Financial Impact Analysis Report on Hospital Asset Disposals by Xinhua Medical (600587)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and analysis, I have prepared a detailed report on the financial impact of Xinhua Medical’s hospital asset disposals for you:

Xinhua Medical was founded in 1943 and listed on the Shanghai Stock Exchange in 2002, making it an established medical device enterprise. Its main business covers four segments: medical devices, pharmaceutical equipment, healthcare services, and medical trade[1][2].

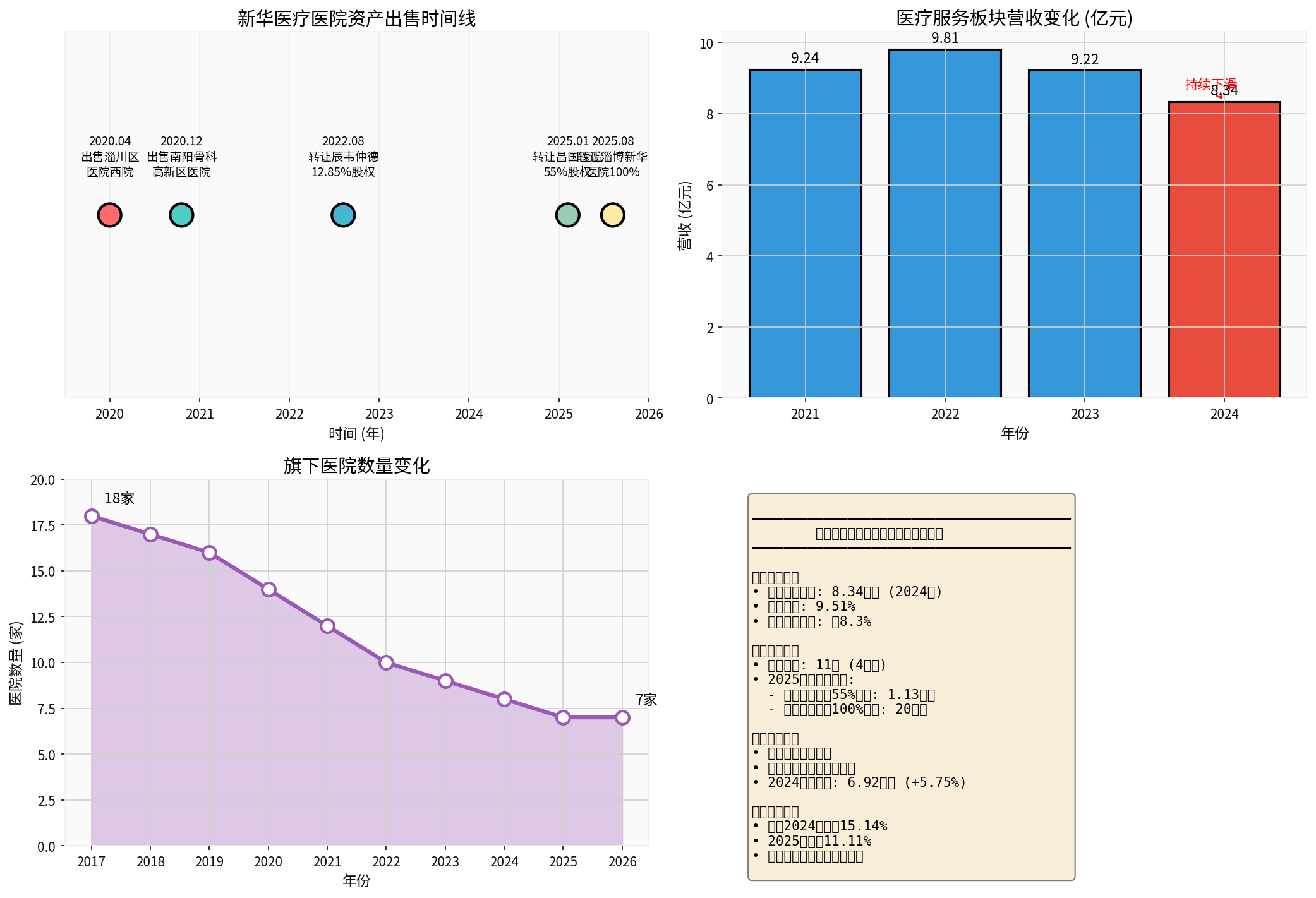

| Time Node | Key Event | Change in Number of Hospitals |

|---|---|---|

| 2017 | Peak period of healthcare services business | 18 hospitals |

| Starting from 2018 | Problems emerged in some hospitals, initiating transfers | 17 hospitals |

