Analysis of the Impact of Geopolitical Risks on the US Dollar and Asian Foreign Exchange Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and information I have collected, here is a comprehensive analysis report for you.

US President Donald Trump announced on social media on January 17, 2026 that he would impose a

As a region rich in strategic resources, Greenland possesses abundant rare earth minerals, uranium ore, and petroleum resources. This tariff threat is not only an escalation of trade frictions but also a manifestation of geopolitical games. The EU has announced that it is coordinating a series of countermeasures, including imposing tariffs on US imports worth

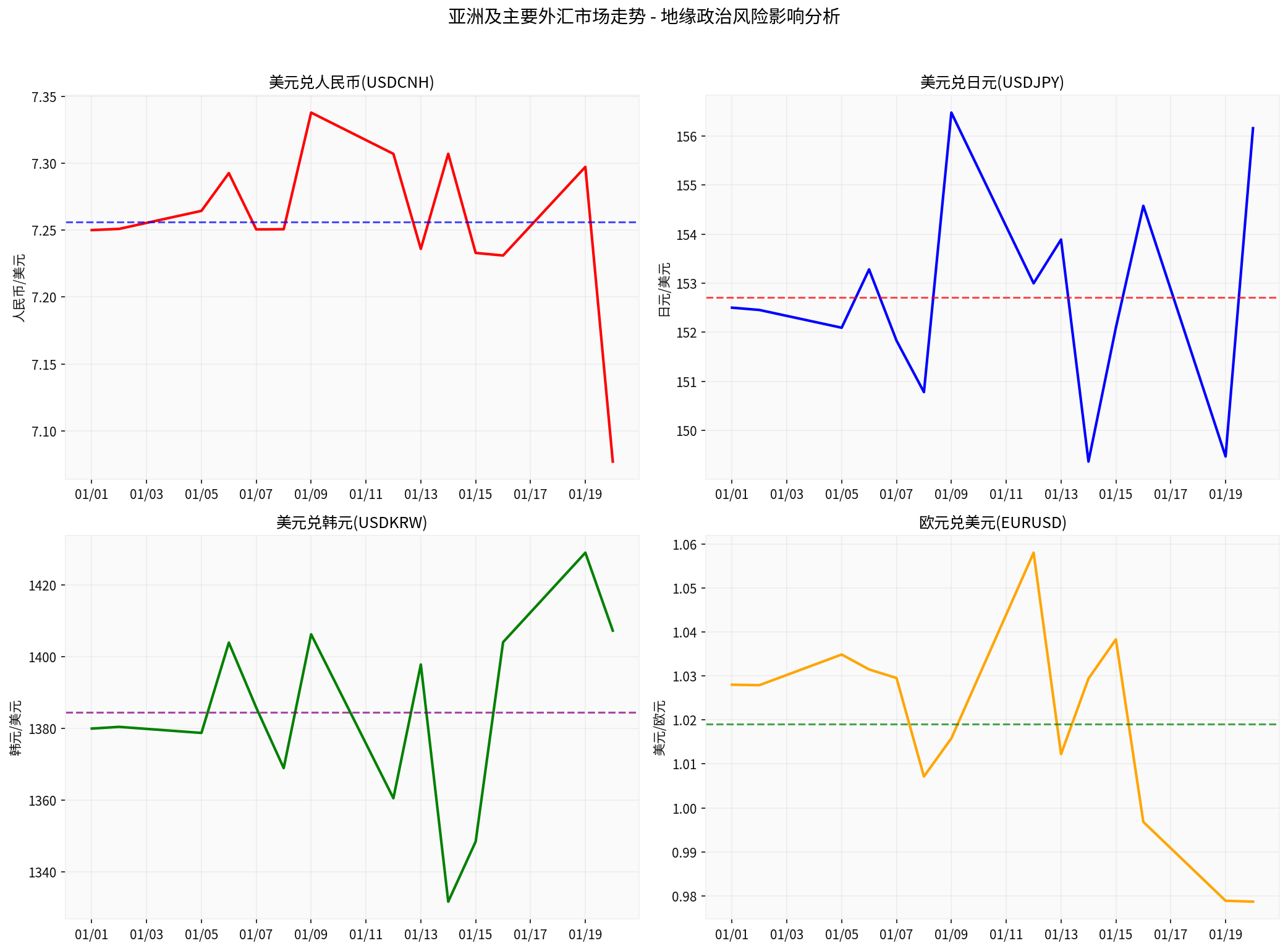

The market’s response to this news was rapid and significant:

| Asset Class | Immediate Reaction | Trend Judgment |

|---|---|---|

| US Dollar Index | Fell immediately, under pressure around the 99.40 level | Short-term Weak |

| Spot Gold | Surged above $4,670 per ounce | Strong Safe-Haven Demand |

| EUR/USD | Pressured within the 1.16-1.17 range | Oscillating Weak |

| Asian Currencies | Divergent trends, rising risk aversion | Increased Volatility |

-

Geopolitical Risk Premium: Concerns about a US-EU tariff war triggered by the Greenland tariff issue are eroding market confidence in the US dollar. The US Supreme Court’s delay in ruling on the legality of the tariff policy has heightened uncertainty[3].

-

Federal Reserve Policy Uncertainty: Remarks threatening to sue Federal Reserve Chairman Powell have sparked market concerns about the independence of the US central bank, which could undermine the credibility of the US dollar as a global reserve currency[1].

-

Capital Flow Shifts: The booming AI industry has attracted global capital into the US, but rising geopolitical risks may prompt some funds to shift to safe-haven assets.

