In-depth Investment Analysis Report on the Smart Grid Equipment Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have collected sufficient data, and now I will generate a complete investment analysis report on the smart grid equipment sector for you.

In early 2026, the smart grid equipment sector showed a strong explosive momentum. According to the latest market data [1], the power grid equipment sector has achieved a “nine consecutive gains” trend, with over 90% of individual stocks rising. In terms of gain rankings,

This week (mid-January 2026), multiple individual stocks in the sector performed prominently: Sanbian Technology and Yineng Power both rose over 30%, Ankao Smart Electric ranked third with a 29.63% gain, and 17 individual stocks including XD Electric, Changlan Technology, Wansheng Smart, TBEA, and New Scenery all rose by more than 10% [2]. As of 10:07 on January 19, the Wind UHV, Smart Grid, and Virtual Power Plant concept indices rose by more than 6.8%, 5%, and 3.7% respectively [3].

Capital flow data shows high attention from institutional investors to this sector. A total of 5 power grid equipment stocks saw net margin purchases exceeding 100 million yuan this week [2]:

| Stock Code | Stock Name | Net Margin Purchase (100 Million Yuan) |

|---|---|---|

| 600089.SS | TBEA | 10.66 |

| 600406.SS | NARI Technology | 2.00+ |

| 601877.SS | Chint Electric | 2.00+ |

| 000400.SZ | XJ Electric | 1.80 |

| 600445.SH | Jinpan Technology | 1.53 |

As the only ETF product in the market tracking the CSI Power Grid Equipment Theme Index,

According to the 15th Five-Year Plan investment plan disclosed by State Grid Corporation of China,

2026 Specific Investment Forecasts:

- State Grid investment is expected to reach 700 billion yuan, a year-on-year increase of 7.6%

- China Southern Power Grid investment is expected to reach 189 billion yuan, a year-on-year increase of 8.0% [7]

The Ministry of Industry and Information Technology and four other departments jointly issued the Guidelines for the Construction and Application of Industrial Green Microgrids (2026–2030) [4][8], which clearly guides industrial enterprises and parks to promote the construction of green microgrids, expand the application of green power, and drive the industry to upgrade towards energy conservation and carbon reduction.

Goldman Sachs predicts that the global investment scale in digital infrastructure and energy systems driven by AI will reach 5 trillion US dollars in the next 10 years [5]. China’s power equipment exports have performed impressively: from January to November 2025, exports of key power equipment reached 71.5 billion US dollars, a year-on-year increase of 20% [5]. Breakdown as follows:

- Transformer exports increased by 35% year-on-year

- Winding wire exports increased by 24% year-on-year

- Insulator exports increased by 45% year-on-year

- Switchgear exports increased by 29% year-on-year

80% of the U.S. power transformers rely on imports, and a 30% supply gap is expected in 2025, providing huge overseas market opportunities for China’s power grid equipment enterprises [5].

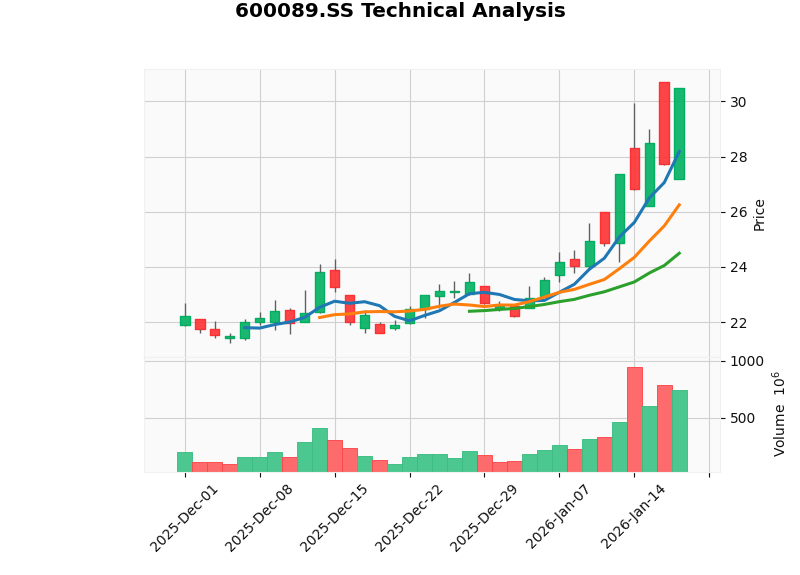

- Total Market Capitalization: 153.12 billion yuan

- Latest Closing Price: 30.50 yuan

- Price-to-Earnings Ratio (PE): 28.77x

- Price-to-Book Ratio (PB): 2.23x

- High Certainty of Performance Growth: Institutional forecasts predict significant net profit growth in 2026 [2]