| 2020 | Sold West Campus of Zichuan District Hospital and Nanyang Orthopedic Hospital | 14 hospitals |

| 2022 | Transferred 12.85% equity in Chenwei Zhongde | 10 hospitals |

| January 2025 | Listed 55% equity in Shandong Changguo Hospital for transfer | Continuously decreasing |

| August 2025 | Transferred Zibo Xinhua Hospital for RMB 200,000 | 7 hospitals |

| January 2026 | Official website shows only 7 hospitals remaining | 7 hospitals [1][2] |

Based on 2024 annual report data, the healthcare services segment shows a continuous downward trend[1][2]:

| Financial Indicator | 2024 Data | YoY Change | Industry Comparison |

|---|---|---|---|

| Healthcare Services Revenue | RMB 834 million |

-9.51% | Gross profit margin only 16.28% |

| Medical Devices Revenue | RMB 6.86 billion | Steady growth | Core business |

| Pharmaceutical Equipment Revenue | RMB 2.171 billion | Steady growth | Core business |

| Total Revenue | RMB 10.021 billion | +0.09% | Tending to stabilize |

| Net Profit | RMB 692 million | +5.75% |

Improved profitability |

- Low Gross Profit Margin: The gross profit margin of the healthcare services segment is only 16.28%, far lower than that of the medical devices business

- Declining Revenue Share: Healthcare services account for approximately 8.3% of total revenue, a significant decrease from its historical peak

- Sustained Loss Pressure: In 2024, Xiangyin Huaya Hospital voluntarily applied for suspension of operations and has been listed as a person subject to execution multiple times[1][2]

| Transaction Time | Target Asset | Transaction Consideration | Transfer Method |

|---|---|---|---|

| January 2025 | 55% equity in Shandong Changguo Hospital | RMB 113 million |

Listed on Shandong Property Rights Exchange Center |

| August 21, 2025 | 100% equity in Zibo Xinhua Hospital | RMB 200,000 |

Listed on Shandong Property Rights Exchange Center |

| December 2025 | Subsidiary equity and related claims | Undisclosed | Pre-listed for transfer |

- Significant Discounted Sale: The 100% equity in Zibo Xinhua Hospital was priced at only RMB 200,000, equivalent to a “fire sale”

- Asset Impairment Pressure: The net assets of some hospitals are negative, and the sale price is far lower than the initial investment

- Clear Transaction Purpose: To realize capital recovery and optimize resource allocation[1][2]

Through the disposal of inefficient hospital assets, the company’s revenue structure has improved significantly:

Before Disposal (Typical Structure in 2017) After Disposal (2024 Structure)

├── Medical Devices: ~60% ├── Medical Devices: 68.4%

├── Pharmaceutical Equipment: ~20% ├── Pharmaceutical Equipment: 21.7%

├── Healthcare Services: ~15% ├── Healthcare Services: 8.3%

└── Medical Trade: ~5% └── Medical Trade: ~1.6%

| Indicator | 2023 | 2024 | Trend |

|---|---|---|---|

| Net Profit | RMB 654 million | RMB 692 million | +5.75% |

| Net Profit Margin | 6.5% | 6.9% | Increased |

| ROE | ~6.0% | 6.55% | Improved |

Although revenue in the healthcare services segment decreased,

The positive impact of asset disposal on the company’s cash flow is reflected in:

- Capital Recovery: Recovered over RMB 115 million through hospital asset disposals

- Loss Reduction: Reduced sustained losses in the healthcare services segment

- Optimized Allocation: Funds can be used for R&D and expansion of the core medical devices business

In January 2025, the company increased capital by RMB 60 million to its wholly-owned subsidiary Xinhua Medical Rehabilitation Industry (Xi’an) Co., Ltd., which reflects the strategy of tilting funds towards core businesses[2].

| Indicator | Data |

|---|---|

| Controlling Shareholder’s Increase in Holdings | Cumulative increase of 3.8638 million shares as of November 2025 |

| Equity Incentive | 2021 restricted stock incentive plan is in implementation |

| ESG Rating | Awarded “AA+pi” rating, leading the industry in sustainable development strength[2] |