Despite short-term pressures, the US dollar’s medium-term resilience remains supported:

- US Economic Soft Landing Expectation: The labor market is cooling moderately, but initial jobless claims remain below market expectations, reinforcing the “soft landing” expectation[1].

- Fed Interest Rate Policy: The market expects the Federal Reserve to release clearer clues about interest rate cuts at its January 27-28 policy meeting, but overall interest rate levels remain attractive.

- Relative Yield Advantage: Despite policy uncertainty, the real yields of US dollar assets remain relatively high.

The RMB exhibits a

- Mid-Rate Performance: The USD/CNY mid-rate was 7.0051 on January 19, 2026[1]

- Volatility Range: Expected to oscillate within the 7.0-7.3 range

- Supporting Factors:

- Record trade surplus provides bottom support

- Central bank emphasizes “range-based volatility” policy

- Increased demand for RMB reserves from multiple countries in the Middle East and Latin America

The yen has become a

- Current Exchange Rate: USD/JPY is oscillating around the 158.48 level[3]

- Appreciation Drivers:

- The Bank of Japan may end negative interest rates in March 2026 and gently lift the yield curve in July

- The US-Japan interest rate differential narrows by 60-80 basis points

- Unwinding of carry trades will drive yen appreciation

- Target Level: UBS’s base case scenario forecasts USD/JPY at 135 by the end of the year, representing an approximate 7% appreciation from current levels

The won is under pressure due to multiple factors:

- Tech Cycle Linkage: As an export-oriented currency, the won is closely linked to the global tech cycle

- Risk Exposure: Rising geopolitical risks increase won volatility

- Allocation Recommendation: Exercise caution in the short term and monitor the performance of the tech sector

