Analysis of the Impact of China's Consumption Promotion Policy Shift to the Service Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

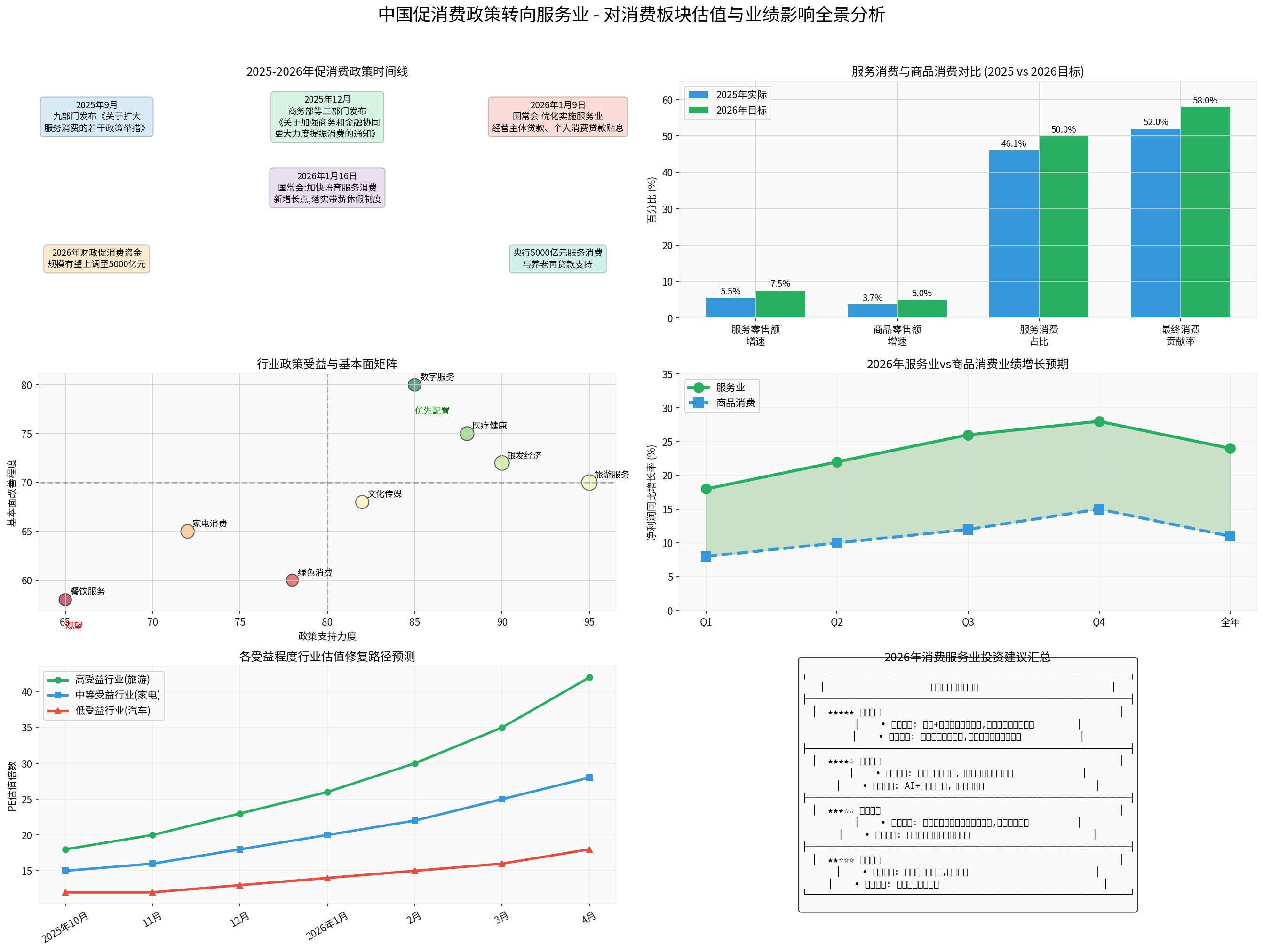

Based on the latest policy developments and market data analysis, the following is an in-depth analysis report on the impact of China’s consumption promotion policy shift to the service industry on the valuation and performance prospects of the consumption sector and listed service industry companies:

