Analysis Report on the Growth Rate Divergence Between China Pacific's Life Insurance and Property & Casualty Insurance Businesses

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I will provide you with a systematic and comprehensive analysis report.

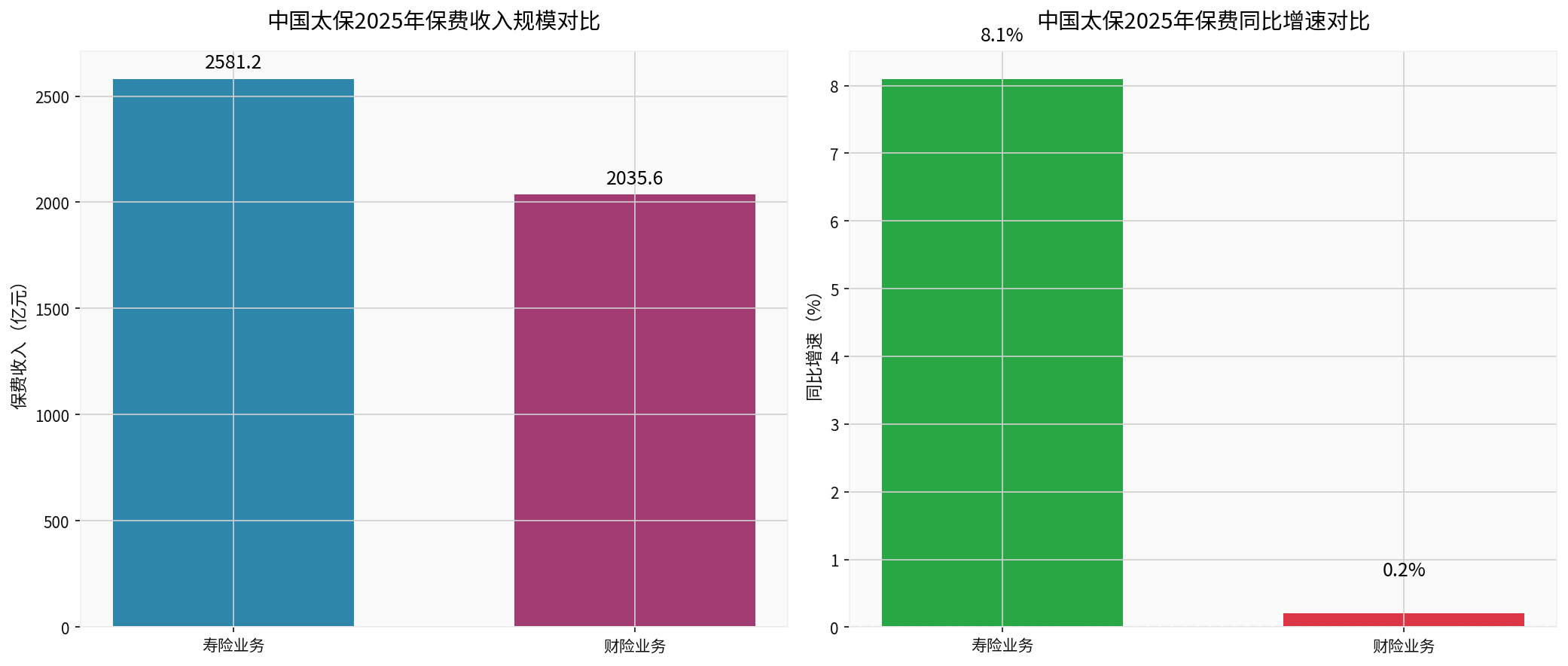

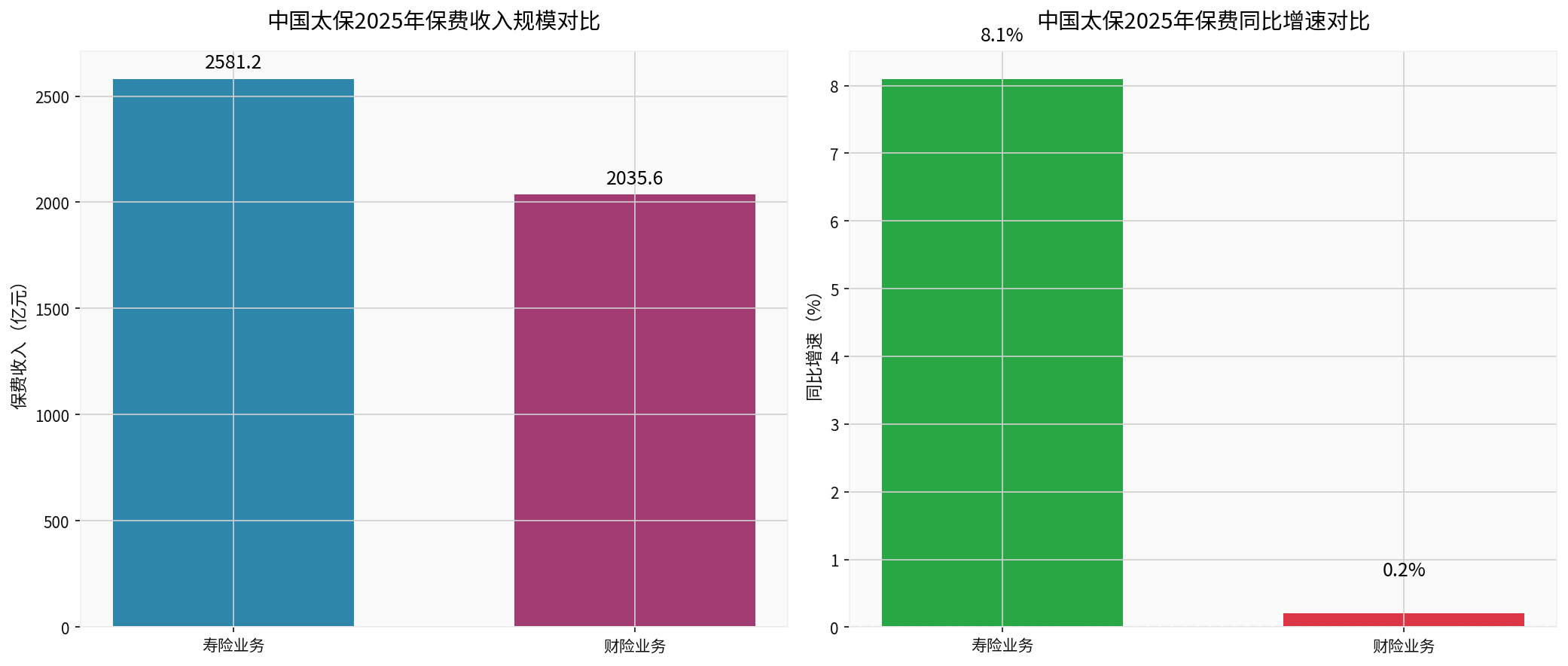

According to the 2025 annual performance data, China Pacific shows a clear trend of business divergence [0][1]:

| Business Segment | Premium Income (CND 100 million) | Year-on-Year Growth Rate | Growth Rate of Insurance Service Income |

|---|---|---|---|

Life Insurance Business |

2,581.15 | +8.1% |

+2.6% |

Property & Casualty Insurance Business |

2,035.61 | +0.2% |

+3.5% |

The growth rate gap is as high as

Pacific Life Insurance launched the “Long Voyage Initiative” transformation strategy in 2021. After years of deepened promotion, the transformation dividends are being accelerated [1][2]:

- Strong Growth of New Business Value: In the first three quarters of 2025, the new business value reached CND 15.351 billion, with a year-on-year growth of 7.7%, and31.2% year-on-year growth on a comparable basis[1]

- Significant Improvement in New Business Value Margin: In 2024, the new business value margin reached 16.8%, up 3.5 percentage points year-on-year; it increased by 8.6 percentage points year-on-year before adjusting economic assumptions [2]

- Steady Growth of Embedded Value: By the end of 2024, the embedded value reached CND 421.837 billion, representing a 4.9% growth from the end of the previous year [2]

The bancassurance channel has become the core engine for life insurance growth [1]:

| Indicator | First Three Quarters of 2025 (CND 100 million) | Year-on-Year Growth Rate |

|---|---|---|

| Total Premium of Bancassurance Channel | 583.10 | +63.3% |

| New Single Premiums with Installment Payment in Bancassurance Channel | 159.91 | +43.6% |