- Highest Capital Attention: Net margin purchase of 1.066 billion yuan this week, ranking first in the sector [2]

- Overseas Business Breakthrough: Continues to expand international markets in UHV, new energy, and computing power center sectors [2]

- Current price is close to the resistance level of 31.30 yuan

- KDJ Indicator: K value 80.2, D value 75.7, in the overbought zone [9]

- MACD indicator shows a bullish pattern

- Beta coefficient 0.63, relatively low volatility compared to the broader market

| Period | Gain |

|---|---|

| 1 Day | +9.99% |

| 1 Month | +39.40% |

| 3 Months | +61.46% |

| 6 Months | +147.97% |

| 1 Year | +152.27% [10] |

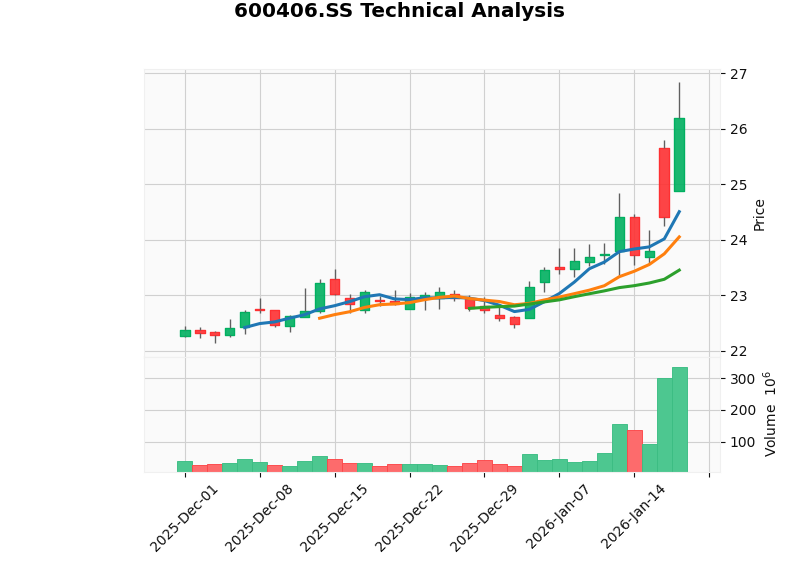

- Total Market Capitalization: 210.43 billion yuan (largest in the sector)

- Latest Closing Price: 26.20 yuan

- Price-to-Earnings Ratio (PE): 26.19x

- Price-to-Book Ratio (PB): 4.25x

- Strongest Profitability: ROE of 16.21% and net profit margin of 12.55%, both ranking highest in the sector [10]

- Healthy Financial Structure: Current ratio of 1.95, quick ratio of 1.54, low financial risk [10]

- Adequate Cash Flow: Latest free cash flow of 9.254 billion yuan [11]

- Optimal Technical Outlook: In a clear upward trend, KDJ shows a bullish signal [9]

- Trend Type: Upward Trend (to be confirmed)

- Support Level: 24.05 yuan

- Resistance Level: 26.84 yuan

- Next Target Level: 27.57 yuan [9]