Since 2025, the focus of China’s consumption promotion policies has shifted comprehensively from traditional goods consumption (such as trade-in programs for home appliances and automobiles) to

- Consumption Structure Upgrading: In 2025, service retail sales grew 5.5% year-on-year, 1.7 percentage points faster than goods retail sales; the proportion of service consumption expenditure in per capita household consumption expenditure reached 46.1%[1]

- Contribution to Economic Growth: In 2025, the contribution of final consumption expenditure to economic growth reached 52%, becoming the main driving force and stabilizer of economic growth[1]

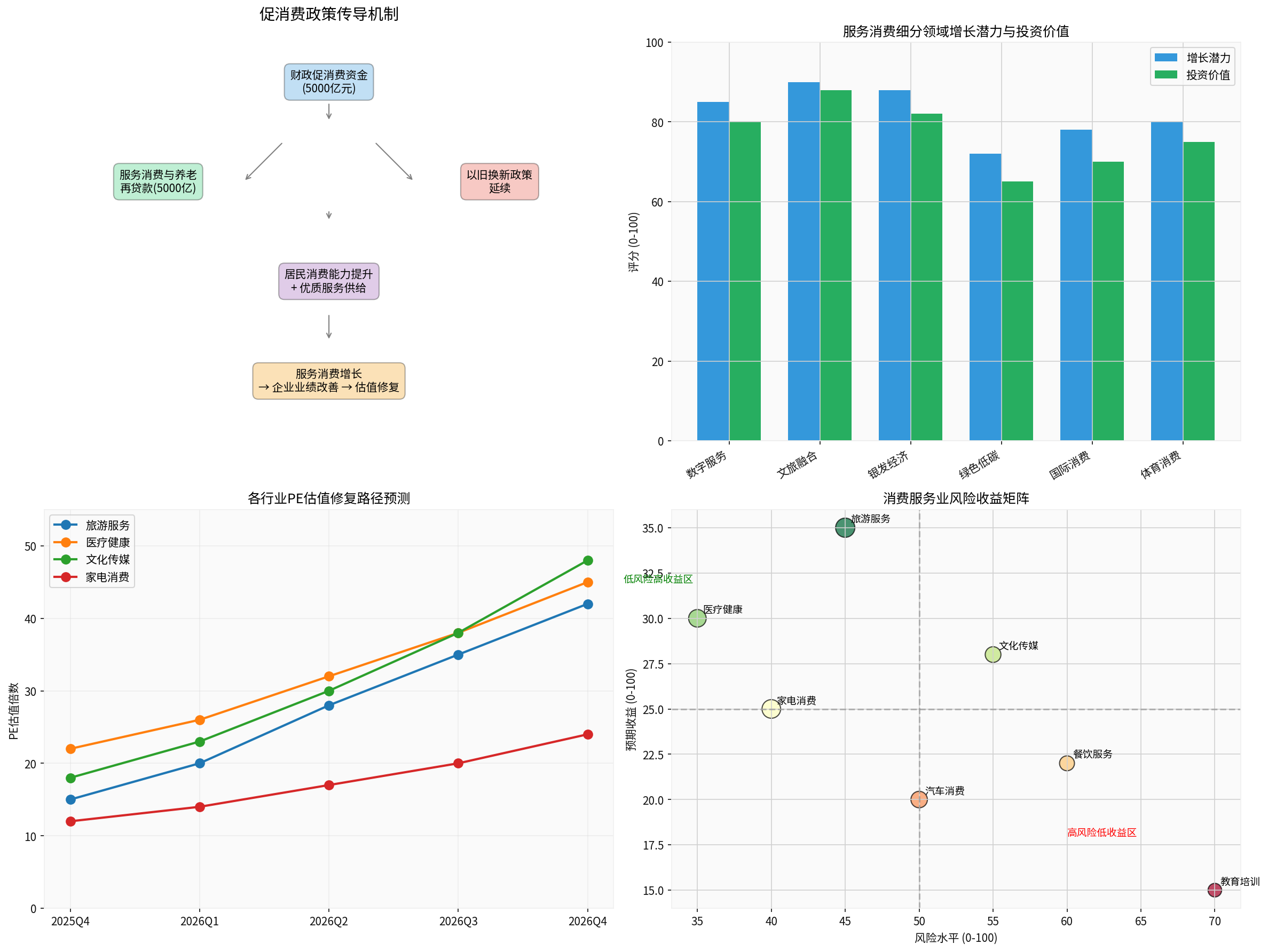

- Policy Tool Innovation: The People’s Bank of China’s RMB 500 billion reloan for service consumption and elderly care, as well as the RMB 500 billion fiscal consumption promotion fund, will serve as the main policy supports[2]

According to the arrangements made at the State Council executive meeting on January 16, policies will focus on five key areas[1][3]:

| Key Area | Specific Measures | Beneficiary Industries |

|---|---|---|

| Digital Service Consumption | Cloud entertainment, online education, intelligent health management | Platform economy, educational technology |

| Cultural and Tourism Integrated Consumption | Intangible cultural heritage experiences, rural tourism, “sports + tourism” | Tourism, hotels, performing arts |

| Silver Economy | Home-based elderly care, rehabilitation care, intelligent companionship | Healthcare services, elderly care industry |

| Green and Low-Carbon Services | New energy vehicle after-sales market, green travel | Travel services, environmental protection |

| International Consumption Services | Duty-free shopping, cross-border healthcare, high-end exhibitions | Retail, healthcare, tourism |