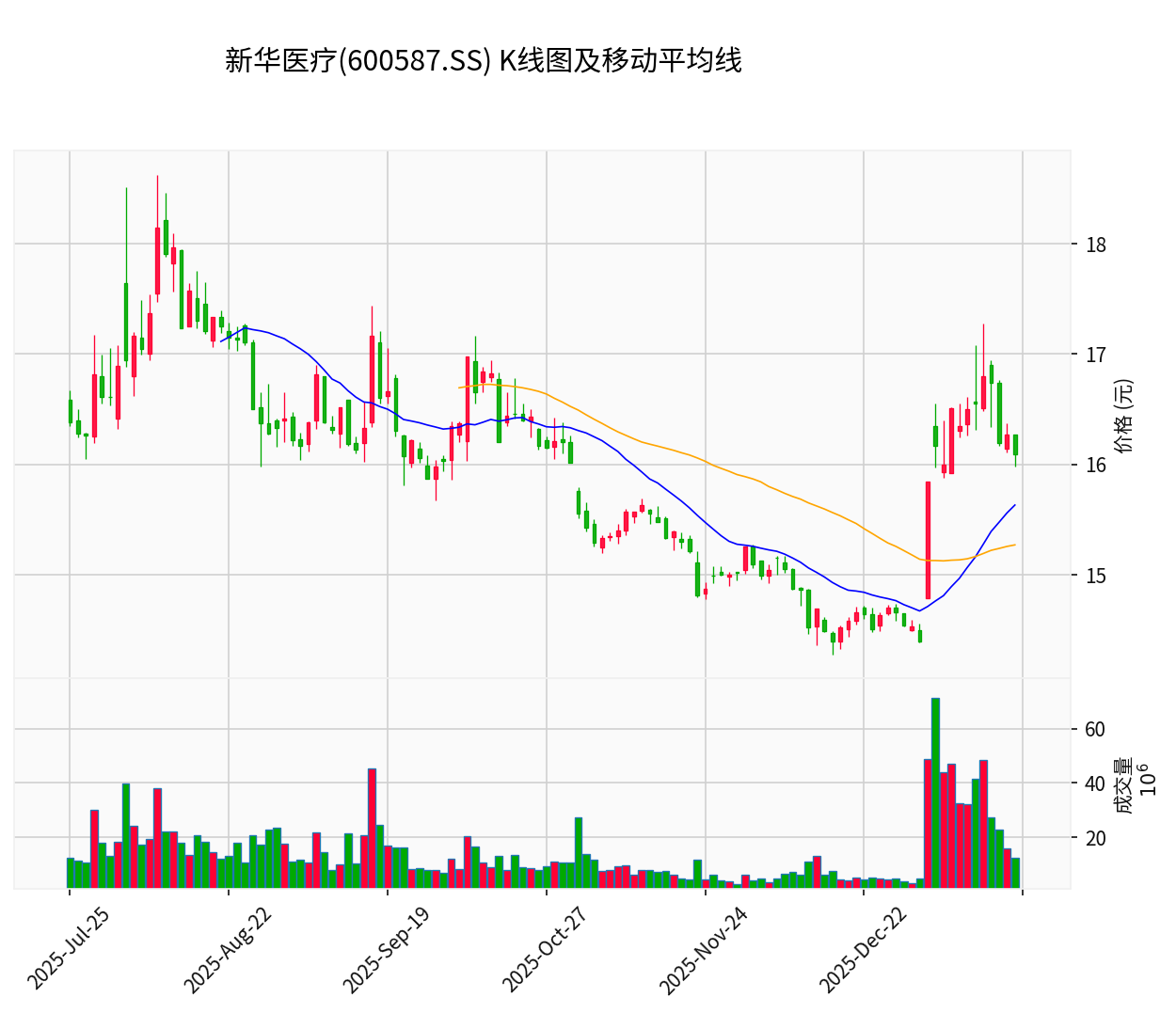

| Time Period | Opening Price | Closing Price | Price Change | Average Daily Trading Volume |

