Analysis of the Stock Price Impact of Rongbai Technology (688005.SS) Being Investigated by the CSRC

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and market information, I have prepared a systematic and comprehensive analysis report for you:

On January 18, 2026, Ningbo Rongbai New Energy Technology Co., Ltd. (Stock Code: 688005.SS) issued an announcement stating that the company had received a <Notice of Case Filing> from the China Securities Regulatory Commission (CSRC) [1][2]. According to the announcement, the CSRC initiated the investigation into Rongbai Technology due to suspected misleading statements and other issues in the major daily operation contract announcement disclosed by the company on January 14, 2026 [2]. This investigation is conducted in accordance with relevant laws and regulations such as the <Securities Law of the People’s Republic of China> and the <Administrative Punishment Law of the People’s Republic of China> [1].

From the perspective of the event timeline, Rongbai Technology disclosed a major daily operation contract worth approximately

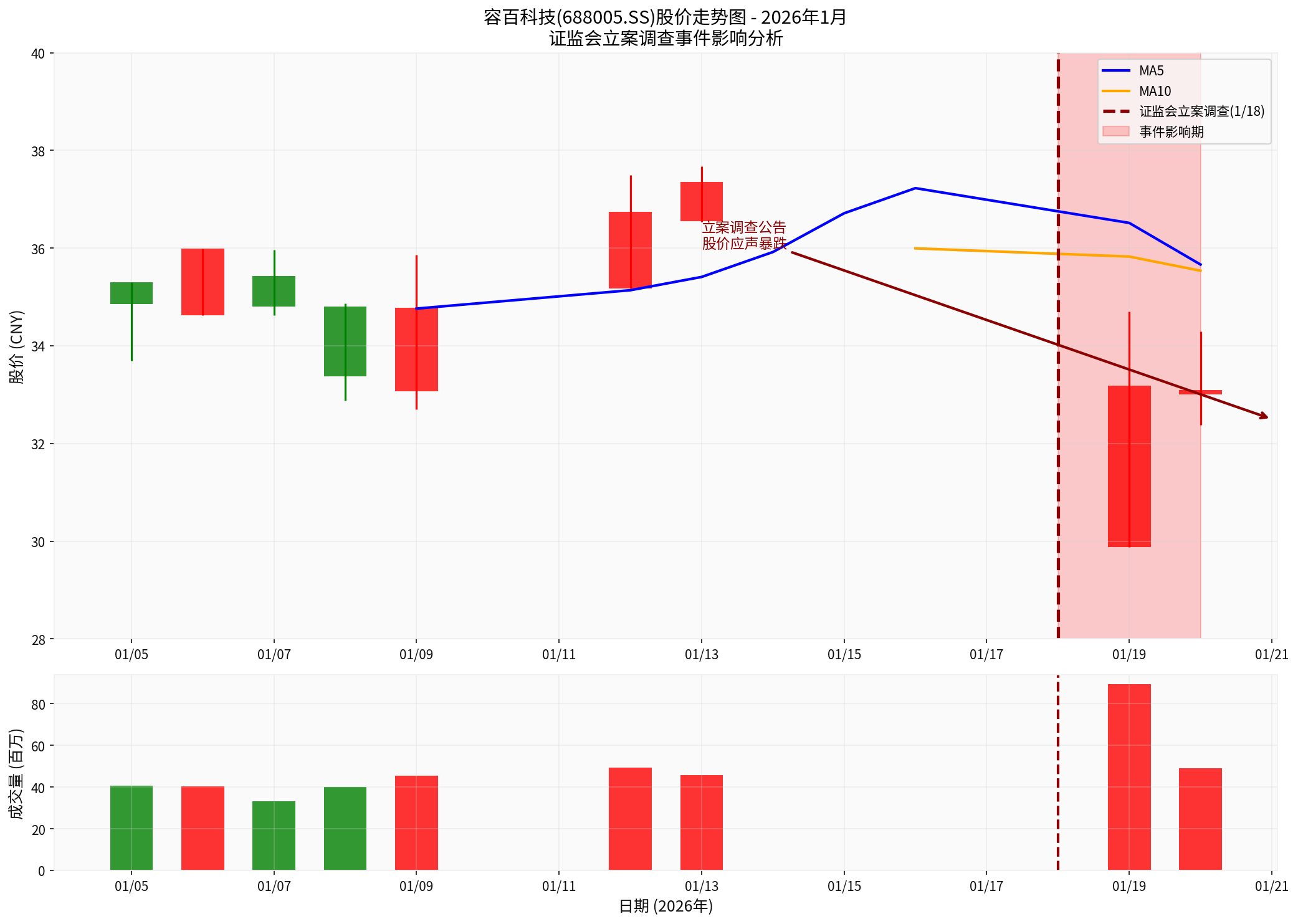

After Rongbai Technology was put under investigation, its stock price immediately reacted significantly in the secondary market. According to market data:

