In-Depth Analysis Report on Ant Group's AI Healthcare Strategic Layout

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest collected information, this report provides an in-depth analysis of Ant Group’s strategic layout in the AI vertical field (healthcare direction) and its impact on valuation and IPO prospects.

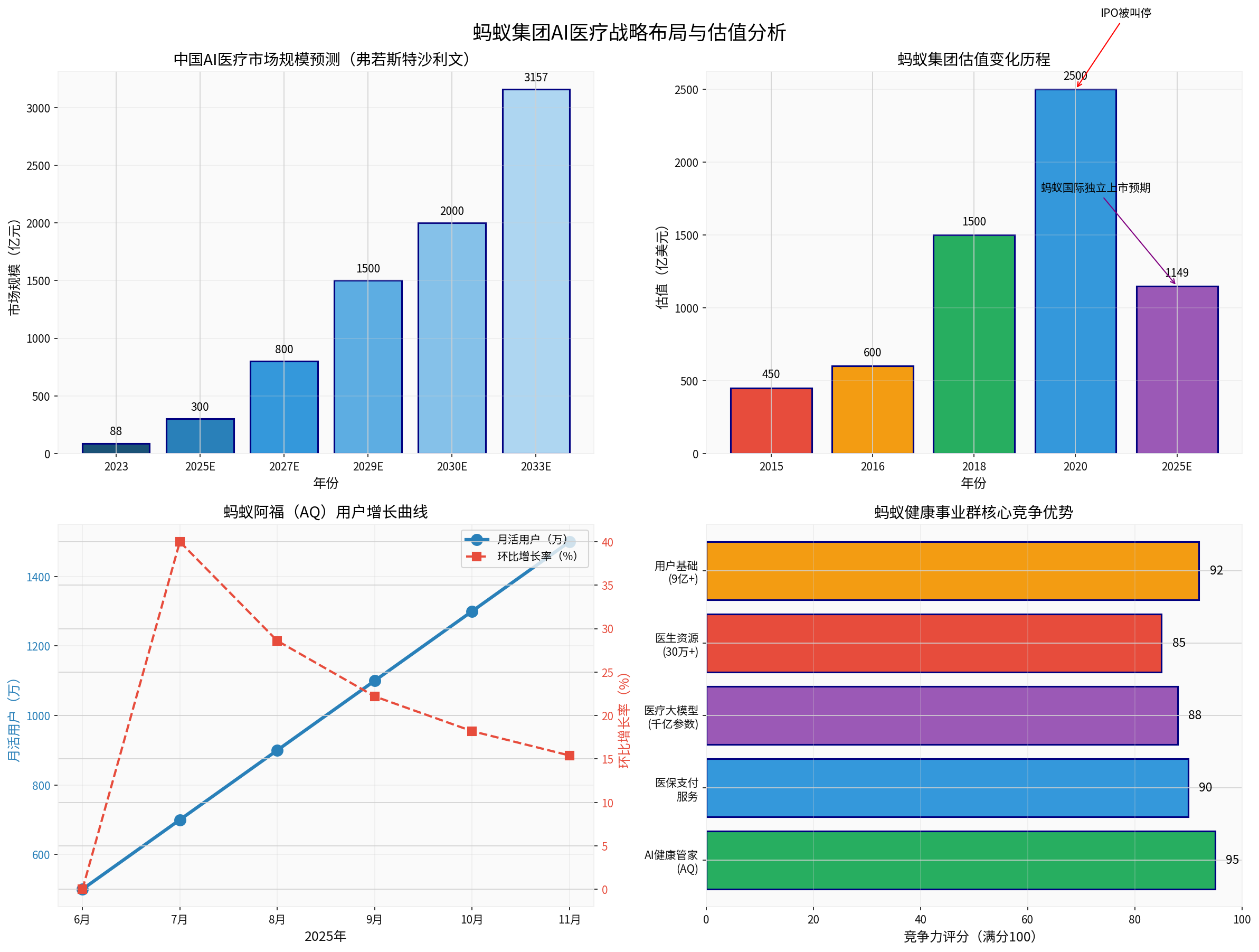

On November 7, 2025, Ant Group CEO Han Xinyi issued a company-wide letter announcing the official upgrade of the original “Digital Healthcare Division” to the “Healthcare Business Group”, which has become one of Ant’s five core business segments (the other four segments are: Alipay Business Group, Digital Payment Business Group, Wealth & Insurance Business Group, and Credit Business Group). [1][2]

This adjustment indicates that healthcare services have achieved the same strategic priority as payment and financial services. Zhang Junjie, a “veteran” who joined Ant in 2014, has been appointed as the President of the Healthcare Business Group. [1][2]