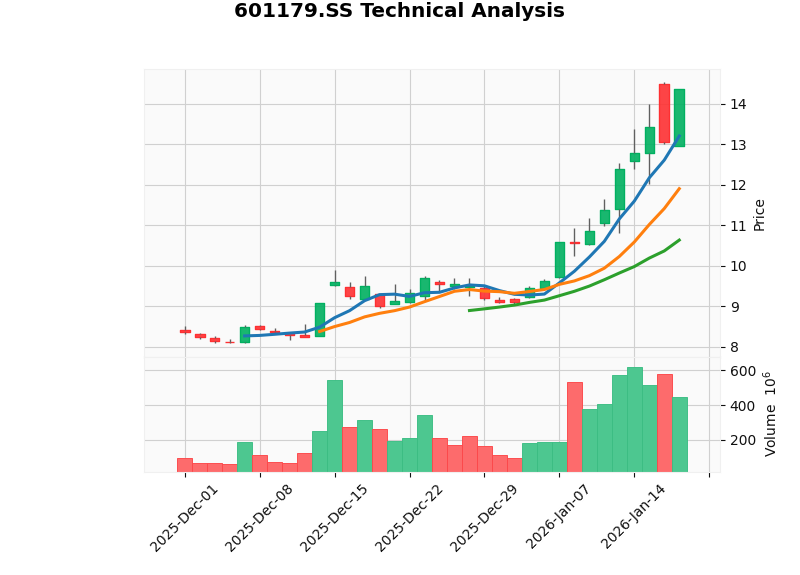

- Total Market Capitalization: 73.61 billion yuan

- Latest Closing Price: 14.36 yuan

- Price-to-Earnings Ratio (PE): 61.04x

- Price-to-Book Ratio (PB): 3.25x

- Leading Gains: 107.51% gain in 3 months, ranking among the top in the sector [10]

- Pure UHV Concept: Benefits from the intensive construction of UHV DC channels [3]

- High Capital Attention: Continuously sought after by margin traders

- Current price is trading within the range [10.63, 14.75]

- KDJ Indicator: K value 86.5, D value 83.6, J value 92.3, in a severely overbought state [9]

- MACD shows a bullish pattern

- Beta coefficient 0.71, with certain elasticity relative to the broader market

| Period | Gain |

|---|---|

| 1 Day | +10.04% |

| 1 Month | +57.11% |

| 3 Months | +107.51% |

| 6 Months | +126.50% [10] |

- Total Market Capitalization: 6.46 billion yuan (small-cap stock)

- Latest Closing Price: 21.97 yuan

- Price-to-Earnings Ratio (PE): 78.39x

- Price-to-Book Ratio (PB): 7.42x

- Gain Champion: Cumulative gain of 59.50% since 2026, ranking first in the sector [2]

- Small Market Cap, High Elasticity: Suitable for participation by aggressive investors

- Extremely High Valuation: PE of 78.39x and PB of 7.42x, with risks of valuation bubble [10]

- Weak Profitability: ROE of only 6.85% and net profit margin of 4.28% [10]

- Overbought Technical Outlook: KDJ is in the overbought zone, and RSI indicates overbought risk [9]

- Total Market Capitalization: 40.35 billion yuan

- Latest Closing Price: 59.24 yuan

- Price-to-Earnings Ratio (PE): 41.02x

- Price-to-Book Ratio (PB): 5.30x

- Major Overseas Order Breakthrough: Successfully won an EPCI general contract for UHV submarine cables and installation for the Asian regional marine energy interconnection, with a total amount of 1.9 billion yuan [2]

- Impressive Bidding Results: Recently won new orders totaling 955 million yuan from State Grid and China Southern Power Grid [2]

- Good Profitability: ROE of 13.67% and net profit margin of 10.01% [12]

- Currently in a sideways consolidation phase

- Trading Range: [58.11, 60.51]

- KDJ shows a bearish pattern (K value 30.2) [9]

- MACD shows a bearish pattern

Based on consistent forecasts from three or more institutions, power grid equipment stocks are expected to see strong performance growth in 2026 [2]:

| Stock Code | Stock Name | 2026 Net Profit Growth Forecast |

|---|---|---|

| 600869.SH | Far East Holding | 66%+ |

| 603051.SH | Guangxin Technology | 52% |

| 688191.SH | Zhiyang Innovation | 41% |

| 301031.SZ | Zhongrong Electric | 30%+ |

| 603606.SH | Orient Cable | 30%+ |

| 600445.SH | Jinpan Technology | 30%+ |

| 300001.SZ | TGood | 30%+ |

According to the research report from CITIC Securities [6], two key directions are recommended:

- Leading Enterprises Related to Domestic Grid Investment Prosperity: Targets closely related to major projects such as UHV, flexible DC, and digital intelligence

