Valuation Outlook for T-Head's Hong Kong IPO and Reassessment of Domestic AI Chip Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will provide a comprehensive investment research analysis report.

Based on multi-dimensional analysis including product line completeness, technological leadership, market position, and commercialization maturity, we estimate that T-Head’s valuation range for its Hong Kong IPO is

T-Head Semiconductor Co., Ltd. was founded in September 2018, and is the wholly-owned semiconductor chip business entity of Alibaba Group. After 8 years of layout, T-Head has built an

| Product Line | Product Name | Core Performance Indicators | Commercialization Status |

|---|---|---|---|

AI Accelerator Chips |

HanGuang 800 | Inference performance of 78,563 IPS, industry-leading | Mass-produced |

General-Purpose GPU (PPU) |

PPU | 96GB HBM2e, 700GB/s bandwidth, comparable to NVIDIA H20 | Mass-produced |

General-Purpose CPU |

Yitian 710 | 20% higher performance than industry benchmarks of the same period | Mass-produced |

Storage Chips |

Zhenyue 510 | Comparable to Samsung’s flagship SSD controller | Mass-produced |

IoT Chips |

Yuzhen Series | Shipment volume of hundreds of millions of units | Mass-produced |

Network Chips |

In Planning | To be launched soon | In Planning |

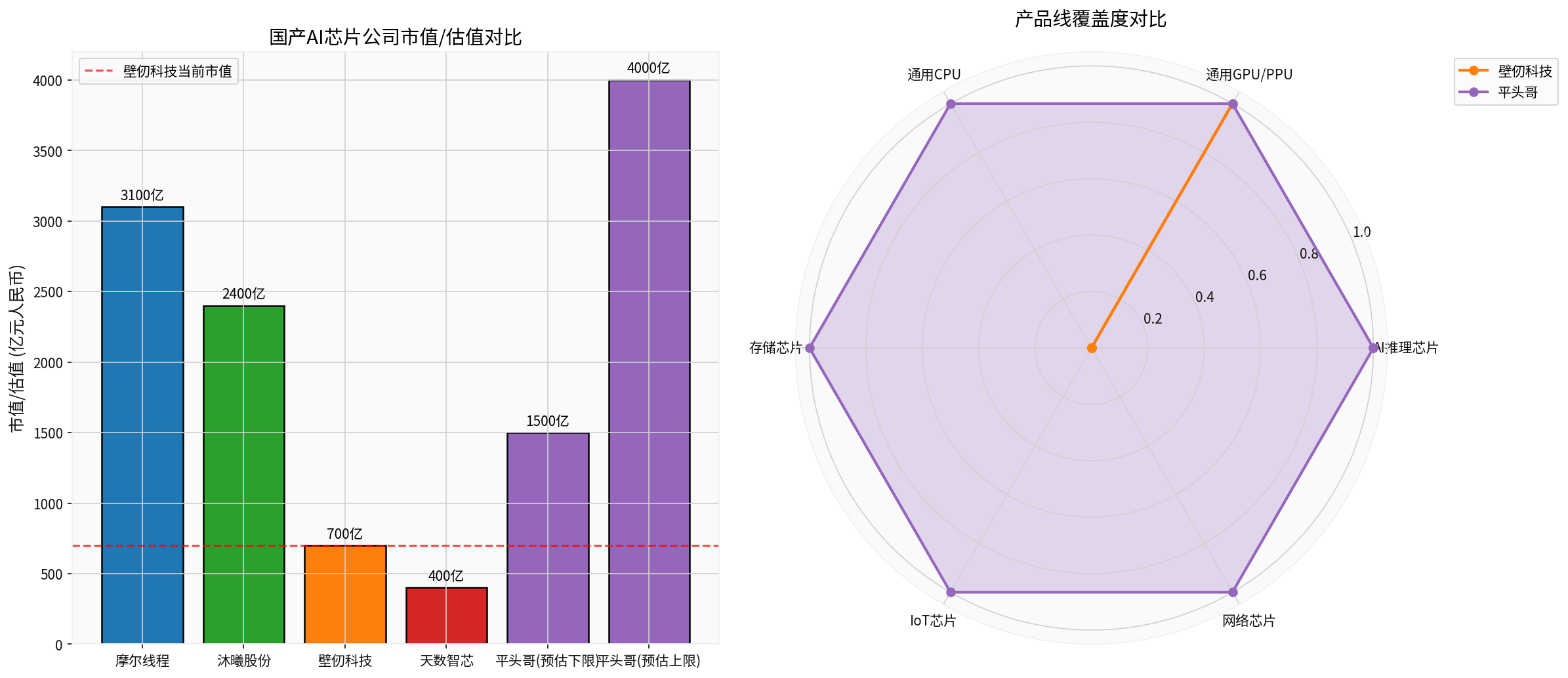

As shown in the figure, Biren Technology only covers a single product line of general-purpose GPUs, while T-Head has formed a

