In-Depth Analysis of the Investment Value of Exclusive Commercial Pension Insurance with 3% Crediting Rate

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the above data and professional analysis, I will provide you with a systematic and comprehensive investment value analysis report on exclusive commercial pension insurance.

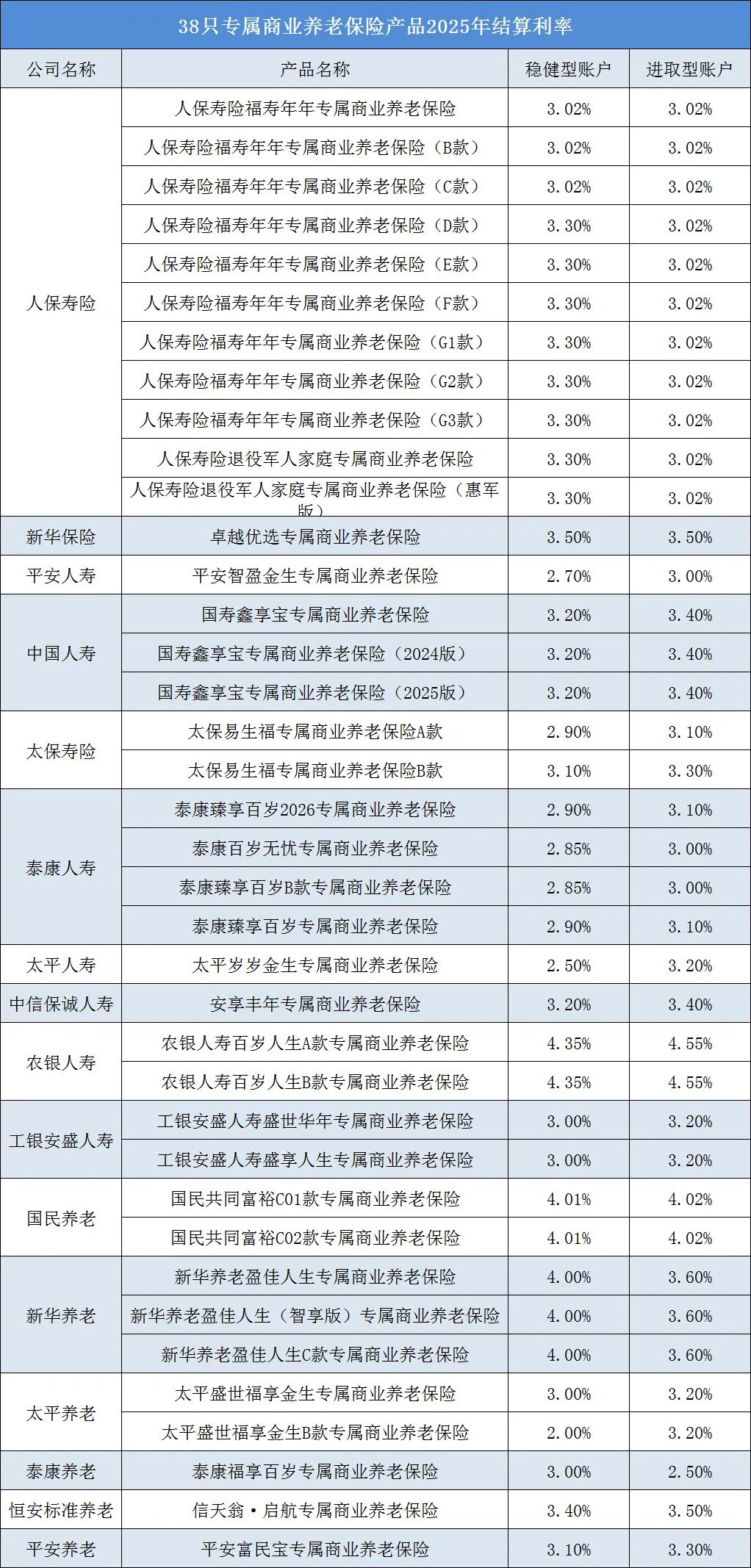

According to the latest disclosed data, the 2025 crediting rates of 40 exclusive commercial pension insurance products released by 16 insurance institutions feature

| Account Type | Average Crediting Rate | Interest Rate Range | Percentage of Products with Rate Above 3% |

|---|---|---|---|

| Conservative Account | 3.29% | 2.00%-4.35% | 80% (32/40 products) |

| Aggressive Account | 3.33% | 2.50%-4.55% | 95% (38/40 products) |

- ABC Life Centennial Life Plan A/B: Conservative Account 4.35%, Aggressive Account 4.55% (highest in the market)

