In-Depth Investment Value Analysis of Intuitive Surgical (ISRG) - Investment Assessment Following Q4 FY2025 Earnings Beat

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data analysis above, below is the detailed investment analysis report for Intuitive Surgical (ISRG):

Intuitive Surgical released its fourth-quarter earnings report on January 22, 2026, which delivered strong results [1]:

| Metric | Actual Value | Consensus Estimate | Beat Margin |

|---|---|---|---|

| Earnings Per Share (EPS) | $2.53 |

$2.25 | +12.4% |

| Revenue | $2.87B |

$2.72B | +5.5% |

| Net Profit Margin | 28.58% | - | - |

| ROE | 15.08% | - | - |

This marks the company’s consecutive quarters of beating consensus estimates. Reviewing the performance over the past five quarters, a consistent growth trajectory can be observed [1]:

- Q4 FY2024: EPS $2.21, Revenue $2.41B

- Q1 FY2025: EPS $1.81, Revenue $2.25B

- Q2 FY2025: EPS $2.19, Revenue $2.44B

- Q3 FY2025: EPS $2.40, Revenue $2.51B

- Q4 FY2025: EPS $2.53, Revenue $2.87B

- Instruments & Accessories(60.6%, $1.52B): Reflects growth in surgical procedures and increased utilization of the Da Vinci System

- System Sales(23.6%, $590.4M): Strong market demand for the next-generation Da Vinci 5

- Service Revenue(15.8%, $395.9M): Demonstrates stable customer loyalty and maintenance demand

- Surgical procedure volume grew approximately 18% year-over-year

- Increased off-hours utilization of the Da Vinci 5 system, resulting in significant fixed cost leverage [2]

- Low Market Penetration: Only approximately 5-10% of surgical procedures worldwide use robotic assistance, leaving significant market room for expansion

- Indication Expansion: The Da Vinci System continues to receive approvals for new surgical indications

- Global Expansion: Markets outside the U.S. (accounting for 31.4% of revenue) have significant growth potential

- Hospital Capital Expenditure Pressures: Macroeconomic uncertainty may impact system purchasing decisions

- Seasonal Factors: Q4 is typically a peak period for medical device purchases, with a potential sequential decline expected in Q1

- Valuation Pressure: The current 68x P/E ratio requires sustained performance to justify it

Despite facing increasingly fierce competition, Intuitive Surgical still dominates the global surgical robotics market with approximately

| Moat Dimension | Specific Performance |

|---|---|

Clinical Experience Accumulation |

Over 20 years of clinical data, real-world evidence generated by thousands of devices |

High Switching Costs |

Hospitals need to invest significant funds, staff training, and clinical process adjustments |

Training Network Effect |

The global community of Da Vinci-trained surgeons has become industry infrastructure |

Data Barriers |

Continuously accumulated surgical data drives system optimization and efficacy verification |

- Current Status: Has obtained FDA approval for urological procedures [3]

- Progress: Conducting clinical trials in areas such as hernia repair

- Outlook: Expected to receive more indication approvals by 2031

- Strengths: Strong global sales network and medical device integration capabilities

- Current Status: Advancing regulatory approval, approaching key milestones [3]

- Strategy: Integrating resources through the Auris Health and Verb Surgical platforms

- Strengths: Strong brand influence and surgical procedure ecosystem

- Stryker: The Mako System dominates the orthopedic surgery segment

- PROCEPT BioRobotics: Focuses on urological surgical robotics

- Globus Medical: Competitor in the spinal surgery segment

The surgical robotics market is transitioning from the “Intuitive-dominated era” to a “diversified competitive landscape” [3]:

- Accelerated Market Education: New entrants are driving industry-wide market education, which may accelerate the adoption of robotic surgery

- Business Model Innovation: Shift from high capital expenditure models to “as-a-service” models

- Mergers and Acquisitions Integration: Private equity is driving industry consolidation to build platform-based solutions

- Technological Differentiation: AI, digital tools, and data platforms have become new competitive focuses

According to assessments from financial analysis tools [4]:

| Dimension | Assessment | Details |

|---|---|---|

Financial Stance |

Neutral | Conservative accounting practices, no extreme operations |

Revenue Growth |

Strong | Consecutive quarters of beating consensus estimates |

Cash Flow |

Healthy | Consistent positive FCF, stable FCF Margin |

Debt Risk |

Low | Low leverage, conservative financial structure |

Profitability |

Excellent | ROE 16.08%, net profit margin 28.58% |

- P/E: 68.26x (above the medical device industry average)

