Analysis of the Impact of Trading Crowding in AI Applications and Commercial Aerospace Sectors on Fund Investment Strategies and Asset Allocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on collected market data and research materials, I will prepare a systematic and comprehensive analysis report for you.

At the start of 2026, the A-share market showed significant structural differentiation. According to the latest market data, the total turnover of all A-shares reached 3.64 trillion yuan on January 12, exceeding 3 trillion yuan for two consecutive trading days. The Shanghai Composite Index closed up 1.09% at 4165.29 points, hitting a new 10-year high[1][2]. However, differentiation among industry sectors remains prominent, with AI applications and commercial aerospace concepts becoming the most watched focus of the market.

Specifically, the AI applications sector broke out across the board: the Kimi Index surged 12.25%, and the Xiaohongshu Platform, Satellite Internet, Agent, Chinese Corpus, and AIGC Indices all rose more than 9%[2]. The commercial aerospace sector also performed strongly. On January 12, the Wind Commercial Aerospace Theme Index and Wind Satellite Industry Theme Index rose 10.18% and 10.16% respectively[2]. As of January 12, 2026, the aforementioned Commercial Aerospace Theme Index and Satellite Industry Theme Index have surged 103.17% and 99.97% respectively in less than two months since November 24, 2025[2].

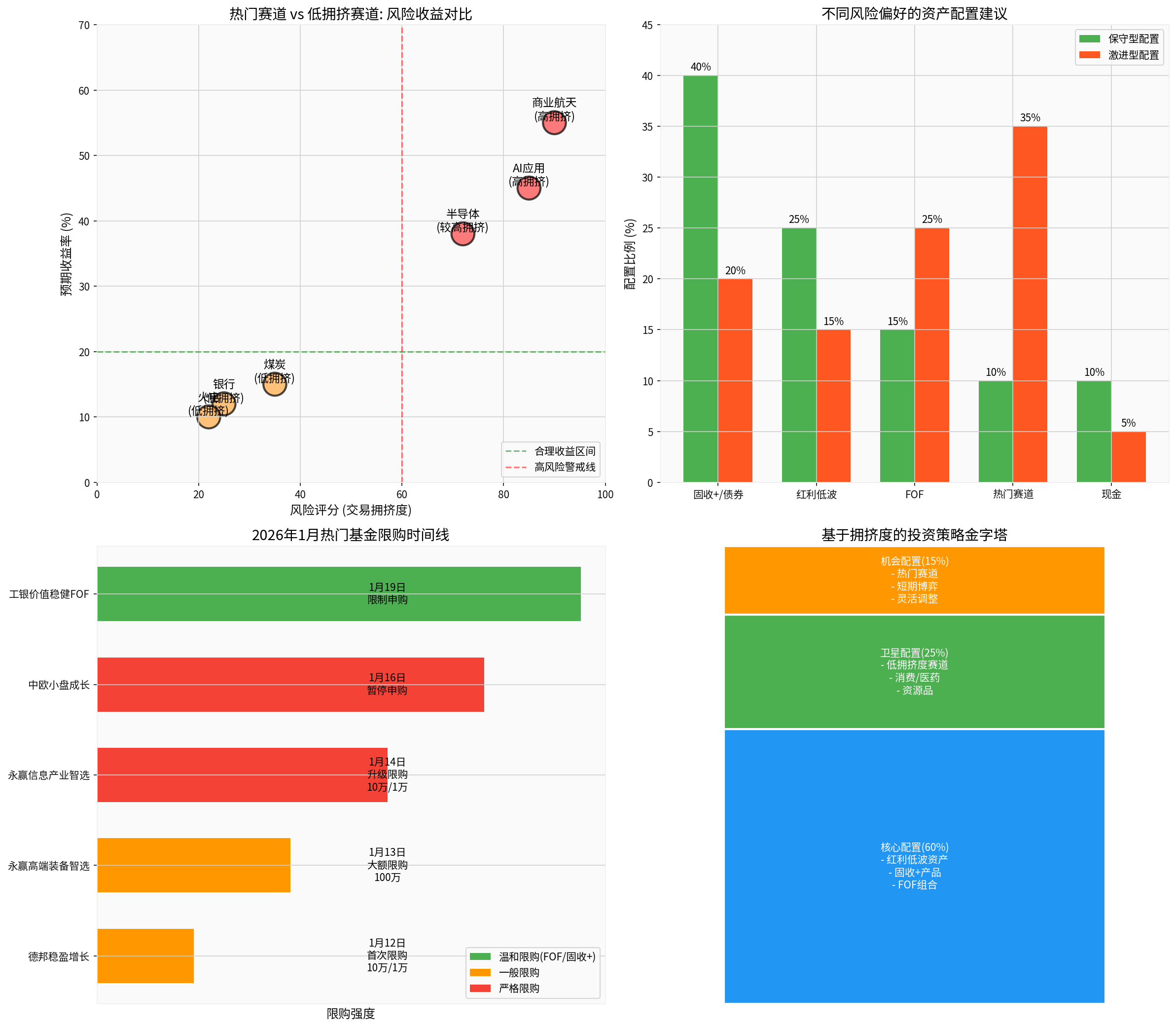

Faced with the continued boom in the market, many fund companies have chosen to launch purchase restrictions on their popular products. On January 13, Yongying Fund announced subscription limits on two of its popular products: Yongying High-End Equipment Smart Selection and Yongying Information Industry Smart Selection[1][3]. Subsequently, products under many fund companies including CEIBS Alpha, Ping An, Huatai-PineBridge, Xingquan, and J.P. Morgan also announced purchase restrictions[1].

The most representative example is the Debang Steady Growth Fund. After rumors that the fund attracted 12 billion yuan in a single day on January 12, the fund company issued two consecutive purchase restriction announcements on January 13 and 14, slashing the subscription limits for Class A shares and Class C shares from 100 million yuan and 10 million yuan to 1 million yuan and 100,000 yuan respectively[4]. This phenomenon reflects that fund companies are transforming from a scale-oriented to an investor return-oriented model[3].