- National Pension Common Prosperity C01/C02: Conservative Account 4.01%, Aggressive Account 4.02%

- New China Pension Yingjia Life Series: Conservative Account 4.00%, Aggressive Account 3.6% [3][4]

Against the current macro environment of

| Product Type | Current Interest Rate Level | Excess Return of Exclusive Commercial Pension Insurance |

|---|---|---|

| 3-Year Time Deposit | 1.10%-1.55% | +1.74% to +2.19% |

| 5-Year Time Deposit | 1.10%-1.35% (some banks have suspended sales) | +1.94% to +2.19% |

| Large-denomination Certificate of Deposit (1-3 months) | 0.90% | +2.39% and above |

The interest rates of large-denomination certificates of deposit of the six major state-owned banks have fully entered the

| Product Type | Average Yield | Risk Characteristics | Advantages of Exclusive Commercial Pension Insurance |

|---|---|---|---|

| R1-Rated Bank Wealth Management Product | 2.44% | Low risk, non-principal-guaranteed | +0.85% excess return, principal guaranteed |

| R2-Rated Bank Wealth Management Product | 2.06% | Medium-low risk, non-principal-guaranteed | +1.23% excess return, principal guaranteed |

| R3-Rated Bank Wealth Management Product | 3.84% | Medium risk, high volatility | Similar yield, lower risk |

It is worth noting that the median yield of medium- and long-term R2-rated bank wealth management products in 2025 was only

Since the pilot launch of exclusive commercial pension insurance in 2021, crediting rates have experienced a clear downward cycle:

| Year | Crediting Rate of Conservative Account | Crediting Rate of Aggressive Account | Market Environment |

|---|---|---|---|

| 2021 | 4.0%-6.0% | 5.0%-6.1% | High interest rate environment |

| 2022 | 3.5%-5.0% | 4.0%-5.0% | Interest rates start to decline |

| 2023 | 3.0%-4.5% | 3.5%-5.0% | Continuous interest rate cut cycle |

| 2024 | 2.5%-4.1% | 3.0%-4.2% | Low interest rate environment |

| 2025 | 2.0%-4.35% | 2.5%-4.55% | Stabilized after decline [7][8] |

- The downward trend of crediting rates has stoppedin 2025, and some products have seen rate rebounds

- The crediting rate range of aggressive accounts has “shifted upward” overall, with the highest rate increasing from 4.12% in 2024 to 4.55%

- The China Insurance Research Institute of Beijing Technology and Business University pointed out that the crediting rate is a dynamic adjustment process, and stable returns can still be achieved in the long run[9]

Exclusive commercial pension insurance adopts a dual-account design and offers a

- Conservative Account: Guaranteed interest rate of 1.5%-3% (most newly launched products have reduced it to 1.5%-2%)

- Aggressive Account: Guaranteed interest rate of 0%-1.2% (some products no longer offer a minimum guarantee)

This design ensures a

According to industry insiders, the stable returns of exclusive commercial pension insurance are mainly due to [10]:

- “Fixed Income as Foundation” Strategy: Mainly allocates to ultra-long-term local government bonds, high-grade credit bonds, etc., to lock in long-term returns

- Equity-Enhanced Allocation: Moderately allocates to high-dividend, low-volatility blue-chip stocks to earn dividend income

- Alternative Investment Enhancement: Actively seizes investment opportunities such as public REITs to earn flexible returns

- Cross-Cycle Layout: Leverages the long-term nature of pension insurance funds to obtain “term premium”

As an important part of the

- In 2023, regulators issued the “Notice on Matters Related to Promoting the Development of Exclusive Commercial Pension Insurance”

