In-Depth Analysis of Coca-Cola HBC's African Market Business Expansion Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive collected data, I will provide you with a detailed analysis report.

Coca-Cola HBC AG (London Stock Exchange: CCH.L) is a multinational enterprise focused on bottling and distributing Coca-Cola products, with a business presence across 29 countries in Europe, Africa, and the Middle East. As one of the world’s largest Coca-Cola bottling partners, the company holds an important position in the packaged consumer goods industry thanks to its unique geographic coverage advantages and stable financial performance [0].

As of January 19, 2026, the company’s market capitalization reached $14.21 billion, with a current share price of $3,916. Over the past year, the share price has risen 39.46% cumulatively, and the three-year gain is as high as 102.71%, demonstrating strong long-term growth momentum [0]. The company is scheduled to release its 2025 fourth quarter financial results on February 10, 2026, with market expectations of $2.71 billion in revenue [0].

From a valuation perspective, the company’s current price-to-earnings ratio is 17.99x, and price-to-book ratio is 4.85x. Considering its 27.67% return on equity (ROE) and 8.12% net profit margin, this valuation level is reasonable in the consumer goods industry, reflecting the market’s recognition of the company’s stable profitability [0].

On October 21, 2025, Coca-Cola HBC announced a definitive agreement with The Coca-Cola Company to acquire a controlling stake in Coca-Cola Beverages Africa (CCBA). The transaction values CCBA’s 100% equity at $3.4 billion, and Coca-Cola HBC will acquire a 75% controlling stake for $2.6 billion (approximately 45 billion South African rand) [1][2].

Specifically, The Coca-Cola Company will sell 41.52% of its 66.52% stake, while Gutsche Family Investments (GFI) will sell its entire 33.48% stake. Upon completion of the transaction, Coca-Cola HBC will obtain controlling stake in CCBA, and will have the right to acquire the remaining 25% stake held by The Coca-Cola Company within six years after the transaction closes [2].

- Share best practices and customization capabilities

- Optimize supply chain and distribution networks

- Reduce unit costs and enhance scale effects

- Accelerate product innovation and brand promotion

The acquisition is expected to close by the end of 2026, but it still needs to meet multiple preconditions, including routine regulatory approval and antitrust review. As part of the transaction, Coca-Cola HBC will list secondary on the Johannesburg Stock Exchange to demonstrate its long-term commitment to South Africa and the entire African continent [1][2].

The African market is of strategic importance to Coca-Cola HBC’s long-term growth, based on multiple structural factors:

According to the company’s official disclosures and investor communication materials, Coca-Cola HBC’s African business covers the following key regions:

| Regional Market | Strategic Positioning | Growth Characteristics |

|---|---|---|

Nigeria |

Core market with nearly 75 years of operating history | High population base, driven by consumption upgrade |

East Africa (Kenya, Tanzania, Uganda) |

Key focus region | Steady growth, improved infrastructure |

South Africa |

Regional hub | Mature market, high-endization opportunities |

North Africa (Morocco, etc.) |

Strategic extension | Emerging growth pole |

Other Emerging Markets |

Long-term layout | High growth potential |

The company held a special investor event themed “Nigeria: Deep foundations, long-term growth” on July 15, 2025, hosted by Chief Operating Officer Naya Kalogeraki, which deeply explored the growth foundation and development prospects of the Nigerian market [3].

It is worth emphasizing that CCBA itself has excellent operational qualifications. On January 15, 2026, Coca-Cola Beverages Africa was named “Top Employer in Africa” for the second consecutive year by the Top Employers Institute, and its operations in Ethiopia, South Africa, Tanzania, and Uganda also received national certifications. Botswana, Kenya, and Mozambique received certifications for the first time, and the scores of all certified countries have improved compared to last year [4]. This reflects CCBA’s excellent practices in human resources management and employee development, which will lay a solid talent foundation for the integrated Coca-Cola HBC.

Coca-Cola HBC held an Extraordinary General Meeting (EGM) on January 19, 2026, at its Swiss headquarters at 9:30 local time [5]. Based on contextual background, the core agenda of the meeting is likely to involve the shareholder approval process for the CCBA acquisition.

After completing the CCBA acquisition, Coca-Cola HBC will achieve the following strategic goals:

- Scale Expansion: Become the world’s second-largest Coca-Cola bottling partner

- Geographic Diversification: Significantly increase the revenue share of high-growth African business

- Market Position Strengthening: Establish a near-monopoly distribution network in key African markets

- Capital Efficiency Improvement: Improve operational leverage through scale effects

Based on the latest disclosed financial data (as of January 2026):

| Financial Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings (P/E) | 17.99x | Mid-to-lower range in consumer goods industry |

| Price-to-Book (P/B) | 4.85x | Slightly above industry average |

| Return on Equity (ROE) | 27.67% | Significantly above industry average |

| Net Profit Margin | 8.12% | Stable |

| Operating Profit Margin | 11.29% | Good |

| Current Ratio | 1.14 | Healthy |

The company’s Q2 2025 financial results showed earnings per share (EPS) of $1.14, in line with market expectations; revenue reached $4.8 billion, slightly below the expected $4.92 billion (-2.3%) [0]. Although revenue was slightly lower than expected, the stability of profitability provides financial support for subsequent expansion.

