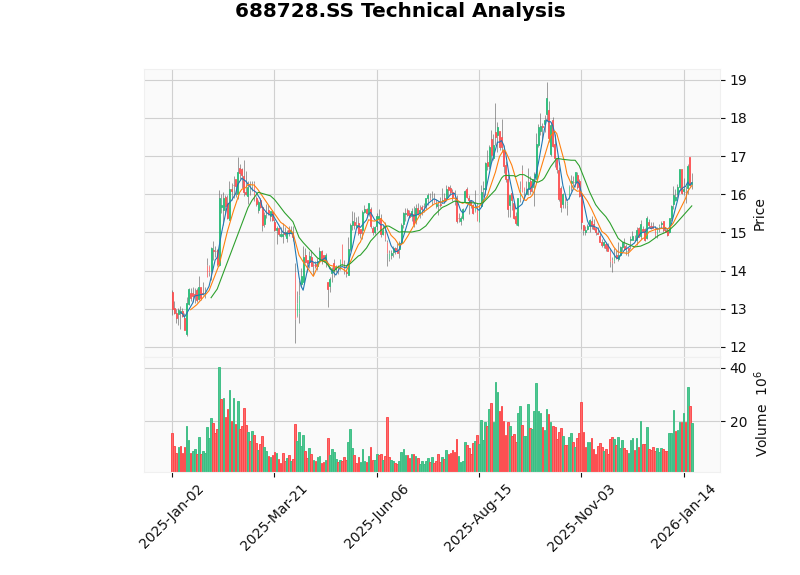

In-Depth Analysis of Yandong Micro's Widening Losses: Strategic Choices Amid Cyclical Downturn Pressures

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive data obtained, I will provide an in-depth analysis of the strategic dilemmas and industry cyclical pressures behind Yandong Micro’s widening losses.

According to the 2025 annual performance forecast released by Yandong Micro, the company expects a full-year net loss of RMB 340 million to RMB 425 million [0]. Notably, the company turned profitable in H1 2025, with a net profit of RMB 127,605,300 [1], indicating a significant performance reversal in H2.

| Drivers | Specific Performance | Impact Level |

|---|---|---|

| Macroeconomic Pressure | Weak demand for consumer products | Pressure on revenue side |

| Intensified Market Competition | Falling product prices, narrowing gross profit margin | Erosion of profit side |

| Increased R&D Investment | 221% surge in 12-inch project investment | Growth on expense side |

| Increased Labor Costs | Raised compensation for R&D personnel | Growth on expense side |

Yandong Micro’s H1 2025 R&D expenses reached

China’s semiconductor industry exhibited significant

| Segment | Prosperity Performance | Performance of Representative Enterprises |

|---|---|---|

| Chip Design | High Prosperity | Cambricon, Hygon Information |

| Memory Chips | High Growth Driven by AI Computing Power | Longsys, Biwin Storage |

| SoC Chips | Short-Term Pressure, Long-Term Optimism | Bestechnic, Rockchip |

| Analog Chips | Cyclical Recovery + Domestic Substitution | Sirui Micro, SG Micro |

Discrete Devices/Power Semiconductors |

Turning Point Emerged |

Wingtech +7215%, Silan Micro +1304%, Yandong Micro +960% |

Yandong Micro’s core business is

- 6-inch SiC Chip R&D: Completed key process optimization for SiC MOSFET [1]

- 12-inch Integrated Circuit Production Line: Concurrent development of multiple process nodes including 28nm, 65nm, 55nm, and 40nm

- Silicon Photonics Process Platform: Took the lead in mass production of silicon photonics process platform, released SiN Silicon Photonics PDK 1.5 [1]

From the perspective of the discrete devices segment, Yandong Micro achieved a

The semiconductor industry features rapid technological iteration and fast development of advanced process nodes, exposing enterprises to multiple risks [1]:

- Continuous Emergence of New Application Scenarios: Sustained new demand for discrete devices and analog integrated circuits

- Rapidly Evolving Demand from Wafer Foundry Clients: Increased requirements for product diversity and stability

- Development of High-Stability Devices Toward Higher Performance: Continuous increase in technical thresholds