| Time Node | Closing Price (RMB) | Daily Price Change | Trading Volume (10,000 lots) | Turnover Rate |

|---|---|---|---|---|

| January 17, 2026 (Pre-investigation) | 37.35 | - | 42.65 | 6.02% |

| January 18, 2026 (Announcement Date) | 33.18 | -11.16% | 89.30 | 12.49% |

| January 19, 2026 | 33.09 | -0.27% | 49.13 | 6.92% |

-

Largest Single-Day Decline: On the first trading day after the investigation announcement (January 18), Rongbai Technology’s stock price dropped by11.16%in a single day, and once hit the “20% limit down” during the trading session [3]

-

Surge in Trading Volume: The trading volume surged to 893,000 lots on the day, doubling that of the previous trading day; the transaction value reached RMB 2.94 billion, with a turnover rate as high as 12.49%, reflecting a concentrated release of market panic [3]

-

Decline Convergence: Notably, after the sharp drop on the first day, the stock price decline narrowed rapidly to 0.27% on January 19, indicating that some capital began to attempt bottom-fishing [3]

From a longer time perspective, Rongbai Technology’s recent stock price performance shows obvious volatility characteristics:

- 1-Month Increase: +14.86%

- 3-Month Increase: +27.02%

- 6-Month Increase: +47.59%

- 1-Year Increase: +51.93%

- 5-Day Decline: -11.41%[0]

The chart above clearly shows Rongbai Technology’s stock price trend in January 2026. After the investigation announcement was released (marked by the red dashed line), the stock price plummeted sharply, and trading volume increased significantly. The shaded area indicates the market reaction during the event impact period.

Based on technical analysis results [0]:

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Current Closing Price | RMB 33.09 | At a recent low |

| 20-Day Moving Average | RMB 34.25 | Stock price is below the moving average |

| 50-Day Moving Average | RMB 31.54 | Short-term trend is weak |

| 200-Day Moving Average | RMB 25.28 | Long-term trend remains upward |

| MACD | No crossover | Shows a death cross signal, bearish |

| KDJ | K:63.3, D:75.9, J:37.9 | J-value has hit the bottom, rebound potential exists |

| RSI(14) | Normal range | No overbought or oversold |

| Beta Coefficient | 0.7 | Low correlation with the Shenzhen Component Index |

The current stock price is trading within the range of

- Support Level: RMB 32.19 (lower edge of the consolidation range)

- Resistance Level: RMB 34.25 (upper edge of the consolidation range/20-day moving average)

The MACD indicator shows a death cross bearish signal, but the J-value in the KDJ indicator has hit a low level, indicating potential short-term technical rebound demand. However, considering the uncertainty of the investigation, the stock price still faces significant volatility risk in the short term.

The recently released financial data of Rongbai Technology shows that the company is facing certain operating pressures [1][0]:

| Financial Indicator | Value |

|---|---|

| Operating Revenue in the First Three Quarters of 2025 | RMB 8.986 billion |

| Net Profit Attributable to Shareholders in the First Three Quarters of 2025 | -RMB 204 million (loss) |

| EPS (Latest Quarter) | -RMB 0.19 (plunged 410.88% from expectations) |

| Revenue Surprise | -18.86% |

| ROE (Return on Equity) | -0.29% |

| Net Profit Margin | -0.19% |

Rongbai Technology is mainly engaged in the R&D, production, and sales of lithium battery cathode materials. According to market analysis [3], the company currently faces the following fundamental challenges:

- Industry Structural Dilemma: The lithium iron phosphate cathode material industry is facing a situation of “strong demand but difficult profitability”

- Product Upgrade Pressure: The company’s third and fourth-generation lithium iron phosphate cathode products have not yet achieved large-scale stable mass production, and the fifth-generation product is still in the development stage

- Controversy Over New Technology: The new technology used by the company has certain controversies in the industry, and its industrialization faces challenges [3]

The core of this investigation is the major contract with CATL. Although the announcement mentioned that CATL may provide assistance when necessary (such as advance payments or joint venture support for capacity construction), the specific implementation clauses of the contract, the timing of revenue recognition, and the completeness of information disclosure have become the focus of regulatory attention [3]. If the investigation concludes that the company made misleading statements, it may face the following risks:

- Administrative penalties (fines, warnings, etc.)

