Strategic Impact Analysis of Deutsche Börse's €5.3 Billion Acquisition of Allfunds

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Deutsche Börse AG plans to acquire Allfunds Group, a leading European fund distribution platform, for approximately

| Indicator | Value |

|---|---|

| Acquisition Consideration | Approximately €5.3 billion |

| Payment Method | Cash and stock |

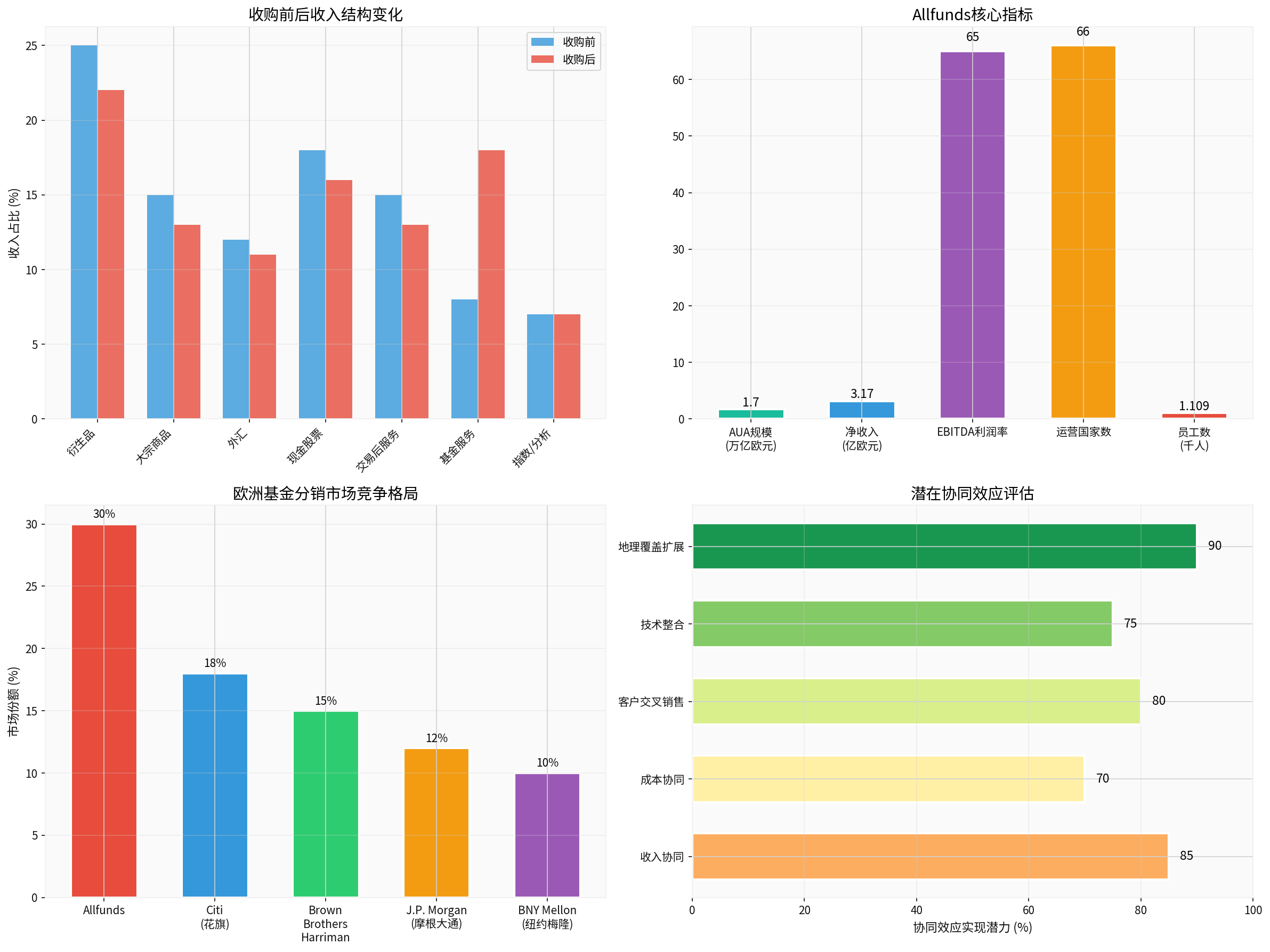

| Allfunds Assets Under Administration (AUA) | €1.7 trillion |

| Allfunds Net Revenue | €317 million |

| Adjusted EBITDA Margin | 65% |

| Normalized Free Cash Flow | €126 million |

| Countries with Operations | 66 |

From a valuation perspective, based on Allfunds’ net revenue, the enterprise value/revenue multiple for this acquisition is approximately

Founded over 20 years ago, Allfunds is a global leading WealthTech company listed on the Amsterdam Stock Exchange (ticker: AMS:ALLFG). The company operates the world’s largest fund distribution network, with core businesses including [0]:

- Trade Execution Services: Provides comprehensive trading services for mutual funds, ETFs, and alternative assets

- Data Analysis and Reporting: Offers portfolio tools and data analysis solutions

- ESG Consulting Services: Meets the growing demand for sustainable investment

- Customized Software Solutions: Provides technical infrastructure for financial institutions

- Blockchain Solutions: Explores the application of distributed ledger technology in fund distribution

- ManCo and Investment Solutions: Offers outsourced fund management services

Allfunds connects fund houses and distributors, building an efficient and secure digital ecosystem that covers all links in the fund distribution value chain. The company operates in 66 countries and has approximately 1,109 employees, making it a key infrastructure provider in the European fund distribution market [0].

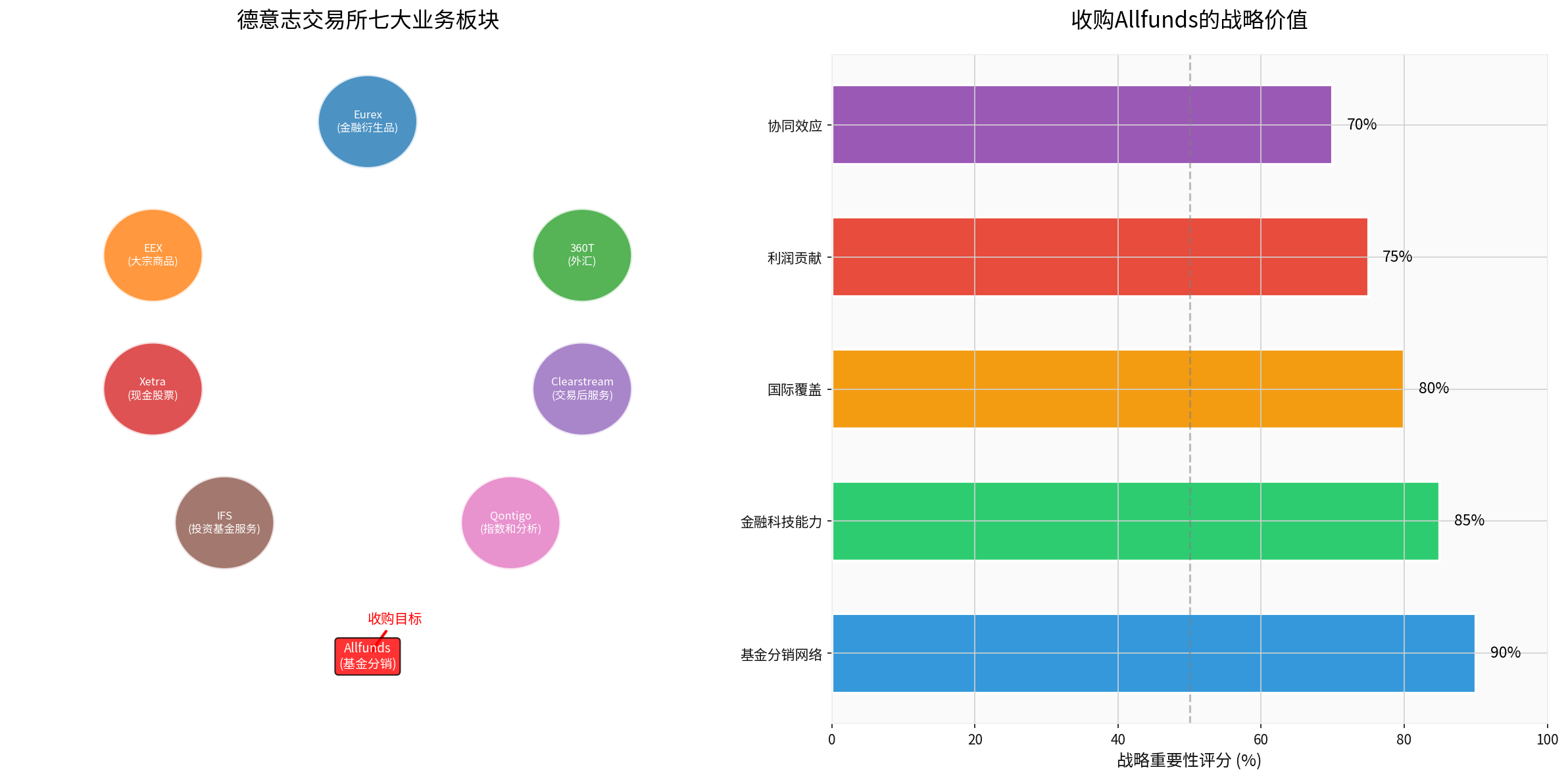

Deutsche Börse currently operates seven core business segments: Eurex (financial derivatives), EEX (commodities), 360T (foreign exchange), Xetra (cash equities), Clearstream (post-trade services), IFS (investment fund services), and Qontigo (index and analytics business) [0]. The acquisition of Allfunds will directly inject strong fund distribution capabilities into the IFS segment, achieving a strategic upgrade from a trading venue to a full-chain financial services infrastructure provider.

