Analysis of the Impact of Shareholder Share Reduction on Valuations of Small and Mid-Cap Pharmaceutical and Chemical Stocks — A Case Study of Lanfeng Bio-chemical (002513.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on obtained market data and company information, I will conduct a systematic analysis of

| Indicator | Data |

|---|---|

Company Name |

Jiangsu Lanfeng Bio-chemical Co., Ltd. |

Stock Ticker |

002513.SZ |

Industry Classification |

Basic Materials / Chemical Industry |

Market Capitalization |

RMB 2.746 Billion |

Current Stock Price |

US$7.31 (approx. RMB53.5) |

Beta Coefficient |

1.35 (relative to the Shenzhen Component Index, high volatility) |

| Financial Indicator | Value | Assessment |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | Loss-making (-16.19x) | Profitability is concerning |

| Price-to-Book Ratio (P/B) | Loss-making (-165.71x) | Negative net assets |

| Price-to-Sales Ratio (P/S) | 1.25x | Relatively reasonable |

| Return on Equity (ROE) | -2413.16% | Severe loss |

| Net Profit Margin | -6.60% | Sustained losses |

| Current Ratio | 0.64 | Insufficient short-term solvency |

| Quick Ratio | 0.54 | Tight liquidity |

| Item | Details |

|---|---|

Share Reduction Subject |

Hainan Wenqin Equity Investment Partnership (Limited Partnership) |

Reduction Ratio |

No more than 3% |

Reduction Method |

Centralized Auction: no more than 1%; Block Trading: no more than 2% |

Reason for Reduction |

Shareholder capital needs |

Reduction Timeframe |

Within 3 months after 15 trading days from the announcement date |

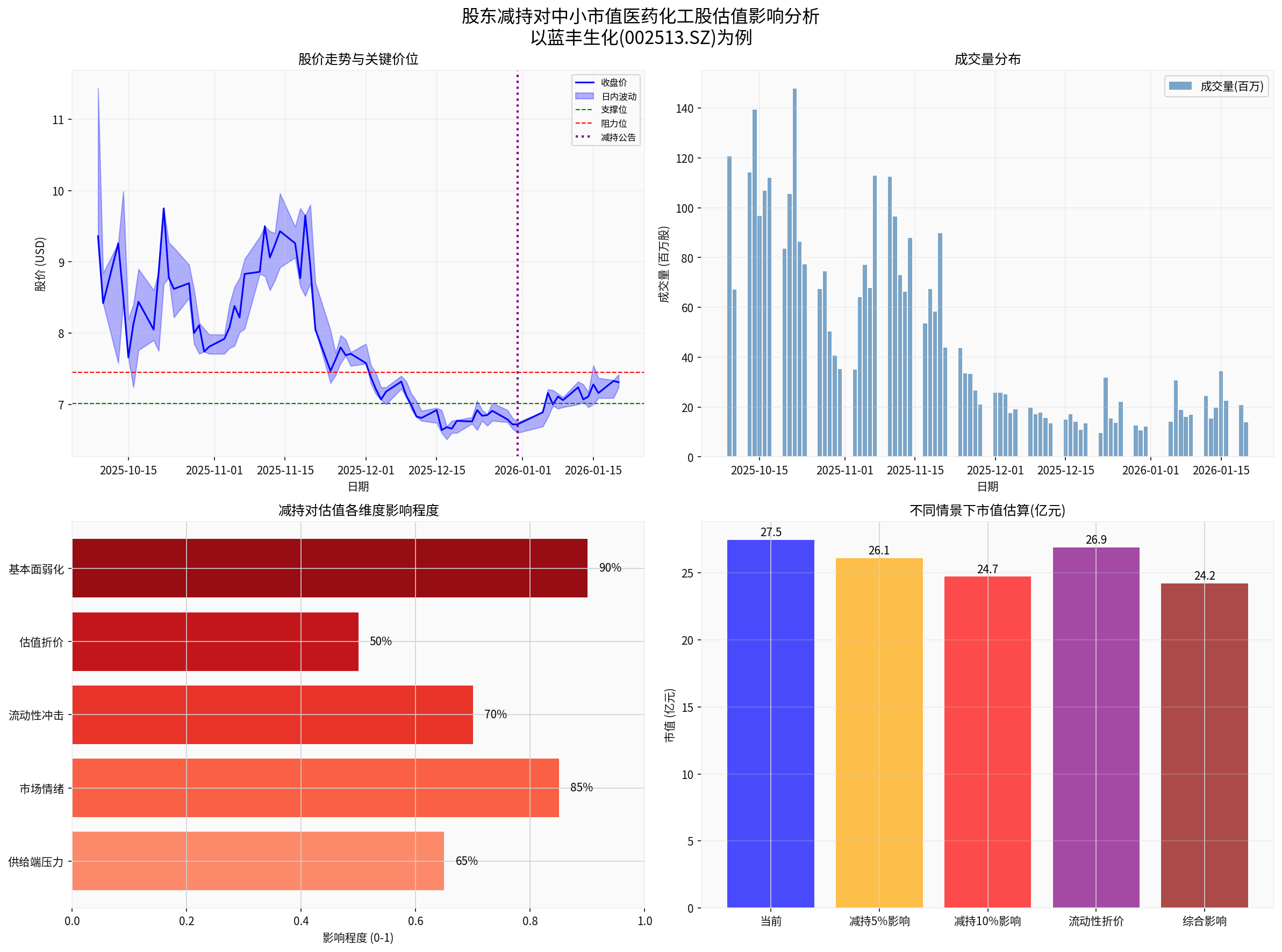

The impact of shareholder share reduction on the valuations of small and mid-cap pharmaceutical and chemical stocks can be analyzed from the following five dimensions:

A 3% share reduction will add approximately

Shareholder share reduction is usually interpreted by the market as the following signals:

- Insider Signaling Theory: As insiders of the company, shareholders may possess unfavorable information unknown to the market

