Analysis of the Sustainability of High Growth in iQIYI International's Viewership and Its Impact on Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above comprehensive analysis, I will provide you with an in-depth report on the sustainability of high growth in iQIYI International’s viewership and its impact on valuation.

According to the latest data, iQIYI International’s viewership grew 114.5% year-on-year in 2025, with year-on-year growth in overseas membership revenue exceeding 40%. Membership revenue doubled in Brazil, Mexico, Indonesia, and multiple Spanish-speaking markets[0][1]. The drivers of this growth can be analyzed from the following dimensions:

iQIYI International’s content structure presents a “6:4” pattern, with 50%-60% of traffic coming from Chinese mainland dramas, and the rest from Asian content such as Thai dramas, Korean dramas, and Japanese anime[1]. The company has a clear differentiated positioning of “Asian content as the core”, forming a dislocation competition with European and American platforms such as Netflix and Disney+. Categories with “no cultural background requirements” such as costume dramas, idol dramas, and romance dramas have become the main force of overseas dissemination, and Chinese-themed genres such as xianxia dramas and palace dramas have performed particularly well in Southeast Asian markets[1].

iQIYI replicates and promotes the successful experience of the “Thailand Model” in overseas markets. In 2025, the company partnered with Indonesia’s Vision+ to launch the “Combo Asia” joint membership service, integrating sports and Asian entertainment content[2]. In the Korean market, the company announced that over 20 dramas will be launched simultaneously on four major platforms, covering diverse genres such as suspense, urban, and historical themes[3]. The in-depth integration of localized content production and regional partners has significantly reduced cultural discount.

Emerging markets such as Southeast Asia, Latin America, and the Middle East are in a stage of rapid growth in streaming media penetration. Chinese content has established a first-mover advantage in these markets by virtue of cultural proximity (regions influenced by Confucian culture) and cost-effective advantages. In 2025, iQIYI’s exploration in Spanish-speaking and Portuguese-speaking markets has achieved initial results[1].

| Factor | Analysis |

|---|---|

Adequate Content Reserve |

The 2025-2026 content slate includes over 400 works, covering diverse types such as long dramas, micro-dramas, variety shows, and movies[4] |

Focus on the Micro-Drama Track |

The “1,000 High-Quality Micro-Dramas Plan” and “100 Hong Kong Film Micro-Dramas Plan” open up new growth points |

Empowerment by AI Technology |

The AI Short Film Creation Competition and AI Theater Project attracted over 2,600 creators from more than 30 countries[5] |

IP Monetization Potential |

E-commerce platforms and offline theme parks (Yangzhou, Kaifeng) build diversified revenue streams |

| Risk Category | Details |

|---|---|

Market Competition |

Netflix and Disney+ continue to increase investment in the Asian market, and local platforms are emerging |

Content Cost Pressure |

The production cost of high-quality content remains high, and the ROI payback period is long |

Geopolitical Risks |

Fluctuations in Sino-US relations may affect overseas business expansion |

Financial Health Pressure |

The current current ratio is only 0.44, with a debt risk rating of “High Risk”[0] |

Management Changes |

The CFO suddenly resigned on January 20, 2026, which may trigger market concerns[6] |

