In-Depth Report on Tianyue Advanced: Investment Logic of SiC as a Core Material for CoWoS

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Tianyue Advanced (Stock Codes: 688234.SS/02631.HK) is a

In terms of industry position, Tianyue Advanced holds a significant share in the global SiC substrate market. In recent years, it has continuously increased R&D investment and maintained a leading edge in large-size substrate preparation technology. Its customer base covers mainstream domestic and international power semiconductor manufacturers and chip manufacturing enterprises, laying a customer foundation for its layout in the AI chip packaging field.

As can be clearly seen from the candlestick chart, Tianyue Advanced has shown a strong upward trend recently:

| Time Period | Price Change | Remarks |

|---|---|---|

| 5-Day | +19.79% | Short-term Surge |

| 20-Day | +27.06% | Trend-Based Upturn |

| 1-Month | +32.10% | Accelerated Rise |

| 3-Month | +52.35% | Mid-term Strong Performance |

| 6-Month | +89.88% | Trend-Driven Bull Market |

| 1-Year | +102.18% | Price Doubled |

As of January 20, 2026, the company’s stock price closed at

CoWoS (Chip on Wafer on Substrate) is an advanced 2.5D packaging technology led by TSMC. It achieves high-density interconnection of multiple chips by adding an interposer between the chip and the substrate. As the performance requirements of AI computing power chips continue to increase, CoWoS packaging faces two core challenges [2][3]:

- NVIDIA Blackwell Ultra B300 GPU has a power consumption of 1400W

- The power consumption of the next-generation Rubin Ultra is expected to further increase

- The thermal conductivity of traditional silicon interposers (approximately 150W/m·K) can no longer meet heat dissipation requirements

- In 2024, the silicon interposer area was approximately 50×50mm² (3x reticle)

- It is expected to expand to 81×81mm² (8x reticle) in 2027

- The area will nearly triple, putting forward higher requirements for material performance

Compared with traditional silicon materials, silicon carbide (SiC) has significant performance advantages, making it an ideal alternative material for CoWoS interposers [1][2][3]:

| Performance Indicator | Silicon (Si) | Silicon Carbide (SiC) | Advantage Multiplier |

|---|---|---|---|

| Thermal Conductivity | 150 W/m·K | 490 W/m·K | 2-3x |

| Band Gap | 1.1 eV | 3.2 eV | 3x |

| Breakdown Electric Field | 0.3 MV/cm | 2.8 MV/cm | 9x |

| Via Aspect Ratio | <17:1 | 109:1 |

Over 6x |

-

Excellent Heat Dissipation Capacity: SiC’s thermal conductivity is 2-3 times that of silicon, which can effectively solve the high-power heat dissipation problem of AI chips. It is also expected to reduce the size of heat sinks and lower overall packaging costs [3].

-

Higher Via Aspect Ratio: A team from Brigham Young University in the United States has successfully fabricated vias with an aspect ratio of up to 109:1 on 350μm-thick 4H-SiC, while the via aspect ratio of conventional silicon interposers is less than 17:1 [3]. This means:

- Enabling denser interconnection layouts

- Reducing interconnection length and improving chip performance

- Reducing packaging volume, making 2.5D packaging performance close to that of 3D packaging

-

Good Chemical Resistance: SiC can be used to fabricate high-aspect-ratio vias through wet etching, with better process compatibility than other materials.

- According to a September 2025 report from Taiwanese media, NVIDIA plans to replace silicon with SiC as the interposer material in the CoWoS packaging of its next-generation Rubin processor [1][2]

- Mass production will be officially introduced by 2027at the latest

- The first-generation Rubin GPU will still use silicon interposers, but subsequent versions will fully switch to SiC

- Has joined forces with equipment manufacturers such as Japan’s DISCO to develop SiC interposer manufacturing technology [2][3]

- Announced at the 2024 European Open Innovation Platform (OIP) Forum:

- Launch 5.5x reticle CoWoS packaging (10,000 mm²) in 2025-2026

- Launch 7x reticle CoWoS packaging (14,400 mm²) in 2027

- Its Q4 2025 financial report exceeded expectations, and its 2026 capital expenditure guidance was significantly raised to USD 52-56 billion, a record high [1]