According to CCTV’s Xinwen Lianbo (News Broadcast) report in September 2025 and verification from multiple sources, the key parameters of T-Head’s PPU are as follows:[3][5]

- Video Memory Specification: 96GB HBM2e

- Inter-Chip Interconnect Bandwidth: 700GB/s

- Interface Standard: PCIe 5.0×16

- Power Consumption Control: 400W (approximately 30% lower than NVIDIA H20’s 550W)

- Peak Computing Power: 120TFLOPS (base version, focused on AI inference)

- Ecosystem Compatibility: CUDA-compatible, significantly reducing user migration costs

| Performance Dimension | T-Head PPU | NVIDIA A800 | NVIDIA H20 | Comparison Conclusion |

|---|---|---|---|---|

| Video Memory Capacity | 96GB | 80GB | 96GB | On par with H20, surpasses A800 |

| Interconnect Bandwidth | 700GB/s | 400GB/s | 900GB/s | Surpasses A800, close to H20 |

| Power Consumption | 400W | 300W | 550W | Best energy efficiency ratio |

| Comprehensive Performance | - | - | - | Surpasses A800, comparable to H20 |

T-Head’s PPU has achieved several milestone breakthroughs:[5]

-

National-Level Project Recognition: China Unicom’s Sanjiangyuan Green Power Intelligent Computing Center project signed an order for1,024 devices with 16,384 T-Head computing cards, with a total computing power of 1945P, becoming thelargest orderamong all brands

-

Leading Market Share: According to industry insiders, T-Head’s PPU has becomeone of the highest-shipping self-developed GPUs in Chinain 2025

-

Significant Cost Advantage: Benefiting from domestic 7nm process and 2.5D packaging technology, the single-card cost of PPU is40% lowerthan that of imported H20

-

Leading Technology Generation: According to a September 2025 report by The Information, the upgraded PPU’s performance is comparable to NVIDIA’s A100