- June 2025: AI Health Manager AQ launched as an independent app

- October 2025: Monthly Active Users (MAUs) exceeded 10 million, becoming the 5th AI-native application in China with over 10 million MAUs

- November 2025: MAUs exceeded 15 million, rising to 7th place on the AI-native application rankings [3][4]

- December 15, 2025: Brand upgraded to “Ant Fu”, with its positioning transformed from “AI Tool” to “AI Health Friend” [5]

- Over 100 functions including health consultations, medical report interpretation, and risk assessment for diseases

- Supports wearable devices from Apple and Huawei, as well as chronic disease management devices from Yuyue Medical

- Daily user inquiries exceed 10 million, with cumulative service users exceeding 100 million [5]

- Self-developed Ant Medical Large Model, relying on a professional medical corpus base with over 1 trillion tokens

- Integrates a multi-modal model with hundreds of billions of parameters and a medical knowledge graph with tens of millions of entries

- Achieved leading results in authoritative evaluations such as MedBench and HealthBench [1][4]

Ant Fu’s PC version has been upgraded with the launch of the DeepSearch function for medical professionals, marking Ant’s formation of a

- Over 1,000 doctors have launched “AI Avatars” on the Ant Fu app, providing 7×24 online responses to user consultations

- Cooperated with Haodf.com’s 290,000 registered doctors to upgrade the AI assistant toolchain

- Added a “Research Assistant” function, integrating DeepSeek technology to support literature review generation, differential diagnosis recommendations, etc. [2][6]

| Resource Dimension | Scale/Capability |

|---|---|

| Healthcare Insurance Code Users | Over 800 million (China’s largest third-party healthcare insurance service platform) |

| Partner Hospitals | 5,000 |

| Registered Doctors | 300,000+ |

| Cumulative Platform Service Users | Nearly 900 million |

| Partners | Nearly 100 partners including Huawei and Alibaba Cloud [1][2][4] |

According to forecasts from Frost & Sullivan:

- 2023: RMB 8.8 billion

- 2025: Exceeds RMB 300 billion

- 2033: Will reach RMB 315.7 billion

- 10-Year Compound Annual Growth Rate (CAGR): 43.1% [7][8]

| Time Node | Valuation (USD 100 million) | Event/Background |

|---|---|---|

| July 2015 | 450 | Series A Financing |

| April 2016 | 600 | Series B Financing |

| June 2018 | 1500 | USD 1.4 billion financing, Pre-IPO round |

| October 2020 | 2500-4600 | Approved for STAR Market listing, investment banks raised expectations |

| 2025 | 300-400 | Expected independent listing of Ant International [9][10][11] |

One of the core reasons for the suspension of Ant Group’s 2020 IPO was its over-reliance on “financial attributes”. The AI healthcare layout fundamentally changes the company’s business structure: [9]

- From Payment → Health Services: From a single payment tool to an integrated service ecosystem

- From Finance → Technology: Technological products such as medical large models and the AQ application strengthen “technological attributes”

- From Platform → Service: From a “connector” to a “deep participant”

Ant Group CEO Han Xinyi clearly stated at the Bund Summit:

Compared with general AI applications (such as Doubao, DeepSeek), Ant Fu’s differentiated advantages are as follows:

| Competitive Advantage | Specific Performance |

|---|---|

| Data Barrier | 800 million healthcare insurance code user data, 10 years of healthcare accumulation |

| Scenario Barrier | Full-link services from appointment registration → payment → claims settlement |

| Trust Barrier | Users in healthcare scenarios have extremely high requirements for professionalism, and first-mover advantages are difficult to replicate |

| Ecological Barrier | Closed-loop system connecting 300,000 doctors, 5,000 hospitals, healthcare insurance and commercial insurance [1][4] |

The market’s valuation logic for fintech companies is being reconstructed:

- Traditional Financial Business: PE multiples are usually 5-10x

- AI Technology Business: PS multiples can reach 10-20x

- AI Healthcare Vertical Field: Due to its high barriers and growth potential, it may enjoy a higher valuation premium

The expected valuation for Ant International’s independent listing is USD 30-40 billion (300-400 in USD 100 million units). Although this is only about 1/10 of Ant Group’s historical valuation in 2020, this is mainly due to: [9][10]

- Ant International only accounts for 20% of the group’s revenue

- The market is generally cautious about fintech valuations

- Independent listing requires separate compliance costs

- On January 7, 2023, Ant Group announced that Jack Ma is no longer its actual controller

- According to regulations, the waiting period for Hong Kong Stock Exchange listing is 1 year, which has now expired [10]

- In May 2025, Ant Group launched a tender offer for Bright Smart Securities through its subsidiary, reigniting rumors of a backdoor listing (but its feasibility is considered low) [10]

