Analysis of the Impact of Shanghai's 15th Five-Year Plan on A-Share Market and RMB Internationalization Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Now I will conduct a systematic and comprehensive analysis for you. Based on the core policy content of Shanghai’s 15th Five-Year Plan proposal, combined with the latest market data, I will elaborate on the investment impact of these policies on the A-share market and the process of RMB internationalization.

Shanghai’s 15th Five-Year Plan proposal clearly puts forward

| Policy Domain | Specific Measures | Expected Impact |

|---|---|---|

Cross-Border Financial Services |

Expand offshore financial service functions, deepen the facilitation of cross-border investment, financing and settlement | Improve cross-border capital flow efficiency |

Financial Trading Platform |

Prepare for the establishment of the Shanghai International Financial Asset Trading Platform | Enrich RMB asset trading channels |

Derivatives Market |

Explore pilot programs for RMB foreign exchange futures trading | Enrich exchange rate risk hedging tools |

Interconnectivity |

Deepen the interconnectivity between domestic and overseas financial markets | Expand access for international investors |

RMB Internationalization |

Support financial institutions in expanding global service networks and enrich RMB-denominated financial products | Advance the process of RMB internationalization |

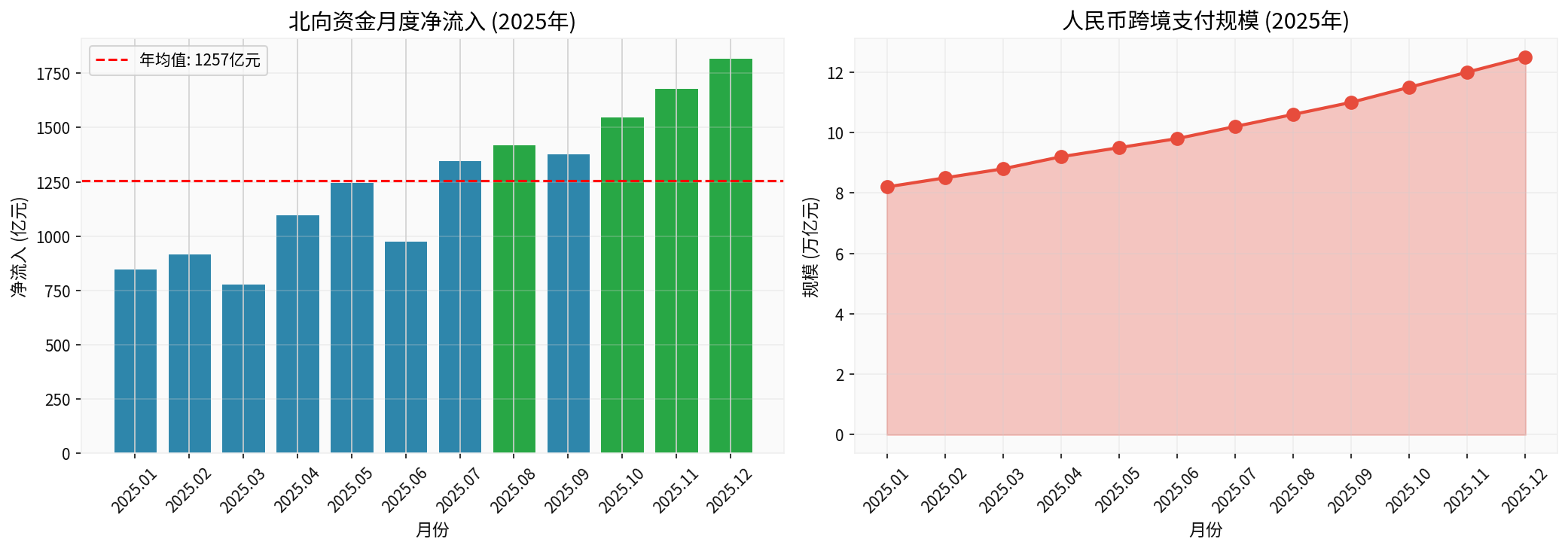

According to data analysis, northbound capital continued to flow into the A-share market in 2025, with a cumulative net inflow of approximately

- Increased Policy Attractiveness: The upgraded level of the international financial center will attract more international institutional investors to allocate to A-shares

- Facilitated Access: Deepened interconnectivity mechanisms lower the threshold for cross-border investment