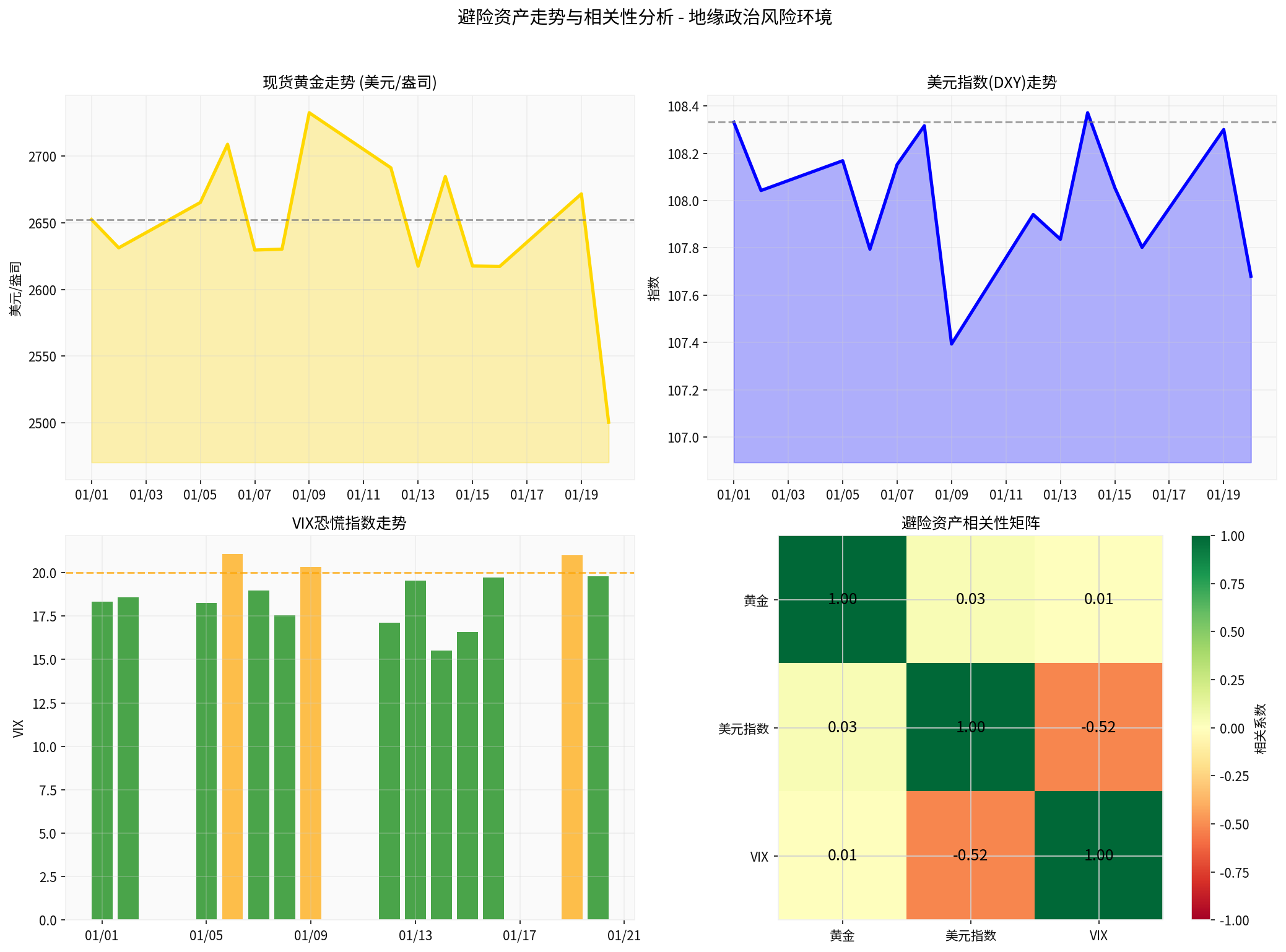

Gold has performed

| Indicator | Value |

|---|---|

| Spot Gold Price | Approaching $4,700 per ounce[4] |

| Year-to-Date Gain | Historic surge of over 60% |

| Institutional Target Price | Everbright Securities forecasts $4,950 per ounce |

| Upside Drivers | Weakening US dollar credit + Central bank gold purchases + Safe-haven demand |

- Long-Term Cornerstone: Weakening US dollar credit and strategic gold purchases by central banks (emerging market central banks hold only 15% of their reserves in gold, far below the 30% level of developed economies)