- P/B: 11.08x

- P/S: 19.61x

- Consensus Target: $633.00

- Upside Potential: +20.4%

- Target Range: $575 - $740

- Rating Distribution: 65.4% Buy / 25.0% Hold / 9.6% Sell

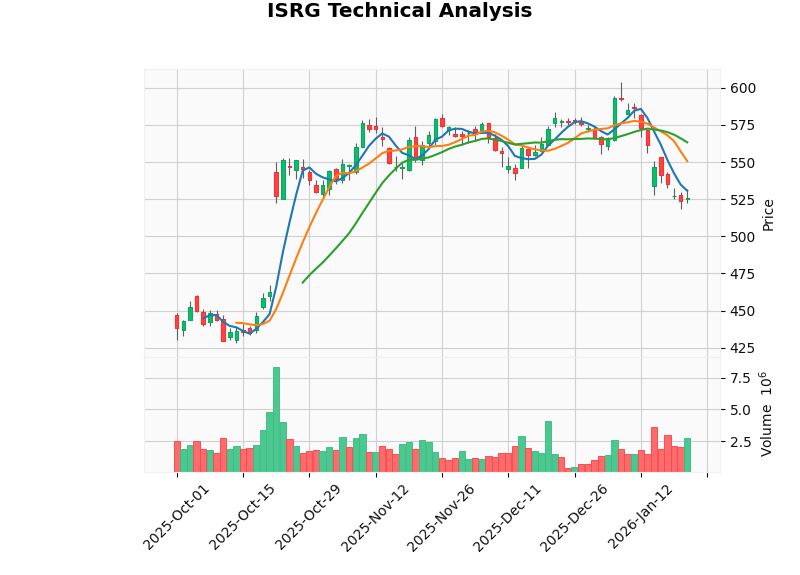

- Trend: Sideways trading, no clear direction

- Support Level: $519.25

- Resistance Level: $563.31

- MACD: No crossover signal, bearish bias

- RSI: Oversold territory, potential rebound opportunity

- Beta: 1.67 (higher volatility relative to the market)

- Stable Market Leadership Position: 65%+ market share, difficult to disrupt in the short term

- Innovation-Driven: Launch of Da Vinci 5 brings a new growth cycle

- High-Quality Business Model: 60% of revenue comes from recurring sources such as instruments and accessories

- AI Transformation Opportunity: Positioning the Da Vinci platform as a data-driven platform [6]

- High Customer Loyalty: Extremely high switching costs for hospitals, stable customer relationships

- Elevated Valuation: 68x P/E ratio requires sustained earnings growth to support it

- Increasing Competition: Continued catch-up from Medtronic and Johnson & Johnson

- Macroeconomic Sensitivity: Hospital capital expenditures may be affected by economic cycles

- Regulatory Risk: Approval progress for new indications may fall short of expectations

- Execution Risk: Ability to integrate AI and digital tools effectively

- Q1 FY2026 earnings beat (high probability, historical beat rate of 92%)

- Growth in Da Vinci 5 orders

- Approval of new surgical indications

- The stock price has declined for 7 consecutive trading sessions, with weak technicals [7]

- Potential “sell the news” effect

- Whether surgical procedure volume growth can be maintained at 15%+

- Impact of competitive landscape changes on market share

- Commercialization progress of AI/digital tools

- Increased global market penetration

- Expansion in emerging markets (China, India, etc.)

- Expansion of surgical robotics indications to more areas

- Commercialization of AI-assisted surgical functions

- If 15-20% revenue growth can be maintained, valuation will be supported

- AI transformation may bring valuation re-rating opportunities

For investors with different risk preferences:

| Investor Type | Recommendation | Rationale |

|---|---|---|

Growth-Oriented |

Appropriate Allocation | Leader in the surgical robotics track with high growth certainty |

Value-Oriented |

Wait and Observe | Elevated valuation, wait for a better entry point |

Risk-Tolerant |

Buy on Dips | Technically oversold, can position near support levels |

- Market Share Distribution Chart: Shows ISRG’s 65% dominant position and the competitive landscape

- Revenue Composition Chart: Clearly illustrates the contribution of the three major revenue streams

- Quarterly Performance Trend Chart: Presents the consistent growth performance trajectory

- Market Size Forecast Chart: Shows the growth outlook of the surgical robotics market

Intuitive Surgical’s Q4 earnings beat is not accidental, but a natural result of the company’s long-term competitive advantages and technological innovation. As the surgical robotics market transitions from a “single-player dominance” to a “diversified competition” landscape, ISRG is still expected to maintain its market leadership position over the next 5 years, supported by its 20 years of clinical accumulation, high customer loyalty, and continuous innovation capabilities [3].

However, investors should note the pressure from the current elevated valuation (68x P/E) and increasing competition. It is recommended to adopt a

[1] Intuitive Surgical Company Overview - Market Data

[2] Yahoo Finance - ISRG Pre-Q4 Analysis

[3] NAI500 - Why Intuitive Surgical Could Still Lead

[4] Financial Analysis API - ISRG

[5] Technical Analysis API - ISRG

[6] Yahoo Finance - AI, Digital Tools and Hub Data

Report Generation Date: January 23, 2026

Data Sources: Gilin AI Financial Database, Brokerage APIs, Authoritative Financial Media

理想汽车战略转型深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.