- Enriched Products: The RMB asset trading platform and foreign exchange futures pilot provide more investment tools

Data shows that the market value of A-shares held by overseas institutions increased from

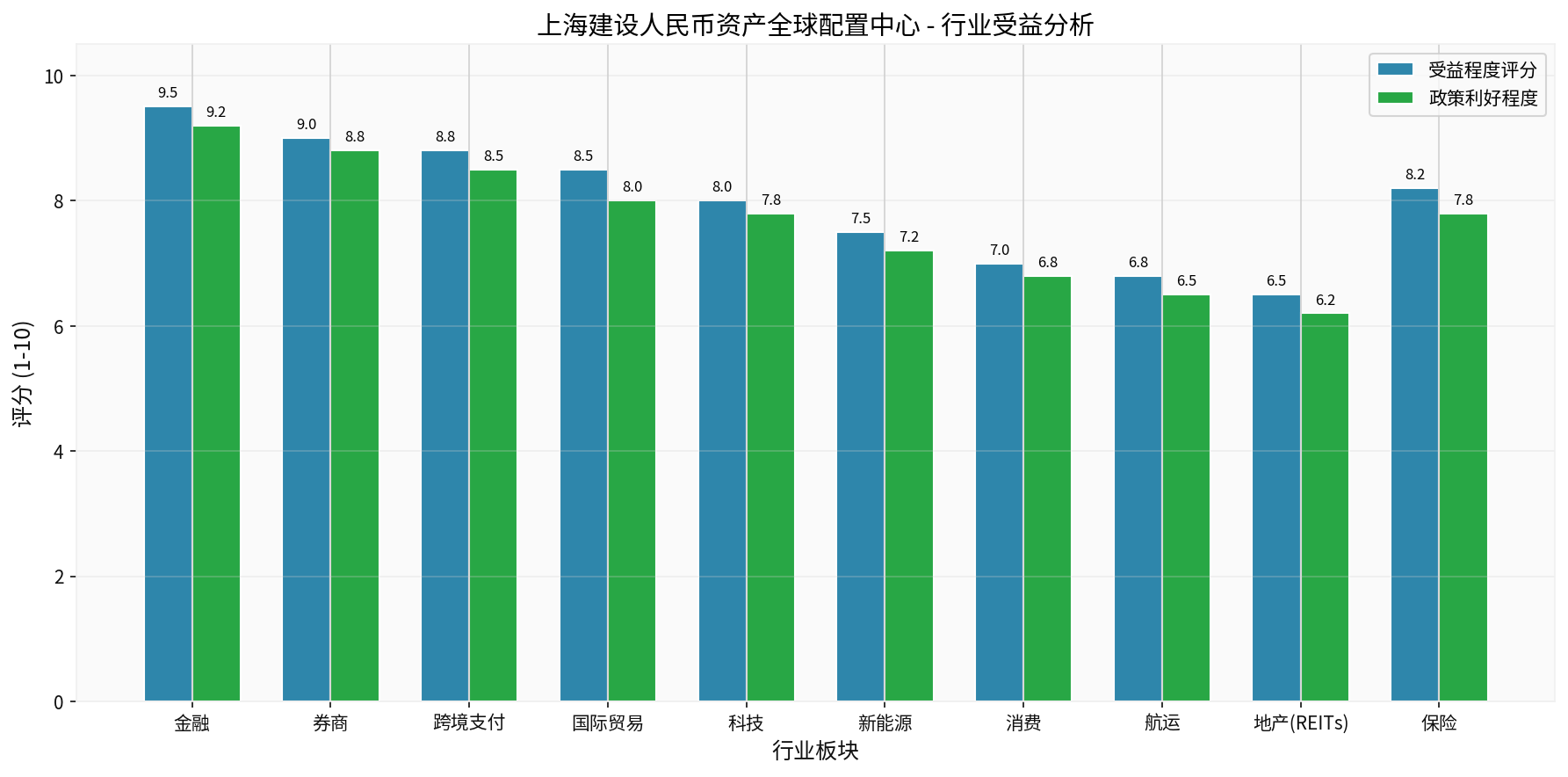

Based on the assessment of policy impact, sectors such as

- Finance(composite score: 9.35): Directly benefits from the construction of the asset allocation center

- Securities Brokerage(composite score: 8.90): Increased cross-border financial transactions bring business growth