- Medium-Term Momentum: Fed rate cuts and balance sheet expansion, combined with a weaker US dollar index, provide liquidity impetus

- Short-Term Catalyst: Escalating geopolitical risks trigger safe-haven buying

The VIX index has rebounded from low levels, reflecting changes in market sentiment:

- Current Level: Approximately 19.79 (up 8.02% from the start of the period)

- Risk Warning: If it breaks above the 25 level, vigilance is required against the spread of market panic

- Strategic Implication: When volatility rises, increase allocation to hedging tools such as options

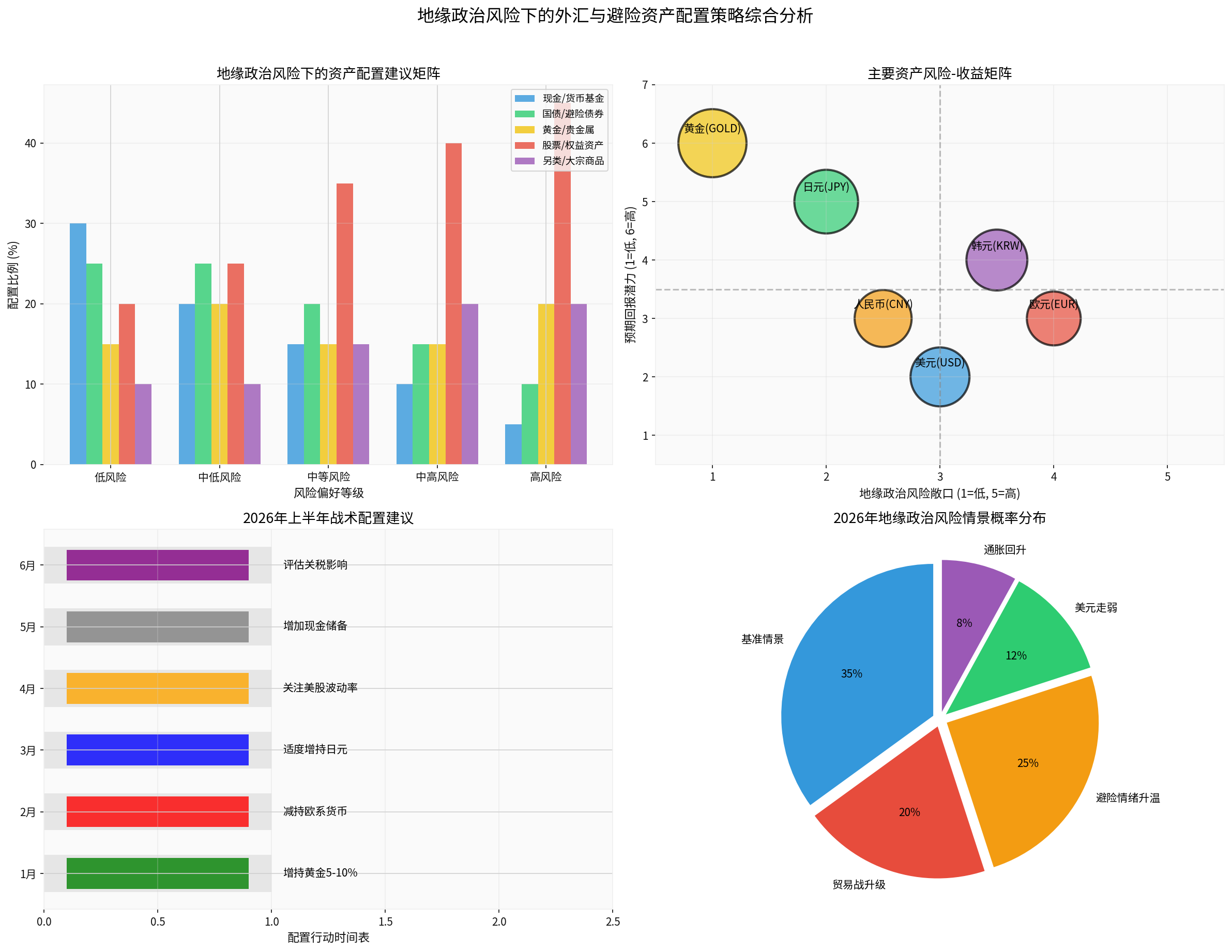

Against the current geopolitical risk backdrop, a

| Asset Class | Allocation Ratio | Strategy Logic |

|---|---|---|

| Cash/Money Market Funds | 30% | Maintain liquidity to address unexpected risks |

| Government Bonds/Safe-Haven Bonds | 25% | Obtain stable returns and hedge against volatility |

| Gold/Precious Metals | 15% | Strategic safe-haven allocation |

| Stocks/Equity Assets | 20% | Underweight, focus on high-dividend assets |

| Alternative Investments | 10% | Appropriate diversification |

| Asset Class | Allocation Ratio | Strategy Logic |

|---|---|---|

| Cash/Money Market Funds | 20% | Maintain moderate liquidity |

| Government Bonds/Safe-Haven Bonds | 25% | Core allocation |

| Gold/Precious Metals | 20% | Increase holdings, strategic bullish outlook |

| Stocks/Equity Assets | 25% | Balanced allocation, focus on tech and dividend sectors |

| Alternative Investments | 10% | Diversify with commodities |

| Asset Class | Allocation Ratio | Strategy Logic |

|---|---|---|

| Cash/Money Market Funds | 10% | Minimum liquidity reserve |

| Government Bonds/Safe-Haven Bonds | 15% | Basic allocation |

| Gold/Precious Metals | 20% | Core safe-haven asset |

