Investment Value Analysis of New Hope's Private Placement and Pig Farm Biosecurity Upgrade

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and materials, I will prepare a systematic and comprehensive analysis report for you.

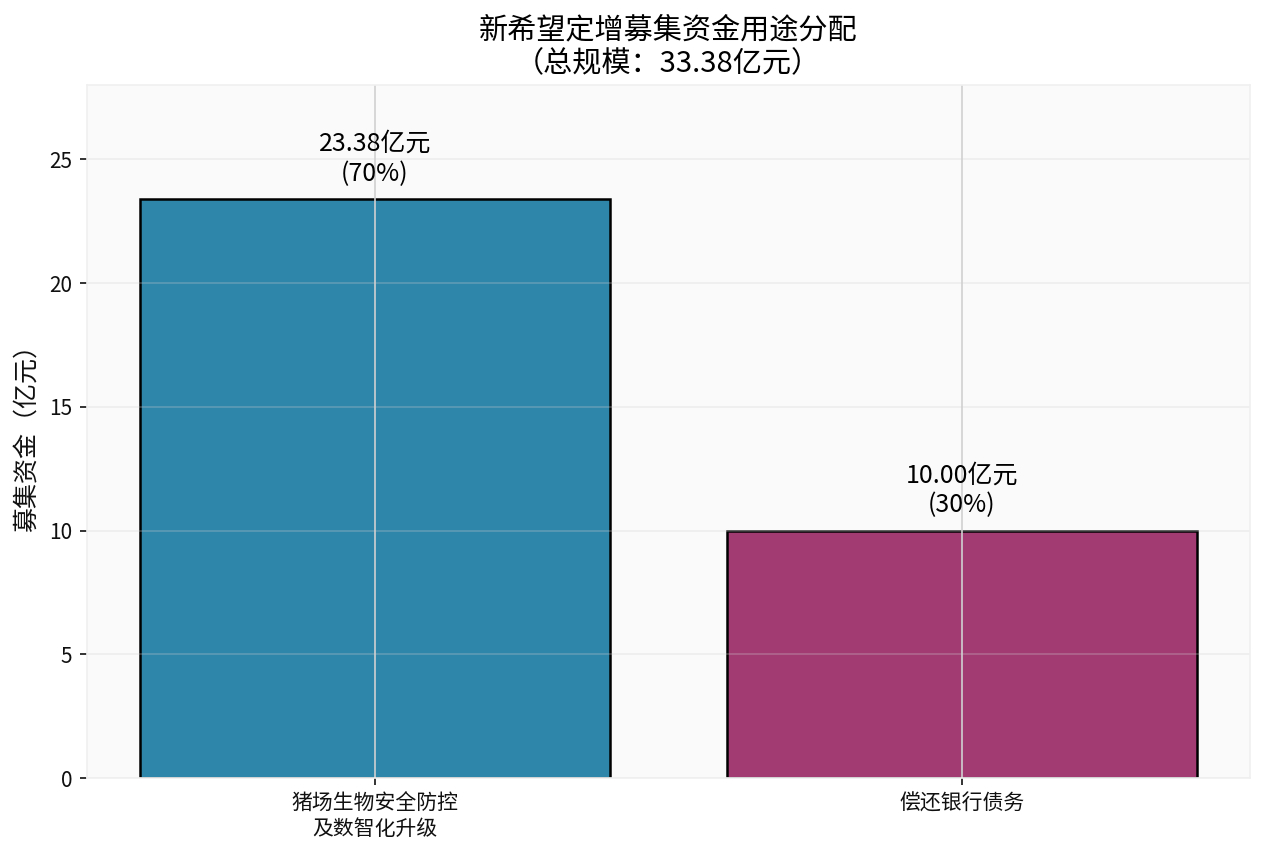

According to the private placement prospectus (second revised version) disclosed on January 12, 2026, New Hope (000876.SZ) plans to issue A-shares to specific targets, with a total fundraising amount of no more than

| Fund Usage | Amount (RMB 100 million) | Proportion | Purpose |

|---|---|---|---|

| Biosecurity Prevention and Control as well as Digital and Intelligent Upgrades of Pig Farms | 23.38 | 70% | Upgrade biosecurity prevention, intelligentization, informatization, and breeding pigs for 77 existing pig farms |

| Repayment of Bank Debts | 10.00 | 30% | Optimize capital structure and reduce asset-liability ratio |