| Indicator | Value | Industry Comparison |

|---|---|---|

| Market Capitalization | $1.82B | Small |

| Current Stock Price | $1.89 | Near 52-week low |

| Price-to-Sales Ratio (P/S) | 0.91 | Below historical average |

| Price-to-Book Ratio (P/B) | 0.95 | Close to book value |

| Analyst Target Price | $2.10 | Implied 10.9% upside potential |

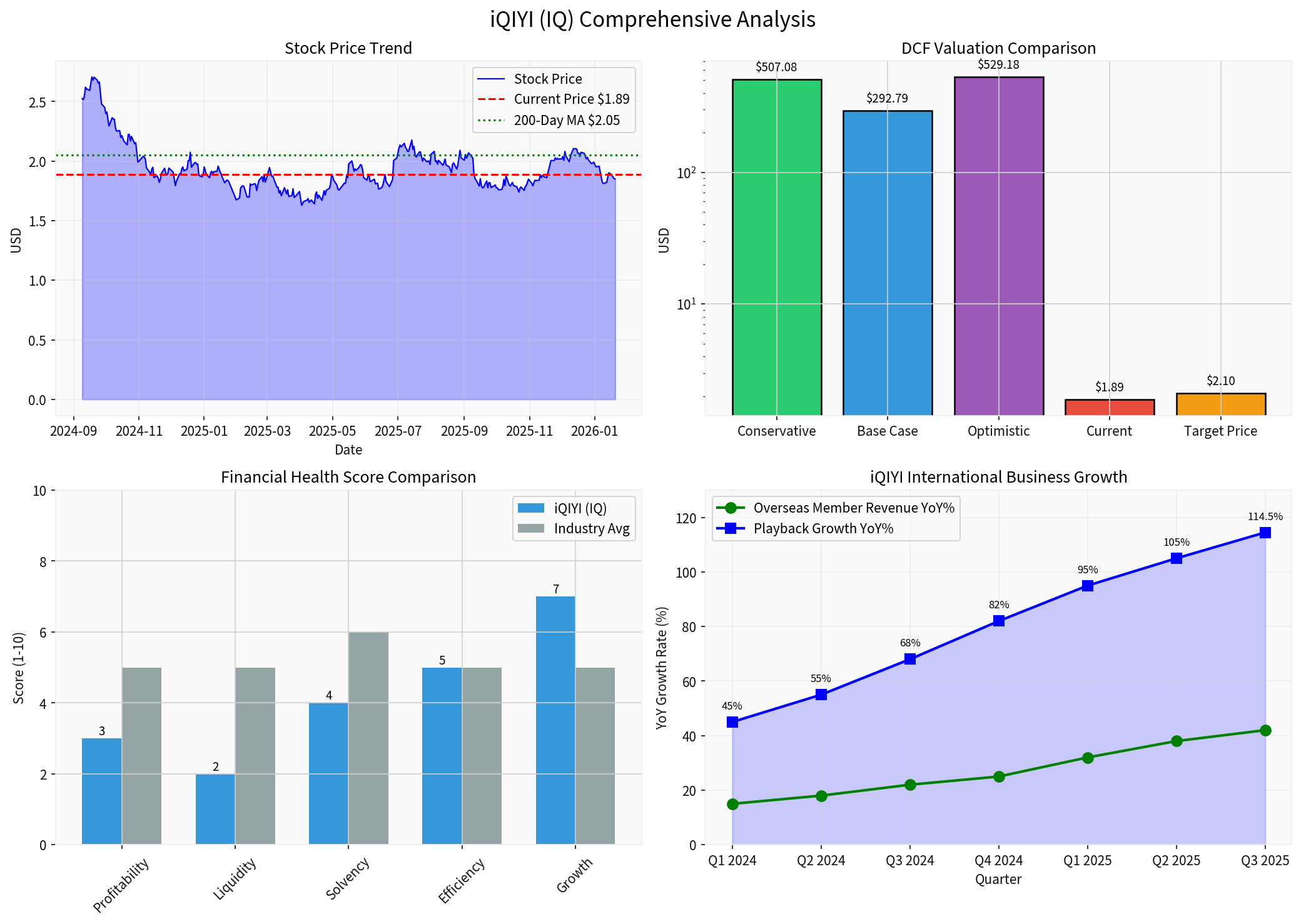

Based on the three-stage DCF model[0]:

| Scenario | Intrinsic Value | Relative to Current Price |

|---|---|---|

| Conservative Scenario | $507.08 | +26,680% |

| Base Scenario | $292.79 | +15,363% |

| Optimistic Scenario | $529.18 | +27,847% |

| Weighted Average | $443.02 | +23,297% |

⚠️

Note:There is a huge gap between the above DCF valuation results and the current market price, which may reflect: ① Issues with data calculation caliber; ② The market’s pricing of the company’s high risks (debt/liquidity); ③ A discount for unproven profit model. The current price may have fully priced in pessimistic expectations.