- The 2024 “Notice on Matters Related to Vigorously Developing Commercial Insurance Annuities” further clarified its positioning

- The products are included in the personal pension product list and enjoy tax-deferred preferential treatment

- The pilot program has been converted to regular operation, and market vitality continues to be released [11]

| Risk Type | Specific Performance | Investor Response Strategies |

|---|---|---|

Interest Rate Risk |

Guaranteed interest rate has been reduced from the initial 3% to 1.5%-2%, and may continue to be lowered in the future | Pay attention to the stability of historical crediting rates |

Return Volatility Risk |

Aggressive accounts are greatly affected by the capital market, and many products experienced “return inversion” in 2025 | Conservative accounts are more suitable for risk-averse investors |

Liquidity Risk |

Funds are locked up for a long period, and the withdrawal period requires reaching the legal retirement age or turning 60 years old | Ensure that the funds do not affect short-term liquidity needs |

Product Discontinuation Risk |

Some high-yield products have been discontinued, and the guaranteed interest rates of newly launched products have generally been lowered | Seize the window period for high-quality products on sale |

- ✅ Those with long-term pension reserve needs: Investors who are more than 10 years away from retirement

- ✅ Conservative risk preference clients: Investors who cannot bear the net value fluctuations of bank wealth management products

- ✅ Flexible employment groups: Self-employed individuals without a fixed occupational annuity plan

- ✅ “Deposit Transfer” demanders: Depositors whose time deposits have matured and are looking for stable alternative products

- ❌ Those with short-term capital turnover needs

- ❌ Investors with high risk preference pursuing excess returns

- ❌ Investors with high requirements for capital liquidity

According to expert recommendations, investors should pay attention to the following when choosing exclusive commercial pension insurance [12]:

- Focus on historical investment returns: Choose products with crediting rates stably above 3% in the past three years

- Pay attention to differences in guaranteed interest rates: The guaranteed interest rates of conservative accounts are generally higher than those of aggressive accounts

- Evaluate the investment capability of insurance companies: Focus on indicators such as investment yield and comprehensive investment yield

- Understand the account conversion mechanism: Some products support flexible conversion between the two types of accounts

- Match your own risk preference: Conservative clients are recommended to choose conservative accounts

| Evaluation Dimension | Rating | Detailed Explanation |

|---|---|---|

Yield Competitiveness |

⭐⭐⭐⭐⭐ | 80% of products have crediting rates above 3%, significantly better than deposits and bank wealth management products |

Principal Safety |

⭐⭐⭐⭐⭐ | Guaranteed + floating model, the guaranteed interest rate of conservative accounts provides a safety bottom line |

Policy Support |

⭐⭐⭐⭐⭐ | Core product of the third pillar of pension finance, policy dividends continue to be released |

Long-Term Stability |

⭐⭐⭐⭐☆ | Signs of stabilization after decline emerged in 2025, and long-term returns are promising |

Liquidity |

⭐⭐⭐☆☆ | Funds are locked up for a long period, with limited liquidity |

- Against the backdrop of continuously declining interest rates, exclusive commercial pension insurance provides an opportunity to lock in long-term stable returns

- Recommended allocation ratio: 20%-30% of household pension reserve assets

- Prioritize products from leading insurance companies with crediting rates stably above 3.5%

- Conservative investors are advised to choose conservative accountsfirst, while aggressive investors can moderately allocate toaggressive accounts

[4] Blue Whale News - Overview of 2025 Crediting Rates of Exclusive Commercial Pension Insurance

[5] Southern Plus - 50 Trillion Yuan of Large-Scale Deposits Are Due Soon

[8] Sina Finance - Competition Among Four Types of Pension Wealth Management Products

[9] Jiemian News - Investment Analysis of Exclusive Commercial Pension Insurance

[10] Beijing Business Daily - Yield Analysis of Exclusive Commercial Pension Insurance

[12] China Times - Recommendations for Personal Pension Product Selection

天箭科技退市风险警示对A股中小板军工概念股投资的警示意义

俄罗斯预算赤字扩大的投资影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.