- Enterprises Catering to Both Domestic and Overseas Demand: Leading enterprises that benefit from domestic major construction investment as well as demand from emerging overseas fields such as AI

| Stock Code | Stock Name | Comprehensive Score | Investment Suggestion |

|---|---|---|---|

| 600089.SS | TBEA | ⭐⭐⭐⭐⭐ | Top Leader, Buy on Pullback |

| 600406.SS | NARI Technology | ⭐⭐⭐⭐⭐ | Optimal Fundamentals, Long-term Allocation |

| 601179.SS | XD Electric | ⭐⭐⭐⭐ | Large Short-term Gains, Cautious on Chasing Highs |

| 002112.SZ | Sanbian Technology | ⭐⭐⭐ | High-risk Speculation, Quick In and Out |

| 603606.SS | Orient Cable | ⭐⭐⭐⭐ | Robust Fundamentals, Accumulate on Dips |

| 600312.SS | Pinggao Electric | ⭐⭐⭐⭐ | Technical Breakthrough, Upward Trend |

- The only ETF in the market tracking the CSI Power Grid Equipment Theme Index

- 88% weight in smart grid, the highest in the market

- 65% weight in UHV, the highest in the market

- Diversified investment, avoiding single-enterprise risks

- Net inflow of over 1.9 billion yuan in 5 days, high capital attention

- Risk of Excessive Short-term Gains: The sector has seen large short-term gains, and some individual stocks face pullback pressure

- Valuation Risk: Small-cap stocks such as Sanbian Technology are overvalued

- Risk of Policy Underperformance: Grid investment progress may be affected by macroeconomic factors

- Risk of Raw Material Price Fluctuations: Fluctuations in prices of raw materials such as copper and aluminum affect gross profit margins

| Stock Code | Stock Name | MACD Signal | KDJ Signal | RSI Signal | Trend Judgment |

|---|---|---|---|---|---|

| 600089.SS | TBEA | Bullish | Overbought Warning | Overbought Risk | Sideways Consolidation |

| 600406.SS | NARI Technology | Bullish | Bullish Signal | Overbought Risk | Upward Trend |

| 601179.SS | XD Electric | Bullish | Overbought Warning | Overbought Risk | Sideways Consolidation |

| 002112.SZ | Sanbian Technology | Bullish | Overbought Warning | Overbought Risk | Sideways Consolidation |

| 603606.SS | Orient Cable | Bearish | Bearish Signal | Normal Range | Sideways Consolidation |

| 600312.SS | Pinggao Electric | Bullish | Overbought Warning | Overbought Risk | Upward Trend [9] |

The smart grid equipment sector is in a period of dual positive catalysts from the 15th Five-Year Plan investment cycle and explosive overseas AI-related power demand, with the following characteristics:

- High Policy Certainty: The 4 trillion yuan investment plan by State Grid provides clear growth space for the industry

- Promising Performance Growth: The vast majority of power grid equipment stocks will achieve year-on-year positive growth in 2026

- Relatively Reasonable Valuation: The sector’s overall PE is about 30x, which is at the historical median level

- Continuous Capital Inflow: Margin traders and ETF funds continue to increase positions

- NARI Technology (600406.SS): Most robust fundamentals, strongest profitability, upward trend

- TBEA (600089.SS): Stable leading position, highest capital attention, high certainty of performance growth

- Orient Cable (603606.SS): Overseas order breakthrough, solid fundamentals, sufficient adjustment

- Sbian Technology (002112.SZ): Gain champion, high elasticity, but high risk

- XD Electric (601179.SS): Benefits from UHV construction, but short-term gains are excessive

- Conservative Investors: Focus on allocatingNARI Technology, supplemented byPower Grid Equipment ETF (159326)

- Aggressive Investors: PositionTBEAandOrient Cableon pullbacks

- Extremely Aggressive Investors: May moderately participate in short-term speculation ofSbian TechnologyandXD Electric

[1] Surge! 4 Trillion Yuan Targets the Sector - FX168 Financial News

[5] AI-driven Trillion-yuan Grid Investment, the Sector Faces Multiple Positive Catalysts - Caifuhao

[7] China Galaxy Securities: Domestic Grid Investment Exceeds 1 Trillion Yuan per Year - 9fzt

[8] Grid Investment Faces Certain Opportunities, Power Grid Equipment ETF Sees Capital Inflows - Hexun

[9] Jinling AI Technical Analysis Data [0]

[10] Jinling AI Company Profile Data [0]

[11] Jinling AI Financial Analysis Data [0]

[12] Jinling AI

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.