Against the backdrop of current semiconductor domestic substitution, Yandong Micro’s R&D investment is strategically necessary [2]:

Core Logic of Domestic Substitution:

├── External technological sanctions force independent controllability

├── Increased policy support for first-of-a-kind (set) products

├── Continued investment from the National Integrated Circuit Industry Investment Fund

└── Global semiconductor equipment market is expected to reach USD 111.88 billion in 2025

| Project | Investment Scale | Progress Status | Strategic Significance |

|---|---|---|---|

| 28nm 12-inch Integrated Circuit Production Line | Continuous Investment | Main workshop and CUB capped | Breakthrough in advanced process nodes |

| 65nm 12-inch Production Line | Continuous Investment | Actively Advancing | Expand production capacity |

| 6-inch SiC Chip | RMB 12 million | Completed Process Optimization | New Energy/Photovoltaic Applications |

| Silicon Photonics Process Platform | Strategic Layout | Achieved Mass Production | Cutting-Edge Technological Breakthrough |

| Indicator | Value | Industry Positioning |

|---|---|---|

| P/E Ratio | 183.22x | High valuation reflects growth expectations |

| P/B Ratio | 5.36x | Moderate |

| ROE | 2.94% | Low, significant profitability pressure |

| Current Ratio | 1.23 | Adequate liquidity |

| Quick Ratio | 0.57 | Short-term solvency requires attention |

| Beta | 0.78 | Lower than market volatility |

- Financial Stance: Conservative (high depreciation/capital expenditure ratio) [0]

- Debt Risk: Medium Risk [0]

- Free Cash Flow: Negative (RMB -681 million), indicating the company is still in the investment expansion phase

The dilemma faced by Yandong Micro is essentially a

Revenue Side: Falling prices of consumer products → Narrowing gross profit margin

Expense Side: Surge in R&D investment → Rising expense ratio

Cash Flow: Negative free cash flow → Capital expenditure pressure

- Optimize product structure to increase the proportion of high-margin products

- Strictly control the pace of non-core R&D projects

- Strengthen cost control and improve operational efficiency

- Focus on mass production ramp-up of 28nm/65nm 12-inch production lines

- Accelerate customer acquisition and order procurement for silicon photonics products

- Promote automotive electronics certification for products such as SiC MOSFET

- Build a differentiated competitive advantage of “Foundry+IDM”

- Deeply integrate into the domestic substitution industrial chain

- Establish technological moats and scale effects

From the perspective of R&D investment structure [1], the company should focus on:

- Improve the commercialization conversion rateof R&D investment

- Strengthen collaborative developmentwith strategic customers

- Optimize the risk-return ratioof the R&D project portfolio

- Elastic Targetin the recovery cycle of the power semiconductor industry

- Production Capacity Breakthroughbrought by the commissioning of 12-inch advanced process production lines

- Technological First-Mover Advantagefrom mass production of silicon photonics process platform

- Industry Cycle Risk: Cyclical fluctuations in the semiconductor industry may further pressure performance

- R&D Investment Return Risk: Delays in key projects or lower-than-expected yields may affect investment returns

- Talent Attrition Risk: Turnover of core technical talents may affect R&D progress

- Cash Flow Pressure: Sustained high capital expenditures may lead to financing needs

Yandong Micro’s widening losses are the result of

- The losses have cyclical characteristics, with price pressures on consumer products being the direct trigger

- The strategic necessityof R&D investment outweighs short-term financial pressures

- 28nm/65nm 12-inch production lines and silicon photonics platforms are the core growth engines for the next 2-3 years

- Attention should be paid to the commercialization progress of R&D achievementsand production capacity ramp-up efficiency

From a long-term perspective, against the backdrop of domestic substitution and AI-driven semiconductor industry recovery, Yandong Micro’s R&D investment layout has

[0] Jilin AI - Yandong Micro Company Profile and Financial Analysis Data

[1] Yandong Micro 2025 Half-Year Report (https://ydme.com/pic/image/250902/170830_770.pdf)

[2] Dongfang Fortune Securities - AI-Driven New Industry Cycle, Domestic Substitution Enters Critical Stage (https://pdf.dfcfw.com/pdf/H301_AP202512241807078581_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.