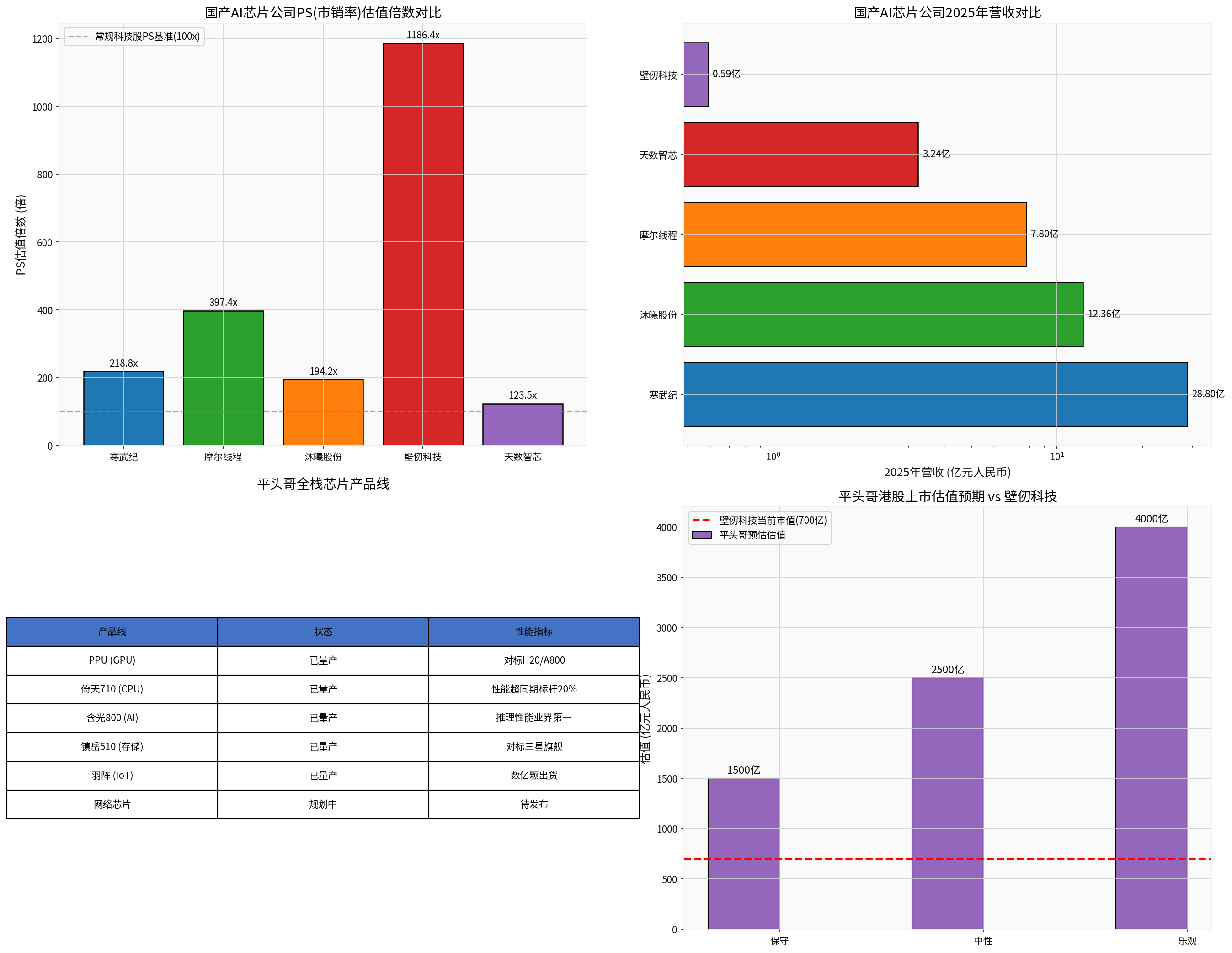

| Company | Listing Venue | Market Capitalization/Valuation (in RMB 100 million) | 2025 Revenue (in RMB 100 million) | PS Valuation Multiple | Characteristics |

|---|---|---|---|---|---|

| Cambricon | A-Share (STAR Market) | 6300 | 28.8 | 218.8x | Leading AI chip enterprise |

| Moore Threads | A-Share (STAR Market) | 3100 | 7.8 | 397.4x | Fastest approval on STAR Market |

| Muxi Semiconductor | A-Share (STAR Market) | 2400 | 12.36 | 194.2x | Full-process domestic production |

Biren Technology |

Hong Kong Stock Exchange (18C) |

700 | 0.59 | 1186.4x | First GPU stock on Hong Kong Stock Exchange |

| Iluvatar CoreX | Hong Kong Stock Exchange (18C) | 400 | 3.24 | 123.5x | General-Purpose GPU |

T-Head |

Hong Kong Stock Exchange (Estimated) |

1500-4000 | Undisclosed |

Pending |

Strongest full-stack capability |

Biren Technology listed on the Hong Kong Stock Exchange on January 2, 2026, becoming the “first GPU stock on the Hong Kong Stock Exchange”, with an issue price of HKD 19.6, and net proceeds of HKD 5.375 billion.[1][6]

- H1 2025 Revenue: approximately RMB 58.9 million

- 2025 Full-Year Revenue Estimate: approximately RMB 660 million

- Order Backlog: RMB 822 million

- Cash as of H1 2025: RMB 1.285 billion

- Cumulative Loss from 2022 to H1 2025: over RMB 6.3 billion

T-Head is the

- One-stop solution capability for customers

- Higher customer stickiness and repurchase rate

- System-level collaborative optimization advantages

- Cross-product line synergy effects

According to IDC data, in H1 2025, NVIDIA accounted for 62% of the Chinese AI chip market, while local chips accounted for 35%. Among domestic players, Huawei Ascend accounted for approximately 57.5% of the share, Cambricon 10%, Moore Threads 3.75%, and other manufacturers 28.75%. Although T-Head’s PPU market share is not disclosed separately, industry insiders revealed that its

| Dimension | Biren Technology | T-Head |

|---|---|---|

| 2025 Revenue Scale | ~RMB 660 million | Undisclosed, but PPU has achieved large-scale shipments |

| Benchmark Customers | China Mobile, China Telecom | Alibaba Cloud, China Unicom |

| Large-Scale Deployment Cases | Relatively limited | Sanjiangyuan Project with 16,384 cards |

| Loss Situation | Cumulative loss over RMB 6.3 billion | R&D investment guaranteed by Alibaba’s support |

If T-Head goes public, it will become

| Scenario | Valuation (in RMB 100 million) | Valuation Logic |

|---|---|---|

Conservative Scenario |

1500 | Referring to Iluvatar CoreX’s 123x PS, estimated based on RMB 1.2 billion revenue |

Base Case Scenario |

2500 | 80% of Moore Threads’ RMB 31 billion valuation, considering full-stack premium |

Optimistic Scenario |

4000 | Approximately 60% of Cambricon’s RMB 63 billion valuation, considering Alibaba ecosystem premium |

The current capital market’s valuation of domestic AI chip companies mainly relies on the following logic:

- Track Heat-Driven: AI chips are classified as strategic emerging industries, enjoying policy dividends and capital pursuit

- PS Valuation Method-Driven: Since most enterprises are not yet profitable, the capital market adopts the PS valuation method, leading to extremely high valuation multiples (Biren Technology’s 1186x PS)

- Single Product Line Valuation: Existing valuation models mainly focus on the single GPU product line, ignoring system-level capabilities

- Shipment Volume Imagination: Over-reliance on optimistic expectations of computing power demand growth