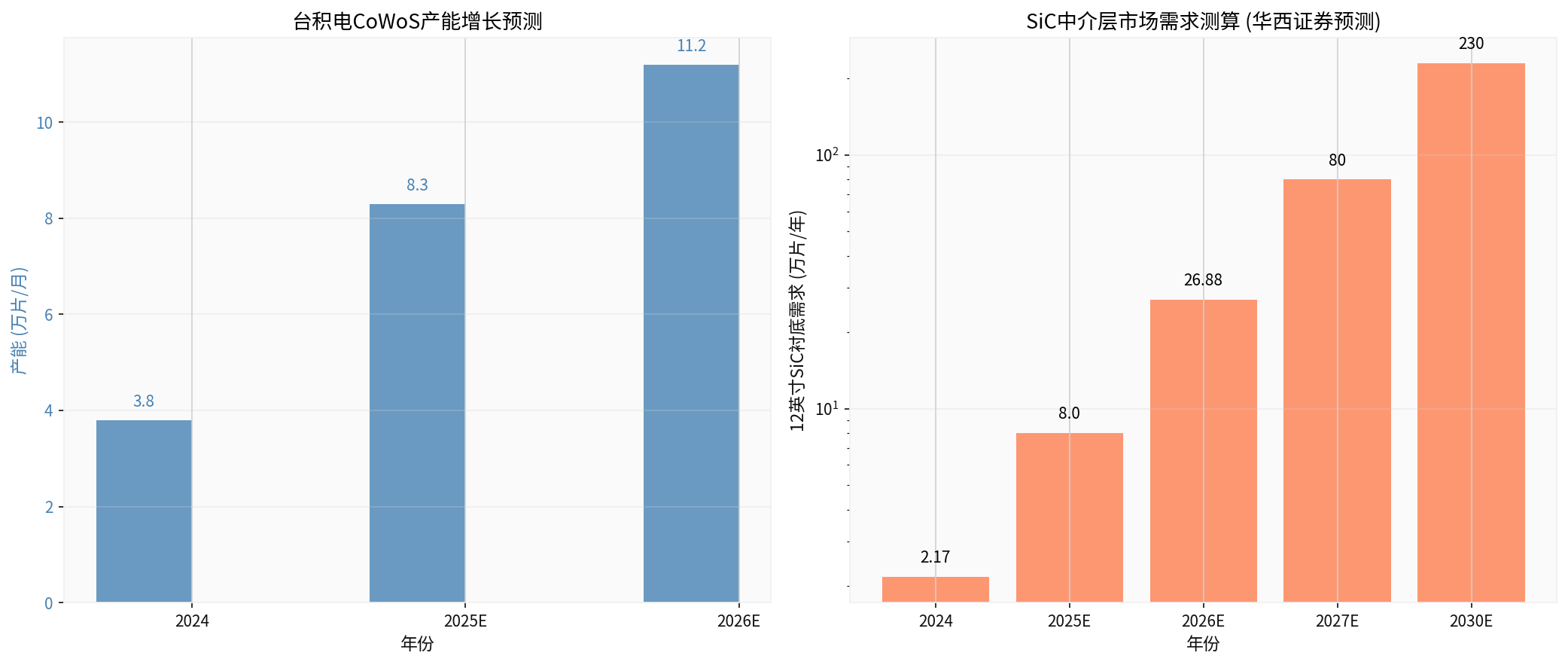

According to a research report from Huaxi Securities, if CoWoS adopts SiC to replace silicon interposers, market demand will experience explosive growth [1][2]:

- CoWoS packaging will maintain a 35% compound annual growth rate after 2028

- The replacement rate of SiC materials will eventually reach 70%

- Calculated based on 5-21 interposers produced per 12-inch wafer

- 2024: Approximately 21,700 12-inch SiC substrates per year

- 2026: Approximately 268,800 12-inch SiC substrates per year

- 2030: Over 2.3 million 12-inch SiC substrates per year

- Equivalent to approximately 9.2 million 6-inch substrates, far exceeding current global capacity supply

- Equivalent to approximately

- Global SiC substrate capacity was limited in 2024

- Demand in 2030 will be more than 10 times the current level

- The huge market supply-demand gap brings significant growth opportunities for domestic enterprises

| Indicator | Value | Evaluation |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 1425.23x | Extremely high, reflecting high growth expectations |

| Price-to-Book Ratio (P/B) | 7.15x | Moderate |

| Price-to-Sales Ratio (P/S) | 29.45x | Relatively high |

| Return on Equity (ROE) | 0.64% | Relatively low |

| Net Profit Margin | 2.32% | Relatively low |

| Current Ratio | 3.53 | Excellent |

| Quick Ratio | 2.81 | Excellent |

| Debt Risk | Low | Financially sound [0] |

From the results of financial analysis, Tianyue Advanced’s current profitability is weak, with the following characteristics [0]:

-

Conservative Accounting Policy: The company adopts conservative accounting treatment, and its high depreciation/capital expenditure ratio may mean that there is room for performance improvement in the future

-

Negative Free Cash Flow: The free cash flow in the latest fiscal year was -RMB 502 million, reflecting that the company is still in the period of capacity expansion and R&D investment

-

Revenue Under Pressure: Q3 2025 revenue was USD 318 million, lower than the market expectation of USD 395 million, a decrease of 19.41%

- The company is in a strategic opportunity period for domestic substitution of semiconductor materials

- Current losses/low profits are the result of strategic investments

- In the future, with the surge in demand for AI chips, there is huge room for profit improvement

- Track Scarcity: There are only about a dozen companies worldwide capable of providing 12-inch SiC substrates, and Tianyue Advanced has a first-mover advantage

- High Growth Expectations: The incremental demand brought by AI chip packaging is several times the size of the traditional market

- Domestic Substitution Dividend: China’s SiC industry chain has three advantages in investment scale, production cost, and downstream support

- Institutional Optimism: Multiple securities firms have given a “Buy” rating, and Huaxi Securities has listed it as a beneficiary target of SiC substrates

