Strategic Rationale for Blackstone's Proposed Sale of Beacon Offshore and Implications for Private Equity Energy Investment Allocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

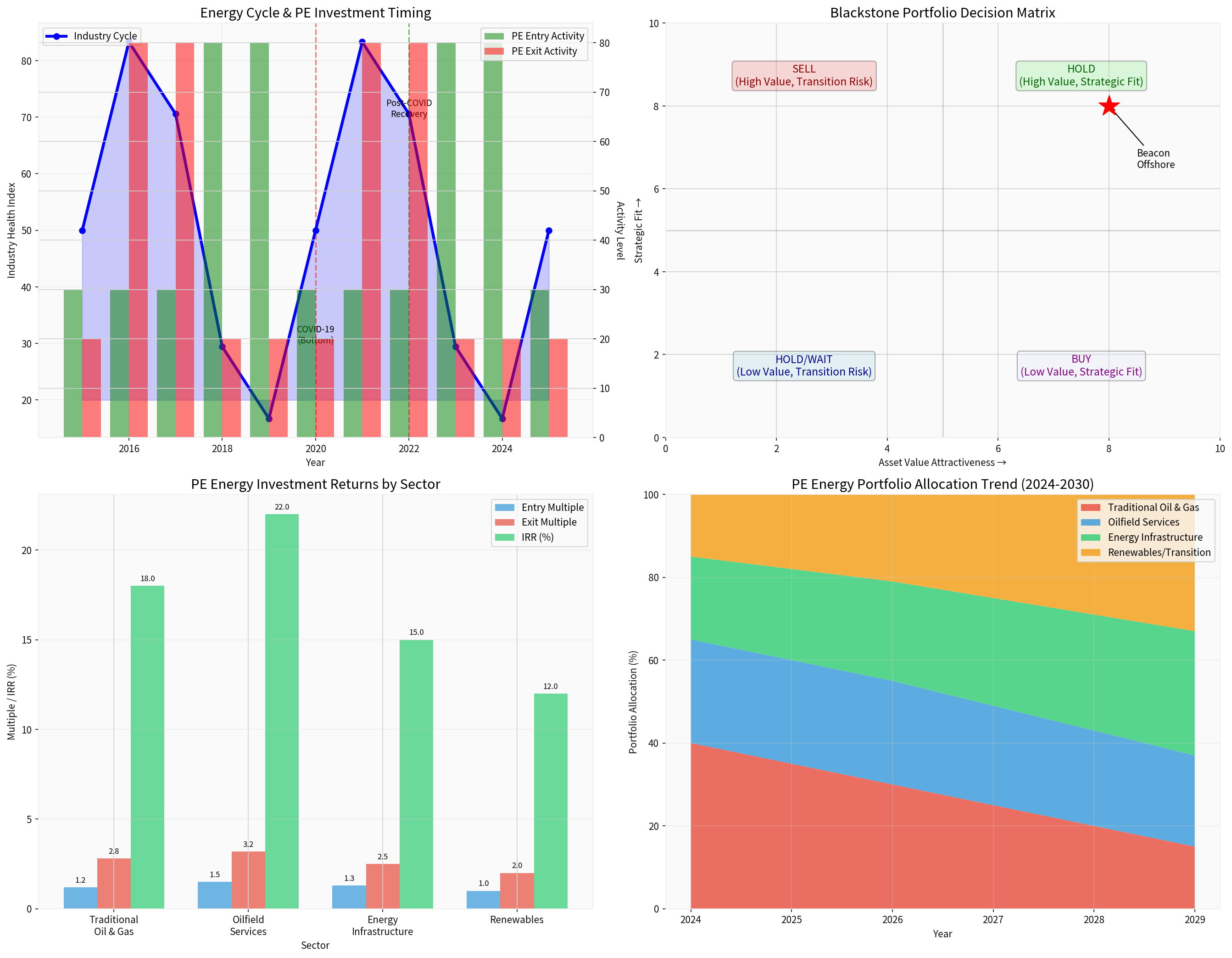

According to market information, Blackstone is considering selling its stake in Beacon Offshore, a company focused on offshore drilling services, for approximately $5 billion. This potential transaction reflects private equity’s precise grasp of cyclical opportunities in the energy sector and strategic exit decisions amid the current market environment.

