Ross Cameron vs ORB+Fibonacci: Strategy Comparison for Beginner Traders

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The Reddit discussion reveals a beginner trader’s dilemma between two contrasting approaches, with community consensus favoring caution:

- Risk Assessment: Multiple users warn that Ross Cameron’s strategy is “too fast/risky for brand new traders” [Reddit], with one commenter highlighting Cameron’s recent “$140k loss in an hour” as a cautionary example [Reddit]

- Strategy Suitability: Users report ORB “rarely works on small caps” due to “frequent fake breakouts that reverse sharply” [Reddit], while noting it “aligns with institutional money in high-volume opens” better suited for large caps [Reddit]

- Experience Requirements: Consensus emphasizes beginners should “start small, paper trade extensively, and avoid Ross’s aggressive style until gaining more market time” [Reddit]

- Personal Experiences: One user reports doing well with Ross strategy at small size but “lost when increasing position size” [Reddit], suggesting scaling challenges

- Focuses on short-term scalping of low-float momentum stocks with high volatility

- Cameron’s verified success: $583.15 turned into $10-12.5+ million (explicitly stated as not typical) [1][2]

- Pure scalping approach requiring expensive courses and premium tools [1]

- Most day traders lose money despite Cameron’s personal success [2]

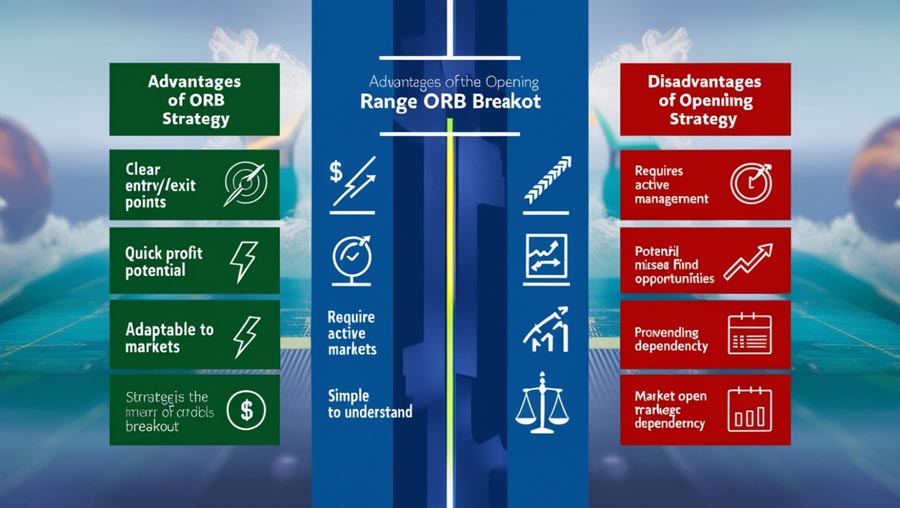

- Identifies breakouts from initial trading range (first 15-30 minutes) enhanced with Fibonacci levels [7]

- Higher win rates (60-70%) compared to momentum strategies (45-55%) [7]

- Lower maximum drawdowns and better risk-adjusted returns [7]

- Range-based stop losses vs percentage-based stops in momentum strategies [7]

- Cameron strategy: High probability of significant losses due to volatility and execution speed requirements

- ORB strategy: False breakouts in low-volume stocks, potential for missed opportunities in momentum markets

- Both strategies require extensive screen time and psychological discipline

- Hybrid approach: Using ORB for market entry timing while incorporating momentum principles for stock selection

- Progressive scaling: Starting with ORB+Fib for consistency, then adding Cameron-style scalps with proven profits

- Market segmentation: Applying ORB to large caps/indexes and momentum strategies to select low-float stocks

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.