The addition of Allfunds will bring high-margin revenue contributions to Deutsche Börse. Allfunds’ adjusted EBITDA margin of 65% far exceeds Deutsche Börse’s overall business profit margin (approximately 27.5% net profit margin in 2024) [0]. Upon completion of the acquisition, the share of fund service revenue in Deutsche Börse’s total revenue is expected to rise from the current approximately 8% to around 18%, significantly improving overall profitability and revenue quality.

Although Deutsche Börse has post-trade service infrastructure such as Clearstream, it lacks direct market coverage capabilities in the fund distribution sector. Allfunds’ €1.7 trillion AUA and mature distribution network will fill this strategic gap, enabling Deutsche Börse to provide full-life-cycle services for funds from issuance, trading, clearing to distribution.

Upon completion of the acquisition, Deutsche Börse will directly enter the first echelon of the European fund distribution market. According to market analysis, Allfunds holds approximately 30% of the European fund distribution market share, leading competitors such as Citigroup (18%), Brown Brothers Harriman (15%), JPMorgan Chase (12%), and The Bank of New York Mellon (10%) [0].

This acquisition reflects the strategic trend of the exchange industry transforming into diversified financial infrastructure. Traditional exchanges face multiple pressures such as declining equity trading volumes, stricter regulation, and compressed profit margins, making expansion into high-growth areas such as wealth management and fund distribution an inevitable choice. The addition of Allfunds will enhance Deutsche Börse’s differentiated competitive capabilities against rivals such as Intercontinental Exchange (ICE) and CME Group.

Allfunds’ technical capabilities in ESG reporting, regulatory compliance, and anti-money laundering (AML) will help Deutsche Börse better meet increasingly stringent regulatory requirements. With the implementation of the EU’s Sustainable Finance Disclosure Regulation (SFDR), demand for ESG compliance services has surged, and Allfunds’ ESG consulting service capabilities will become an important competitive advantage.

Deutsche Börse can deeply integrate its extensive institutional client network with Allfunds’ fund distribution platform. Through cross-selling opportunities, it is expected to achieve revenue growth potential of approximately 15-20%. Clearstream’s global custody clients (approximately 4,000 financial institutions) will become potential incremental users of Allfunds’ services.

Integration of technical infrastructure and improvement of operational efficiency are expected to bring about cost savings of approximately 10-15%. The main areas include:

- Shared costs for the development and maintenance of common technology platforms

- Standardization and automation of operational processes

- Integrated optimization of administrative functions

Allfunds’ operating network in 66 countries will help Deutsche Börse establish a stronger presence in emerging markets, particularly Latin America and Asia. These regions are emerging as new growth engines for the global asset management industry.

As a major M&A transaction involving European financial market infrastructure, this acquisition requires approval from the European Commission, Germany’s Federal Financial Supervisory Authority (BaFin), and other relevant regulatory authorities. Regulators may impose additional conditions regarding market competition and systemic risks.

As an independently operated technology company, Allfunds has differences in corporate culture and technical architecture from Deutsche Börse. Successful integration requires:

- Retaining Allfunds’ core technical talents

- Smooth transition of customer relationships

- Avoiding service interruptions or quality degradation

The fund distribution industry is facing competitive pressure from zero-commission trading platforms and fintech startups. Allfunds needs to continue innovating to adapt to changes in the market landscape and maintain its technological leadership.

Deutsche Börse’s €5.3 billion acquisition of Allfunds is a strategically significant transaction that will have the following far-reaching impacts:

-

Business Transformation: Drives Deutsche Börse’s transformation from a traditional exchange to an integrated financial infrastructure provider, significantly enhancing its position in the wealth management value chain.

-

Competitive Edge: By acquiring Europe’s largest fund distribution network (with €1.7 trillion in AUA), Deutsche Börse will gain a differentiated advantage in competition with global exchange groups.

-

Profitability Improvement: Allfunds’ 65% EBITDA margin will significantly improve Deutsche Börse’s overall profitability and optimize revenue quality.

-

Market Landscape: This transaction will accelerate the consolidation of the European fund distribution market and may trigger strategic responses from other competitors.

The successful implementation of this acquisition will consolidate Deutsche Börse’s position as a global leading financial infrastructure provider, laying a solid foundation for its strategic development over the next decade.

[0] Jinling AI Financial Database - Deutsche Börse (DB1.DE) Company Profile and Allfunds Group Information

- Deutsche Börse Business Architecture and Financial Data

- Allfunds Assets Under Administration and Operating Metrics (as of September 30, 2025)

- Analysis of European Fund Distribution Market Competitive Landscape

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.