The reasons for the high growth of the bancassurance channel include:

- Deepened innovation in cooperation models with banking channels

- Captured the wealth management and pension health insurance needs of bank customers

- Continuously optimized product and service supply, and strengthened customer management

Pacific Life Insurance proactively adjusted its product strategy to increase the proportion of high-value businesses [1][2]:

- Significant Increase in the Proportion of Participating Insurance: The proportion of participating insurance in new single installment premiums of the agent channel reached 58.6%, a significant year-on-year increase

- Upward Shift to Middle and High-End Customer Segments: The proportion of middle and high-end customers and above increased by 4.8 percentage points year-on-year

- Deep Integration of Products and Services: Deeply integrated insurance products with the health care service ecosystem

The agent channel achieved “stable scale and improved quality” [1]:

| Indicator | Value | Change |

|---|---|---|

| Monthly Average Insurance Agents | 181,000 | Basically flat year-on-year |

| Monthly Average First-Year Total Premium per Core Employee | CND 71,000 | +16.6% |

| 13-Month Policy Persistency Rate | 96.6% | Increased by 2.8 percentage points year-on-year |

The growth rate of China’s auto market sales has slowed down. In 2024, the cumulative retail sales of narrow-passenger vehicles in the domestic market reached 22.89 million units, with a year-on-year growth of 5.49% [3]. As the largest business segment of P&C insurance, the growth rate of auto insurance is basically flat. In the first three quarters of 2025, the original insurance premium income of Pacific P&C Insurance reached CND 160.206 billion, with

The continuous tightening of regulatory policies has a direct impact on the P&C insurance business [4][5]:

- In September 2025, the State Administration of Financial Regulation issued the “Notice on Strengthening the Supervision of Non-Auto Insurance Business (Draft for Comment)”, expanding the “Premium Rate & Expense Compliance” requirement from the auto insurance sector to the non-auto insurance sector [4]

- The “Notice” requires insurance companies to strictly implement the registered insurance clauses and rates, and shall not set high fees that are inconsistent with the services provided

- The reduction of expense ratio restricts the growth of premium scale in the short term

The P&C insurance business is facing multiple cost pressures [3][5]:

- Higher Loss Ratio of New Energy Vehicle Insurance: The claim rate and compensation cost of new energy vehicles are higher than those of traditional fuel vehicles

- Impact of Natural Disasters: Frequent natural disasters such as heavy rainfall in southern China in 2024 led to an increase in claim payments

- Pressure on Combined Ratio: The combined ratio of Pacific P&C Insurance in 2024 was 98.6%, up 0.9 percentage points year-on-year

Competition in the non-auto insurance sector is becoming increasingly fierce [4]:

- Small and medium-sized insurance companies seize market share through price wars

- Irrational competition through high handling fees, long account periods, etc. has emerged in some sectors

- Although leading insurance companies have stable market shares, their growth space is limited

| Value Indicator | 2024 Performance | Investment Implication |

|---|---|---|

| New Business Value | CND 13.258 billion, +20.9% | Foundation for future profit growth |

| New Business Value Margin | 16.8%, +3.5pct | Continuous improvement in business quality |

| Embedded Value | CND 421.837 billion, +4.9% | Core valuation indicator for life insurance companies |

| Net Profit | CND 35.821 billion, +83.4% | Significant improvement in profitability [2] |

Although the growth of the P&C insurance business has slowed down, its operating quality remains stable [1][5]:

- Improvement in Underwriting Profit: In the first half of 2025, the underwriting profit reached CND 35.5 million, with a year-on-year growth of 30.9%

- Optimization of Combined Ratio: In the first quarter of 2025, the combined ratio was 97.4%, down 0.6 percentage points year-on-year

- Stable Leading Position: Pacific P&C Insurance firmly ranks among the top three in the industry, with a stable market share

Current Valuation Level [0]:

| Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 8.10x | At a historical low |

| Price-to-Book Ratio (P/B) | 1.49x | Below the industry average |

| Return on Equity (ROE) | 18.68% | Better than the industry average |

- Interest Rate Risk: A continuous decline in long-term interest rates may affect investment income and reserve accrual

- Transformation Progress: The progress of the “Long Voyage” transformation may fall short of expectations

- Policy Risk: Regulatory policies such as “Premium Rate & Expense Compliance” continue to tighten

- Market Competition: Competition in the life insurance and P&C insurance markets continues to intensify

- Continuous Release of Transformation Dividends from Life Insurance Business: The growth of new business value is accelerating, the product structure and customer structure are continuously optimized, and the bancassurance channel has strong growth momentum

- P&C Insurance Business Provides Stable Support: Although growth has slowed down, underwriting profit has improved, the combined ratio (COR) has been optimized, providing a stable profit foundation

- Valuation at Historical Low: P/E ratio is only 8.1x, P/B ratio is only 1.49x, providing a high margin of safety

- Recovery of Capital Market: In the first three quarters of 2025, total investment income increased, and net profit grew by 19.3% year-on-year [1]

| Assessment Dimension | Rating | Explanation |

|---|---|---|

| Growth | ★★★☆☆ |

The high growth of life insurance offsets the slowdown of P&C insurance, maintaining steady overall growth |

| Profitability | ★★★★☆ |

ROE reaches 18.68%, with a substantial growth in net profit |

| Valuation Attractiveness | ★★★★☆ |

Valuation is at a historical low with sufficient margin of safety |

| Business Quality | ★★★★☆ |

New business value margin continues to improve, product structure is optimized |

| Risk Level | ★★★☆☆ |

Need to pay attention to interest rate risk and transformation progress |

[0] Jinling API - China Pacific Company Profile and Market Data (601601.SS)

[1] Wall Street CN - “China Pacific’s Net Profit Surges 19.3% in the First Three Quarters, with Significant Results from Life Insurance Transformation” (https://wallstreetcn.com/articles/3758356)

[2] China Pacific 2024 Annual Report - Analysis of the Results of “Long Voyage” Transformation and Business Value (https://www.cpic.com.cn/upload/resources/file/2025/03/26/85911.pdf)

[3] Lianhe Ratings - “2025 Property & Casualty Insurance Industry Analysis” (https://www.lhratings.com/file/fda56e6231f.pdf)

[4] Securities Times - “Non-Auto Insurance ‘Premium Rate & Expense Compliance’ Reshapes Half of the P&C Insurance Market” (https://www.stcn.com/article/detail/3588725.html)

[5] Guosen Securities - “Commentary on Non-Auto Insurance ‘Premium Rate & Expense Compliance’: Reshaping the Non-Auto Insurance Ecosystem, Benefiting Underwriting Profit Improvement” (https://pdf.dfcfw.com/pdf/H3_AP202507091705738674_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.