting the company’s expected revenue and profit.

The tungsten industry is closely related to macroeconomic and manufacturing cycles. If demand in downstream manufacturing slows down, the sustainability of the growth of contract liabilities will be tested. In addition, fluctuations in tungsten concentrate prices will also affect the company’s cost structure and profitability.

According to the company’s annual report, due to the impact of US tariff hikes and the country’s export controls on tungsten and related items, product exports have been hindered, and the company needs to actively expand the domestic market[8]. Changes in the international political and economic situation and adjustments to trade policies may have an impact on the company’s business.

Based on the latest market data, the current share price of Zhongwu Hi-tech is USD 37.50 (Shenzhen Stock Exchange), with a total market value of approximately RMB 85.45 billion. The main valuation indicators are as follows[9]:

| Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 54.12x | Upper-mid level in the industry |

| Price-to-Book Ratio (P/B) | 8.66x | Relatively high |

| Return on Equity (ROE) | 17.29% | Excellent |

| Net Profit Margin | 9.14% | Good |

| Gross Profit Margin | Approximately 21% | Stable |

- The substantial growth of contract liabilities reflects strong downstream demand, providing a guarantee for future performance

- After the completion of industrial chain integration, the company’s competitiveness and profitability are expected to continue to improve

- Backed by a central state-owned enterprise background and leading industry position, it has strong risk resistance capabilities

- The valuation level is relatively high, and it is necessary to pay attention to whether the performance growth rate can match it

- The sustainability of the rapid growth of contract liabilities remains to be seen

- Raw material price fluctuations and industry policy changes need to be continuously tracked

Zhongwu Hi-tech’s contract liabilities grew from RMB 370 million in Q4 2023 to RMB 846 million in Q3 2025,

- Business Level: Indicates strong market demand for the company’s products, strong willingness of customers to purchase, and a significant increase in orders

- Strategic Level: Reflects the emergence of the company’s industrial chain integration effects, and improvements in market competitiveness and industry status

- Financial Level: Lays a solid foundation for the company’s future performance growth, and the cash flow situation continues to improve

- Investment Level: It is a positive signal of the company’s value growth, but a comprehensive judgment needs to be made in combination with the valuation level

Overall, the doubling of Zhongwu Hi-tech’s contract liabilities is an important signal of the company’s improved operating quality and released development potential. Against the backdrop of a booming tungsten industry and gradually emerging industrial chain synergies, the company is expected to continue maintaining a good development momentum. Investors should continue to pay attention to the conversion progress of contract liabilities, capacity expansion progress, and changes in industry policies, and pay attention to risk control while seizing investment opportunities.

[1] Zhongwu Hi-tech 2024 Annual Report Summary - Eastmoney PDF (https://pdf.dfcfw.com/pdf/H2_AN202504241661773123_1.pdf)

[2] Zhongwu Hi-tech Materials Co., Ltd. 2025 Semi-annual Report - CNINFO (http://static.cninfo.com.cn/finalpage/2025-08-27/1224577056.PDF)

[3] China Tungsten Industry Association - Tungsten Product Price Trend Analysis (https://www.ctia.com.cn/wp-content/uploads/2025/01/tungsten-price-in-the-past-twenty-years-20250103.jpg)

[4] Accounting Standards for Business Enterprises No. 14 - Revenue - Accounting Department of the Ministry of Finance

[5] Zhongwu Hi-tech’s Net Profit Rose 8% in H1 2025 - China Tungsten Industry News Network (http://news.chinatungsten.com/cn/tungsten-news/tungsten-jewelry-new/20-tungsten-news-cn/tungsten-product-news/173060-tpn-14922.html)

[6] Zhongwu Hi-tech 2024 Annual Report Summary - Major Asset Restructuring Announcement

[7] Zhongwu Hi-tech 2025 Semi-annual Report - Balance Sheet Data

[8] Zhongwu Hi-tech 2025 Semi-annual Report - Risk Analysis and Countermeasures

[9] Gilin API Market Data - Zhongwu Hi-tech Real-time Quotes and Financial Indicators (Data as of January 18, 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.