- Signal of Lack of Confidence: Even neutral reasons such as “capital needs” will arouse market suspicion about whether shareholders are “bearish” on the company

- Herd Selling: Share reduction announcements often trigger panic selling

The liquidity characteristics of small and mid-cap stocks make the impact of share reduction more significant:

- Lanfeng Bio-chemical has an average daily turnover of approximately RMB175 million

- The 3% share reduction amounts to approximately RMB0.82 billion, accounting for 47%of the average daily turnover

- Insufficient liquidity may lead to a liquidity discount, and the actual reduction price may be 3%-5% lower than the market price

During the share reduction period, the market usually assigns a certain valuation discount to the relevant stock:

- Information Asymmetry Discount: The market is concerned that the reducing party holds undisclosed information

- Time Pressure Discount: The reducing party needs to complete the sell-off within the specified timeframe

- Block Trading Discount: Block trades are usually executed at a 2%-5% discount

Lanfeng Bio-chemical currently has weak fundamentals, which will amplify the negative impact of the share reduction:

- The company is in a state of sustained losses, with an ROE of -2413%

- Both the current ratio and quick ratio are below 1

- Weak fundamentals make the stock price more susceptible to sentiment and capital flow influences

| Impact Dimension | Impact Level | Valuation Impact Range | Cumulative Impact |

|---|---|---|---|

| Supply-Side Pressure | Medium | -3%~-5% | -3%~-5% |

| Market Sentiment | High | -5%~-10% | -8%~-15% |

| Liquidity Shock | Medium-High | -3%~-7% | -11%~-22% |

| Valuation Discount | Medium-Low | -2%~-5% | -13%~-27% |

| Weak Fundamentals | High | -5%~-10% | -18%~-37% |

Based on the above analysis, we have constructed three scenarios for valuation calculation:

| Scenario | Assumptions | Adjusted Market Capitalization | Adjusted Stock Price |

|---|---|---|---|

Optimistic Scenario |

Share reduction is completed smoothly, market sentiment is stable | Approximately RMB2.65 billion | Approximately RMB51.7 |