It is worth noting that this private placement

- Issuance targets: No more than 35 specific investors meeting the requirements of the China Securities Regulatory Commission

- Issuance volume: Calculated by dividing the total fundraising amount by the issue price determined in the final inquiry, and shall not exceed 30% of the company’s total share capital before issuance

- Change of control: This issuance will not result in a change of the company’s control

According to the latest financial data, New Hope’s profitability is facing significant challenges [0]:

| Financial Indicators | Value | Industry Comparison |

|---|---|---|

| P/E (Price-to-Earnings Ratio) | 40.43x | Relatively High |

| ROE (Return on Equity) | 4.19% | Relatively Low |

| Net Profit Margin | 1.02% | Relatively Low |

| Operating Profit Margin | 2.12% | Relatively Low |

The Q3 2025 results show that the company’s EPS was $0.00, which was significantly lower than the expected $0.04, a decrease of

Financial risk analysis shows that the company is at a

| Indicator | 2024 | 2023 | 2022 |

|---|---|---|---|

| Asset-Liability Ratio | 69.01% | 72.28% | 68.02% |

| Current Ratio | 0.49 | - | - |

| Quick Ratio | 0.26 | - | - |

As of the end of Q3 2025, the company’s asset-liability ratio remains as high as

The historical losses of New Hope’s pig farming segment are severe [3]:

| Year | Losses from Pig Farming (RMB 100 million) |

|---|---|

| 2021 | 111.5 |

| 2022 | 24.6 |

| 2023 | 53.0 |

| 2024 | 2.8 |

| 2025 First Three Quarters | 1.8 |

Since October 2025, the company’s commercial pig price has fallen below RMB 12 per kg, dropping to

Against the background of overcapacity and low pig prices in the current pig farming industry,

Wen’s Group reduced the comprehensive cost of pork pig farming to

The core investment direction of New Hope’s private placement — biosecurity prevention and control as well as digital and intelligent upgrades of pig farms — may bring the following benefits:

| Type of Benefit | Specific Content | Expected Effect |

|---|---|---|

Reduce Mortality and Culling Rate |

Improve epidemic prevention facilities to reduce the occurrence of African swine fever and other diseases | Reduce pig losses caused by diseases |

Improve Breeding Efficiency |

Intelligent equipment enables precise feeding and environmental control | Increase PSY (Piglets Weaned per Sow per Year) |

Optimize Breeding Pig Quality |

Update and upgrade the breeding pig population to improve breeding performance | Improve survival rate and growth rate of piglets |

Reduce Labor Costs |

Automated and information-based management | Reduce labor demand and improve management efficiency |

However, the project also faces certain challenges and uncertainties:

- Large investment scale: The total investment of the project is as high as RMB 2.92 billion, with a long investment payback period [3]

- Pressure from existing under-construction projects: As of the first half of 2025, the company still has 10 pig farm projects under construction on its books, with a total budget of RMB 2.815 billion [3]

- Limited room for cost reduction: New Hope’s breeding cost is not significantly different from that of listed pig farming enterprises in the same industry, so there is limited room for further reduction in the short term [3]

The current pig farming industry still faces the problem of overcapacity [4]:

- As of the end of October 2025, the national stock of productive sows was 39.9 million heads, which is102.3%of the normal stock of 39 million heads

- In the first three quarters of 2025, the national pig slaughter volume increased by 4.72%year-on-year

- The average weight of slaughtered pigs remains at a high level, about 127.13 kg, which is the highest in recent years

According to the requirements of the symposium held by the Ministry of Agriculture and Rural Affairs, 25 leading pig farming enterprises including New Hope need to gradually reduce the stock of productive sows by the end of January 2026, and the slaughter volume in 2026 will also be reduced to a certain extent [3]. This means that the industry is shifting from “scale expansion” to “refined operation”.