- Current valuation has fully priced in some optimistic expectations

- Performance realization takes time, and there is uncertainty in technology introduction

- Need to be alert to valuation corrections caused by unmet expectations

| Analysis Dimension | Conclusion |

|---|---|

| Trend Type | Upward Trend |

| Trend Status | To be confirmed (observed after breakthrough) |

| Buy Signal Date | January 16, 2026 |

| Support Level | RMB 98.05 |

| Resistance Level | RMB 114.94 |

| Next Target Level | RMB 121.01 |

| Trend Score | 7.5/10 [0] |

| Indicator | Value | Signal |

|---|---|---|

| MACD | No Death Cross | Bullish Bias |

| KDJ | K:76.9, D:70.9, J:88.9 | Buy Signal |

| RSI (14) | Overbought Zone | Risk Warning |

| Beta | 0.07 | Extremely Low Correlation with Market |

- RSI is in the overbought zone: There is a risk of short-term correction

- High Volatility: The daily volatility standard deviation is 4.92%, making it a high-volatility stock

- Need to Confirm Breakdown Validity: A buy signal was issued on January 16, but subsequent candlestick charts are required for confirmation

| Evaluation Dimension | Score | Description |

|---|---|---|

| Logical Rationality | ★★★★★ | The industry trend of SiC replacing silicon interposers is clear |

| Market Size | ★★★★★ | The incremental market is more than 10 times the current size |

| Company Competitiveness | ★★★★☆ | One of the few companies worldwide with mass production capacity of 12-inch SiC |

| Valuation Rationality | ★★☆☆☆ | Extremely high static valuation |

| Short-Term Risk | ★★★☆☆ | In the overbought zone |

- The stock price has risen sharply in the short term (up 27% in the past 20 days)

- RSI is in the overbought zone

- It is recommended to wait for a correction to the support level (around RMB 98) before positioning

- Monitor the progress of NVIDIA’s Rubin GPU and TSMC’s CoWoS capacity expansion

- Track the technology introduction schedule of SiC interposers

- Gradually build positions on corrections

- The market space for SiC in AI chip packaging is huge

- The company has first-mover advantages and technological barriers

- Driven by two wheels: domestic substitution and AI computing power demand

| Risk Type | Specific Content | Risk Level |

|---|---|---|

Technological Risk |

The progress of SiC interposer technology falls short of expectations, leading to delayed introduction | High |

Competitive Risk |

Domestic and international competitors accelerate R&D of 12-inch SiC, eroding market share | Medium |

Geopolitical Risk |

Sino-US technological frictions may affect chip supply chain cooperation | Medium |

Valuation Risk |

Current valuation has fully priced in optimistic expectations; a significant correction will occur if performance falls short of expectations | High |

Market Risk |

Slowdown in the growth rate of AI chip demand affects CoWoS capacity expansion progress | Medium |

The investment logic behind Tianyue Advanced’s 20% daily limit up is

- Clear Industry Trend: NVIDIA plans to adopt SiC interposers in its Rubin GPU in 2027, and TSMC has joined forces with equipment manufacturers for R&D, with a clear technical roadmap [1][2][3]

- Huge Market Space: According to Huaxi Securities’ estimates, more than 2.3 million 12-inch SiC substrates will be needed in 2030, which is more than 10 times the current market size [1]

- Company Competitiveness: Tianyue Advanced is one of the few companies worldwide capable of providing 12-inch SiC substrates, and some of its customers have entered NVIDIA’s supply chain [1]

- Catalyst Approaching: TSMC’s Q4 2025 performance exceeded expectations, its 2026 capital expenditure was significantly raised to USD 56 billion, and CoWoS capacity expansion is accelerating [1]

- The current valuation is extremely high (1425x P/E), and the stock price has already priced in some expectations

- SiC interposer technology has not yet reached mass production, and there is uncertainty in order implementation

- RSI is in the overbought zone in the short term; it is recommended to wait for a correction before selecting an opportunity to position

[1] Sina Finance - “TY Advanced Rises Over 16% in the Morning; the Company Actively Expands Applications of Silicon Carbide in Emerging Fields” (https://finance.sina.com.cn/stock/hkstock/marketalerts/2026-01-16/doc-inhhnkez5660595.shtml)

[2] Zhitong Finance - “Hong Kong Stock Market Volatility | Tianyue Advanced (02631) Rises Over 17%; TSMC’s Performance Exceeds Expectations with Positive Guidance” (https://cn.investing.com/news/stock-market-news/article-3168656)

[3] EET China - “NVIDIA Adopts 12-inch SiC? A New Track is Added” (https://www.eet-china.com/mp/a435577.html)

[4] Huaxi Securities - “In-Depth Report on SiC in the Semiconductor Industry (1): Advanced Packaging, the Future Material Choice of NVIDIA and TSMC” (http://www.sdyanbao.com/detail/933023)

[0] Jinling AI Financial Database (Company Overview, Financial Data, Technical Analysis, Market Data)

金凯生科SNAC中间体业务深度分析报告

四方精创中国银行业务收入变动分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.