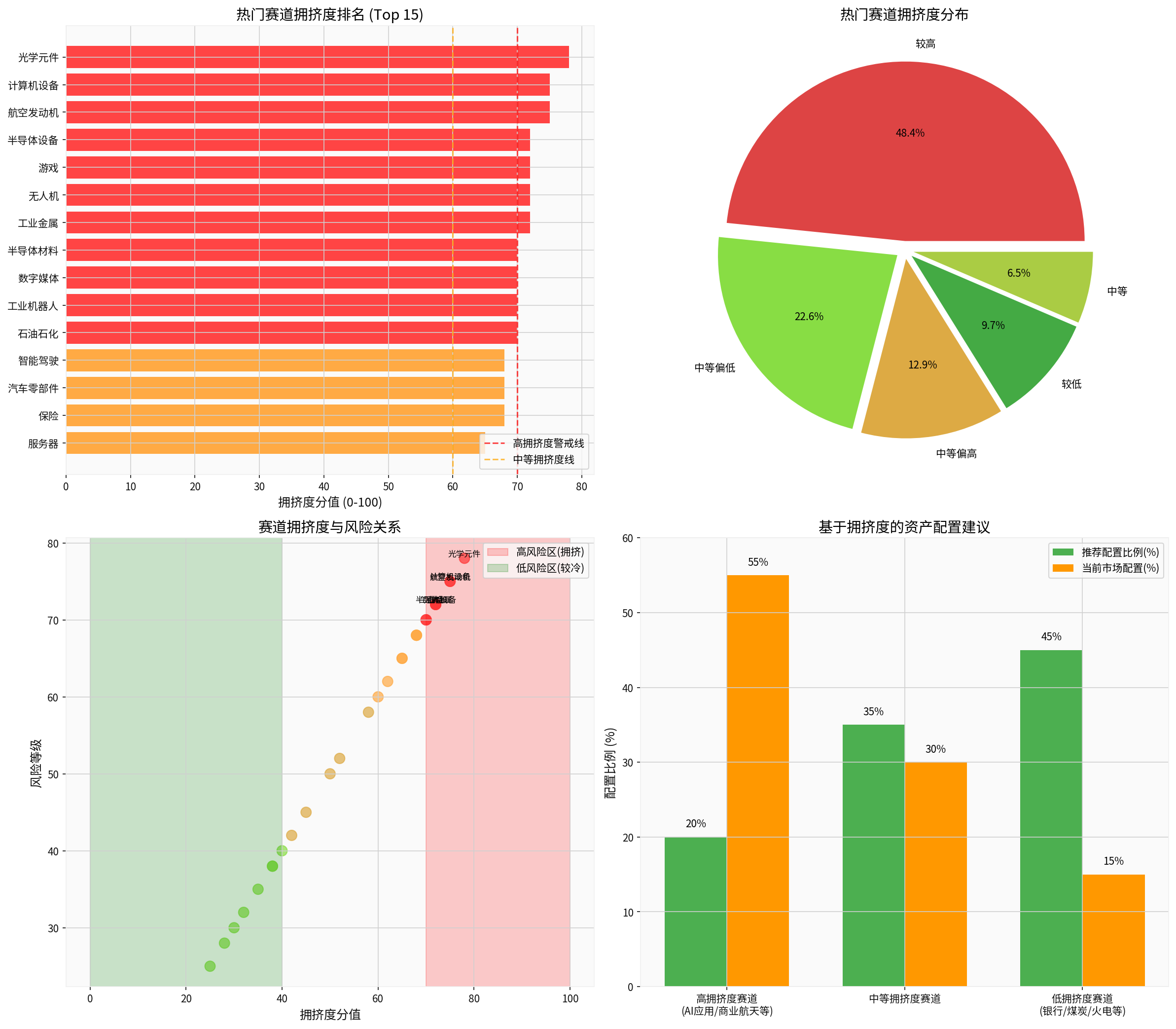

Trading crowding is an important indicator for measuring the risk of specific sectors. According to the crowding index system constructed by the Industrial Securities Strategy Team, this index is synthesized from four dimensions (volume, price, capital, and analyst forecasts) and seven indicators, and has strong indicative significance for the short-term trend of stock prices[5].

Based on the latest data (January 5 to January 9, 2026), the crowding levels of current hot market sectors show obvious differentiation:

- Computer Equipment, Optical Components, RF Components: High crowding level

- Semiconductor Materials, Semiconductor Equipment: High crowding level

- Intelligent Driving, Games, Digital Media: High crowding level

- Aero-engines, UAVs, Industrial Robots: High crowding level

- Industrial Metals, Oil and Petrochemicals: High crowding level[5]

- Servers, Optical Fibers and Cables, IDC: Medium-high crowding level

- IT Services, Financial IT, Internet of Things: Medium-high crowding level

- Semiconductor Packaging and Testing, Design, Manufacturing: Medium-high crowding level

- Lithium Batteries, Energy Storage, Photovoltaic Modules: Medium crowding level[5]

- Optical Modules, Consumer Electronics: Medium-low crowding level

- White Goods, Banking, Coal, Thermal Power: Low crowding level

- Traditional Chinese Medicine, Innovative Drugs, Baijiu: Low crowding level[5]

The most direct reason for fund companies to implement purchase restrictions on popular products is to avoid diluting holder returns due to rapid scale expansion. When the fund net value is at a relatively high level, the influx of a large amount of new funds is likely to cause the following problems:

- Return Dilution Effect:According to the operation rules of public offering funds, the fund’s net asset value per share is equal to the total market value of assets such as stocks held by the fund plus cash, divided by the total number of shares. When a huge amount of new subscription funds influx on T day, these funds will be confirmed with the net value of T day on T+1 day[4]. If the fund manager has not yet invested all the cash in stocks, and the original stock positions happen to surge, the large amount of cash will “dilute” the overall asset growth.