Neutral Scenario |

Share reduction exerts moderate liquidity shock | Approximately RMB2.48 billion | Approximately RMB48.3 |

Pessimistic Scenario |

Market panic selling, heightened concerns over fundamentals | Approximately RMB2.25 billion | Approximately RMB43.8 |

| Sensitivity Factor | Change Range | Impact on Market Capitalization |

|---|---|---|

| Stock Price Decline | -5% | -RMB137 million |

| Trading Volume Decline | -10% | -Approx. RMB55 million |

| P/S Ratio Compression | -5% | -Approx. RMB137 million |

| Liquidity Discount | -3% | -Approx. RMB82 million |

Based on the above analysis, the estimated target price range for Lanfeng Bio-chemical is as follows:

- Target Price in Neutral Scenario: RMB42-RMB52 (10%-20% discount relative to the current stock price)

- Risk-Adjusted Reasonable Valuation: RMB38-RMB48 (considering share reduction risk premium)

The pharmaceutical and chemical industry has the following characteristics that make it more sensitive to shareholder share reductions:

- Capital-Intensive Nature: The industry requires continuous capital investment, and shareholder share reductions may affect refinancing capabilities

- High Policy Sensitivity: Changes in policies such as environmental protection and work safety have a significant impact on companies

- Long R&D Investment Cycle: It is difficult to offset the negative impact of share reductions through performance improvement in the short term

- Cyclical Fluctuations: The chemical industry has obvious cyclicality, and share reductions often occur during industry downturns

| Characteristic | Small and Mid-Cap Stocks | Impact on Share Reduction |

|---|---|---|

| Liquidity | Lower average daily turnover | Larger impact from large-scale share reductions |

| Research Coverage | Less institutional research coverage | More severe information asymmetry |

| Shareholder Structure | High proportion of retail investors | Greater market sentiment volatility |

| Risk Resistance | High performance volatility | Weak fundamental support |

- Short-Term Avoidance Strategy: Exercise caution during the share reduction period, wait for the completion of the reduction

- Monitor Post-Reduction Changes: Observe the use of funds from the reduction and improvements in the company’s fundamentals

- Technical Analysis Alignment: Wait for the stock price to stabilize and show bottom signals before entering a position

- Position Control: Even if optimistic about the company’s prospects, control position size to cope with uncertainty

Taking Lanfeng Bio-chemical as a case study, the impact of a 3% shareholder share reduction on the valuations of small and mid-cap pharmaceutical and chemical stocks can be summarized as follows:

| Impact Type | Assessment |

|---|---|

Short-Term Impact |

Negative, expected to exert 5%-15% pressure on the stock price |

Medium-Term Impact |

Negative-leaning, the market may assign a 10%-20% valuation discount |

Long-Term Impact |

Depends on the use of funds from the reduction and improvements in the company’s fundamentals |

Comprehensive Rating |

Bearish due to share reduction , short-term avoidance recommended |

- The company is in a state of sustained losses, with concerning financial conditions

- Both the current ratio and quick ratio are below 1, resulting in significant short-term debt repayment pressure

- The beta coefficient of 1.35 is higher than the market average, leading to high stock price volatility

- The chemical industry is significantly affected by policy and environmental protection factors

- Small and mid-cap stocks have relatively poor liquidity

- Short-Term (1-3 Months): Recommended to avoid, wait for the share reduction pressure to ease

- Medium-Term (3-6 Months): Monitor changes in fundamentals and performance improvements after the completion of the share reduction

- Long-Term (Over 6 Months): If the company achieves substantial performance improvements, re-evaluate investment value

- Jinling AI Financial Database - Real-time Market and Financial Data of Lanfeng Bio-chemical (002513.SZ)[0]

- Jinling AI Technical Analysis Module - Technical Indicators and Trend Analysis of Lanfeng Bio-chemical[0]

- Jinling AI Market Data - Sector Performance Data of the Chemical Industry[0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.