- Civil compensation risks

- Restrictions on refinancing

- Damaged investor confidence

The investigation of Rongbai Technology is not an isolated incident. Statistics show that as of January 19, 2026,

| Company Name | Reason for Investigation | Industry Hotspot |

|---|---|---|

| Rongbai Technology | Misleading statements in major contract | New Energy |

| Sunflower | Misleading statements in restructuring plan | Pharmaceuticals/Materials |

| Tianpu Co., Ltd. | Major omissions in abnormal stock trading fluctuation announcement | AI Concept |

| Hangxiao Steel Structure | Inaccurate information disclosure | Construction/AI |

| CETC Digital Technology | Inadequate risk warning | Technology/AI |

- Transformation from “post-hoc punishment” to “in-process intervention” [3]

- “Zero tolerance” for concept speculation and information disclosure violations

- Significantly improved response speed (Rongbai Technology was investigated only 5 days after the announcement)

From the market reaction, investors have divided attitudes towards the Rongbai Technology incident:

- Panic Selling: On the first trading day after the investigation announcement, the stock price plummeted 11.16%, and the turnover rate surged to 12.49%, indicating that some investors chose to exit in panic

- Bottom-Fishing: In the subsequent trading days, the decline narrowed rapidly, and trading volume remained at a high level, indicating that some capital attempted bottom-fishing at low prices

- Concept Sector Linkage: Affected by the incident, related concept stocks such as new energy and lithium batteries came under overall pressure, but some capital flowed to other stocks in the same sector

- Investigation Uncertainty: The result of the CSRC investigation is still uncertain, which may continue to pressure the stock price

- Liquidity Risk: Increased trading volume may exacerbate short-term price fluctuations

- Market Sentiment Recovery: Investor confidence takes time to rebuild

- Investigation Result: Focus on the investigation conclusion and potential administrative penalties

- Business Fundamentals: Pay attention to the company’s technological breakthroughs and mass production progress in the lithium iron phosphate cathode material field

- Industry Prosperity: The impact of demand changes in the new energy vehicle and energy storage industries on the company’s performance

Despite facing short-term regulatory pressure, Rongbai Technology still has the following long-term investment rationales:

- Industry Position: As an important supplier in the lithium battery cathode material field, it benefits from the long-term growth of the new energy vehicle industry

- Technology Reserves: The company’s technological accumulation and R&D investment in the cathode material field

- Cooperation with CATL: If the contract is executed smoothly, it is expected to obtain stable order guarantees [3]

The CSRC investigation into Rongbai Technology has had a

- Nature of the Event: This investigation stems from suspected misleading statements in the major contract announcement, reflecting the regulatory authorities’ high emphasis on information disclosure compliance, and is a continuation of the high-pressure regulatory stance in 2026 [1][2][3]

- Stock Price Impact: The short-term impact is significant, but the market reaction shows signs of gradual stabilization; the medium-to-long-term trend will depend on the investigation result and changes in the company’s fundamentals

- Regulatory Trend: It only took 5 days from Rongbai Technology’s announcement to being investigated, reflecting the regulatory transformation from post-hoc punishment to in-process intervention [3]

- Investment Advice: Given the unclear investigation result, it is recommended that investors pay close attention to subsequent developments and carefully assess investment risks

[1] Caizhong News - “CSRC Investigates Rongbai Technology for Misleading Statements in Major Contract” (https://rccaijing.com/news-7418579790653486416.html)

[2] China Economic Net - “CSRC Launches Investigation into Rongbai Technology for Suspected Misleading Statements in Major Contract Announcement” (http://www.ce.cn/xwzx/gnsz/gdxw/202601/t20260120_2715623.shtml)

[3] Financial Investment News/Eastmoney - “Regulatory ‘Heavy Blow’ at the Start of the Year! Rongbai Technology Investigated Only 5 Days After Announcing RMB 120 Billion Order!” (https://wap.eastmoney.com/a/202601193623529451.html)

[0] Jinling AI Financial Data API - Company Market Quotations, Technical Analysis, Financial Data

飞天茅台批发价与零售价价差分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.