- Cross-Border Payment(composite score: 8.65): Accelerated process of RMB internationalization

- International Trade(composite score: 8.25): Facilitated cross-border investment and financing

- Insurance(composite score: 8.00): Construction of the risk management center

According to recent market data, major A-share indices show a volatile upward trend[0]:

| Index | Early December 2025 | Mid-January 2026 | Change |

|---|---|---|---|

| Shanghai Composite Index | 3,435.14 | 3,613.01 | +5.18% |

| Shenzhen Component Index | 10,518.87 | 10,502.65 | -0.15% |

| ChiNext Index | 2,198.83 | 2,323.26 | +5.66% |

The scale of RMB cross-border payments increased from

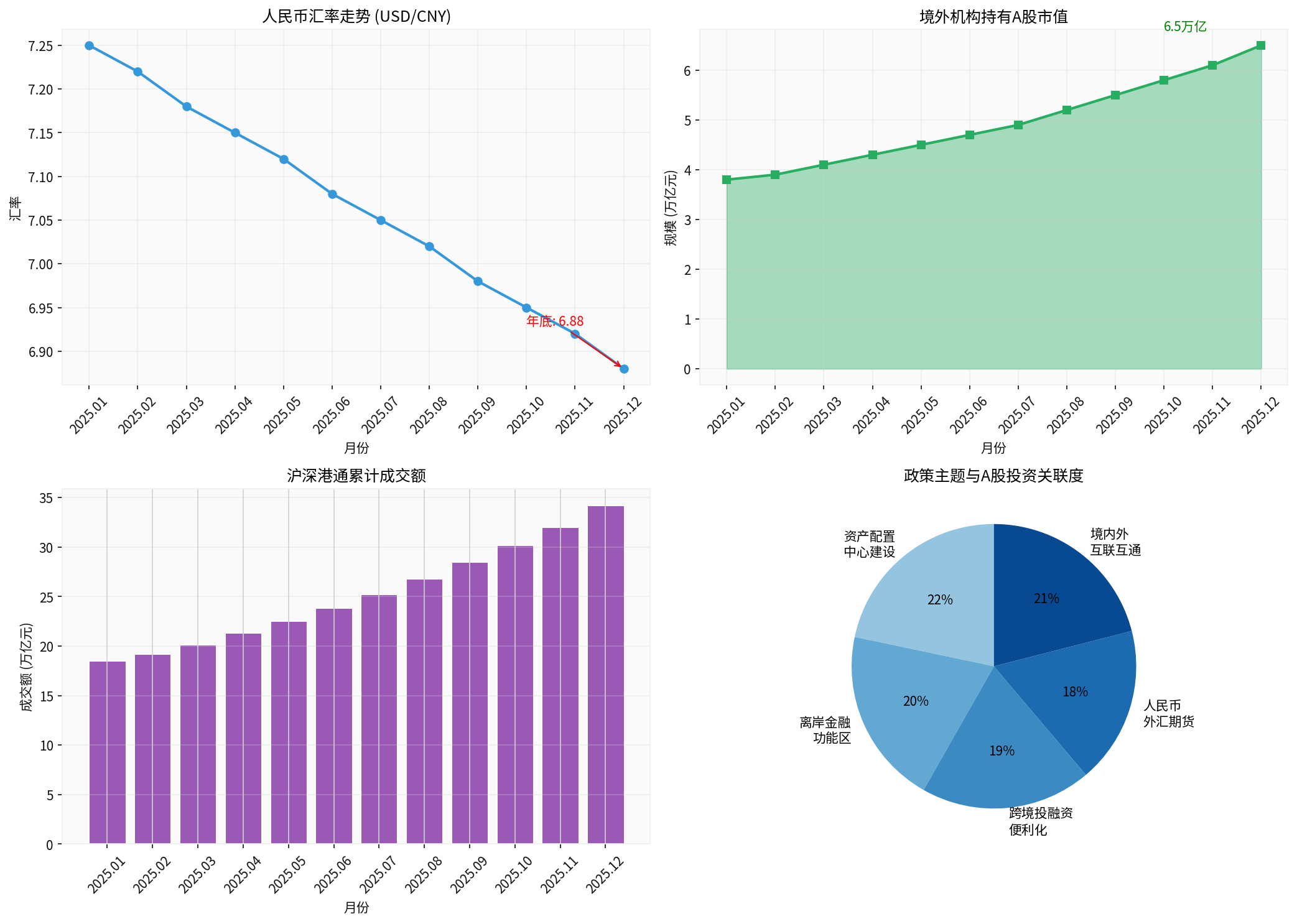

The RMB to USD exchange rate appreciated from

- Increased confidence of international investors in RMB assets

- Cross-border capital inflows support the exchange rate

- Steady advancement of the RMB internationalization process

The 2026 work conference of the Shanghai Head Office of the People’s Bank of China clearly proposed to