| Stocks/Equity Assets | 40% | Capture structural opportunities |

| Alternative Investments | 15% | Increase commodity exposure |

| Currency | Allocation Recommendation | Core Logic |

|---|---|---|

Japanese Yen (JPY) |

Moderately increase holdings | Carry trade unwinding + Central bank policy normalization |

Chinese Yuan (CNY) |

Maintain neutral position | Policy support + Reasonable valuation |

US Dollar (USD) |

Range trading | Short-term pressure, medium-term resilience |

Euro (EUR) |

Moderately reduce holdings | High exposure to geopolitical risks |

South Korean Won (KRW) |

Cautious allocation | Tech cycle volatility + Risk exposure |

For import and export enterprises,

- Export Enterprises: Buy domestic currency call options / Sell foreign currency call options

- Import Enterprises: Buy foreign currency call options / Sell domestic currency call options

- Option Fee Budget: 1.2%-1.5% of the contract amount

- Initial Position: 30% of the target position at the current price

- Add on Pullbacks: Increase position by 10% for every 5% pullback

- Target Allocation: 15%-20% of the total asset portfolio

- Physical Gold: Long-term value preservation, suitable for conservative investors

- Gold ETFs: Convenient trading, suitable for flexible allocation

- Gold Stocks: Leverage effect, suitable for aggressive investors

| Time Node | Key Event | Allocation Action |

|---|---|---|

January - February |

Window before tariff takes effect | Increase gold holdings by 5-10%, reduce exposure to European currencies |

March |

Bank of Japan policy meeting | Evaluate yen trends, moderately increase holdings |

April - May |

Earnings season and policy observation period | Monitor US stock volatility, increase volatility hedging tools |

June |

Tariff rate hike window | Increase cash reserves, evaluate the impact of countermeasures |

