Analysis of the Impact of the Honor Magic 8 Pro Air Launch on the Mid-to-High-End Smartphone Market and MediaTek

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data collected above, I now provide you with a systematic and comprehensive analysis report.

Honor officially launched the new Magic 8 Pro Air on

| Item | Specification |

|---|---|

| Processor | Dimensity 9500 (TSMC 3rd-gen 3nm) |

| Display | 6.31-inch OLED straight screen, 1.08mm ultra-narrow four equal sides, 6000nits peak brightness |

| Battery | 5500mAh Qinghai Lake Battery (917Wh/L energy density) |

| Fast Charging | 80W wired + 50W wireless |

| Camera System | 50MP main camera + 64MP periscope telephoto + 50MP ultra-wide-angle |

| Protection | IP68 & IP69 dual certification, 6m water resistance |

| Unlock | 3D ultrasonic fingerprint |

| Storage Version | Official Price | Price After National Subsidy |

|---|---|---|

| 12GB+256GB | RMB 4,999 | RMB 4,499 |

| 12GB+512GB | RMB 5,299 | RMB 4,799 |

| 16GB+512GB | RMB 5,599 | RMB 5,099 |

| 16GB+1TB | RMB 5,999 | RMB 5,499 |

From Q4 2025 to early 2026, China’s mid-to-high-end smartphone market exhibited the following competitive characteristics:

- Apple iPhone Air (expected to launch in 2026)

- Samsung Galaxy S25 Edge

- Honor Magic 8 Pro Air

The pricing strategy of Honor Magic 8 Pro Air (starting at RMB 4,999) makes its direct competitors the

According to industry data, a total of 28 flagship models shipped over 1 million units each in China in 2025, with domestic brands performing strongly. 11 Huawei flagship models shipped over 1 million units in 2025, and domestic brands such as vivo, OPPO, and Xiaomi also made breakthroughs in the high-end market[5].

The launch of Honor Magic 8 Pro Air marks Honor’s further deepening in the mid-to-high-end market after its independence:

| Strategic Dimension | Analysis |

|---|---|

Product Positioning |

“Lightweight Lifestyle + Powerful Performance”, breaking the industry stereotype that “thin & light phones have poor camera performance and short battery life” |

Target Users |

Young users who pursue a thin & light feel without compromising core experiences |

Pricing Strategy |

Pricing range of RMB 4,999-5,999, covering the core price band of the mid-to-high-end market |

Technological Innovation |

First launch of Honor’s Cicada Wing Architecture, integrated aviation aluminum middle frame, and Qinghai Lake Battery technology |

-

Strengthened Differentiation Advantage: Through the industry’s first combination of 6.1mm ultra-thin design + 5500mAh large battery, Honor has established unique product differentiation in the mid-to-high-end market.

-

Increased Share of Domestic High-End Phones: Honor, together with Huawei, Xiaomi, vivo, and OPPO, forms a domestic high-end camp, which helps further erode Apple and Samsung’s share in China’s high-end market.

-

Price Band Competition: The RMB 4,999 price directly competes with the Apple iPhone standard edition, and is expected to attract original Apple users.

According to the Q3 2025 global smartphone AP-SoC market share report released by

| Vendor | Market Share | YoY Change | Ranking |

|---|---|---|---|

MediaTek |

34% |

+2% |

1 |

| Qualcomm | 24% | -1% | 2 |

| Apple | 18% | +1% | 3 |

| Unisoc | 14% | +3% | 4 |

| Samsung | 6% | -2% | 5 |

| HiSilicon | 3% | +1% | 6 |

MediaTek has ranked first in the global smartphone AP-SoC market for

The Dimensity 9500 was released on September 22, 2025, adopting

- CPU: 3rd-gen all-large-core architecture, consisting of 1 3.73GHz Cortex-X925 super large core, 3 Cortex-X4 super large cores, and 4 Cortex-A720 large cores

- GPU: Immortalis-G925, supporting ray tracing technology

- NPU: “Ultra Performance + Ultra Energy Efficiency” dual NPU architecture

- ISP: Imagiq 1190 image processor

| Indicator | Improvement |

|---|---|

| Single-Core Performance | +32% |

| Multi-Core Performance | +17% |

| Super Large Core Power Consumption | -55% |

| Multi-Core Power Consumption | -37% |

- Supports 4K ultra-high-definition image generation, with 100% improved output performance for 3B-parameter text-to-text large models