- Bank Stocks: Increased cross-border business drives performance growth

- Securities Brokerage Stocks: Deepened interconnectivity and expanded international business

- Insurance Stocks: Construction of the risk management center improves underwriting capacity

- AI Industry Chain: Has an independent ecosystem, highly attractive to international investors

- New Energy: Development of green finance provides financing support

- Semiconductors: Independent innovation drives valuation revaluation

- High-Quality Central State-Owned Enterprises: Provide downside protection

- Dividend Strategy: Has allocation value in a downward interest rate cycle

| Risk Type | Specific Content | Response Strategy |

|---|---|---|

Policy Risk |

Policy implementation progress falls short of expectations | Monitor policy catalysts |

Exchange Rate Risk |

Increased volatility of RMB exchange rate | Allocate exchange rate hedging tools |

Geopolitical Risk |

Uncertainty in China-US relations | Diversify allocation across different markets |

Liquidity Risk |

Potential increase in market volatility | Control positions and maintain appropriate diversification |

According to institutional forecasts, the A-share market is expected to continue the slow bull pattern in 2026, and it is recommended to adopt the

- Defensive End: Allocate to high-dividend high-quality central state-owned enterprises to provide downside protection

- Offensive End: Lay out growth stocks under the dual background of independent technological innovation and overseas expansion

- Middle Layer: Pay attention to valuation repair opportunities in the consumer sector

- A-Share Market: Driven by policies, the accelerated internationalization process will attract more overseas capital allocation, the valuation system is expected to be revalued, and structural opportunities continue to emerge

- RMB Internationalization: With policy support combined with market demand, the scope and scale of international RMB usage will continue to expand, and the foundation for exchange rate stability will be more solid

- Investment Strategy: It is recommended to seize investment opportunities in directly beneficiary sectors such as finance, securities brokerage, and cross-border payment, while paying attention to the allocation value of technology growth and high-dividend assets

- Short-Term (2026): Policy catalytic effects will continue to be released, and northbound capital is expected to maintain an inflow trend

- Mid-Term (2027-2028): The upgraded level of Shanghai’s international financial center will attract more international financial institutions to settle in

- Long-Term (2029-2030): The global allocation status of RMB assets will be significantly enhanced, and the weight of A-shares in international indices will increase

Investors should closely monitor the progress of policy implementation and changes in the fundamentals of relevant beneficiary sectors, seize structural market opportunities, and at the same time pay attention to preventing volatility risks brought by external uncertainties.

[1] Yicai - “Shanghai’s 15th Five-Year Plan Proposal: Accelerate the Construction of a Global Allocation Center and Risk Management Center for RMB Assets” (https://www.yicai.com/brief/103010105.html)

[2] Securities Times - “Shanghai’s 15th Five-Year Plan Proposal Released” (https://www.stcn.com/article/detail/3598973.html)

[3] China Trade in Services Network - “Shanghai Head Office of the People’s Bank of China: Continue to Advance RMB Internationalization” (https://tradeinservices.mofcom.gov.cn/article/yanjiu/hangyezk/202601/181153.html)

[4] Sina Finance - “Central Bank: Deepen High-Level Opening of Financial Markets, Support the Construction of Shanghai International Financial Center” (https://finance.sina.com.cn/roll/2026-01-06/doc-inhfkfur5682384.shtml)

[5] China Fund Journal - “Chinese and Foreign Institutions: China Will Be a Market Focused by Global Investors in 2026” (https://www.chnfund.com/article/AR8d8a9e0e-145b-5974-09a1-3a1eba0e5330)

[6] Eastmoney - “How to Allocate Major Assets in 2026? Chief Economists Speak Out” (https://finance.eastmoney.com/a/202601123615693884.html)

[0] Jinling AI Financial Data Analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.