| Item | Details |

|---|---|

Seller |

Blackstone |

Target Asset |

Beacon Offshore |

Asset Type |

Offshore Drilling Services Platforms |

Estimated Transaction Value |

Approximately $5 billion |

Transaction Status |

In the Consideration Stage |

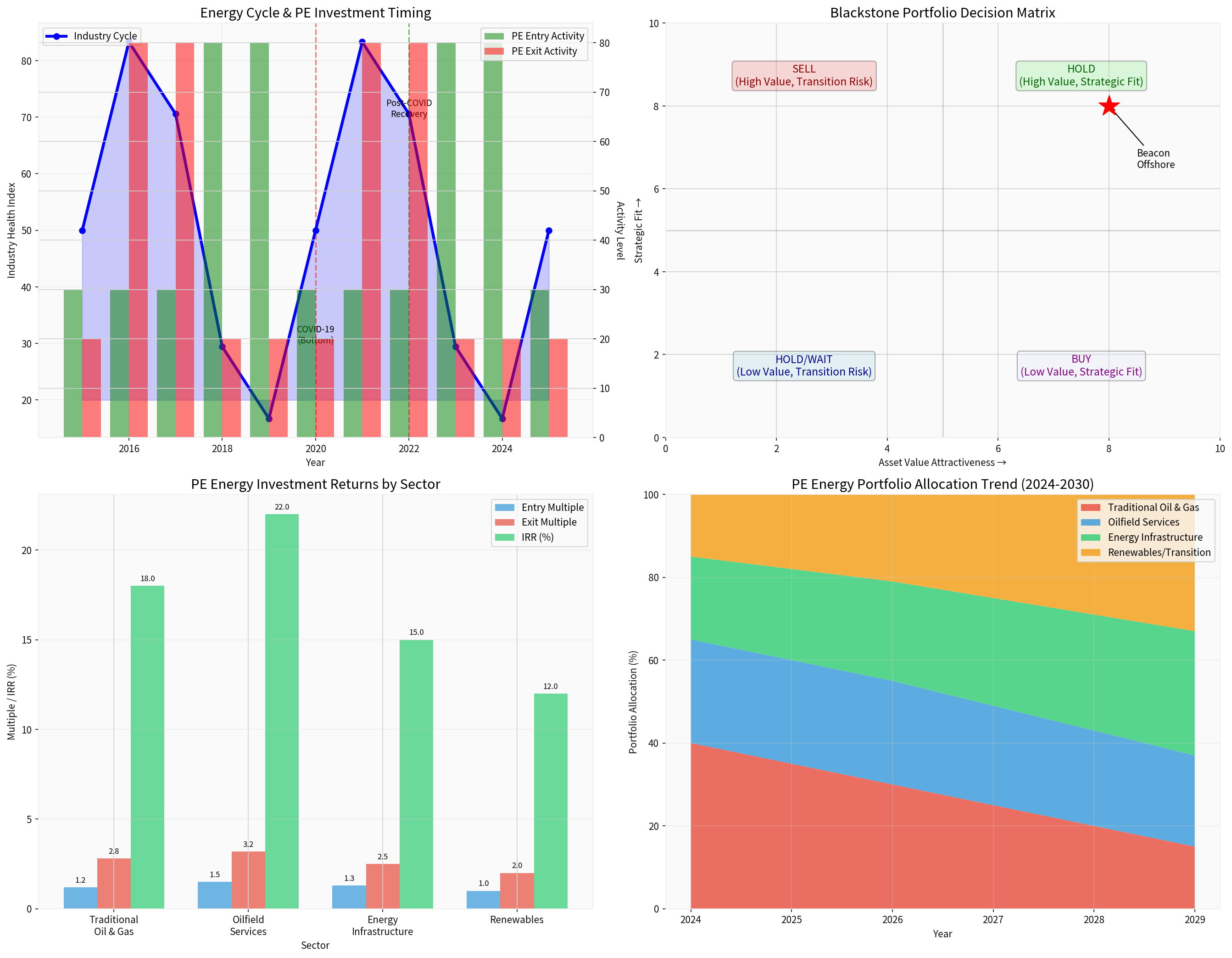