- Supports on-device processing of 128K-token long texts

- Supports 144fps gameplay for mainstream games such as PUBG Mobile and Dark Zone Breakout

- Supports 165fps high-frame-rate games

- vivo X300 series

- OPPO Find X9 series

- iQOO Neo11 Pro

- Honor Magic 8 Pro Air[9][10]

-

Enhanced High-End Brand Image

- Honor Magic 8 Pro Air is positioned in the RMB 5,000 price band (close to the Apple iPhone price range). The entry of the Dimensity 9500 chip into the high-end market alongside this model will help enhance MediaTek’s high-end image among consumers.

- Global shipments of the Dimensity 9000 series chips reached approximately 18 million unitsin 2024, a 60% YoY increase, and are expected to reach24 million unitsin 2025[6].

-

Further Consolidated Market Share

- MediaTek has already won a 36%share in the domestic Android flagship market and a58%share in the global non-flagship Android market[6].

- As more high-end models such as the Magic 8 Pro Air adopt the Dimensity 9500, MediaTek’s share in the high-end market is expected to continue to increase.

- MediaTek has already won a

-

Optimized Product Portfolio

- MediaTek simultaneously launched the Dimensity 9500s (flagship) and Dimensity 8500 (light flagship), forming a complete high-end product matrix[11].

- The Dimensity 9500s is designed specifically for gaming enthusiasts, while the Dimensity 8500 targets the mainstream mid-to-high-end market, forming differentiated coverage.

-

AI Capability Empowerment

- The on-device AI capabilities of Dimensity 9500 (generative AI, agent AI) synergize with the AI functions of Honor Magic 8 Pro Air (such as AI Flash Master, AI Color Tracking), enhancing product competitiveness.

| Indicator | Value |

|---|---|

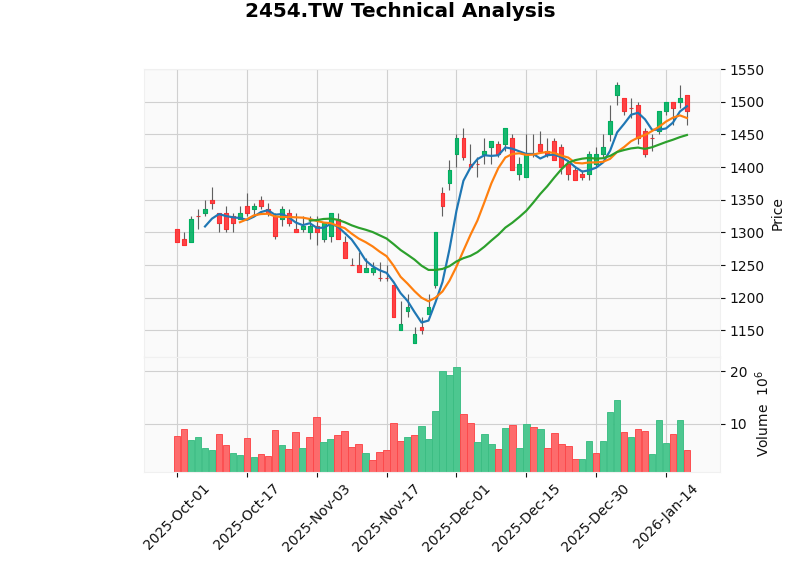

| Latest Closing Price (2026-01-19) | $1,485.00 |

| 52-Week Range | $1,130 - $1,530 |

| 90-Day Price Increase | +13.79% |

| Price-to-Earnings Ratio (P/E) | 22.27 |

| Price-to-Book Ratio (P/B) | 5.63 |

| Price-to-Sales Ratio (P/S) | 4.06 |

| Beta Coefficient | 0.96 |

| Indicator | Value | Signal Interpretation |

|---|---|---|

| MACD | No golden cross appeared | Neutral to Bullish |

| KDJ | K:66.3, D:62.3, J:74.3 | Buy Signal |

| RSI(14) | Normal Range | Neutral |

| 20-Day Moving Average | $1,449.00 | Support Level |

| 50-Day Moving Average | $1,372.10 | Support Level |

According to the financial analysis report[0]:

- Financial Approach: Aggressive accounting treatment, low depreciation/capital expenditure ratio

- Free Cash Flow: NT$140.12 billion (latest data)

- Debt Risk:Low Risk

| Logic Dimension | Analysis |

|---|---|

Market Share |

Ranked first globally for 21 consecutive quarters, with the leading advantage of its 34% market share continuing to expand |

Product Competitiveness |

Dimensity 9500 is technologically leading (3nm, all-large-core architecture), with excellent performance and power consumption performance |

Customer Base |

Full coverage of mainstream brands such as vivo, OPPO, Honor, and Xiaomi |

Opportunities in the AI Era |

Growing demand for on-device AI chips, with Dimensity 9500 having first-mover advantage |

Valuation Level |

P/E ratio of 22.27x, attractive relative to growth expectations |

- Qualcomm Competition: Qualcomm still holds a 24% market share, and its Snapdragon 8 series has brand advantages in the flagship market

- HiSilicon’s Recovery: Although HiSilicon’s share is only 3%, the return of Huawei’s Mate series may bring competitive pressure

- Unisoc’s Growth: Unisoc’s share reached 14% with a 3% YoY increase, posing a threat in the mid-to-low-end market

- Macroeconomy: Fluctuations in overall smartphone market demand may affect chip shipments

Entering the market at a price of RMB 4,999, paired with the Dimensity 9500 flagship chip, Honor Magic 8 Pro Air will have the following impacts:

- Intensified Competition in the RMB 5,000 Price Band: Directly challenges the market position of the Apple iPhone standard edition and Samsung Galaxy S series

- Promoted Domestic High-End Development: Honor, together with Huawei, Xiaomi, and other domestic brands, forms a joint force to enhance the voice of Chinese brands in the high-end market

- Competition in the Innovation Track: The product definition of “thin & light + all-around” may trigger industry follow-up, driving smartphone innovation

- Enhanced Brand Value: The entry of Dimensity chips into the high-end market alongside the Magic 8 Pro Air helps improve consumers’ awareness of MediaTek’s flagship chips

- Consolidated Market Share: Its leading global share of 34% is expected to be further consolidated

- Optimized Product Portfolio: The Dimensity 9500 series and Dimensity 8500 form a complete high-end product matrix, covering a wider price range

- Valuation Support: Technological leading advantages and market share provide fundamental support for the stock price

[1] MyDrivers - “6.31-inch/6.1mm smallest thin phone! Honor Magic8 Pro Air launched: starting at RMB 4,999” (https://www.mydrivers.com)

[2] Honor Official Website - “Putting Pro into Air: The amazing thin & small Honor Magic8 Pro Air is officially launched” (https://www.honor.com/cn/news/honor-magic8-pro-air-launch/)

[3] Notebookcheck - “Honor Magic 8 Pro Air launches as 6.1mm-thin flagship phone” (https://www.notebookcheck.net)

[4] CCTime - “MediaTek launches two chips simultaneously: Dimensity 9500s and 8500 stir the market with flagship-level performance” (http://www.cctime.com)

[5] MyDrivers - “11 Huawei flagship models shipped over 1 million units in 2025” (https://www.mydrivers.com)

[6] Pacific Technology - “MediaTek reclaims the first place in global smartphone AP-SoC market share in Q3 2025” (https://zhuanlan.zhihu.com)

[7] IT Home - “MediaTek tops the Q3 global mobile chip market again with 34% share” (https://www.sohu.com)

[8] Baidu Baike - “Dimensity 9500” (https://baike.baidu.com/item/天玑9500)

[9] NetEase News - “MediaTek launches two chips simultaneously: Dimensity 9500s and 8500 stir the market with flagship-level performance” (https://www.163.com/dy/article)

[10] Sina Tech - “Dimensity 9500 officially released” (https://n.sinaimg.cn)

[11] Counterpoint Research - Global Smartphone AP-SoC Market Share Report (https://www.counterpointresearch.com)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.