T-Head’s full-stack product layout will force investors to re-examine the valuation logic of AI chip enterprises:

- Synergistic value of CPU+GPU+Storage+Network+IoT

- Premium space brought by end-to-end solution capabilities

- Economies of scale in cross-product line R&D investment

Biren Technology’s H1 2025 revenue was only RMB 58.9 million, while T-Head’s PPU has already secured a large-scale order of

Cambricon achieved

The “AI full-stack layout” model of Alibaba Cloud + T-Head chips + Tongyi Qianwen model will make the capital market pay more attention to the synergy between AI chip enterprises and ecosystem systems, rather than purely technical indicators.

| Valuation Dimension | Before Adjustment | After Adjustment | Adjustment Logic |

|---|---|---|---|

| Full-Stack Chip Companies | No reference | RMB 250-400 billion | T-Head sets a benchmark |

| Single GPU Companies | RMB 30-70 billion | RMB 30-70 billion | Positioning of Biren, Iluvatar CoreX |

| AI Inference-Focused Companies | RMB 20-50 billion | RMB 50-100 billion | Explosive growth of inference market |

| Pure Design Companies | RMB 10-30 billion | RMB 10-30 billion | Light asset model |

- Policy Support Exceeding Expectations: Continued intensification of domestic computing power localization policies

- Commercialization Exceeding Expectations: PPU secures more orders from internet giants

- Technological Breakthrough: Next-generation PPU’s performance surpasses NVIDIA’s mainstream products

- Valuation Reassessment: T-Head drives the upward shift of the industry valuation center

- IPO Process Falling Short of Expectations: Uncertainties in restructuring and IPO timeline

- Intensified Competition: Continuous efforts by Huawei Ascend, Cambricon, etc.

- Macroeconomic Fluctuations: Cooling of AI investment boom affects valuation

- Technological Iteration Risk: Launch of new-generation products by international giants

- Significant valuation premium brought by full-stack chip capabilities

- PPU’s leading market position verifies technological competitiveness

- Alibaba ecosystem synergy provides commercialization guarantees

- Conservative valuation of RMB 150 billion, base case of RMB 250 billion, optimistic case of RMB 400 billion

- Perspective shift from single product line to full-stack capability

- Evaluation upgrade from shipment volume expectations to commercialization quality

- Focus shift from loss tolerance to profitability

- Comprehensive evaluation from single-point technology to ecosystem synergy

| Investor Type | Recommended Strategy |

|---|---|

| Primary Market Investors | Closely monitor T-Head’s IPO progress, reserve subscription quota |

| Secondary Market Investors | Pay attention to valuation reassessment opportunities in the domestic AI chip sector |

| Industrial Investors | Evaluate cooperation opportunities with T-Head in the computing power field |

| Long-Term Investors | Include T-Head in core allocation targets for AI computing power |

2025 is the first year of the collective outbreak of China’s domestic AI chips. According to the Hurun China AI Top 50 list, AI chip-related enterprises account for 7 of the top 10 spots, with the threshold for the top 10 reaching RMB 73 billion, more than three times that of the previous year.[4] The addition of T-Head will further strengthen the domestic AI chip camp, promoting China’s transformation from a “big country in AI applications” to a “strong country in AI innovation”.

[1] Sina Finance - “Complete Review! Biren Technology Lists, Market Capitalization Surges to HKD 90 Billion, Revealing the Capital Layout Behind It” (https://finance.sina.com.cn/stock/hkstock/2026-01-02/doc-inhewqnv2282085.shtml)

[2] 36Kr - “Alibaba’s T-Head Launches IPO Plan, Has Laid Out Full-Stack AI Chips” (https://eu.36kr.com/zh/p/3650412256731265)

[3] OFweek - “Farewell to ‘Choke Points’! Domestic AI Chips Break Out Collectively” (https://mp.ofweek.com/ai/a756714367577)

[4] Hurun Research Institute - “2025 Hurun China Top 50 Artificial Intelligence Enterprises” (https://www.163.com/dy/article/KJKKPLQE0519D5IA.html)

[5] CCTV Xinwen Lianbo (News Broadcast) - “Construction Achievements of China Unicom’s Sanjiangyuan Green Power Intelligent Computing Center Project” (Aired on September 16, 2025)

[6] Caixin Media - “Biren Technology, the First GPU Stock on Hong Kong Stock Exchange, Surges 94.59%” (https://www.cls.cn/detail/2246285)

[7] Caijing - “How Can China’s Computing Power Become Strong?” (https://news.qq.com/rain/a/20260104A05JOE00)

[8] New Hunan - “Alibaba’s US Pre-Market Up Over 5%, Its Chip Subsidiary T-Head Reportedly Plans to List Independently” (https://m.voc.com.cn/xhn/news/202601/31410239.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.