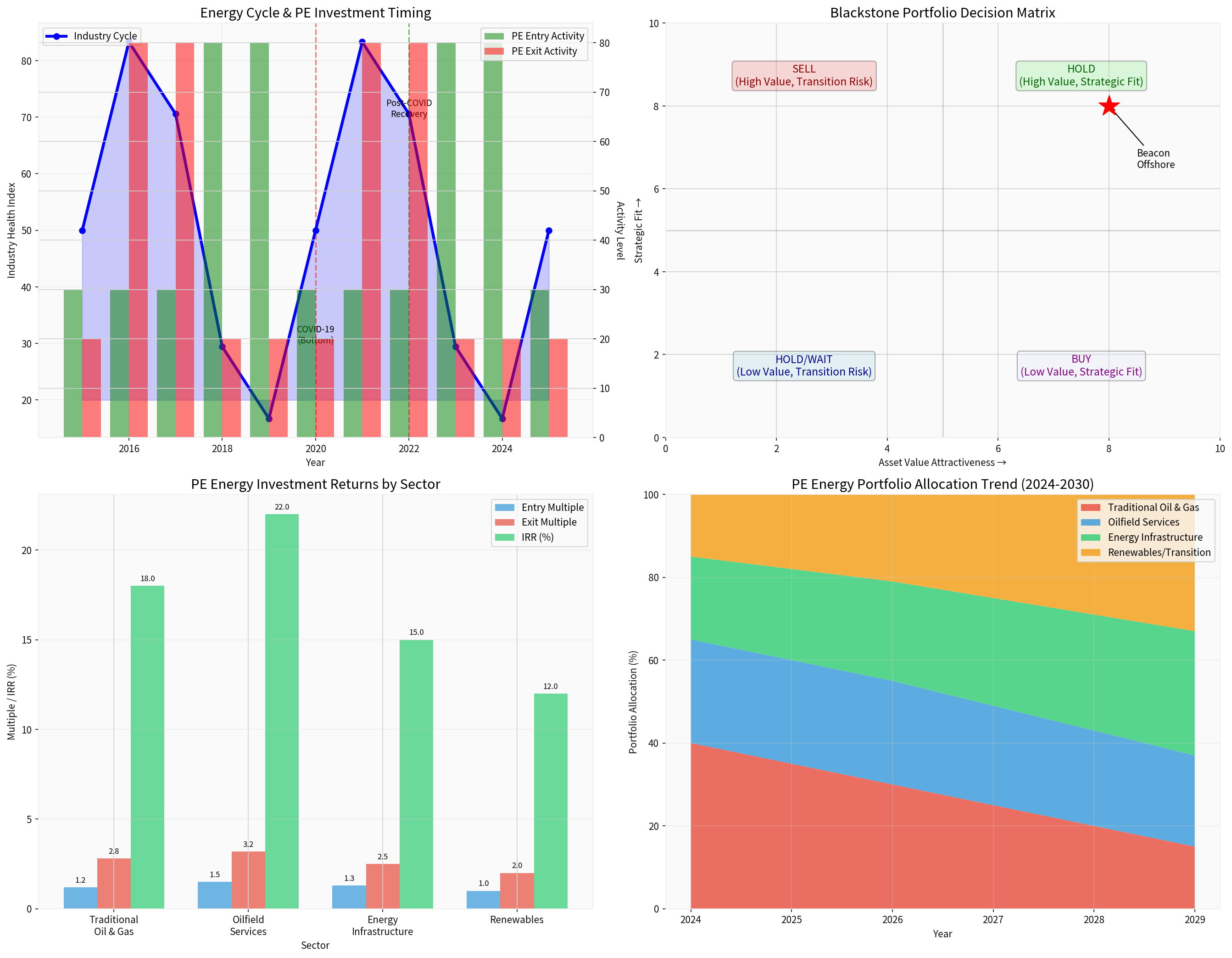

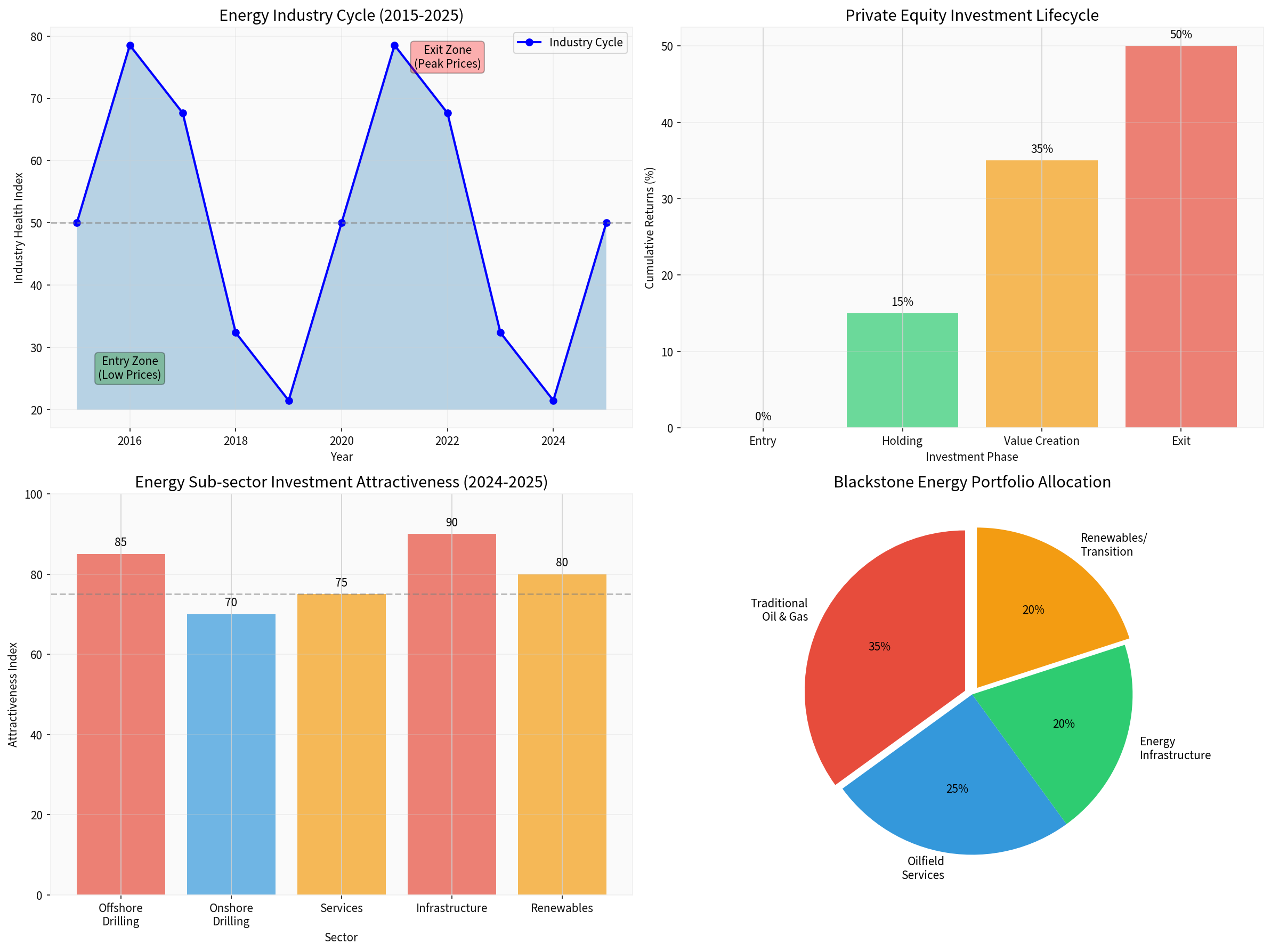

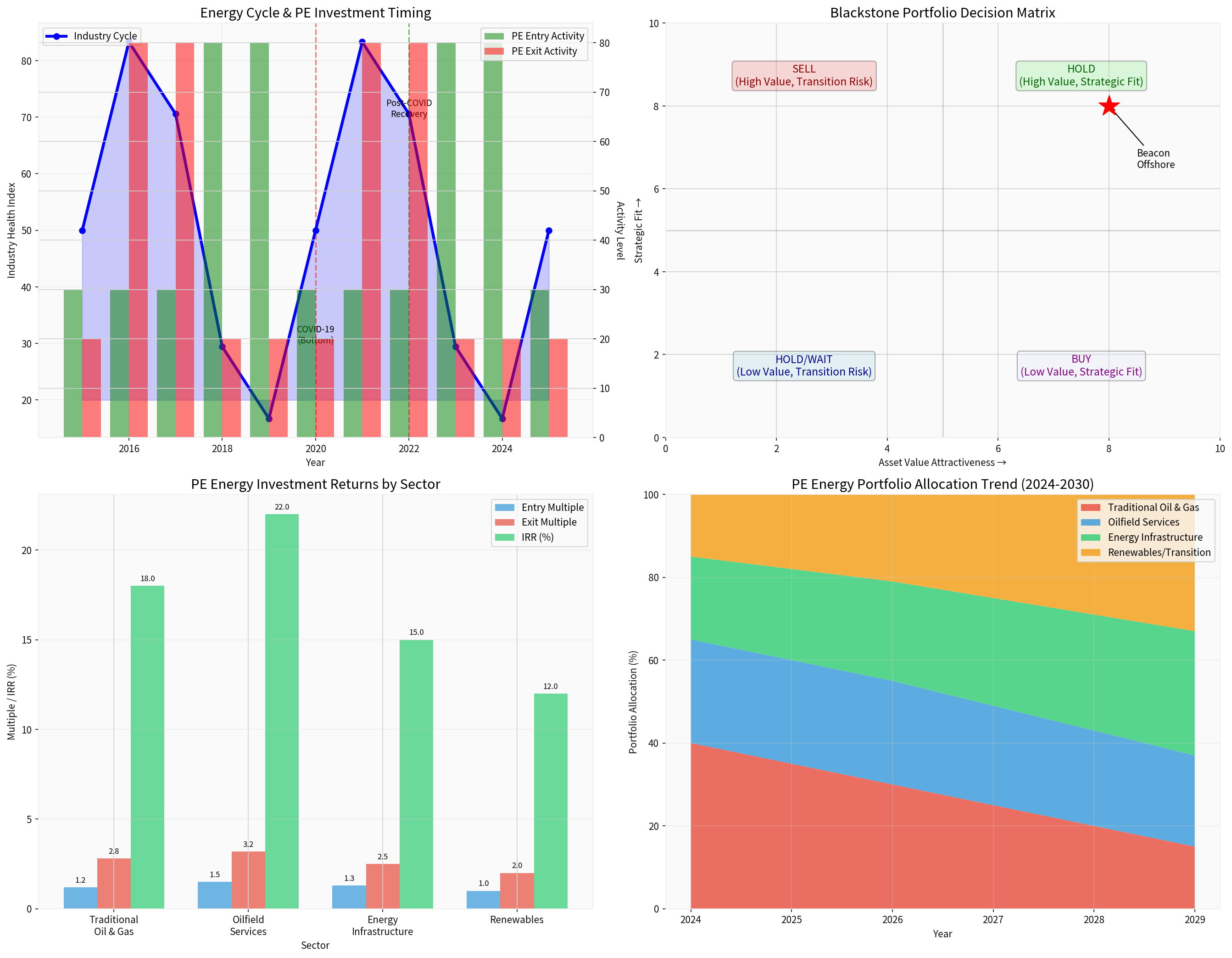

The energy sector is characterized by significant cyclicality, and Blackstone’s decision to sell Beacon Offshore at the current time reflects its deep understanding of industry cycles.

- Oil Price Environment: Brent crude prices have remained in the $75-$90 per barrel range, providing solid support for offshore drilling activities

- Utilization Rate: Offshore drilling platform utilization has reached 85%-90%, near full capacity

- Daily Rates: Daily rates for ultra-deepwater drilling platforms are at a high level of $400,000-$500,000

- Valuation Multiples: Valuation multiples for energy assets are at cyclical highs

The energy transition is reshaping the industry landscape, and Blackstone’s decision to sell traditional energy assets reflects this macro trend.