Based on current information, the 2026 geopolitical risk scenario probability distribution is as follows:

| Scenario | Probability | Asset Allocation Implications |

|---|---|---|

Base Case Scenario |

35% | Trade frictions are manageable, risk assets oscillate upward |

Tariff War Escalation |

20% | Safe-haven assets surge, US dollar comes under pressure |

Rising Risk Aversion |

25% | Gold and Japanese yen benefit, stock market volatility intensifies |

US Dollar Weakening |

12% | Non-US currencies rebound, commodities rise |

Inflation Rebound |

8% | Bonds come under pressure, gold’s anti-inflation value becomes prominent |

- US Dollar Index: If it breaks below the 98 level, vigilance against systemic risks is required

- VIX Index: If it breaks above 25, safe-haven sentiment may accelerate

- US Treasury Yield Curve: A flattening 2-year/10-year yield curve signals economic slowdown

- EU Countermeasures: Substantive countermeasures may trigger a chain reaction

- Set Stop-Loss Levels: Maximum loss for a single asset should not exceed 5% of the portfolio

- Dynamic Rebalancing: Evaluate allocation ratios monthly and rebalance accordingly

- Liquidity Management: Maintain 20%-30% of assets in cash or highly liquid instruments

- Hedging Tools: Appropriately allocate to options and VIX-related products

-

US Dollar: Short-Term Pressure, Medium-Term Resilience: Geopolitical risks are weakening the US dollar’s short-term performance, but US economic fundamentals and relative yield advantages provide medium-to-long-term support.

-

Increased Volatility in Asian Forex Markets: The RMB remains relatively stable, the yen is poised to benefit from carry trade unwinding, while the won is under pressure.

-

Gold’s Allocation Value Prominent: Driven by weakening US dollar credit, central bank gold purchases, and safe-haven demand, gold’s medium-term upward logic is solid.

-

Defense-Based Allocation Strategy: Increase holdings of safe-haven assets, maintain moderate liquidity, and focus on volatility management.

The 2026 geopolitical landscape is expected to shift from “chaos to ordered confrontation”, with reduced uncertainty but persistent risks of unpredictable “black swan” events. In this environment, investors should:

- Strategically: Adhere to defensive positions and reduce exposure to high-valued assets

- Tactically: Capture structural opportunities in commodities and equities as the economy bottoms out and rebounds

- Risk Management: Maintain flexibility and adjust allocations timely to respond to unexpected shocks

[1] Yongyi-Financial Vision: Has the US-EU Tariff War Officially Begun? Volatility Across Multiple Markets (https://www.yanglee.com/information/Details.aspx?i=140034)

[2] Ranking of Asian Currencies, 2026 Forecast of Asia’s Most Promising Currencies (https://www.ebc.com/zh-cn/jinrong/282382.html)

[3] Daily Investment Bank/Institution View Summary (2026-01-15) - Market Reference (https://xnews.jin10.com/details/206975)

[4] Gold Price Approaches $4,700 per Ounce, Multiple Geopolitical Risks Drive a Historic Rally! (https://www.21jingji.com/article/20260119/herald/d6bec9df2dee127502635eccdc5a29a0.html)

[5] Breaking the Deadlock and Pursuing Innovation, Moving Toward a New Balance - 2026 Annual Macro Strategy Outlook (Strategy Section) (https://finance.sina.com.cn/stock/report/2025-12-22/doc-inhcsexp6338335.shtml)

[6] US Dollar Led Last Week’s Forex Rally; This Week’s Economic Data and Geopolitical Risks Draw Attention (https://www.cmegroup.com/cn-s/education/cloud-hands/2026-01-13.html)

[7] Uncertainty in the Global Crude Oil Market Rises in 2026 (http://jjckb.xinhuanet.com/20260120/87f5356fc2794e99ab92006be284e8ee/c.html)

[8] Greenland Contest Escalates! Trump’s Tariff Stick Targets Europe, Gold Price Surges (https://finance.sina.com.cn/money/nmetal/hjzx/2026-01-19/doc-inhhuvaf7089109.shtml)

Report Generation Date: January 20, 2026

Data Sources: Jinling AI Financial Analysis Database, Public Market Information

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.