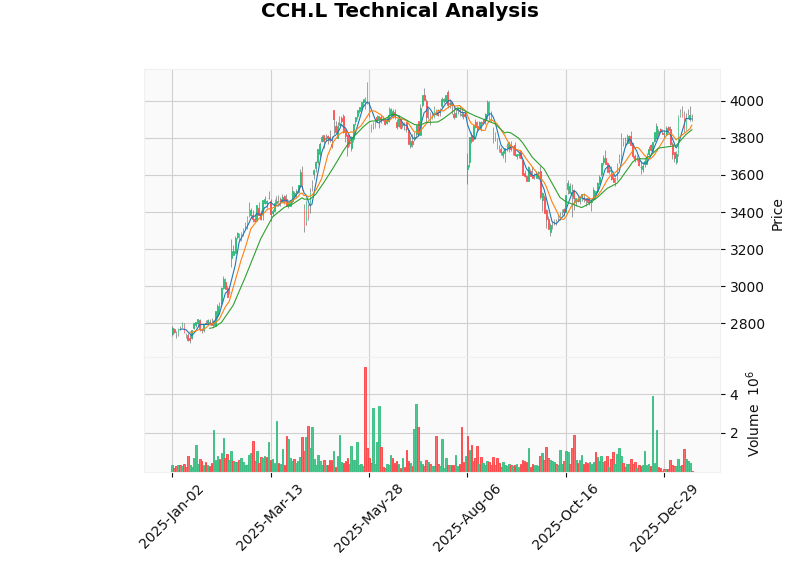

From a technical analysis perspective, Coca-Cola HBC is currently showing a clear upward trend [0]:

- Trend Judgment: In a breakout upward trend, pending confirmation

- Buy Signal: Triggered on January 8, 2026

- Key Support Level: $3,869.40

- Key Resistance Level: $3,972.00

- Next Target Level: $4,041.15

- Beta Coefficient: 0.47 (relative to the S&P 500 Index)

The share price is above the 20-day moving average ($3,844.20) and 50-day moving average ($3,745.00), and the daily volatility standard deviation is 1.28%, indicating relatively stable market trading [0].

Considering the following factors, Coca-Cola HBC’s current valuation level is attractive:

- Growth Premium: The annual return of 39.46% reflects the market’s recognition of the company’s growth prospects

- ROE Support: The 27.67% return on equity supports the current price-to-book ratio level

- Expansion Dividend: The CCBA acquisition is expected to create significant synergies and growth momentum

- Dividend Return: As a mature consumer goods enterprise, the company is expected to maintain or increase dividend distribution

As a multinational enterprise, Coca-Cola HBC faces significant exchange rate risks. Exchange rate fluctuations of multiple African currencies may have a substantial impact on the consolidated financial statements denominated in US dollars/Swiss francs.

Based on comprehensive analysis, Coca-Cola HBC’s long-term growth potential in the African market is driven by the following factors:

| Growth Driver | Impact Level | Time Horizon |

|---|---|---|

| Population Growth and Urbanization | High | Long-term (10-20 years) |

| Middle Class Expansion | High | Medium-to-long term (5-15 years) |

| Channel Penetration Deepening | Medium-High | Medium term (3-7 years) |

| Product Portfolio Upgrade | Medium | Ongoing |

| Operational Efficiency Improvement | Medium-High | Short-to-medium term |

From a strategic perspective, the value of the CCBA acquisition to Coca-Cola HBC is reflected in:

- Scale Effect: Covers two-thirds of Coca-Cola’s sales volume in Africa

- First-Mover Advantage: Establishes a leading position in a fast-growing market

- Platform Effect: Lays the foundation for further expansion in the future

- Brand Synergy: Integrates the best practices of the Coca-Cola system

The chart above shows the share price trend of Coca-Cola HBC (CCH.L) since January 2025. After experiencing fluctuations in the early part of the year, the share price launched a steady upward trend in the second half of the year, and recently approached the key resistance level of $4,000. Technical indicators show that the share price is in an upward channel, and both MACD and KDJ indicators show bullish signals [0].

Coca-Cola HBC’s acquisition of Coca-Cola Beverages Africa is a landmark strategic move in the company’s development history. Through this $2.6 billion transaction, the company will gain absolute leadership in the African market, covering two-thirds of the Coca-Cola system’s sales volume in the continent. With nearly 75 years of operating experience in Africa, a mature management team and strong brand influence, Coca-Cola HBC has the ability to successfully integrate CCBA and unlock huge growth potential.

From a financial perspective, the company’s current valuation level (17.99x P/E ratio, 27.67% ROE) is attractive, and the technical outlook of the share price shows a clear upward trend. After completing the CCBA acquisition, the company’s scale effect and synergy will create significant long-term value for shareholders.

It is recommended that investors focus on the resolution results of the Extraordinary General Meeting on January 19, 2026, the regulatory approval progress of the acquisition, and the fourth quarter financial results to be released on February 10, 2026, which will provide key references for investment decisions.

[0] Jinling API Market Data - Coca-Cola HBC Company Overview, Financial Analysis and Technical Analysis (January 19, 2026)

[1] Deep Research Global - Coca-Cola Company Analysis and Outlook Report 2026 (https://www.deepresearchglobal.com/p/coca-cola-company-analysis-outlook-report)

[2] AdGully - Coca-Cola Strategic Moves and Portfolio Optimization (https://www.adgully.com/tag/29984)

[3] Coca-Cola HBC Official Website - Nigeria Investor Webinar (https://www.coca-colahellenic.com/)

[4] Africa Newsroom - Coca-Cola Beverages Africa Recognised as Top Employer in Africa for 2026 (https://www.africa-newsroom.com/press/cocacola-beverages-africa-recognised-as-a-top-employer-in-africa-for-2026?lang=en)

[5] Nordea - Upcoming General Meetings January 2026 (https://www.nordea.fi/Images/146-557621/upcoming-general-meetings-07-01-2026.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.