Analysis of Citizens' Reaffirmation of Cloudflare (NET) Market Outperform Rating

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data I have collected, let me provide a detailed analysis of the significance of Citizens’ reaffirmation of Cloudflare (NET) stock rating and its implications for investors.

| Rating Factor | Details |

|---|---|

| Rating Agency | Citizens Financial Group |

| Analyst | Trevor Walsh |

| Rating | Market Outperform (Reaffirmed) |

| Target Price | $270.00 |

| Current Share Price | $184.17 |

| Potential Upside | +46.6% |

| Rating Date | October 31, 2025 |

According to the latest market data [0], Cloudflare stock exhibits the following characteristics:

| Time Period | Price Change |

|---|---|

| 1-Day | +0.02% |

| 5-Day | -3.07% |

| 1-Month | -5.88% |

| 3-Month | -13.55% |

| YTD | -6.05% |

| 1-Year | +53.67% |

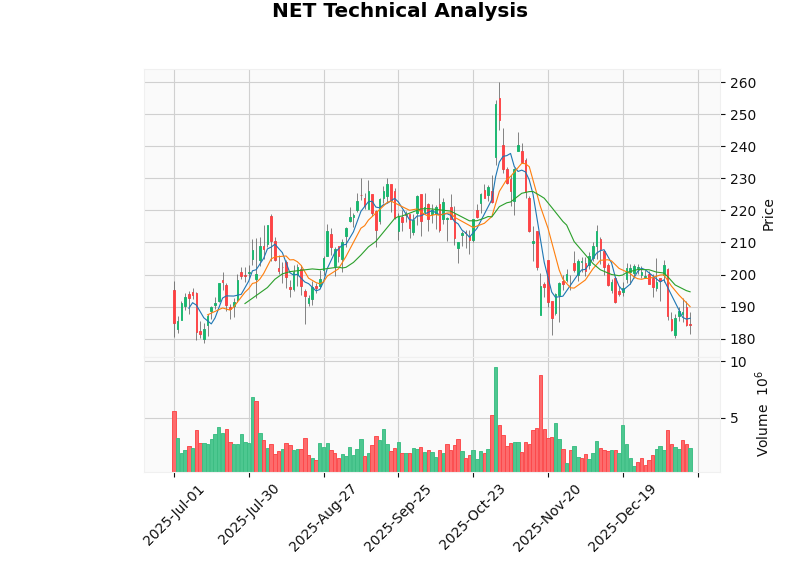

- Current Price: $184.17

- Support Level: $180.57

- Resistance Level: $194.61

- 52-Week Trading Range: $76.24 - $253.30

From a technical analysis perspective, NET stock is currently in a

- MACD Indicator: Shows a bearish crossover signal

- KDJ Indicator: K value 22.3, D value 27.5, indicating a bearish trend

- RSI Indicator: In the normal range

- Beta Coefficient: 1.97 (higher volatility relative to the S&P 500)

A “Market Outperform” rating means Citizens expects NET stock to

- The $270.00 target price represents approximately 46.6% upsidefrom the current share price

- The Wall Street consensus target price is $247.50, representing +34.4% upsidefrom the current price [0]

Based on the latest financial reports and industry developments [0][1]:

- Q3 2025 earnings beat expectations: EPS of $0.27, exceeding market expectations by 17.34%

- Revenue of $562 million, representing 19.2% year-over-year growth

- Achieved consecutive quarterly earnings growth

- Analysts expect 2026 revenue growth to exceed 30%

- Institutions such as Oppenheimer believe market growth expectations are too conservative, with room for upward revision

- Concerns about customer churn have been overstated, while actual contract sizes continue to grow

- As a leading global CDN and cybersecurity service provider

- Maintains technological leadership in edge computing and zero-trust security

- Recent acquisition of the Astro web framework further strengthens its product ecosystem [1]

Investors should pay attention to the following risks:

| Risk Type | Details |

|---|---|

| Valuation Risk | Current P/S ratio of 32.04x, at a historical high |

| Volatility Risk | Beta coefficient of 1.97, indicating high share price volatility |

| Competitive Risk | Competitive pressure from traditional CDN providers such as Akamai |

| Operational Risk | Service outages occurred in 2025 |

According to the latest statistics [0][1], Wall Street holds a

| Rating | Number | Percentage |

|---|---|---|

| Buy | 25 | 64.1% |

| Hold | 12 | 30.8% |

| Sell | 2 | 5.1% |

Consensus Rating |

BUY |

- |

- Oppenheimer: Maintained Outperform rating, target price $300.00 (most optimistic)

- Keybanc: Maintained Overweight rating, target price $300.00

- UBS: Maintained Neutral rating, target price $210.00 (most conservative)

- Citigroup: Maintained Buy rating, target price $318.00 [1]

-

Confirmation of Institutional Confidence: After a recent share price correction (13.55% decline over 3 months), the institution’s reaffirmation of a positive rating indicates that fundamentals remain solid

-

Relative Return Opportunities: Amid increased market uncertainty, the “Market Outperform” rating provides a reference for investors seeking excess returns

-

Focus on Key Price Levels:

- Short-term Resistance Level: $194.61

- Short-term Support Level: $180.57

- Mid-term Target Levels: $247.50 (Wall Street Consensus) / $270.00 (Citizens’ Target)

-

Focus on Catalysts:

- Q4 2025 Earnings Report on February 10, 2026 (Estimated EPS: $0.27) [0]

- Whether 2026 revenue growth can exceed expectations

- Progress in AI-related businesses

[0] Jinling API Data - Cloudflare (NET) Market Data, Technical Analysis, and Company Profile

[1] TickerNerd - NET Stock Forecast 2026 - CloudFlare Price Targets & Predictions (https://tickernerd.com/stock/net-forecast/)

金融分析服务介绍

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.