| Enterprise | Full Breeding Cost (RMB per kg) | Competitive Advantage |

|---|---|---|

| Muyuan Foods | 12.04 (2025 Average) | Cost leadership in the industry by RMB 2.46 per kg |

| Wen’s Group | 11.8 (2026 Target) | Cost reduction through refined management |

| New Hope | 12.9 (Q3) | Still needs to strive to catch up |

According to the DCF model analysis by Jinling AI [0]:

| Scenario | Intrinsic Value | Premium/Discount to Current Price |

|---|---|---|

| Conservative Scenario | RMB 69.64 | +687.8% |

| Neutral Scenario | RMB 97.41 | +1001.9% |

| Optimistic Scenario | RMB 369.91 | +4084.5% |

| Weighted Average | RMB 178.99 | +1924.7% |

It should be noted that DCF valuation is based on many assumptions, and the huge difference between the current stock price (RMB 8.84) and the valuation may reflect:

- Market concerns about the company’s profit prospects

- Downward pressure of the industry cycle

- Financial risks brought by high debt

According to the latest technical analysis data [0][5]:

| Indicator | Value | Technical Signal |

|---|---|---|

| Latest Closing Price | RMB 8.84 | - |

| 20-day Moving Average | RMB 9.16 | Stock price is below the short-term moving average |

| 50-day Moving Average | RMB 9.35 | Stock price is below the medium-term moving average |

| 200-day Moving Average | RMB 9.67 | Stock price is below the long-term moving average (weak) |

| Annualized Volatility | 12.69% | Medium volatility |

| Decline from 52-week High | -25.59% | At a relatively low level |

It can be seen from the K-line chart that the stock price has been under continuous pressure recently. After the private placement announcement was released on January 12, the stock price did not show a significant upward reaction, indicating that the market’s attitude towards this private placement is relatively cautious [5].

- Private placement scale halved: Reduced from RMB 6.6 billion to RMB 3.338 billion, reflecting changes in the market financing environment and the company’s compromise to the capital market [1][2]

- Fund usage focuses on core business: 70% of the funds are used for pig farm biosecurity upgrade, reflecting the company’s strategic intention of cost reduction and efficiency improvement, but it is difficult to reverse performance in the short term

- Continuous financial pressure: High asset-liability ratio and losses in the pig farming business are still the main challenges faced by the company

- Weak industry cycle: The pig farming industry is overall overcapacity, with pig prices running at a low level, and it is expected to achieve break-even in Q2 2026 [4]

| Dimension | Evaluation | Explanation |

|---|---|---|

| Short-term | Neutral-Bearish |

Low pig prices, private placement dilution, performance under pressure |

| Medium-term | Cautious Wait-and-See |

Pay attention to the progress of cost reduction and pig price trend |

| Long-term | To Be Observed |

Depends on the effect of biosecurity upgrade and industry cycle reversal |

- Pig price fluctuation risk: Sustained low pig prices may lead to continued losses in the breeding business

- Epidemic risk: African swine fever and other diseases may still have a significant impact on the company

- Financial risk: High asset-liability ratio may bring liquidity pressure

- Private placement dilution risk: The issuance of new shares may have a dilutive effect on the rights and interests of existing shareholders

- Project execution risk: The implementation effect of the biosecurity upgrade project is uncertain

[1] CLS - New Hope Plans to Raise No More Than RMB 3.338 Billion Through Private Placement (https://www.cls.cn/detail/2255182)

[2] China Feed Network - New Hope Raises RMB 3.3 Billion for Pig Farm Upgrade and Debt Repayment (http://www.chinafeedm.com/h-nd-30824.html)

[3] Sina Finance - Pig Prices Break Below Cost Line Again in September; When Will the Pig Industry Turn the Corner After Four Consecutive Years of Losses (https://finance.sina.com.cn/stock/observe/2026-01-16/doc-inhhnzar2532289.shtml)

[4] Sina Finance - Supply-Demand Imbalance in Pig Farming Industry; Full Industry Chain Layout Becomes the Key (https://finance.sina.com.cn/jjxw/2026-01-10/doc-inhfueta9986465.shtml)

[5] Jinling API - Market Data and Technical Analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.