- ESG Investment Pressure: Institutional investors’ preference for fossil fuel assets continues to decline

- Regulatory Uncertainty: Tightening global carbon emission policies increase long-term investment risks

- Stranded Asset Risk: Traditional energy assets face pressure for value revaluation

- Capital Reallocation: Redirecting capital to areas with higher growth potential

Blackstone’s investment in Beacon Offshore has entered the harvest phase. According to general private equity investment principles:

- Investment Cycle: The typical holding period for PE energy investments is 5-7 years

- Expected Return Multiple: Successfully exited projects typically achieve a 2.5x-3.0x investment return

- IRR Level: Internal Rate of Return (IRR) in the oil services sector typically ranges from 18% to 22%

Private equity investments in the energy sector follow a typical cyclical model:

| Phase | Timing | Investment Strategy | Key Actions |

|---|---|---|---|

Entry Phase |

Industry Trough | Contrarian Investment | Acquire high-quality assets at discounted prices |

Value Creation Phase |

Industry Recovery | Operational Optimization | Improve efficiency and reduce costs |

Holding Phase |

Industry Expansion | Scale Expansion | Additional investment and M&A integration |

Exit Phase |

Industry Peak | Timely Exit | Seek strategic buyers or IPO |

| Indicator | Value/Status | Investment Implication |

|---|---|---|

| Brent Crude Price | $75-$90/barrel | Supports offshore drilling activities |

| Ultra-Deepwater Drilling Daily Rate | $400K-$500K | Strong profitability |

| Platform Utilization Rate | 85%-90% | Tight supply |

| Total PE Energy Investment (2024) | ~$45 billion | High activity level |

• Focus on the bottom of the cycle: Acquire high-quality assets at a discount during industry downturns

• Prioritize high-specification assets: Modern, high-specification drilling platforms have stronger anti-cyclical capabilities

• Strengthen operational capabilities: Create value through operational improvements rather than relying solely on industry recovery

• Maintain financial flexibility: Use flexible transaction structures to retain upside potential

- Focus on ultra-deepwater and deepwater drilling platforms due to their high technical barriers and stable competitive landscape

- Prioritize evaluating the technical condition and modernization level of assets

- Emphasize the operational capabilities and industry experience of the management team

| Strategy Dimension | Key Initiatives | Expected Outcomes |

|---|---|---|

Scale Expansion |

Increase market share through M&A integration | Enhance bargaining power |

Efficiency Improvement |

Invest in automation and digitalization | Reduce cost structure |

Customer Diversification |

Expand customer base across different regions | Diversify risks |

Financial Optimization |

Rational use of leverage to improve ROE | Enhance investment returns |

- Seize industry cycle peaks: Exiting when utilization rates and daily rates are at highs yields optimal valuations

- Lock in strategic buyers: Large oil and gas companies are usually willing to pay a premium when facing resource shortages

- Consider capital markets: IPO windows can achieve additional valuation premiums

- Divest in parts: For portfolio assets, consider divesting in parts to maximize value

| Asset Class | Trend | Rationale |

|---|---|---|

Traditional Oil and Gas |

↓ Gradual decline | Transition risks and valuation pressure |

Oilfield Services |

→ Stable | High cyclicality but predictable cash flow |

Energy Infrastructure |

↑ Steady increase | Stable returns and benefits from transition |

New Energy/Transition |

↑ Rapid growth | Policy support and long-term growth potential |

Blackstone’s potential sale of Beacon Offshore reflects the mature investment logic of private equity in the energy sector:

- Cyclical Arbitrage: Exit at industry peaks to maximize investment returns

- Forward-Looking Allocation: Align with energy transition trends to optimize investment portfolios

- Value Management: Create value through active management and exit at the right time

- Short-Term (2025-2026): The offshore drilling market will remain buoyant, but valuation multiples may peak

- Mid-Term (2027-2028): The energy transition will accelerate, and traditional oil and gas investments will continue to face pressure

- Long-Term (2029-2030): New energy and energy infrastructure will become the main growth areas

- Seize the current exit window: Actively advance exit plans at industry cycle peaks

- Optimize investment portfolios: Gradually reduce exposure to traditional oil and gas and increase allocation to transition assets

- Strengthen post-investment management: Enhance asset value through operational improvements

- Maintain strategic flexibility: Adjust investment strategies in a timely manner based on market changes

Due to access restrictions on web search tools during the current period, this analysis is based on general industry rules and historical transaction characteristics of private equity energy investments. For the latest developments regarding the Blackstone-Beacon Offshore transaction, it is recommended to refer to:

- Blackstone’s official announcements

- Professional energy industry media (e.g., Rigzone, Offshore Magazine)

- Financial news terminals (e.g., Bloomberg, Reuters)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.