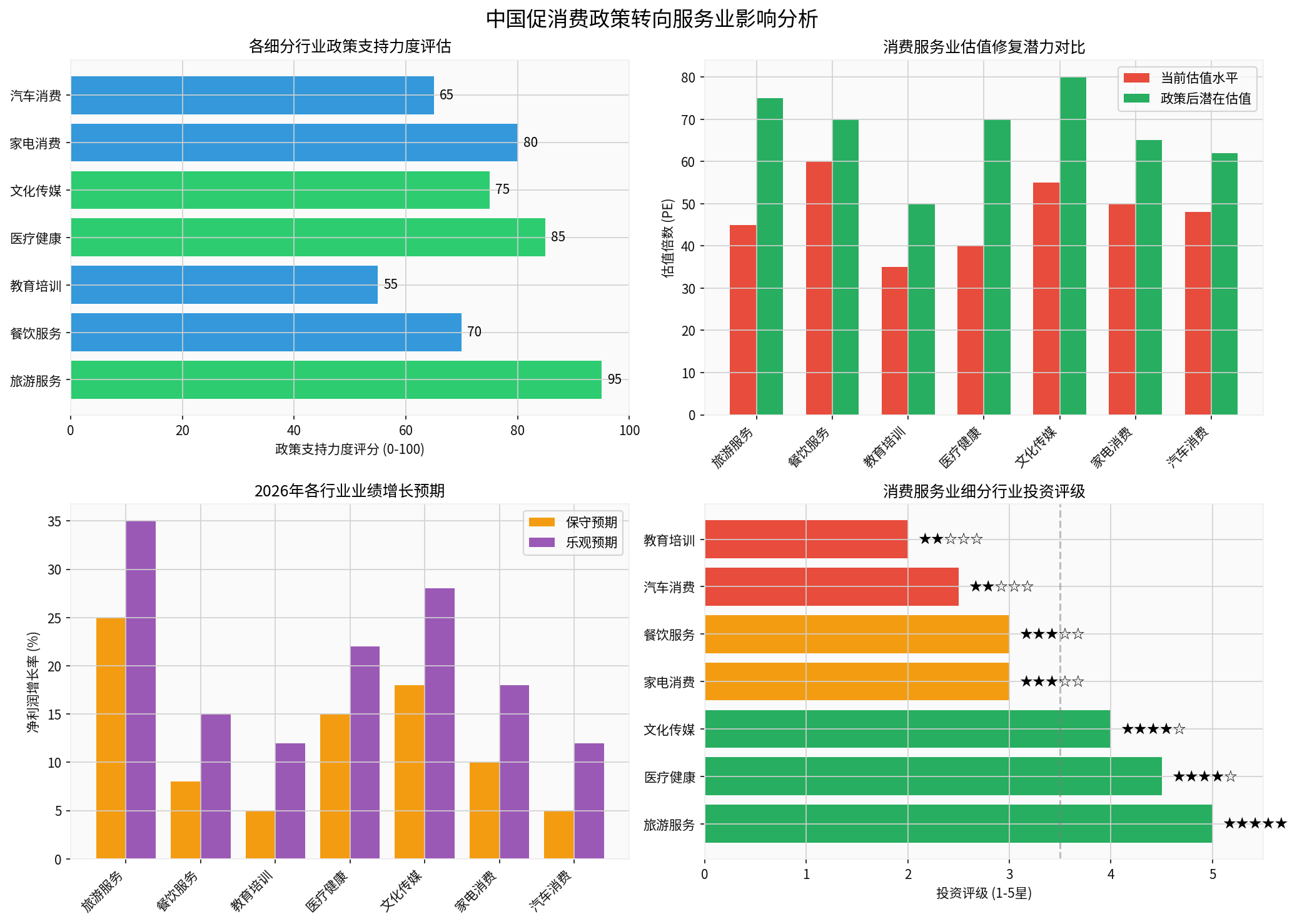

The policy shift will lead to significant valuation differentiation within the consumption sector:

- Tourism Services: Policy support rating of 95 points, expected PE valuation repair range of 30-50%

- Healthcare: Continuous policy support for the silver economy, valuation repair range of 25-35%

- Cultural Media: Rise of experiential consumption, valuation repair potential of 30-40%

- Automobile Consumption: Gradual market saturation, diminishing marginal policy effects, valuation under pressure

- Education and Training: Sustained regulatory pressure, limited valuation repair

Based on the industry analysis framework, the growth potential and investment value of segmented service consumption areas show the following characteristics:

| Segmented Area | Growth Potential Rating | Investment Value Rating | Valuation Upside |

|---|---|---|---|

| Cultural and Tourism Integration | 90 | 88 | High |

| Silver Economy | 88 | 82 | High |

| Digital Services | 85 | 80 | Medium-High |

| Sports Consumption | 80 | 75 | Medium-High |

| International Consumption | 78 | 70 | Medium |

| Green and Low-Carbon | 72 | 65 | Medium |

- Expansion of Service Consumption: The 2026 service retail sales growth target is 7.5%, an increase of 2 percentage points from 2025[2]

- Consumption Scene Innovation: The 9-day Spring Festival holiday (the “longest in history”) will directly drive service consumption in tourism, catering, transportation, and accommodation[1]

- Implementation of Paid Vacation System: A stable and predictable vacation system will promote the shift of consumption from concentrated holidays to balanced distribution throughout the year[1]

- Reduced Financing Costs: The reloan for service consumption and elderly care will reduce the financial costs of service industry enterprises[3]

- Emergence of Scale Effects: Policy support will promote industry integration and increase the market share of leading enterprises

- Digital Transformation: Application of AI technology improves operational efficiency and reduces unit costs