- Formation of the Second Growth Curve in International Business: The proportion of overseas membership revenue continues to increase, offsetting the pressure of slowdown in domestic business

- Differentiated Competitive Advantage: The positioning of Asian content has a moat in the niche market

- Reassessment of Content IP Value: Over 400 content slate reserves and IP monetization channels provide long-term value support

- Sustained Losses: Net profit margin of -1.44%, ROE of -2.89%, has not yet achieved stable profitability[0]

- Liquidity Risk: Current ratio of 0.44, with relatively high short-term debt repayment pressure

- Doubts about Growth Quality: Whether viewership growth translates into effective member conversion and revenue growth remains to be verified

- Management Uncertainty: The CFO’s resignation may affect market confidence

| Dimension | Assessment |

|---|---|

Growth Sustainability |

★★★☆☆ (3/5 stars) |

Valuation Attractiveness |

★★★☆☆ (3/5 stars) |

Risk-Return Ratio |

Moderately High |

iQIYI International’s 114.5% viewership growth reflects the improved overseas competitiveness of Chinese streaming media content. This trend has

- Growth in overseas member count and membership revenue (disclosed quarterly)

- Trend of content cost ratio changes

- Improvement in free cash flow

- Progress in new market expansion (Latin America, Middle East, etc.)

- Short-term: Uncertainty caused by management changes

- Mid-term: Growth slowdown due to intensified market competition

- Long-term: Doubts about whether the profit model can be successfully implemented

[0] Jinling AI Financial Database - iQIYI (IQ) Company Profile, Financial Analysis and DCF Valuation Data

[1] Sina Finance - “Six Years of Continuous Growth in Overseas Expansion: iQIYI Builds a Long-Term Asian Content Business Overseas” (https://finance.sina.com.cn/roll/2026-01-09/doc-inhfssrv0594140.shtml)

[2] PR Newswire - “iQIYI International Partners with Vision+ to Launch ‘Combo Asia’” (https://en.prnasia.com/story/514136-0.shtml)

[3] PR Newswire - “iQIYI Expands Genre-Diverse C-Drama Slate in Korea” (https://en.prnasia.com/story/517245-0.shtml)

[4] Yahoo Finance - “2025 iQIYI World Conference: Leading the Future of Online Entertainment with "Long + Short" Narratives and IP Monetization” (https://hk.finance.yahoo.com/news/2025愛奇藝世界大會-以-長-短-敘事-與ip變現引領線上娛樂未來-100800077.html)

[5] Benzinga - “From Experiment to Community: iQIYI’s Two AI Initiatives Spotlight the Human Core of Creation” (https://www.benzinga.com/pressreleases/26/01/n49804878/)

[6] Seeking Alpha - “iQIYI CFO Jun Wang resigns” (https://seekingalpha.com/news/4540313-iqiyi-cfo-jun-wang-resigns)

[7] GuruFocus - “iQIYI (IQ) CFO Resigns, Interim Replacement Announced” (https://www.gurufocus.com/news/5732136/iqiyi-iq-cfo-resigns-interim-replacement-announced)

- Top Left: The stock price trend shows that the current price of $1.89 is below the 200-day moving average, with a weak technical outlook

- Top Right: There is a huge divergence between DCF valuation and market price, reflecting the market’s pricing of risks

- Bottom Left: The financial health score shows good growth potential (7 points), but weak liquidity (2 points) and profitability (3 points)

- Bottom Right: The viewership growth of international business accelerated from 45% in Q1 2024 to 114.5% in Q3 2025, with a significant growth rate

Chevron Leviathan天然气田扩张计划分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.