Taking the Debang Steady Growth Fund as an example, on January 12, its top 10 heavyweight stocks all surged 10%-20%, but the daily return of the fund’s Class A shares was only about 8%; on January 13, while most of the top 10 heavyweight stocks continued to rise, the fund’s net value only rose slightly by 0.05%[4]. This means that the returns of old holders were significantly diluted by the influx of new funds.

- Position Building Timing Issue:When the market is at a relatively high level, it is often not a particularly suitable time for fund managers to build positions. After a large amount of funds enter, it is difficult to find suitable investment targets in a short time, and the funds can only be held in cash, which will cause idle funds and reduce capital utilization efficiency[3].

Many industry insiders pointed out that from the purchase restrictions on top-performing funds, it can be seen that fund companies are transforming from a scale-oriented to an investor return-oriented model[3]. In the market rally of 2019 and 2020, fund companies issued many new products, and the scale of old products continued to rise. However, in this round of market rally, fund companies are very restrained in their pursuit of scale.

This transformation reflects several important changes:

- Industry Ecology Optimization:From simply pursuing scale growth to focusing on investor experience and long-term returns

- Product Strategy Adjustment:From “traffic is king” to refined management and differentiated competition

- Strengthened Investor Education:Guiding investors to invest rationally and avoid chasing highs and selling lows

Currently, funds are concentrated in sectors such as “hard technology” and resources, leading to relatively crowded trading structures in related fields, reduced chip stability, and easy amplification of volatility under external disturbances[6]. Purchase restriction measures help fund companies actively adjust the rhythm of capital inflows and protect the interests of existing holders.