|---|---|---|---|---|

| Full Year 2024 | RMB 19.62 | RMB 16.65 | -15.14% |

7.92 million shares |

| Full Year 2025 | RMB 16.20 | RMB 14.40 | -11.11% |

9.78 million shares |

| Event | Time | Stock Price Performance | Trading Volume Change |

|---|---|---|---|

| Disposal of Shandong Changguo Hospital | Q1 2025 | -0.80% | Normal level |

| Disposal of Zibo Xinhua Hospital | August 2025 | -1.99% | Increased to 19.64 million shares per day |

| Pre-listed transfer of subsidiary | December 2025 | -5.64% | Normal level |

| Indicator | Current Value | Market Interpretation |

|---|---|---|

| Current Price | RMB 16.09 | - |

| 20-day Moving Average | RMB 15.63 | Above short-term moving average |

| 50-day Moving Average | RMB 15.27 | Weak medium-term trend |

| 52-week Fluctuation Range | RMB 14.28 - 18.62 | In the lower-middle part of the range |

| P/E Ratio (TTM) | 18.83x | Reasonable level for the medical device industry |

Xinhua Medical’s asset disposal is not an isolated case, but part of a collective “great retreat from cross-border hospital operation” among A-share listed companies[1][2]:

| Company | Disposal Target | Disposal Status |

|---|---|---|

| Yonghe Zhikong | Dazhou Medical Oncology Hospital, etc. | Listed at 10% of original price but still unsold |

| Great Eastern | Multiple medical subsidiaries | Sold for a symbolic RMB 1 |

| China Resources Sanjiu | Healthcare services assets | Cut off “toxic assets” |

| Yibai Pharmaceutical | Hospital equity | Gradually exited |

| Genview Pharmaceuticals | Healthcare services assets | Sold hospital business |

- Long Payback Period: Hospitals are long-term investments, and pharmaceutical companies face tight cash flow

- Policy Changes: Volume-based procurement, bidding, and medical anti-corruption increase operational pressure

- Stricter Regulation: Supervision over private hospitals has been strengthened, leading to increased compliance costs

- Underperforming Results: Most hospitals continue to incur losses, dragging down the performance of listed companies[1][2]

| Impact Dimension | Specific Performance |

|---|---|

| Revenue Side | Healthcare services revenue decreased by approximately RMB 834 million, but only accounts for 8.3% of total revenue |

| Cost Side | Reduced hospital operating losses and improved overall gross profit margin |

| Cash Flow | Recovered over RMB 100 million through asset disposals |

| Stock Price | Short-term pressure, market holds a wait-and-see attitude towards asset disposals |

| Impact Dimension | Specific Performance |

|---|---|

| Strategic Focus | Resources focused on core businesses of medical devices and pharmaceutical equipment |

| Profitability | Increased revenue share of manufacturing products and improved net profit margin |

| Valuation Reconstruction | Market re-evaluates the value of the company’s core businesses |

| Competitive Advantage | Focusing on core businesses is expected to consolidate leading industry position |

- Intensified Competition in Core Business: Sustained pressure from volume-based procurement of medical devices

- Valuation Volatility: Stock price may fluctuate during asset disposal period

- Transformation Growing Pains: Business structure adjustment requires time to be absorbed

-

Strategic Level: The disposal of hospital assets is aproactive strategic contractionby the company, which aligns with the overall strategy of “focusing on core businesses and optimizing resource allocation”

-

Financial Level:

- Healthcare services segment revenue continues to decline (-9.51% YoY in 2024) with a low gross profit margin (16.28%)

- Disposal of inefficient assets helps improve overall profitability and cash flow

- Net profit grew 5.75% YoY in 2024, indicating initial effectiveness of strategic adjustment

-

Market Level: The stock price performed weakly during the asset disposal period, butincreased trading volumeindicates rising market attention

-

Industry Level: Against the backdrop of the retreat from “private hospital operation”, Xinhua Medical’s exit is arational choice in line with industry trends

[1] Caifuhao - “Xinhua Medical Hurriedly Sells 11 Hospitals: RMB 1 Fire Sale, 10% Price Unanswered” (https://caifuhao.eastmoney.com/news/20260120114606991919650)

[2] Sohu - “Xinhua Medical Hurriedly Sells 11 Hospitals: The Great Collapse of Listed Companies’ ‘Hospital Operation Trend’” (https://m.sohu.com/a/977949723_617205)

[0] Jinling AI Financial Database - Real-time Quotes and Financial Data of Xinhua Medical (600587.SS)

民丰特纸(600235)停产事件与扭亏策略深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.