Based on profit model calculations, the service industry has a high fixed cost structure, and revenue growth will bring greater profit elasticity:

| Industry | 2026 Net Profit Growth Rate (Conservative) | 2026 Net Profit Growth Rate (Optimistic) |

|---|---|---|

| Tourism Services | 25% | 35% |

| Healthcare | 15% | 22% |

| Cultural Media | 18% | 28% |

| Home Appliance Consumption | 10% | 18% |

| Catering Services | 8% | 15% |

┌─────────────────────────────────────────────────────────────┐

│ Investment Ratings and Allocation Recommendations │

├─────────────────────────────────────────────────────────────┤

│ ★★★★★ Strong Buy │

│ • Tourism Services: Dual catalysis of policies + Spring Festival holiday │

│ • Silver Economy: Explosive demand for elderly care services │

├─────────────────────────────────────────────────────────────┤

│ ★★★★☆ Active Allocation │

│ • Cultural Media: Rise of experiential consumption │

│ • Digital Services: AI + new consumption scenarios │

├─────────────────────────────────────────────────────────────┤

│ ★★★☆☆ Cautious Attention │

│ • Home Appliance Consumption: Trade-in programs continue but marginal effects are declining │

│ • Catering Services: High recovery certainty but fierce competition │

├─────────────────────────────────────────────────────────────┤

│ ★★☆☆☆ Neutral │

│ • Automobile Consumption: Industry enters adjustment period │

│ • Education and Training: Policy uncertainty remains │

└─────────────────────────────────────────────────────────────┘

| Industry | Leading Targets | Rationale |

|---|---|---|

| Tourism Services | CYTS (600138), BTG Hotels (600258) | Directly benefit from cultural and tourism integration |

| Healthcare Services | Aier Eye Hospital (300015), Tongce Medical (600763) | Core track of the silver economy |

| Cultural Media | Wanda Film (002739), Enlight Media (300251) | Upgrade of experiential consumption |

| Platform Economy | Meituan (3690.HK), Alibaba (9988.HK) | Carrier of digital service consumption |

- Policy Implementation Risk: Uncertainty exists in the implementation effect of consumption promotion policies

- Macroeconomic Risk: Slow growth of household income may constrain consumption willingness

- Industry Competition Risk: Intensified competition in the service industry may compress profit margins

- Valuation Pullback Risk: Excessive short-term gains may trigger valuation corrections

The shift of China’s consumption promotion policy to the service industry is an inevitable result of consumption structure upgrading and economic growth model transformation.

- Valuation Aspect: Highly benefited industries such as tourism, healthcare, and cultural media will see a 15-30% valuation increase

- Performance Aspect: The overall net profit growth rate of the service industry is expected to reach 15-25%, significantly outperforming goods consumption

- Capital Aspect: Institutional capital will gradually shift from goods consumption to service consumption, with incremental capital continuously entering the market

[1] 21st Century Business Herald - “State Council Executive Meeting Intensively Arranges Consumption Promotion: Service Consumption, Trade-In Programs, and Sinking Markets Become New Priorities” (https://www.21jingji.com/article/20260119/herald/72cdaacd48a7a4906fc84130329ba0ad.html)

[2] Securities Times - “Policy Support for Service Consumption Expected to Increase” (https://www.stcn.com/article/detail/3598937.html)

[3] Securities Times - “Multiple Factors Catalyze Optimism on Allocation Value of the Large Consumption Sector” (https://www.stcn.com/article/detail/3563438.html)

[4] Sina Finance - “Consumption Market Renews in the New Year, the Sector Enters a Resonance Inflection Point!” (https://finance.sina.com.cn/roll/2026-01-19/doc-inhhvsfv6920421.shtml)

[5] Wen Hui Bao - “Promote the Integrated Development of Service Industry Quality Improvement, Efficiency Enhancement, and Consumption Boosting and Expansion” (https://www.jfdaily.com/news/detail?id=1051532)

鱼跃医疗投资重庆蚂蚁消费金融战略分析与财务回报预期

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.