In the past two years, the strong performance of the A-share technology market and the rise of tool-based investment have led some public offering institutions to focus on exploring the tool-based approach of active equity funds[7]. Such “tool funds” can achieve larger gains than index products by virtue of more concentrated positions in specific sectors. However, this strategy has significant risks:

-

Risk of Short-term Capital Influx:A large amount of funds flooding in a short period of time will not only dilute the returns of original fund holders, but also increase the difficulty of managing the fund portfolio.

-

Risk of High Concentration in Sectors:Emerging sectors have high uncertainty and great risks. Once market sentiment reverses or industry logic changes, it is easy to cause capital flight and stampede, bringing huge losses to investors.

-

Risk of Deviation in Net Value Performance:After the fund scale expands rapidly, the fund manager may find it difficult to continue implementing the original high-concentration strategy, resulting in the product’s net value performance deviating from investors’ expectations.

According to the 2025 fourth-quarter reports of public offering funds, top-performing fund managers show the following characteristics in their investment strategies:

Faced with the risk of trading crowding in hot sectors, fund companies are adjusting their product marketing strategies:

- Explore Other Sub-sectors:Fund companies have begun to promote products with non-hot sectors such as chemical varieties as their main positions, providing investors with different options for diversified allocation[3].

- Recommend “Fixed Income +” Products:When the market is booming, some investors with lower risk appetite both hope for stable returns and want to participate in the secondary market, so “Fixed Income +” products with good performance have become an important choice[3].

- FOF Products Gain Attention:More than 90% of FOFs have achieved positive returns since the start of the year, and FOFs are favored as a new choice for asset allocation[3]. Bank channels are also promoting FOF products, such as China Merchants Bank’s “TREE Long-term Growth Plan” and China Construction Bank’s “Longwin Plan”[9].

Based on the current market environment, it is recommended that investors build an asset allocation framework based on sector crowding levels:

- Dividend Low-volatility Assets:Including low-crowding sectors such as banking and coal, which have the characteristics of high dividends and high cash flow, providing defensive attributes during market volatility

- “Fixed Income +” Products:Pursuing stable returns while participating in the equity market, which is an important choice for deposit substitution in an environment of declining interest rates

- FOF Portfolios:Fund selection and portfolio allocation through professional institutions to reduce the risk of single funds

- Low Crowding Sectors:Focus on advanced manufacturing fields with medium-low crowding levels such as wind power, photovoltaic inverters, and smart grids

- Consumer and Pharmaceutical:The consumer and pharmaceutical sectors such as Baijiu, traditional Chinese medicine, and innovative drugs have low crowding levels and potential for valuation recovery

- Resource Products:Non-ferrous metals such as copper, aluminum, and lithium benefit from the recovery of global physical demand and the pull of AI industry trends

- Flexible Participation in Hot Sectors:Maintain appropriate allocation to hot sectors such as AI applications and commercial aerospace, but strictly control the position size

- Add Positions After Pullbacks:Adopt the operation method of “adding positions on pullbacks, holding with trends, and taking profits in batches” to avoid chasing highs[6]

- Focus on Rotation Opportunities:Technology directions such as low-position innovative drugs and games catalyzed by fundamental performance improvements in the first quarter are expected to rotate[2]

- “Fixed Income +”/Bond Assets: 40%

- Dividend Low-volatility Assets: 25%

- FOF Products: 15%

- Hot Sectors: 10%

- Cash: 10%

- “Fixed Income +”/Bond Assets: 20%

- Dividend Low-volatility Assets: 15%

- FOF Products: 25%

- Hot Sectors: 35%

- Cash: 5%

-

Directions with Low Crowding and Fundamental Support:

- White Goods, Banking, Coal: Low crowding level, reasonable valuation

- Optical Modules: Medium-low crowding level, benefiting from AI hardware demand

- Wind Power, Photovoltaic Inverters, Smart Grids: Medium-low crowding level, long-term trend of new energy remains unchanged

-

Main Lines of Policy and Industry Resonance:

- Scientific and technological innovation, high-end manufacturing going global

- High-quality targets benefiting from consumption promotion

- Directions of technological self-reliance emphasized in the “15th Five-Year Plan”

-

Directions Expected to Enter the Early Stage of Industrialization Investment in 2026:

- Solid-state Batteries, Intelligent Driving, Robots

- Application scenarios such as AI Companions, AI Education, and AI Advertising

- Speculation Risks of Short-term Hot Sectors:Especially sentiment-driven sectors such as commercial aerospace, be alert to valuation pullback pressure[2]

- “Fake Growth” Risk:Funds are over-concentrated in a few sectors. If the performance of the main sectors fails to meet expectations, it may trigger rapid capital switching[6]

- Targets with Valuation Deviated from Fundamentals:The valuation of some hot sectors has reached a historical high. If the first-quarter performance fails to match high expectations, it may bring valuation return pressure[6]

-

Holding Positions is More Important Than Frequent Adjustments:Against the background of the appreciation trend of the RMB, mild economic recovery, and overseas funds flowing back to emerging markets, maintain the stability of core allocation[6]

-

Appropriate Balanced Allocation:On the basis of bottom positions such as dividend low-volatility products, balance technology and resources to avoid over-concentration in a single sector[6]

-

Dynamically Balance Risk and Return:Take sectors with high growth potential as the bottom position, balancing aggressiveness and safety[6]

-

Focus on Key Observation Signals:

- Matching degree between macro data and profit expectations

- Core variables such as the Federal Reserve’s policy trends

- Whether trading volume can maintain a high level

-

Risk of Expected Premature Realization:The continuous rise has reflected many optimistic expectations. If the subsequently released macro data or corporate first-quarter reports fail to meet expectations, the market may experience adjustments brought by expected revisions[6]

-

Problem of Incremental Capital Undertaking Capacity:The rapid rise of the market requires continuous capital support. If the trading volume cannot maintain a high level, the upward momentum may gradually weaken[6]

-

Risk of External Disturbances:Under the influence of factors such as the current global monetary policy cycle and geopolitics, market volatility may be amplified[6]

-

Risk of AI Applications Sector:There is uncertainty in the pace of AI application implementation. Currently, some companies’ related businesses have not yet formed a mature profit model[1]

-

Risk of Commercial Aerospace Sector:The commercial aerospace sector will most likely shift from short-term sentiment-driven to value return, and may enter a consolidation stage in the future[2]

-

Risk of Valuation Pullback:The situation where the valuation of hot sectors deviates from revenue fundamentals deserves attention, and valuation bubbles need to be guarded against[2]

-

Risk of Chasing Highs:Short-term investment speculation and continuous chasing highs and selling lows are difficult to achieve ideal investment return expectations[2]

-

Risk of Excessively Rapid Scale Expansion:When the fund scale is too large, it is easy to restrict position adjustment operations, which may bring unexpected sharp fluctuations in fund net value[3]

-

Risk of Over-concentrated Positions:Avoid over-concentrated positions in a single sector, and balance returns and risks through diversified allocation[2]

-

Trading Crowding is at a Historical High:The crowding level of hot sectors such as AI applications and commercial aerospace is significantly higher than the historical average, with a large risk of pullback.

-

Fund Company Purchase Restrictions are Rational Actions to Protect Holders:Purchase restriction measures help avoid dilution of returns due to rapid scale expansion, and also reflect the industry’s transformation from scale-oriented to investor return-oriented.

-

Asset Allocation Needs to Be Balanced:While paying attention to opportunities in hot sectors, investors should appropriately allocate to low-crowding sectors and products such as “Fixed Income +” and FOFs to achieve risk diversification.

-

Focus on Performance Verification:Investment in 2026 needs to pay more attention to differentiated selection. Companies that truly have core technologies, can achieve technological breakthroughs, and promote application implementation are expected to continue to perform outstandingly.

From the institutional consensus, the main line of the market in 2026 may focus on two directions: one is the technology growth direction. Driven by the clear AI industry trend and the policy dividend of technological self-reliance, the prosperity of the “hard technology” sector continues to be recognized; the other is the resource products sector. Against the background of the deepening “anti-involution” policy and the overseas interest rate cut cycle, the prices of the upstream chain are supported[6].

It is expected that the market will show a “slow bull” or “shock upward” pattern. Investors need to grasp structural opportunities while doing a good job in risk management. In terms of investment strategy, it is recommended to adopt the “Core + Satellite” model, with low-crowding assets as the core allocation and hot sectors as the satellite allocation, dynamically adjusting the position ratio to achieve long-term steady value appreciation.

[4] Sina Finance - Debang Launches a Hit Fund! But Fund Holders’ Returns are Significantly Diluted

[7] Eastmoney.com - “Tool Funds” Surge in Popularity, Who is Buying?

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.