- July 2023: Ant Group was fined RMB 7.123 billion, marking the end of the rectification phase

- Huabei and Jiebei were incorporated into Ant Consumer Finance, subject to stricter risk control supervision

- Non-compliant businesses such as “Xianghubao” have been shut down [9][10]

The core selling point of Ant Group’s 2020 IPO was “technological attributes”, but the market still viewed it as a financial company. The AI healthcare strategy provides new supporting points for the IPO narrative:

| Traditional Narrative | New Narrative |

|---|---|

| Payment Platform | AI Healthcare Service Entry |

| Fintech Company | Medical Large Model Technology Company |

| Traffic Monetization | Health Ecosystem Operator |

| Regulatory Arbitrage | Social Value Creator [1][4] |

The explosive growth of the AI healthcare market (43.1% CAGR from 2025 to 2033) provides Ant with enormous growth narrative space. Frost & Sullivan predicts that China’s AI healthcare market will surge from RMB 8.8 billion in 2023 to RMB 315.7 billion in 2033. [7][8]

Compared with financial business, AI healthcare belongs to the people’s livelihood and inclusive field, and regulatory attitudes are more friendly. Ant Group, through initiatives such as one-stop settlement of “healthcare insurance + commercial insurance” and empowerment of primary healthcare, demonstrates social value, which helps improve its regulatory image. [2][4]

- Time Window: Preparation started in May 2025, with CICC and Morgan Stanley hired as advisors [10]

- Expected Valuation: USD 30-40 billion (300-400 in USD 100 million units)

- Business Foundation: Alipay+ (covering 90 million merchants in 66 countries and regions), WorldFirst (serving over 1 million SMEs), Antom (supporting 250+ payment methods) [9][10]

- Challenges: Cross-jurisdictional regulatory coordination, data privacy compliance, lower-than-expected valuation

| Listing Venue | Advantages | Challenges |

|---|---|---|

| Hong Kong Stock Exchange | Waiting period expired, convenient access to international capital | Valuation may be limited |

| STAR Market (Shanghai) | Matches technological attributes, recognized by domestic investors | Needs to meet stricter technology recognition requirements |

| Simultaneous A+H Listing | Balances domestic and international capital | Complex regulatory approval [11] |

- The “hallucination” issue of medical AI may lead to misdiagnosis risks, requiring continuous optimization of model accuracy [6]

- Medical data privacy protection has extremely high requirements, and compliance costs continue to rise

- Integration risks after the acquisition of Haodf.com

- Tech giants such as ByteDance (Doubao), Baidu (Ernie), and Tencent are all laying out AI healthcare [4]

- Vertical players such as Ping An Good Doctor and JD Health are also accelerating their AI transformation

- AI healthcare has a long investment cycle and slow returns (refer to Ping An Good Doctor, which took 10 years to achieve profitability) [5]

- The market is generally cautious about fintech valuations

- Ant International’s valuation is only 1/10 of Ant Group’s historical valuation

- Need to prove the independent profitability of the AI healthcare business

-

Strategic Level: Ant Group’s upgrade of AI healthcare from a division to a business group is a key move in its “Life Services + Financial Services + Health Services” AI strategy. The rapid rise of AQ proves the feasibility of this strategy.

-

Valuation Level: The AI healthcare layout brings Ant the opportunity to reconstruct its valuation from “fintech” to “AI tech”. Although the expected valuation for Ant International’s independent listing is only USD 30-40 billion, the high growth potential and differentiated barriers of AI healthcare are expected to bring valuation premiums in the future overall listing.

-

IPO Prospects: The waiting period for the Hong Kong Stock Exchange has expired, regulatory rectification has basically been completed, and the possibility of Ant International’s independent listing first is relatively high. The AI healthcare strategy, by enhancing technological attributes, demonstrating social value, and opening up growth space, creates a more favorable narrative environment and valuation foundation for Ant Group’s future overall listing.

[3] QbitAI - New AI Battlefield for Tech Giants: AQ’s Surging Growth, Ant Bets on the Big Health Track

[4] 36Kr - Ant Fu Delivers Excellent Results After Its “First Month”

[5] AIBase - Ant Fu Upgrades PC Version, Launches DeepSearch Function for Medical Professionals

[6] OFweek - 2025 Great Health Industry Upheaval: AI Restructures the Ecosystem

[8] Frost & Sullivan - China AI Healthcare Market Forecast

[9] DoNews - Five Years After Its Setback, Ant Group Revives Its IPO Dream

[11] Securities Times - The Largest Wealth Creation Movement in History! Ant Announces Dual Listing Plan

A股中小市值股票异常波动与停牌核查机制有效性分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.